Intro

Maximize profits with the Earnings Calendar Call Trading Strategy, utilizing options trading, stock market analysis, and financial news to make informed investment decisions and optimize returns during earnings season.

The earnings calendar is a vital tool for traders and investors, providing a schedule of upcoming earnings announcements from publicly traded companies. This information can be used to inform trading decisions, particularly when combined with a call trading strategy. In this article, we will explore the importance of the earnings calendar and how it can be used in conjunction with call trading to maximize profits.

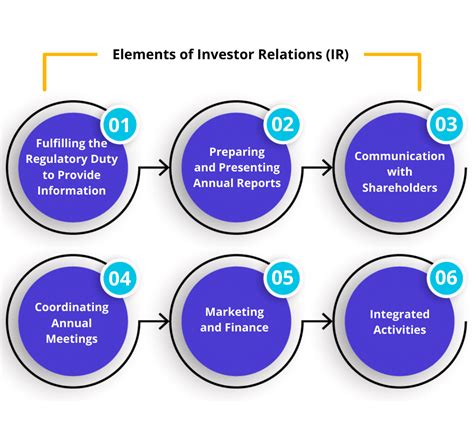

The earnings calendar is a comprehensive list of companies that are scheduled to release their quarterly or annual earnings reports. This information is typically released by the companies themselves, and it can be found on their investor relations websites or through financial news outlets. By staying on top of the earnings calendar, traders and investors can anticipate potential market-moving events and adjust their strategies accordingly.

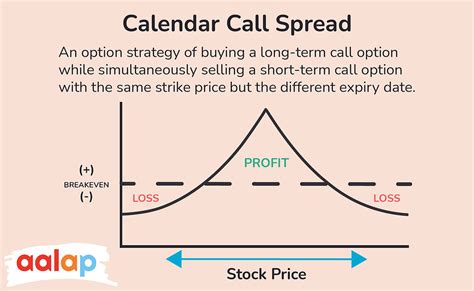

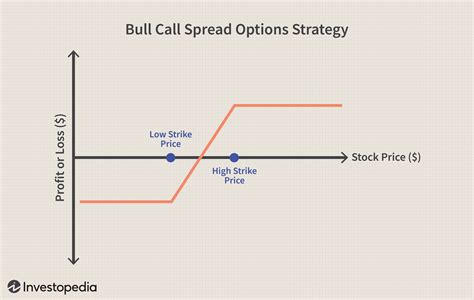

Call trading is a popular options trading strategy that involves buying call options on a stock with the expectation of selling them at a higher price. This strategy is often used by traders who are bullish on a particular stock or market sector. When used in conjunction with the earnings calendar, call trading can be a powerful tool for generating profits. By identifying companies that are scheduled to release their earnings reports and buying call options on those stocks, traders can potentially profit from any positive surprises or upward momentum following the earnings announcement.

Earnings Calendar and Call Trading Strategy

The key to successfully using the earnings calendar and call trading strategy is to identify companies that are likely to experience significant price movements following their earnings announcements. This can be done by analyzing the company's past earnings reports, industry trends, and overall market conditions. Traders should also consider factors such as the company's financial health, management team, and competitive landscape.

Some common indicators that traders use to identify potential earnings winners include:

- Historical earnings trends: Companies that have consistently beaten earnings expectations in the past are more likely to do so again in the future.

- Industry trends: Companies that operate in growing industries or have a strong competitive position are more likely to experience upward momentum following their earnings announcements.

- Valuation metrics: Companies with low price-to-earnings ratios or high dividend yields may be undervalued and poised for a rebound.

Benefits of Earnings Calendar Call Trading

There are several benefits to using the earnings calendar and call trading strategy. Some of the most significant advantages include:

- Potential for high returns: Call options can provide significant leverage, allowing traders to generate substantial profits from relatively small price movements.

- Flexibility: The earnings calendar provides a wide range of trading opportunities, allowing traders to choose from a variety of companies and industries.

- Risk management: By using call options, traders can limit their potential losses to the premium paid for the option, while still participating in any upward momentum.

However, it's essential to note that the earnings calendar and call trading strategy also involve significant risks. Some of the potential drawbacks include:

- Volatility: Earnings announcements can be highly unpredictable, and traders may experience significant losses if the company's report fails to meet expectations.

- Time decay: Options are subject to time decay, which means that their value decreases over time. Traders must carefully manage their positions to avoid losses due to time decay.

- Liquidity: Some options may have low liquidity, making it difficult to enter or exit positions quickly.

Steps to Implement Earnings Calendar Call Trading

To implement the earnings calendar and call trading strategy, traders should follow these steps:

- Identify potential earnings winners: Analyze the earnings calendar and identify companies that are likely to experience significant price movements following their earnings announcements.

- Choose the right options: Select call options that are likely to provide the best returns, considering factors such as strike price, expiration date, and volatility.

- Set a trading plan: Establish a clear trading plan, including entry and exit points, position sizing, and risk management strategies.

- Monitor and adjust: Continuously monitor the market and adjust the trading plan as needed to respond to changing market conditions.

Some popular call trading strategies that traders can use in conjunction with the earnings calendar include:

- Buying call options on companies with a history of beating earnings expectations

- Selling put options on companies with a strong track record of meeting or exceeding earnings expectations

- Using spreads or straddles to profit from volatility surrounding earnings announcements

Common Mistakes to Avoid

When using the earnings calendar and call trading strategy, traders should avoid common mistakes such as:

- Overleveraging: Traders should avoid using too much leverage, as this can increase the risk of significant losses.

- Lack of research: Traders should thoroughly research the company and its industry before making a trade, rather than relying on intuition or rumor.

- Failure to manage risk: Traders should establish a clear risk management plan, including stop-loss orders and position sizing, to limit potential losses.

Real-World Examples

To illustrate the potential benefits and risks of the earnings calendar and call trading strategy, let's consider a few real-world examples:

- Company A: A technology company with a history of beating earnings expectations. A trader buys call options on the company's stock before its earnings announcement and sells them after the report is released, generating a significant profit.

- Company B: A retail company with a history of missing earnings expectations. A trader buys put options on the company's stock before its earnings announcement and sells them after the report is released, generating a significant profit.

- Company C: A biotechnology company with a history of volatility surrounding its earnings announcements. A trader uses a straddle strategy to profit from the volatility, buying both call and put options on the company's stock before its earnings announcement.

Gallery of Earnings Calendar Call Trading

Earnings Calendar Call Trading Image Gallery

FAQs

What is the earnings calendar?

+The earnings calendar is a schedule of upcoming earnings announcements from publicly traded companies.

How can I use the earnings calendar to inform my trading decisions?

+By analyzing the earnings calendar and identifying companies that are likely to experience significant price movements following their earnings announcements, you can inform your trading decisions and potentially generate profits.

What are some common mistakes to avoid when using the earnings calendar and call trading strategy?

+Common mistakes to avoid include overleveraging, lack of research, and failure to manage risk. Traders should establish a clear trading plan and risk management strategy to limit potential losses.

How can I get started with the earnings calendar and call trading strategy?

+To get started, traders should analyze the earnings calendar and identify potential earnings winners. They should then choose the right options and establish a clear trading plan, including entry and exit points, position sizing, and risk management strategies.

What are some popular call trading strategies that can be used in conjunction with the earnings calendar?

+Popular call trading strategies include buying call options on companies with a history of beating earnings expectations, selling put options on companies with a strong track record of meeting or exceeding earnings expectations, and using spreads or straddles to profit from volatility surrounding earnings announcements.

In conclusion, the earnings calendar and call trading strategy can be a powerful tool for generating profits in the stock market. By analyzing the earnings calendar and identifying potential earnings winners, traders can inform their trading decisions and potentially generate significant returns. However, it's essential to avoid common mistakes, such as overleveraging and lack of research, and to establish a clear trading plan and risk management strategy to limit potential losses. With the right approach and a solid understanding of the earnings calendar and call trading strategy, traders can maximize their profits and achieve their investment goals. We invite you to share your thoughts and experiences with the earnings calendar and call trading strategy in the comments below.