Intro

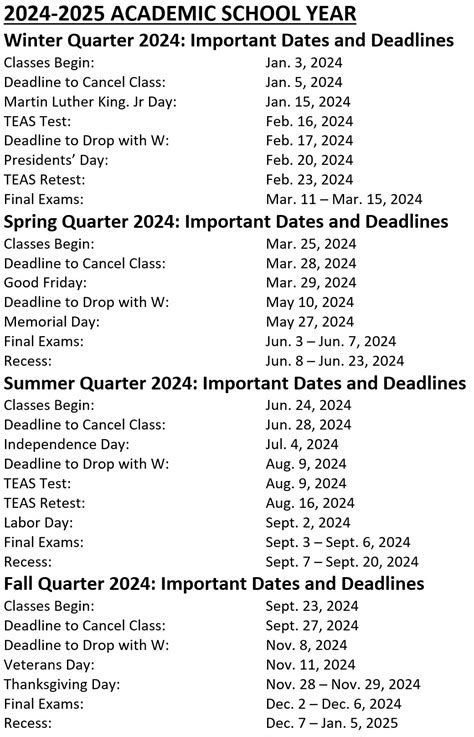

Discover crucial 5 Um key dates, milestones, and deadlines, including submission, review, and decision timelines, to navigate the process efficiently with related keywords like application, notification, and enrollment periods.

The world of business and finance is filled with numerous key dates that can significantly impact the global economy, stock markets, and individual investments. Understanding these dates is crucial for making informed decisions and staying ahead of the curve. In this article, we will delve into the importance of key dates, their effects on the market, and provide a comprehensive overview of the most significant dates to watch out for.

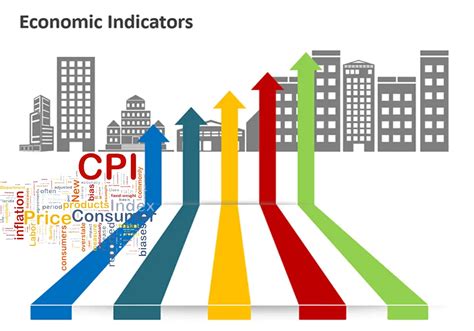

The key dates can be broadly categorized into several groups, including economic indicators, earnings reports, and major events. Economic indicators, such as GDP growth rate, inflation rate, and unemployment rate, are crucial in determining the overall health of an economy. Earnings reports, on the other hand, provide insights into the financial performance of individual companies, while major events, such as elections and policy changes, can have far-reaching consequences on the market. By keeping track of these key dates, investors and businesses can make informed decisions, mitigate risks, and capitalize on opportunities.

The importance of key dates cannot be overstated. For instance, the release of economic indicators can significantly impact stock prices, while earnings reports can make or break a company's reputation. Major events, such as elections and policy changes, can lead to market volatility and uncertainty. By understanding the significance of these dates, investors and businesses can navigate the complex world of finance with confidence and precision. In the following sections, we will explore the different types of key dates, their effects on the market, and provide practical examples to illustrate their importance.

Understanding Key Dates

The effects of key dates on the market can be far-reaching and significant. For instance, the release of economic indicators can lead to market volatility, while earnings reports can impact a company's stock price. Major events, such as elections and policy changes, can lead to uncertainty and risk. By understanding the effects of key dates, investors and businesses can mitigate risks and capitalize on opportunities. In the following sections, we will explore the different types of key dates and their effects on the market.

Types of Key Dates

Some of the most significant key dates include:

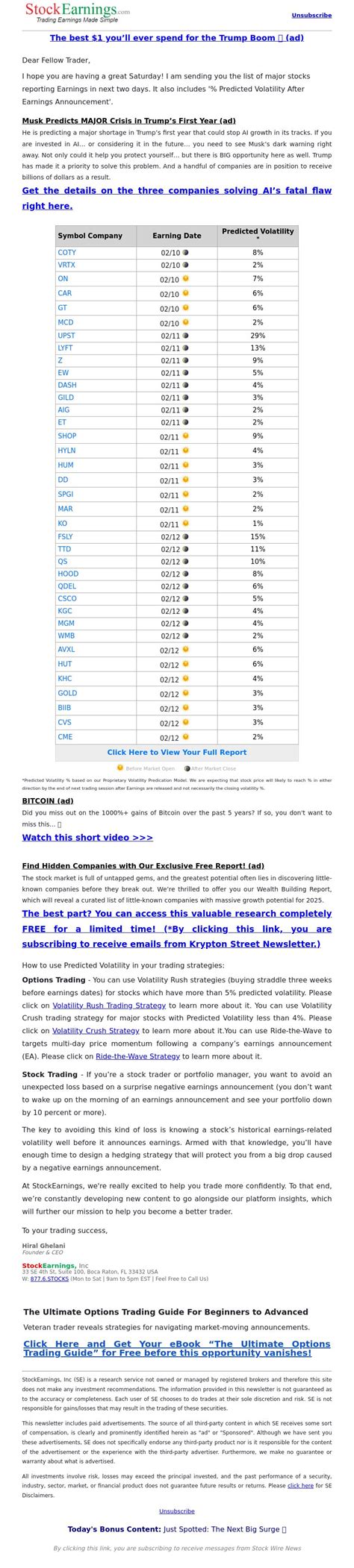

- Earnings reports: These reports provide insights into a company's financial performance and can significantly impact stock prices.

- Economic indicators: These indicators, such as GDP growth rate and inflation rate, provide insights into the overall health of an economy.

- Major events: These events, such as elections and policy changes, can have far-reaching consequences on the market.

- Central bank meetings: These meetings can lead to changes in interest rates and monetary policy, which can impact the economy and financial markets.

Importance of Key Dates

Some of the benefits of keeping track of key dates include:

- Informed decision-making: By understanding the significance of key dates, investors and businesses can make informed decisions about their investments and operations.

- Risk mitigation: By being aware of potential risks and uncertainties, investors and businesses can take steps to mitigate them.

- Capitalizing on opportunities: By understanding the effects of key dates, investors and businesses can capitalize on opportunities and maximize their returns.

Practical Examples

Major events, such as elections and policy changes, can also have far-reaching consequences on the market. For instance, the outcome of an election can impact the overall direction of the economy, while policy changes can lead to changes in interest rates and monetary policy. By understanding the significance of these key dates, investors and businesses can navigate the complex world of finance with confidence and precision.

Steps to Keep Track of Key Dates

Some of the tools that can be used to keep track of key dates include:

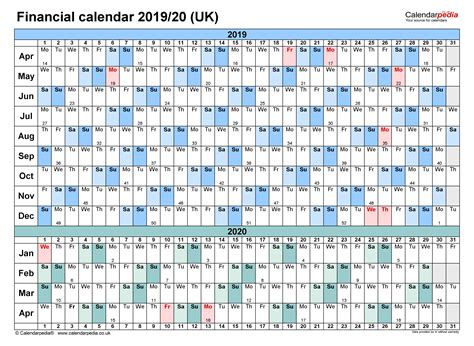

- Financial calendars: These calendars provide a comprehensive list of key dates, including economic indicators, earnings reports, and major events.

- News alerts: These alerts provide real-time updates on market trends and news, allowing investors and businesses to stay informed and up-to-date.

- Market analysis: This analysis provides insights into market trends and news, allowing investors and businesses to understand the significance of key dates and make informed decisions.

Benefits of Keeping Track of Key Dates

In addition to these benefits, keeping track of key dates can also help investors and businesses to:

- Stay ahead of the curve: By understanding the significance of key dates, investors and businesses can stay ahead of the curve and navigate the complex world of finance with confidence and precision.

- Build trust: By demonstrating a understanding of key dates, investors and businesses can build trust with their clients and stakeholders.

Key Dates Image Gallery

What are key dates?

+Key dates refer to specific points in time that have a significant impact on the market, economy, or individual investments.

Why are key dates important?

+Key dates are important because they can significantly impact stock prices, provide valuable insights into a company's financial performance, and lead to changes in interest rates and monetary policy.

How can I keep track of key dates?

+You can keep track of key dates by creating a calendar, setting reminders, and staying informed about market trends and news.

What are the benefits of keeping track of key dates?

+The benefits of keeping track of key dates include improved decision-making, reduced risk, and increased returns.

How can I use key dates to my advantage?

+You can use key dates to your advantage by understanding the significance of these dates, making informed decisions, and capitalizing on opportunities.

In

Final Thoughts