Intro

Discover 5 ways to utilize W9 form printable templates, streamlining tax compliance with independent contractors, freelancers, and sole proprietors, ensuring accurate IRS reporting and efficient income tracking.

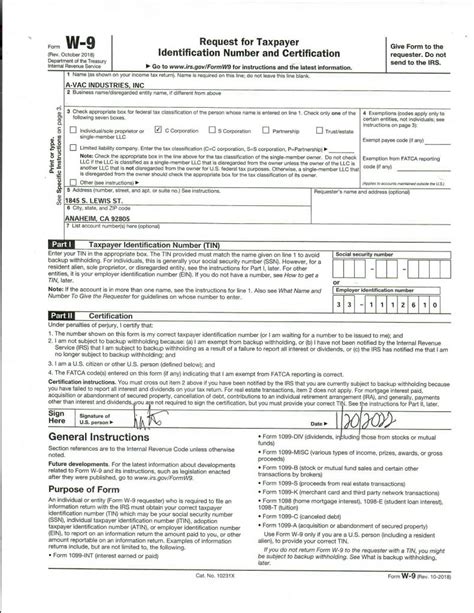

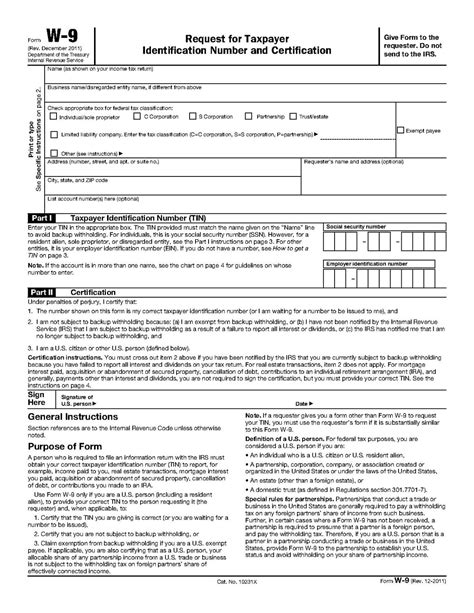

The W9 form is a crucial document for businesses and individuals who work as independent contractors or freelancers. It provides essential information to clients and the Internal Revenue Service (IRS) about the taxpayer's identity and tax status. In this article, we will explore the importance of the W9 form and provide a comprehensive guide on how to obtain a W9 form printable.

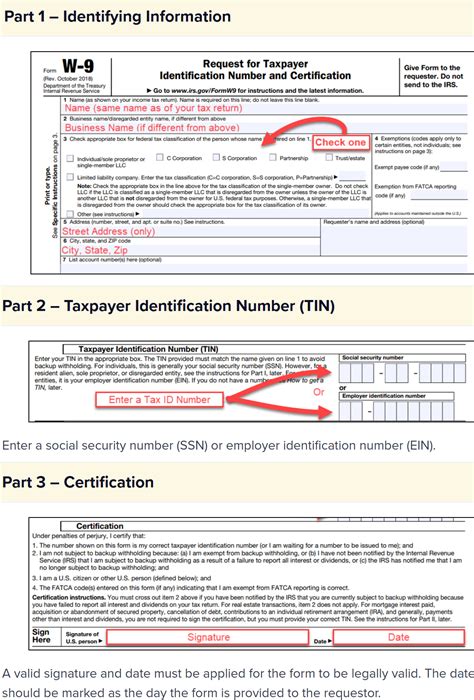

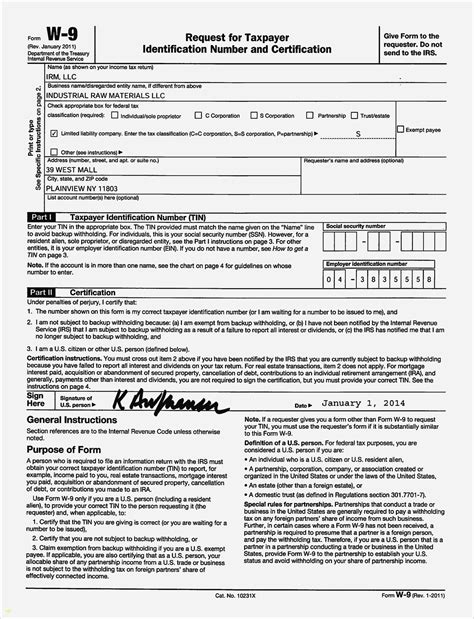

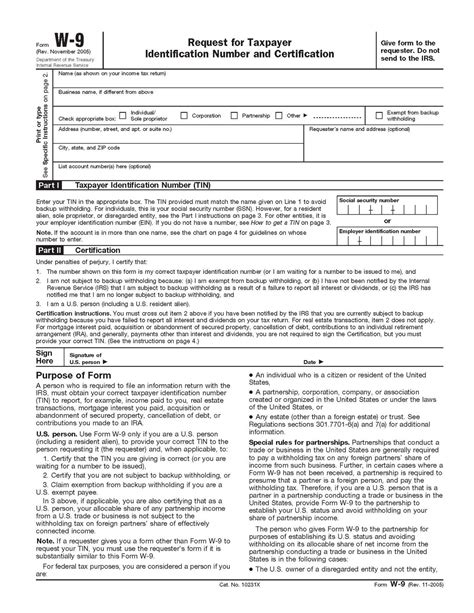

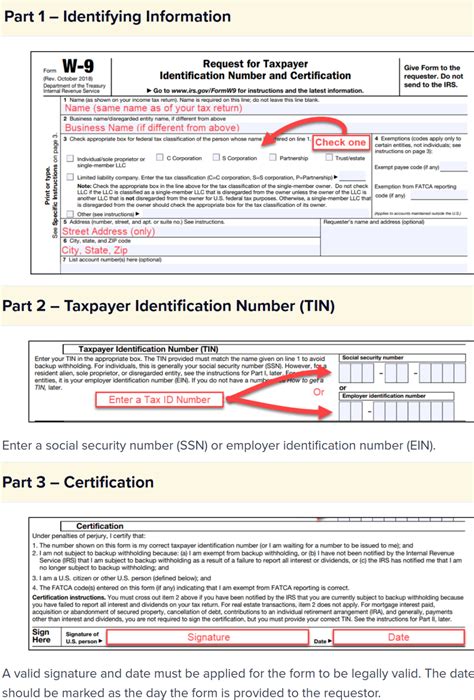

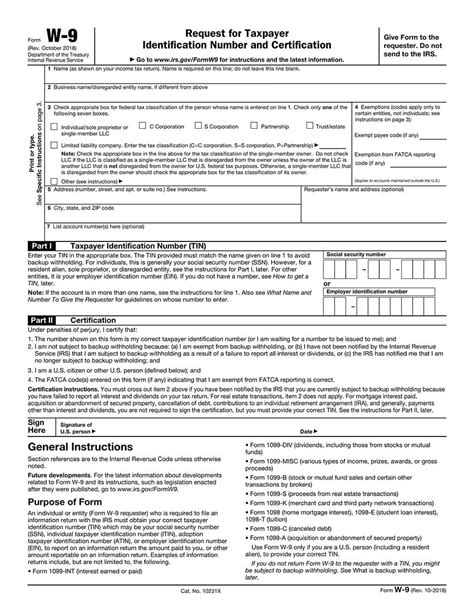

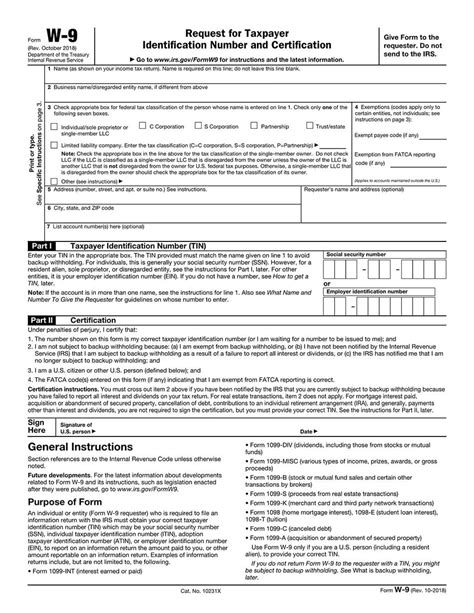

The W9 form is used to certify the taxpayer's identity and tax status, and it is typically required by clients who hire independent contractors or freelancers. The form includes information such as the taxpayer's name, address, and tax identification number, as well as their tax classification (e.g., individual, corporation, partnership). The W9 form is usually provided to the client at the beginning of the working relationship, and it is used to determine the correct amount of taxes to be withheld from payments made to the contractor.

For businesses and individuals who need to provide a W9 form to their clients, it is essential to have access to a W9 form printable. This can be obtained from the IRS website or through various online sources. Having a W9 form printable can save time and effort, as it eliminates the need to manually fill out the form or wait for a physical copy to be mailed.

What is a W9 Form?

A W9 form is a document that provides essential information about a taxpayer's identity and tax status. It is used by clients to determine the correct amount of taxes to be withheld from payments made to independent contractors or freelancers. The W9 form includes information such as the taxpayer's name, address, and tax identification number, as well as their tax classification.

Importance of W9 Form

The W9 form is a critical document that serves several purposes. It helps clients to verify the taxpayer's identity and tax status, which is essential for tax compliance and reporting purposes. The W9 form also provides a record of the taxpayer's tax classification, which determines the correct amount of taxes to be withheld from payments.Benefits of Using a W9 Form Printable

Using a W9 form printable offers several benefits, including convenience, time-saving, and accuracy. With a W9 form printable, businesses and individuals can quickly and easily provide the required information to their clients, without having to manually fill out the form or wait for a physical copy to be mailed.

How to Obtain a W9 Form Printable

There are several ways to obtain a W9 form printable, including: * Downloading the form from the IRS website * Using online tax software or services * Contacting a tax professional or accountant * Visiting a local IRS office5 Ways to Use a W9 Form Printable

Here are five ways to use a W9 form printable:

- Provide required information to clients: A W9 form printable can be used to provide the required information to clients, including the taxpayer's name, address, and tax identification number.

- Verify tax status: The W9 form printable can be used to verify the taxpayer's tax status, including their tax classification and withholding status.

- Determine tax withholding: The W9 form printable can be used to determine the correct amount of taxes to be withheld from payments made to independent contractors or freelancers.

- Comply with tax regulations: Using a W9 form printable can help businesses and individuals comply with tax regulations and avoid penalties or fines.

- Streamline tax reporting: The W9 form printable can be used to streamline tax reporting and reduce errors or discrepancies.

Best Practices for Using a W9 Form Printable

To get the most out of a W9 form printable, it is essential to follow best practices, including: * Ensuring accuracy and completeness of the information provided * Using the latest version of the W9 form * Keeping a record of the W9 form for future reference * Providing the W9 form to clients in a timely mannerFor more information on tax forms and compliance, you can check out our article on tax compliance.

Common Mistakes to Avoid When Using a W9 Form Printable

When using a W9 form printable, there are several common mistakes to avoid, including:

- Incomplete or inaccurate information

- Using an outdated version of the W9 form

- Failing to provide the W9 form to clients in a timely manner

- Not keeping a record of the W9 form for future reference

Consequences of Not Using a W9 Form Printable

Failing to use a W9 form printable can have serious consequences, including penalties or fines for non-compliance with tax regulations. It can also lead to errors or discrepancies in tax reporting, which can result in additional taxes or interest owed.Conclusion and Next Steps

In conclusion, a W9 form printable is a valuable resource for businesses and individuals who need to provide required information to clients. By following best practices and avoiding common mistakes, taxpayers can ensure compliance with tax regulations and avoid penalties or fines.

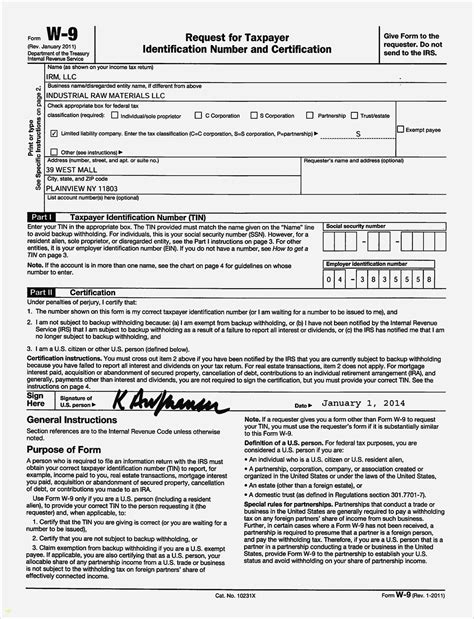

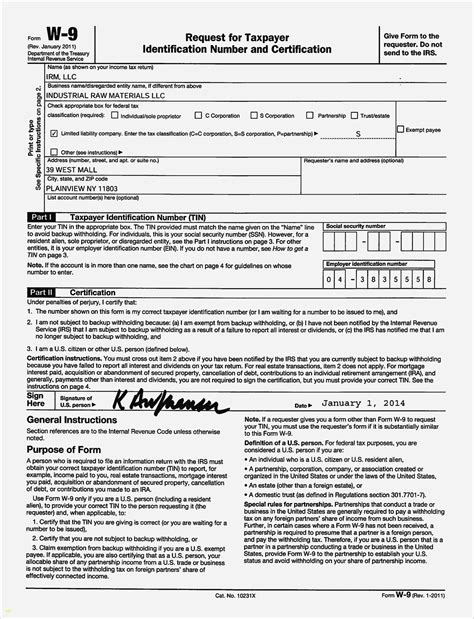

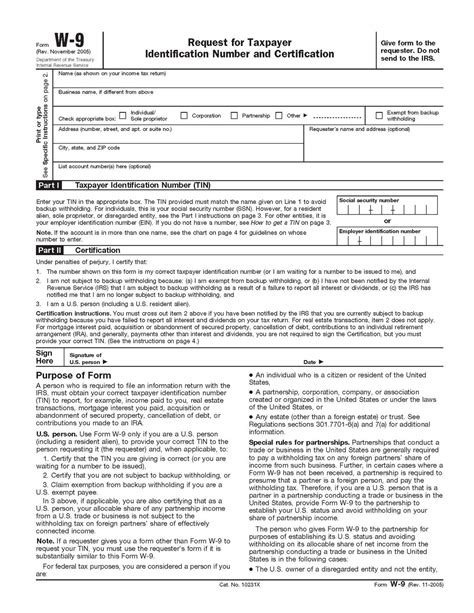

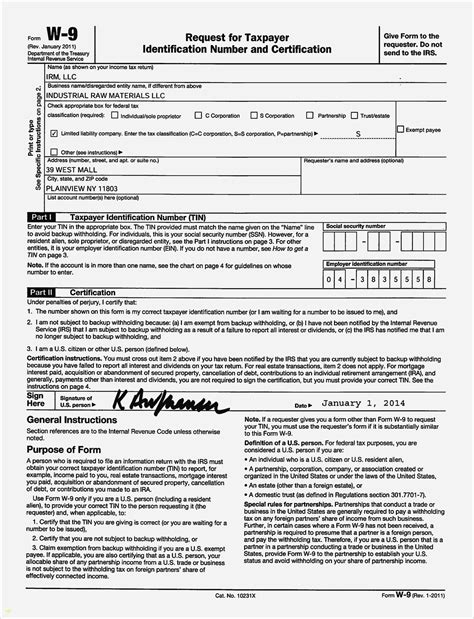

W9 Form Image Gallery

What is a W9 form used for?

+A W9 form is used to certify the taxpayer's identity and tax status, and it is typically required by clients who hire independent contractors or freelancers.

How do I obtain a W9 form printable?

+You can obtain a W9 form printable by downloading the form from the IRS website, using online tax software or services, contacting a tax professional or accountant, or visiting a local IRS office.

What are the consequences of not using a W9 form printable?

+Failing to use a W9 form printable can result in penalties or fines for non-compliance with tax regulations, as well as errors or discrepancies in tax reporting.

We hope this article has provided you with a comprehensive guide on how to use a W9 form printable. If you have any further questions or need additional information, please don't hesitate to comment below. You can also share this article with others who may find it useful. Additionally, you can check out our other articles on tax compliance and reporting for more information and resources.