Intro

Discover how to calculate your USAF deployment pay with ease. Learn the 5 simple steps to determine your special pay entitlements, including combat pay, hazardous duty pay, and per diem allowances. Get a clear understanding of the USAF pay chart and how to maximize your earnings during deployment.

As a member of the United States Air Force (USAF), deployments can be a regular part of your service. While deployments can be challenging, they also come with additional pay and allowances to help support you and your family during this time. Calculating your USAF deployment pay can seem complex, but it can be broken down into five easy steps.

Understanding Deployment Pay

Before we dive into the steps, it's essential to understand the different types of pay and allowances you may be eligible for during a deployment. These include:

- Basic Allowance for Housing (BAH)

- Basic Allowance for Subsistence (BAS)

- Cost of Living Allowance (COLA)

- Hazardous Duty Pay

- Hostile Fire Pay

- Family Separation Allowance (FSA)

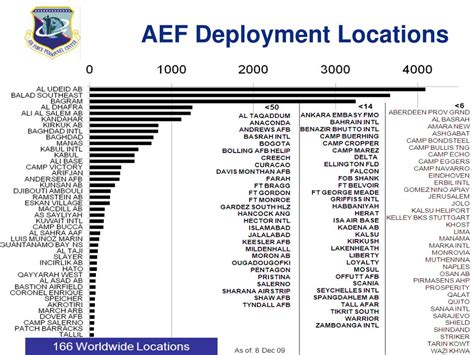

Step 1: Determine Your Deployment Location

The first step in calculating your deployment pay is to determine your deployment location. This will help you understand which pay and allowances you are eligible for. The USAF uses a system of codes to identify different locations, including:

- Combat zones (e.g., Afghanistan, Iraq)

- Hazardous duty locations (e.g., Korea, Turkey)

- Non-combat zones (e.g., Europe, Japan)

You can use the USAF's deployment location codes to determine which category your deployment falls under.

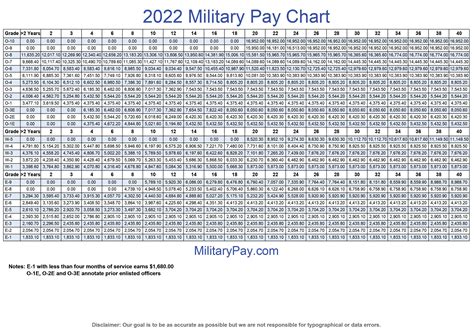

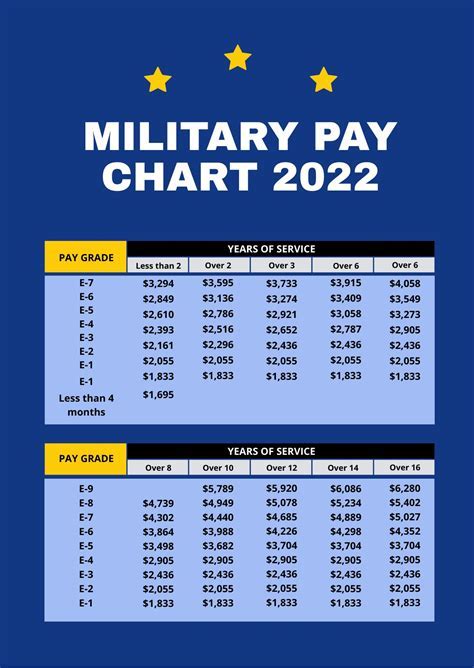

Step 2: Calculate Your Basic Allowance for Housing (BAH)

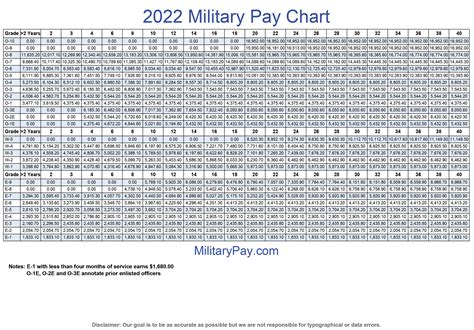

BAH is a tax-free allowance paid to service members to help cover the cost of housing while deployed. The amount of BAH you receive will depend on your deployment location and your pay grade.

You can use the USAF's BAH calculator to determine your BAH rate. You will need to know your pay grade, deployment location, and whether you are married or single.

Step 3: Calculate Your Basic Allowance for Subsistence (BAS)

BAS is a tax-free allowance paid to service members to help cover the cost of food while deployed. The amount of BAS you receive will depend on your pay grade and deployment location.

You can use the USAF's BAS calculator to determine your BAS rate. You will need to know your pay grade and deployment location.

Step 4: Calculate Your Hazardous Duty Pay and Hostile Fire Pay

If you are deployed to a combat zone or hazardous duty location, you may be eligible for hazardous duty pay and hostile fire pay. These pays are tax-free and are paid in addition to your basic pay.

You can use the USAF's hazardous duty pay and hostile fire pay calculators to determine your rates. You will need to know your pay grade and deployment location.

Step 5: Calculate Your Family Separation Allowance (FSA)

FSA is a tax-free allowance paid to service members who are deployed for more than 30 days and are separated from their families. The amount of FSA you receive will depend on your pay grade and deployment location.

You can use the USAF's FSA calculator to determine your FSA rate. You will need to know your pay grade and deployment location.

By following these five easy steps, you can calculate your USAF deployment pay and understand the different types of pay and allowances you are eligible for.

Gallery of USAF Deployment Pay Calculators

USAF Deployment Pay Calculators

Frequently Asked Questions

How do I calculate my USAF deployment pay?

+To calculate your USAF deployment pay, follow the five easy steps outlined in this article. You will need to determine your deployment location, calculate your BAH, BAS, hazardous duty pay, hostile fire pay, and FSA.

What is the difference between BAH and BAS?

+BAH (Basic Allowance for Housing) is a tax-free allowance paid to service members to help cover the cost of housing while deployed. BAS (Basic Allowance for Subsistence) is a tax-free allowance paid to service members to help cover the cost of food while deployed.

How do I determine my deployment location code?

+You can use the USAF's deployment location codes to determine your deployment location. You can find this information on the USAF's website or by contacting your unit's personnel office.

What is hazardous duty pay?

+Hazardous duty pay is a tax-free allowance paid to service members who are deployed to hazardous duty locations, such as combat zones or areas with high levels of terrorism.

How do I calculate my FSA?

+You can use the USAF's FSA calculator to determine your FSA rate. You will need to know your pay grade and deployment location.

We hope this article has helped you understand how to calculate your USAF deployment pay. Remember to follow the five easy steps outlined in this article, and don't hesitate to reach out to your unit's personnel office if you have any questions or concerns.