Intro

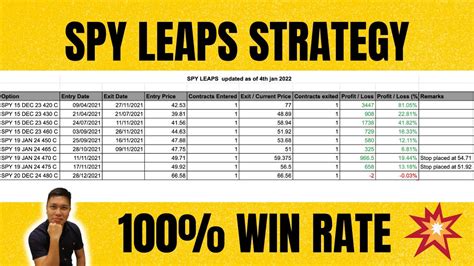

Maximize trading profits with the Spy Leaps Calendar Spread Strategy, utilizing options spreads, volatility, and risk management for informed investment decisions.

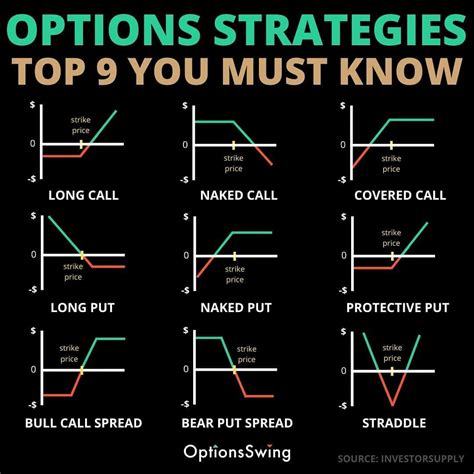

The world of options trading is complex and multifaceted, offering a wide range of strategies that traders can employ to manage risk and potentially increase returns. Among these strategies, the spy leaps calendar spread has garnered attention for its unique approach to navigating market volatility. This strategy involves combining two types of options contracts: LEAPS (Long-Term Equity Anticipation Securities) and calendar spreads. Understanding how these components work together is crucial for traders looking to leverage the spy leaps calendar spread strategy effectively.

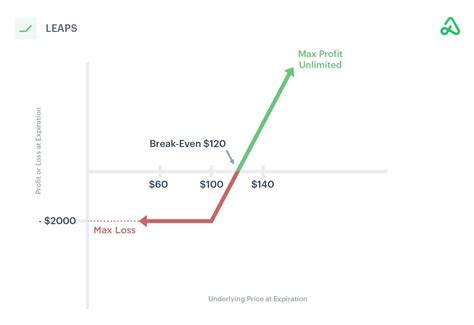

For those new to options trading, it's essential to start with the basics. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price (strike price) before a specified date (expiration date). LEAPS are a type of option that has a longer expiration period, typically up to three years, which distinguishes them from standard options that usually expire within a few months to a year. This longer timeframe can be particularly useful for investors with a long-term outlook, allowing them to hedge against potential losses or speculate on future price movements of the underlying asset.

The spy leaps calendar spread strategy specifically involves SPY, which is an ETF (Exchange-Traded Fund) that tracks the S&P 500 index, providing a broad exposure to the US stock market. By using LEAPS options on SPY, traders can create a calendar spread, which involves buying and selling options with the same strike price but different expiration dates. This strategy can help traders profit from the difference in time decay between the two options, as the option that is closer to expiration typically loses value faster than the one with the longer expiration.

Understanding LEAPS Options

LEAPS options are designed for long-term investors who want to leverage the benefits of options without the pressure of short-term expirations. They offer flexibility, allowing traders to speculate on price movements or hedge against potential downturns in the market over an extended period. However, LEAPS also come with unique considerations, such as the impact of time decay over a longer timeframe and the potential for significant price movements in the underlying asset.

Benefits of LEAPS

The benefits of using LEAPS include: - Long-term flexibility: LEAPS provide traders with the ability to make long-term bets on the market without the immediate pressure of short-term expirations. - Hedging capabilities: They can be used to hedge against potential losses in a portfolio over an extended period. - Speculation: LEAPS allow traders to speculate on future price movements of the underlying asset with a longer timeframe to be proven correct.Calendar Spreads

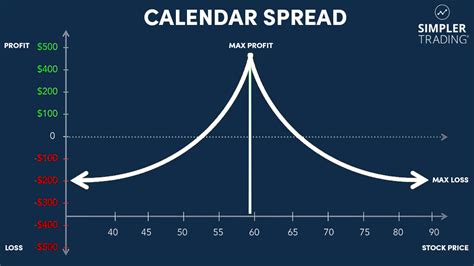

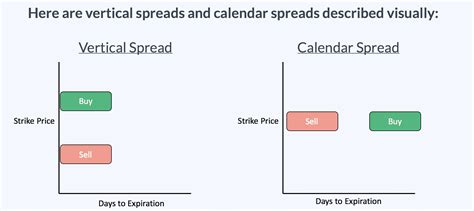

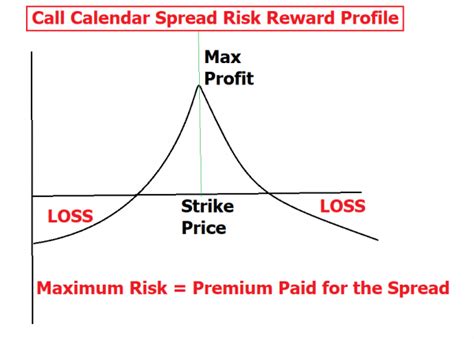

A calendar spread, also known as a time spread, involves buying and selling options with the same strike price but different expiration dates. This strategy is based on the principle that the rate of time decay for options accelerates as the expiration date approaches. By selling an option with a near-term expiration and buying an option with a longer-term expiration, traders can profit from the difference in time decay between the two options.

How Calendar Spreads Work

- **Selling the Near-Term Option**: The trader sells an option with a near-term expiration, receiving the premium. - **Buying the Long-Term Option**: Simultaneously, the trader buys an option with the same strike price but a longer expiration, paying the premium. - **Profit from Time Decay**: As time passes, the near-term option loses value faster than the long-term option, allowing the trader to close the position at a profit or continue to hold the long-term option.Implementing the Spy Leaps Calendar Spread Strategy

To implement the spy leaps calendar spread strategy, traders follow these steps:

- Select the Underlying Asset: Choose SPY as the underlying asset, given its broad market exposure.

- Choose the Strike Price: Select a strike price that is expected to be close to the price of SPY at the time of the trade, considering the trader's market outlook.

- Sell the Near-Term LEAPS: Sell a LEAPS call or put option with a near-term expiration (e.g., in a few months).

- Buy the Long-Term LEAPS: Buy a LEAPS call or put option with the same strike price but a longer expiration (e.g., in a year or more).

- Manage the Position: As the near-term option approaches expiration, the trader can close the position, roll it to a further expiration, or adjust the strategy based on market conditions.

Risks and Considerations

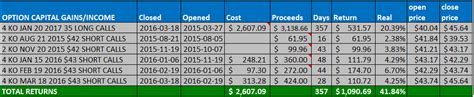

While the spy leaps calendar spread strategy can offer potential benefits, it also comes with risks and considerations: - **Time Decay**: The strategy relies on the difference in time decay, which can be affected by changes in volatility and interest rates. - **Volatility**: Increased volatility can impact the pricing of options, potentially affecting the profitability of the strategy. - **Interest Rates**: Changes in interest rates can influence the cost of carrying a long options position.Gallery of Spy Leaps Calendar Spread

Spy Leaps Calendar Spread Image Gallery

FAQs

What are LEAPS options?

+LEAPS (Long-Term Equity Anticipation Securities) are options with expiration dates that are longer than standard options, typically up to three years.

How does a calendar spread work?

+A calendar spread involves buying and selling options with the same strike price but different expiration dates, profiting from the difference in time decay.

What is the spy leaps calendar spread strategy?

+The spy leaps calendar spread strategy combines LEAPS options on SPY (an ETF tracking the S&P 500) with a calendar spread, aiming to profit from the difference in time decay between options with different expirations.

In conclusion, the spy leaps calendar spread strategy offers traders a unique approach to navigating the complexities of the options market. By combining the long-term flexibility of LEAPS options with the time decay differential of calendar spreads, traders can potentially profit from market movements while managing risk. However, like all trading strategies, it requires a deep understanding of the underlying principles, careful management, and an awareness of the potential risks involved. Whether you're a seasoned trader or just beginning to explore the world of options, the spy leaps calendar spread strategy is certainly worth considering as part of a broader investment approach. We invite you to share your thoughts and experiences with this strategy in the comments below and look forward to continuing the conversation on how to effectively leverage options trading for long-term success.