Intro

Master UCSD payroll with 5 expert tips, covering timesheets, payroll schedules, and employee compensation, to ensure accurate and timely payments, simplifying payroll management and reducing errors.

The University of California, San Diego (UCSD) is a prestigious institution that employs a large and diverse workforce. Managing payroll for such a large organization can be complex, and it's essential for employees to understand the payroll process to ensure they receive their compensation accurately and on time. In this article, we will discuss five UCSD payroll tips to help employees navigate the payroll system and make the most of their compensation.

The importance of understanding payroll cannot be overstated. Payroll errors can lead to delayed or incorrect payments, which can cause financial hardship for employees. Moreover, understanding payroll can help employees make informed decisions about their benefits, taxes, and financial planning. By following these five UCSD payroll tips, employees can ensure they receive their compensation correctly and make the most of their employment at UCSD.

UCSD's payroll system is designed to provide employees with accurate and timely compensation. The system is managed by the UCSD Payroll Department, which is responsible for processing payroll, managing benefits, and ensuring compliance with tax laws and regulations. To take advantage of the payroll system, employees need to understand how it works and how to navigate it effectively. This includes understanding pay schedules, benefits, and tax deductions, as well as how to report errors or discrepancies.

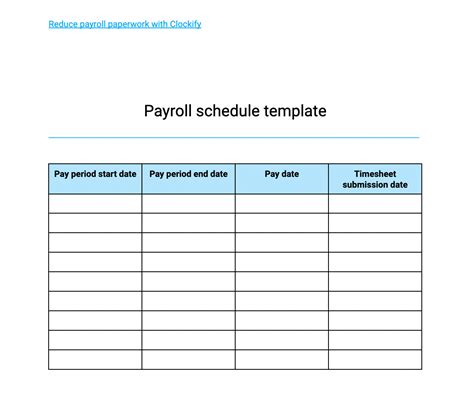

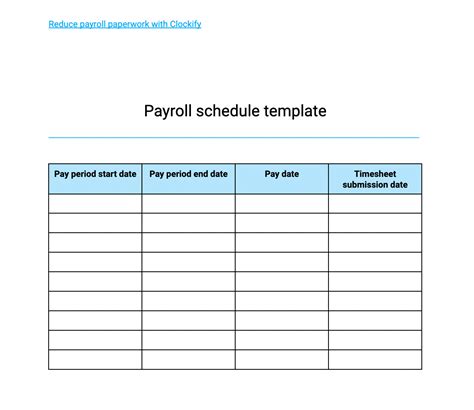

Understanding UCSD Payroll Schedules

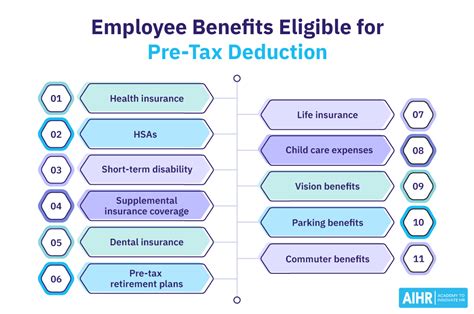

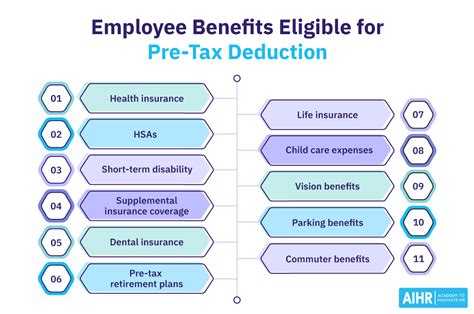

Managing Benefits and Deductions

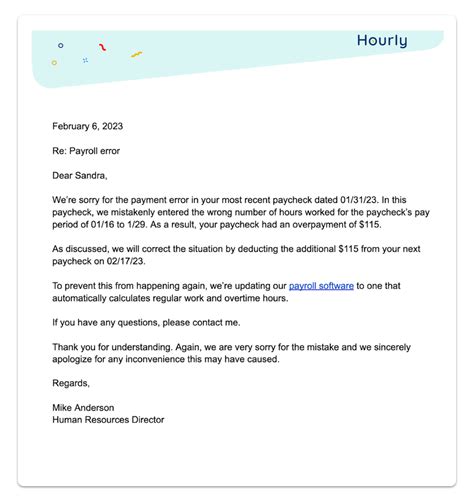

Reporting Payroll Errors

Understanding Tax Deductions

Taking Advantage of UCSD Payroll Resources

Some of the key benefits of understanding UCSD payroll include:

- Accurate and timely compensation

- Informed decisions about benefits and taxes

- Reduced errors and discrepancies

- Improved financial planning

- Increased employee satisfaction

To get the most out of UCSD payroll, employees should:

- Review their pay stubs regularly

- Understand their pay schedule and benefits

- Manage their tax deductions and exemptions

- Report payroll errors promptly

- Take advantage of UCSD payroll resources

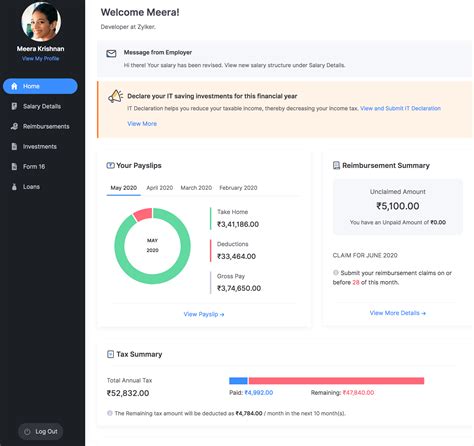

In addition to these tips, employees can also use online payroll tools to manage their payroll information. These tools include the UCSD Payroll Portal, which allows employees to view their pay stubs, manage their benefits, and report errors.

UCSD Payroll Portal

The UCSD Payroll Portal is a secure online platform that allows employees to manage their payroll information. The portal provides employees with access to their pay stubs, benefits information, and tax deductions. Employees can also use the portal to report errors, manage their benefits, and update their personal information.UCSD Payroll Department

The UCSD Payroll Department is responsible for managing the payroll system and providing support to employees. The department is staffed by experienced payroll professionals who can answer questions, resolve errors, and provide guidance on payroll-related matters. Employees can contact the UCSD Payroll Department by phone, email, or in person.UCSD Payroll Image Gallery

What is the UCSD payroll schedule?

+The UCSD payroll schedule varies depending on the employee's job classification, department, and union affiliation. Employees can find their pay schedule on the UCSD Payroll Department website or by contacting their department's payroll representative.

How do I report a payroll error?

+Employees can report payroll errors to the UCSD Payroll Department or their department's payroll representative. Employees should provide documentation to support their claim, and follow up on their error report to ensure it is resolved promptly.

What benefits does UCSD offer to its employees?

+UCSD offers a range of benefits to its employees, including health insurance, retirement plans, and life insurance. Employees can find information about benefits on the UCSD Benefits website or by contacting the UCSD Benefits Department.

In summary, understanding UCSD payroll is essential for employees to receive their compensation accurately and on time. By following the five UCSD payroll tips outlined in this article, employees can ensure they receive their correct compensation and make the most of their employment at UCSD. We encourage readers to share their experiences and tips on navigating the UCSD payroll system in the comments below. Additionally, readers can share this article with their colleagues and friends who may benefit from understanding the UCSD payroll system. By working together, we can ensure that all UCSD employees receive their compensation accurately and on time.