Intro

Discover how Vanguard invests in the UK with these 5 expert strategies. Learn about their approach to index fund investing, ETFs, and active management, and how they navigate the UK market. Get insights into Vanguards investment philosophy and explore the benefits of their low-cost, long-term approach for UK investors.

The UK has long been a prime destination for investors, offering a stable economy, robust financial markets, and a wide range of investment opportunities. Vanguard, one of the world's largest investment management companies, has a significant presence in the UK, with a range of investment products and strategies designed to help investors achieve their financial goals. In this article, we'll explore five ways Vanguard invests in the UK, highlighting the company's approach to investing in the region.

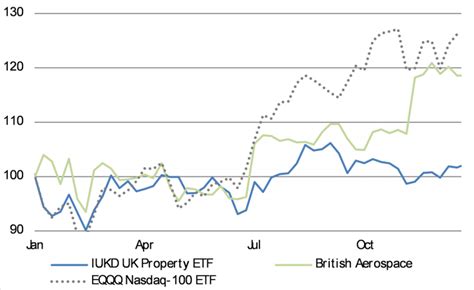

1. UK Equity Market

Vanguard offers a range of UK equity funds, providing investors with exposure to the UK stock market. These funds track a variety of indices, including the FTSE 100, FTSE 250, and FTSE All-Share, offering investors a diversified portfolio of UK stocks. Vanguard's UK equity funds are designed to provide long-term capital growth, making them a popular choice for investors seeking to benefit from the UK's economic growth.

Benefits of Investing in UK Equities

- Diversification: Investing in UK equities can provide a diversification benefit, as the UK market is less correlated with other global markets.

- Growth potential: The UK equity market has a long history of providing strong returns over the long term.

- Income generation: Many UK companies pay dividends, providing investors with a regular income stream.

2. UK Bond Market

Vanguard also offers a range of UK bond funds, providing investors with exposure to the UK bond market. These funds invest in a diversified portfolio of UK government and corporate bonds, offering investors a regular income stream and relatively low risk. Vanguard's UK bond funds are designed to provide investors with a stable source of returns, making them a popular choice for those seeking to reduce their portfolio risk.

Benefits of Investing in UK Bonds

- Income generation: UK bonds offer a regular income stream, making them a popular choice for income-seeking investors.

- Low risk: UK bonds are generally considered to be low-risk investments, making them a popular choice for conservative investors.

- Diversification: Investing in UK bonds can provide a diversification benefit, as the UK bond market is less correlated with other global markets.

3. UK Real Estate

Vanguard offers a range of UK real estate funds, providing investors with exposure to the UK property market. These funds invest in a diversified portfolio of UK commercial and residential properties, offering investors a potential source of long-term capital growth and income. Vanguard's UK real estate funds are designed to provide investors with a stable source of returns, making them a popular choice for those seeking to diversify their portfolios.

Benefits of Investing in UK Real Estate

- Diversification: Investing in UK real estate can provide a diversification benefit, as the UK property market is less correlated with other global markets.

- Income generation: Many UK properties generate rental income, providing investors with a regular income stream.

- Potential for long-term capital growth: The UK property market has a long history of providing strong returns over the long term.

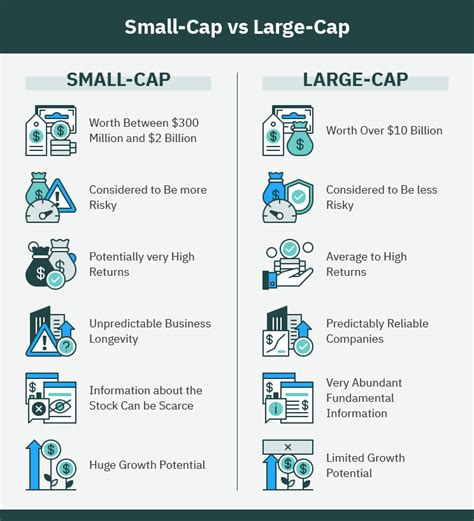

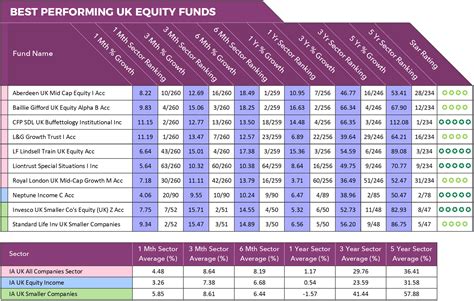

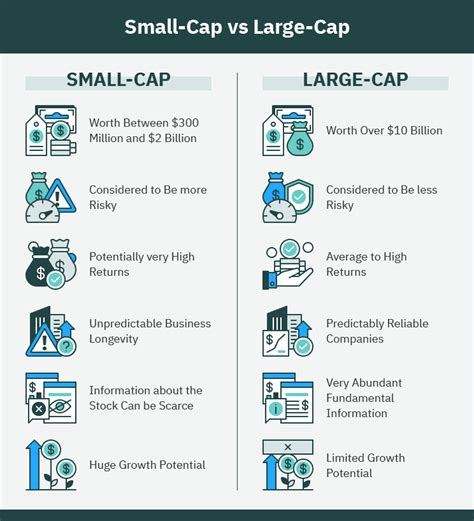

4. UK Small-Cap and Mid-Cap Stocks

Vanguard also offers a range of UK small-cap and mid-cap funds, providing investors with exposure to smaller UK companies. These funds invest in a diversified portfolio of UK small-cap and mid-cap stocks, offering investors a potential source of long-term capital growth. Vanguard's UK small-cap and mid-cap funds are designed to provide investors with a high-growth investment option, making them a popular choice for those seeking to benefit from the UK's entrepreneurial spirit.

Benefits of Investing in UK Small-Cap and Mid-Cap Stocks

- Potential for long-term capital growth: UK small-cap and mid-cap stocks have a long history of providing strong returns over the long term.

- Diversification: Investing in UK small-cap and mid-cap stocks can provide a diversification benefit, as these companies are often less correlated with larger UK companies.

- Support for UK entrepreneurship: By investing in UK small-cap and mid-cap stocks, investors can help support the growth of UK businesses.

5. UK Sustainable Investing

Vanguard also offers a range of UK sustainable investing funds, providing investors with exposure to UK companies that meet certain environmental, social, and governance (ESG) criteria. These funds invest in a diversified portfolio of UK stocks that have strong ESG track records, offering investors a potential source of long-term capital growth while also promoting sustainable investing practices. Vanguard's UK sustainable investing funds are designed to provide investors with a responsible investment option, making them a popular choice for those seeking to align their investments with their values.

Benefits of Investing in UK Sustainable Investing

- Potential for long-term capital growth: UK sustainable investing funds have a long history of providing strong returns over the long term.

- Positive impact: By investing in UK sustainable investing funds, investors can help promote sustainable investing practices and support UK companies that prioritize ESG considerations.

- Diversification: Investing in UK sustainable investing funds can provide a diversification benefit, as these companies are often less correlated with other UK companies.

Gallery of Vanguard's UK Investment Options

What is Vanguard's approach to investing in the UK?

+Vanguard's approach to investing in the UK is centered around providing investors with a range of low-cost, diversified investment products that track the UK market. Vanguard's UK investment products are designed to provide investors with a potential source of long-term capital growth and income.

What types of UK investment products does Vanguard offer?

+Vanguard offers a range of UK investment products, including UK equity funds, UK bond funds, UK real estate funds, UK small-cap and mid-cap stocks, and UK sustainable investing funds.

What are the benefits of investing in Vanguard's UK investment products?

+The benefits of investing in Vanguard's UK investment products include potential for long-term capital growth, income generation, diversification, and support for UK entrepreneurship. Additionally, Vanguard's UK investment products are designed to be low-cost and offer a range of investment options to suit different investment goals and risk tolerances.

We hope this article has provided you with a comprehensive overview of Vanguard's approach to investing in the UK. Whether you're a seasoned investor or just starting out, Vanguard's UK investment products offer a range of options to help you achieve your financial goals. Remember to always do your research and consider your individual circumstances before making any investment decisions.