Intro

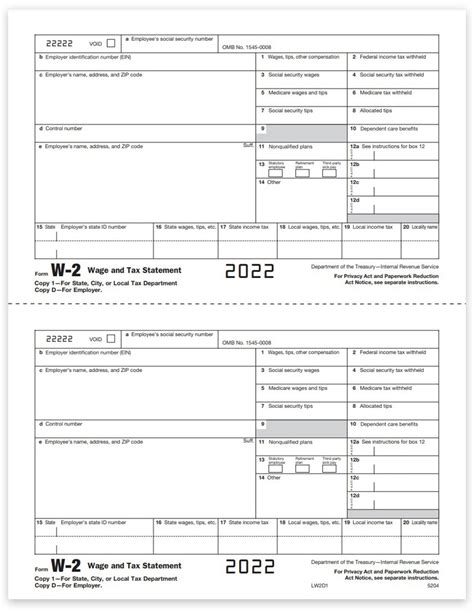

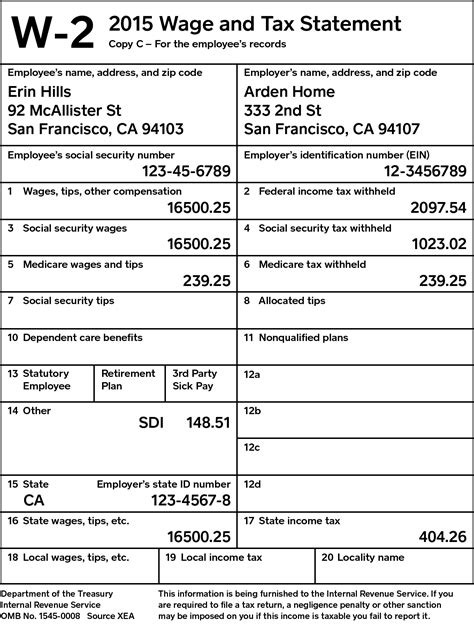

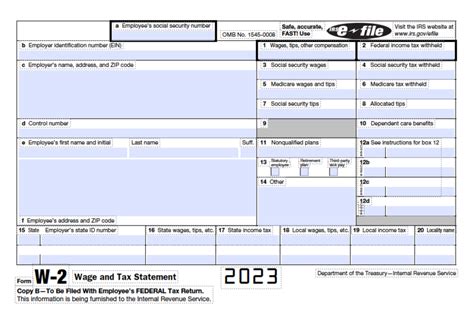

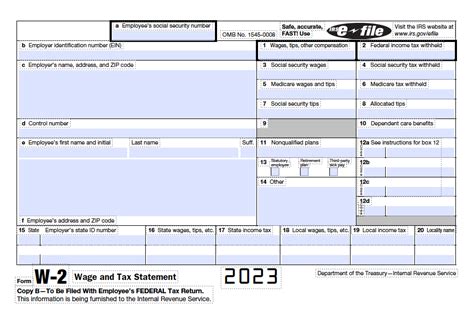

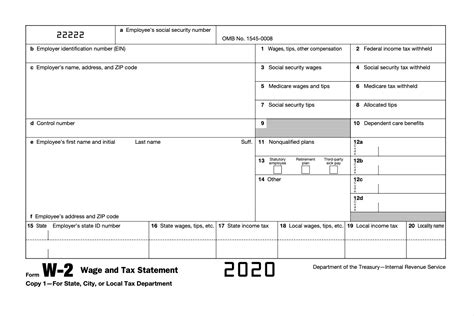

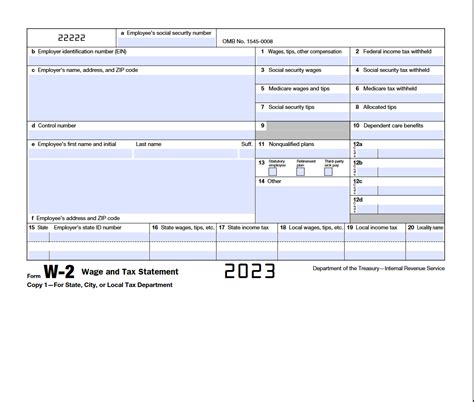

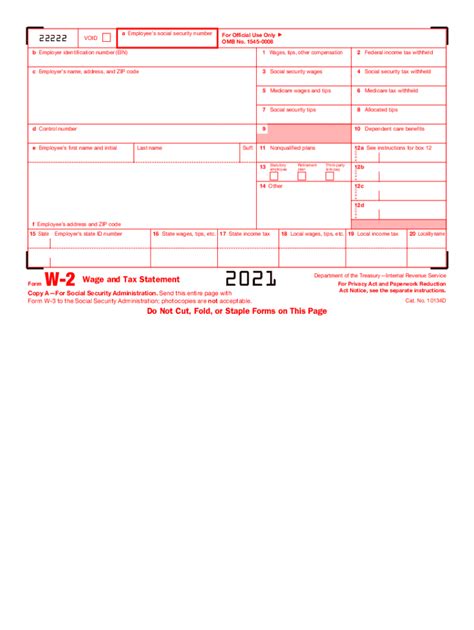

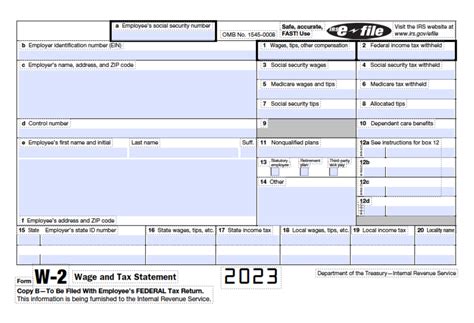

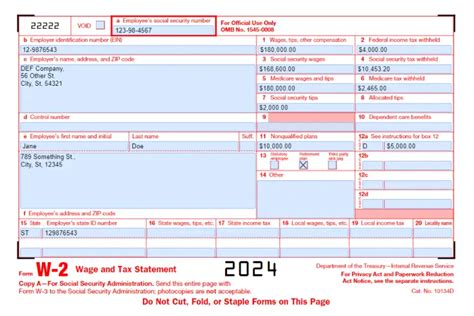

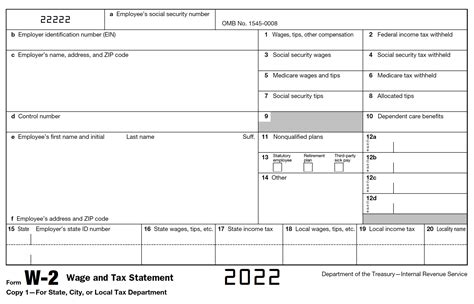

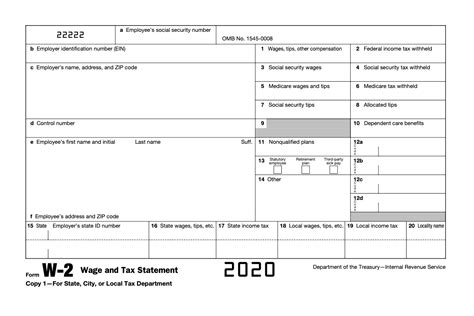

Download a free W2 printable form template to simplify tax season, featuring fillable fields for employee information, income, and deductions, making it easy to generate accurate W-2 forms for employers and employees.

The W2 printable form template is an essential document for employers and employees alike. It serves as a vital tool for reporting wages and taxes withheld from an employee's income. The W2 form, also known as the Wage and Tax Statement, is used by employers to provide employees with a summary of their annual earnings and taxes deducted. This information is crucial for employees to file their tax returns accurately. In this article, we will delve into the importance of the W2 printable form template, its components, and how to use it effectively.

The W2 form is typically issued by employers to their employees by January 31st of each year, covering the previous tax year. It contains vital information such as the employee's name, address, Social Security number, wages earned, and taxes withheld. Employers must also submit a copy of the W2 form to the Social Security Administration (SSA) by the same deadline. The SSA uses this information to track employees' earnings and determine their eligibility for Social Security benefits.

The W2 printable form template is a convenient and efficient way for employers to generate and distribute W2 forms to their employees. The template can be easily customized to include the employer's name, address, and other relevant details. It also ensures that the W2 form is filled out correctly and includes all the necessary information. Employers can use software or online tools to generate the W2 form template, making it easier to manage and distribute the forms to their employees.

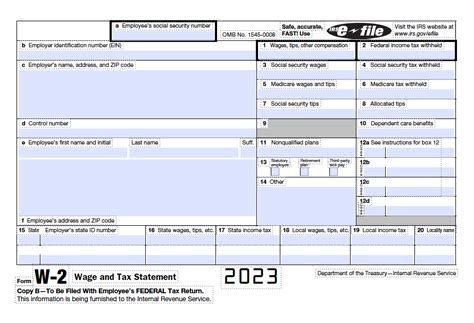

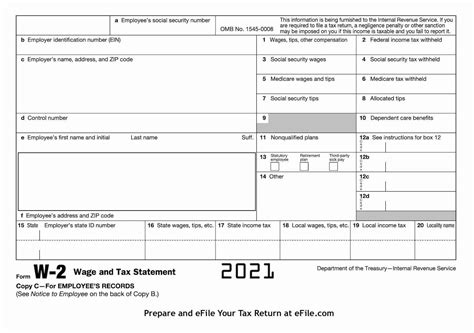

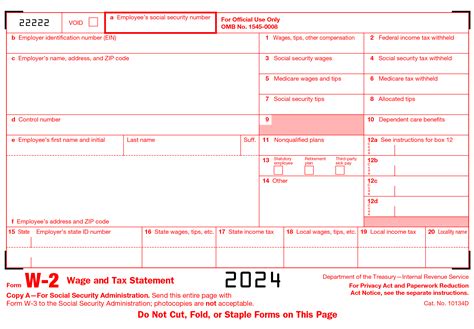

Understanding the W2 Form Components

The W2 form consists of several components that provide essential information about an employee's wages and taxes withheld. The form is divided into several boxes, each containing specific information. Box 1, for example, shows the employee's wages, tips, and other compensation, while Box 2 displays the federal income tax withheld. Box 4 shows the Social Security tax withheld, and Box 6 displays the Medicare tax withheld. The W2 form also includes information about the employer, such as their name, address, and Employer Identification Number (EIN).

Benefits of Using a W2 Printable Form Template

The W2 printable form template offers several benefits for employers and employees. For employers, it provides a convenient and efficient way to generate and distribute W2 forms, reducing the risk of errors and delays. The template can be easily customized to include the employer's name, address, and other relevant details. Employees also benefit from the W2 printable form template, as it provides them with a clear and accurate summary of their annual earnings and taxes deducted.How to Use the W2 Printable Form Template

Using the W2 printable form template is relatively straightforward. Employers can start by downloading the template from a reputable source, such as the IRS website or a payroll software provider. The template can then be customized to include the employer's name, address, and other relevant details. Employers must ensure that the template is filled out accurately and includes all the necessary information, such as the employee's name, Social Security number, and wages earned.

Steps to Complete the W2 Form

To complete the W2 form, employers must follow these steps: * Gather the necessary information, including the employee's name, Social Security number, and wages earned. * Fill out the W2 form template accurately, including all the necessary information. * Review the form for errors and ensure that it is complete. * Distribute the W2 form to employees by January 31st of each year. * Submit a copy of the W2 form to the Social Security Administration (SSA) by the same deadline.Common Mistakes to Avoid When Using the W2 Printable Form Template

When using the W2 printable form template, employers must avoid common mistakes that can lead to errors and delays. These mistakes include:

- Inaccurate or incomplete information, such as incorrect Social Security numbers or wages earned.

- Failure to distribute the W2 form to employees by the deadline.

- Failure to submit a copy of the W2 form to the SSA by the deadline.

- Using an outdated or incorrect W2 form template.

Best Practices for Managing W2 Forms

To manage W2 forms effectively, employers should follow these best practices: * Use a reputable payroll software provider to generate and distribute W2 forms. * Ensure that the W2 form template is filled out accurately and includes all the necessary information. * Review the W2 form for errors before distributing it to employees. * Keep a record of all W2 forms distributed to employees and submitted to the SSA.For more information on managing payroll and tax-related tasks, you can check out our article on payroll processing.

W2 Form Template Customization

The W2 printable form template can be customized to include the employer's name, address, and other relevant details. Employers can use software or online tools to generate the W2 form template, making it easier to manage and distribute the forms to their employees. The template can also be customized to include additional information, such as the employer's logo or a message to employees.

W2 Form Template Security

When using the W2 printable form template, employers must ensure that the template is secure and protected from unauthorized access. This can be achieved by using a reputable payroll software provider and following best practices for managing sensitive employee data.W2 Form Template Distribution

The W2 printable form template can be distributed to employees in various ways, including:

- Mail: Employers can mail the W2 form to employees at their home address.

- Email: Employers can email the W2 form to employees, provided that the email is secure and protected from unauthorized access.

- Online portal: Employers can provide employees with access to an online portal where they can view and download their W2 form.

W2 Form Template Storage

When using the W2 printable form template, employers must ensure that the template is stored securely and protected from unauthorized access. This can be achieved by using a reputable payroll software provider and following best practices for managing sensitive employee data.W2 Form Image Gallery

What is the purpose of the W2 form?

+The W2 form is used to report an employee's wages and taxes withheld from their income.

Who is required to file a W2 form?

+Employers are required to file a W2 form for each employee who earned wages subject to income tax withholding.

What is the deadline for filing W2 forms?

+The deadline for filing W2 forms is January 31st of each year.

Can I use a W2 printable form template to file my W2 forms?

+Yes, you can use a W2 printable form template to file your W2 forms, but you must ensure that the template is accurate and complete.

How do I distribute W2 forms to my employees?

+You can distribute W2 forms to your employees by mail, email, or through an online portal.

In summary, the W2 printable form template is an essential tool for employers and employees alike. It provides a convenient and efficient way to generate and distribute W2 forms, reducing the risk of errors and delays. Employers must ensure that the template is accurate and complete, and that it is distributed to employees by the deadline. By following best practices for managing W2 forms, employers can ensure that they are in compliance with tax laws and regulations. We invite you to share your thoughts and experiences with using W2 printable form templates in the comments below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.