Intro

Get a free W9 Form printable template to streamline tax reporting, including independent contractor income, self-employment taxes, and IRS filings, with easy-to-use fillable PDFs.

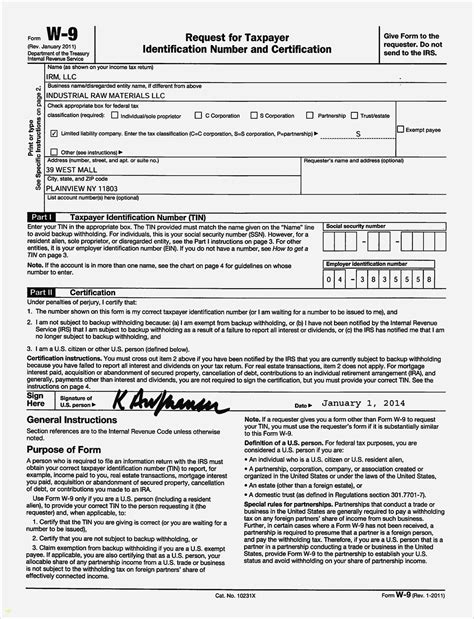

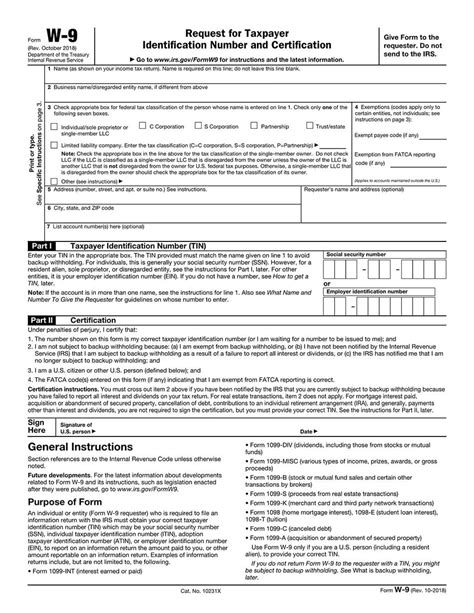

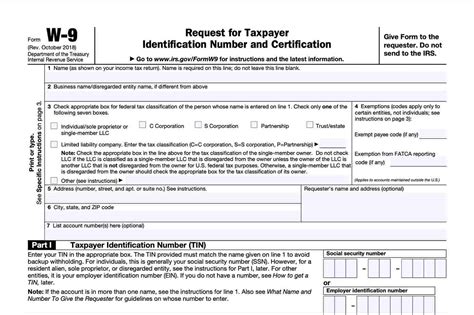

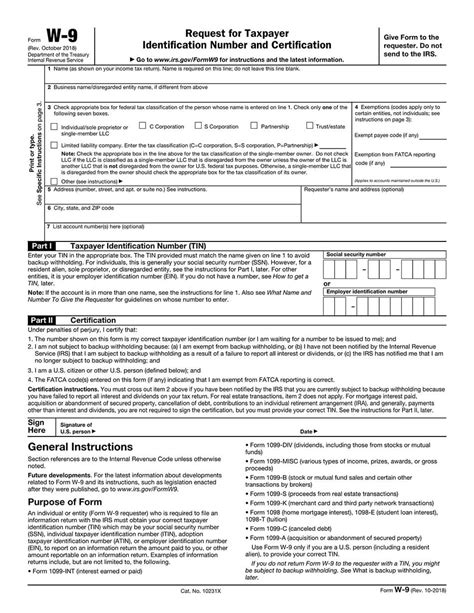

The W9 form is a crucial document for businesses and individuals in the United States, serving as a request for taxpayer identification number and certification. It is used to confirm the identity of independent contractors, freelancers, and vendors, ensuring compliance with tax regulations. The importance of having a W9 form cannot be overstated, as it helps prevent identity theft, ensures accurate tax reporting, and avoids potential penalties. In this article, we will delve into the world of W9 forms, exploring their purpose, benefits, and how to obtain a printable template.

The W9 form is typically used by businesses to collect necessary information from independent contractors, such as their name, address, and taxpayer identification number. This information is then used to generate a 1099-MISC form, which reports the income earned by the contractor. The W9 form is usually provided by the business, but it can also be downloaded from the official IRS website or obtained through various online platforms. With the rise of digital technology, it is now possible to access a W9 form printable template, making it easier for businesses and individuals to manage their tax obligations.

One of the primary benefits of using a W9 form printable template is convenience. It saves time and effort, as users can simply download and print the form, rather than having to manually create one or visit a physical location to obtain it. Additionally, a printable template ensures accuracy, as it provides a standardized format that is easy to follow and understand. This reduces the risk of errors, which can lead to delays or penalties. Furthermore, a W9 form printable template is often free or low-cost, making it an accessible solution for businesses and individuals with limited budgets.

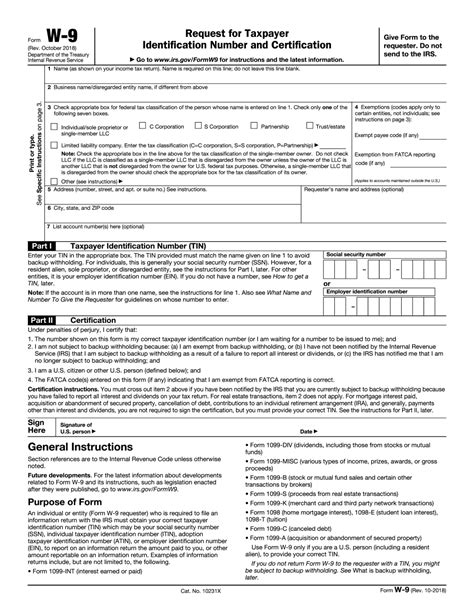

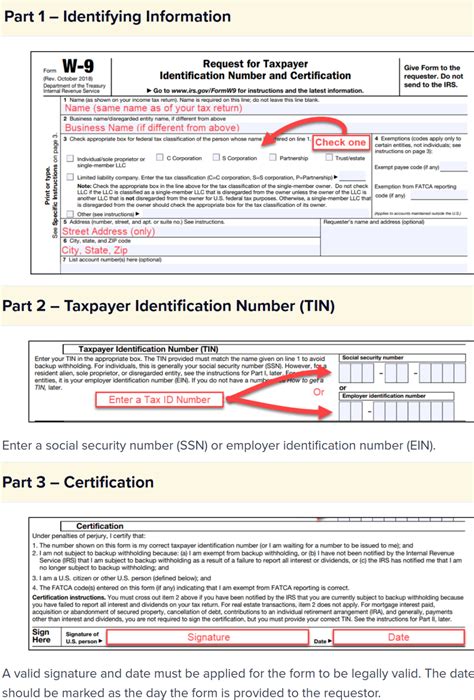

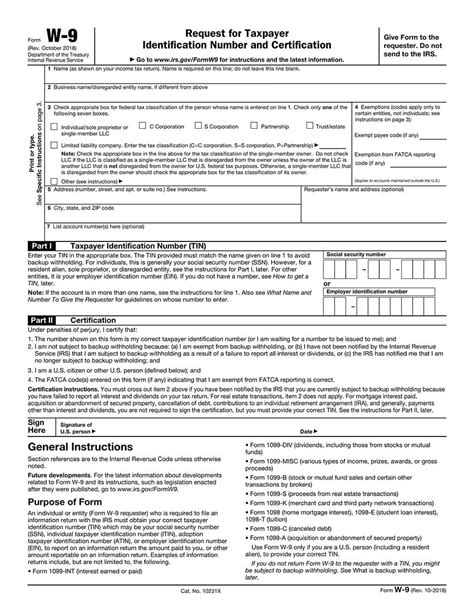

Understanding the W9 Form

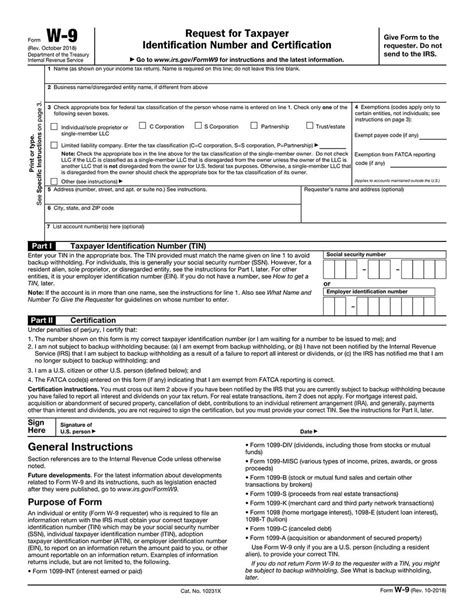

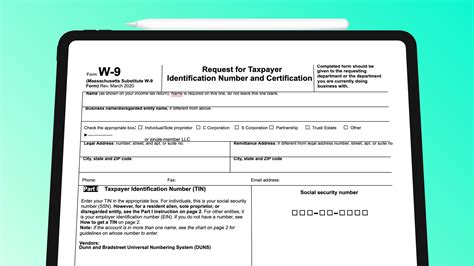

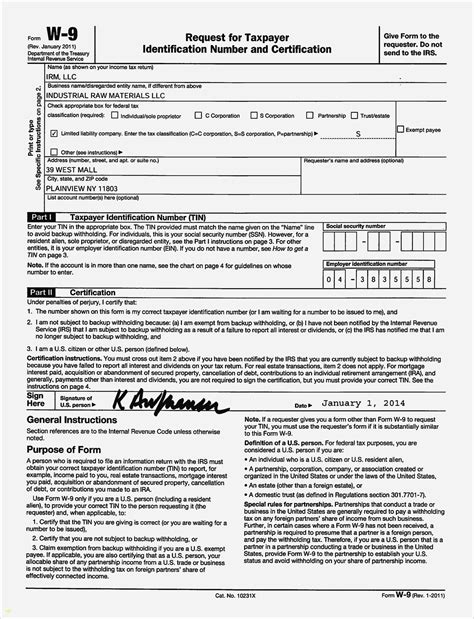

To understand the W9 form, it is essential to familiarize oneself with its components. The form typically includes the following information: the contractor's name, business name, address, taxpayer identification number, and certification. The taxpayer identification number can be either a social security number or an employer identification number, depending on the type of business or individual. The certification section confirms that the information provided is accurate and that the contractor is not subject to backup withholding.

Benefits of Using a W9 Form Printable Template

The benefits of using a W9 form printable template are numerous. Firstly, it streamlines the process of collecting necessary information from independent contractors, making it easier to manage tax obligations. Secondly, it reduces the risk of errors, as the template provides a standardized format that is easy to follow and understand. Thirdly, it saves time and effort, as users can simply download and print the form, rather than having to manually create one or visit a physical location to obtain it. Finally, it is often free or low-cost, making it an accessible solution for businesses and individuals with limited budgets.

How to Obtain a W9 Form Printable Template

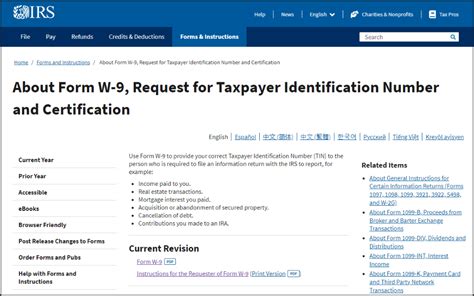

Obtaining a W9 form printable template is relatively straightforward. Users can download the form from the official IRS website or access it through various online platforms. Many websites offer free or low-cost printable templates, which can be easily downloaded and printed. Additionally, some accounting software and tax preparation programs provide W9 form printable templates as part of their services. It is essential to ensure that the template is accurate and up-to-date, as the IRS regularly updates the form to reflect changes in tax regulations.

Steps to Complete a W9 Form

Completing a W9 form involves several steps. Firstly, the contractor must provide their name, business name, and address. Secondly, they must provide their taxpayer identification number, which can be either a social security number or an employer identification number. Thirdly, they must certify that the information provided is accurate and that they are not subject to backup withholding. Finally, they must sign and date the form, confirming that the information is true and accurate.

Importance of Accurate Information

Accurate information is crucial when completing a W9 form. Inaccurate or incomplete information can lead to delays or penalties, which can have serious consequences for businesses and individuals. It is essential to ensure that the information provided is accurate and up-to-date, as the IRS regularly updates the form to reflect changes in tax regulations. Additionally, accurate information helps prevent identity theft, ensures accurate tax reporting, and avoids potential penalties.

Common Mistakes to Avoid

There are several common mistakes to avoid when completing a W9 form. Firstly, ensure that the information provided is accurate and up-to-date. Secondly, use the correct taxpayer identification number, which can be either a social security number or an employer identification number. Thirdly, certify that the information provided is accurate and that the contractor is not subject to backup withholding. Finally, sign and date the form, confirming that the information is true and accurate.

Best Practices for Managing W9 Forms

Managing W9 forms effectively is crucial for businesses and individuals. Firstly, ensure that all W9 forms are completed accurately and thoroughly. Secondly, store the forms in a secure location, such as a locked cabinet or a digital database. Thirdly, regularly review and update the forms to reflect changes in tax regulations or business operations. Finally, consider using a W9 form printable template to streamline the process and reduce errors.

Internal Link to Another Post

For more information on tax compliance and management, check out our article on tax preparation tips.W9 Form Image Gallery

What is a W9 form?

+A W9 form is a request for taxpayer identification number and certification, used to confirm the identity of independent contractors, freelancers, and vendors.

Why is a W9 form important?

+A W9 form is important because it helps prevent identity theft, ensures accurate tax reporting, and avoids potential penalties.

How do I obtain a W9 form printable template?

+You can obtain a W9 form printable template by downloading it from the official IRS website or accessing it through various online platforms.

What are the benefits of using a W9 form printable template?

+The benefits of using a W9 form printable template include convenience, accuracy, and cost-effectiveness.

What are the common mistakes to avoid when completing a W9 form?

+Common mistakes to avoid when completing a W9 form include providing inaccurate or incomplete information, using the incorrect taxpayer identification number, and failing to certify the information provided.

In conclusion, the W9 form is a vital document for businesses and individuals in the United States, serving as a request for taxpayer identification number and certification. By understanding the purpose and benefits of the W9 form, as well as how to obtain a printable template, users can streamline their tax obligations and avoid potential penalties. We encourage readers to share their experiences and tips for managing W9 forms in the comments section below. Additionally, we invite readers to explore our other articles on tax compliance and management, such as our post on tax preparation tips. By working together, we can ensure accurate and efficient tax reporting, and avoid the pitfalls of non-compliance.