Intro

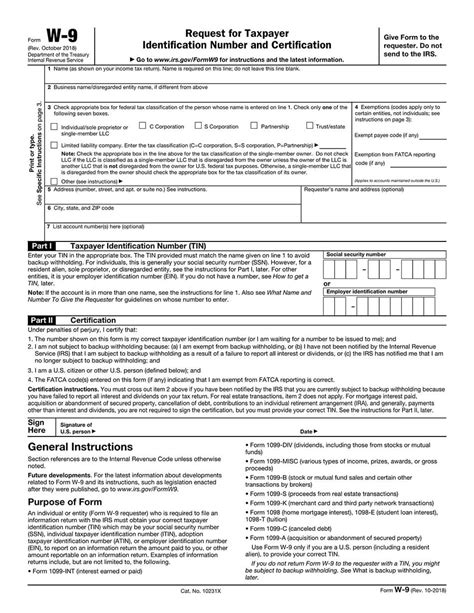

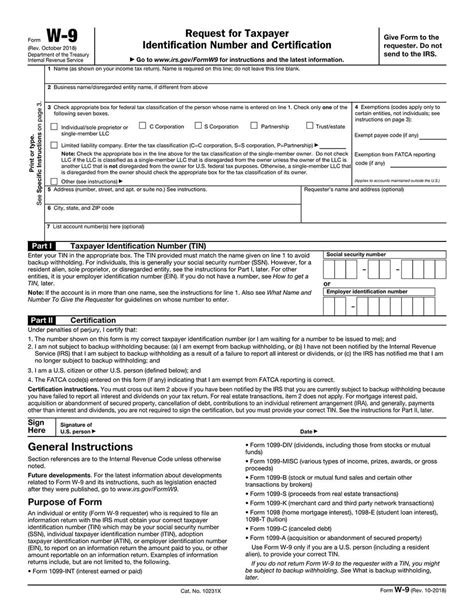

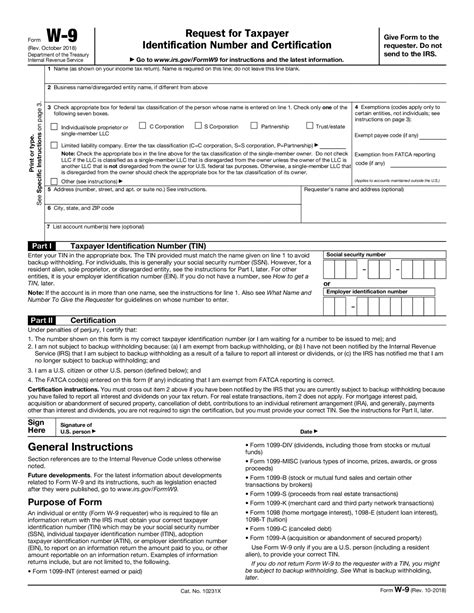

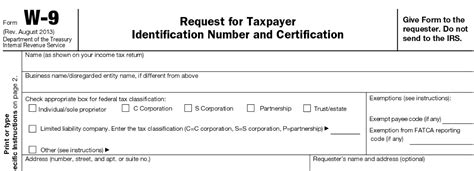

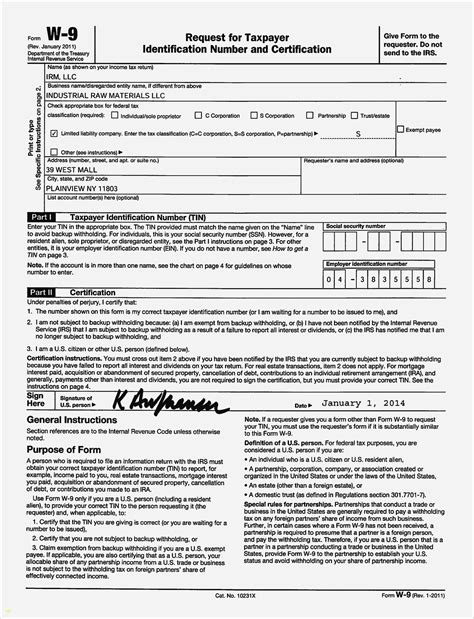

Download a free W9 Forms Printable Template to streamline tax reporting, featuring fillable fields for independent contractors, freelancers, and vendors, with IRS-compliant layout and instructions for easy 1099 filing and compliance.

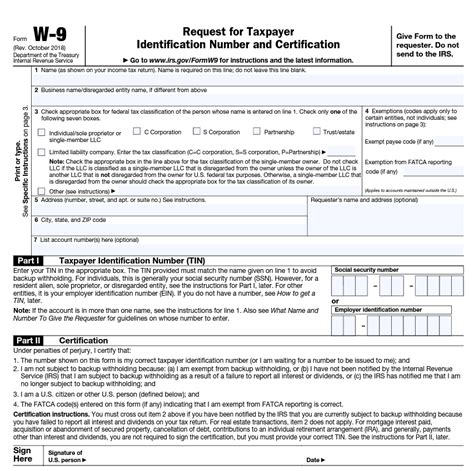

The W9 form is a crucial document for businesses and individuals in the United States, as it provides essential information for tax purposes. A W9 form, also known as the Request for Taxpayer Identification Number and Certification, is used to confirm a person's identity and taxpayer identification number. In this article, we will delve into the world of W9 forms, exploring their importance, benefits, and how to obtain a printable template.

The W9 form is typically used by employers to verify the identity of their employees, contractors, and vendors. It is essential for businesses to have a completed W9 form on file for each worker, as it helps to ensure compliance with tax laws and regulations. The form requires individuals to provide their name, address, taxpayer identification number, and certification that they are not subject to backup withholding. The W9 form is usually submitted to the employer or payer, who will then use the information to prepare tax returns and other documents.

Having a W9 form printable template can be beneficial for businesses and individuals, as it saves time and effort. Instead of searching for a blank W9 form online or visiting the IRS website, individuals can simply print out a template and fill it in. This can be especially helpful for small businesses or those with limited administrative resources. Moreover, using a printable template can reduce errors and ensure that all necessary information is included.

Benefits of Using a W9 Form Printable Template

Using a W9 form printable template offers several benefits, including convenience, accuracy, and compliance. With a printable template, individuals can quickly and easily complete the form, reducing the risk of errors or omissions. Additionally, using a template can help ensure that all necessary information is included, which can help to prevent delays or issues with tax returns. Furthermore, having a completed W9 form on file can help businesses to demonstrate compliance with tax laws and regulations, reducing the risk of audits or penalties.

How to Obtain a W9 Form Printable Template

There are several ways to obtain a W9 form printable template, including downloading one from the IRS website or using a third-party provider. The IRS website offers a range of tax forms and publications, including the W9 form, which can be downloaded and printed out. Alternatively, individuals can use a third-party provider, such as a tax preparation software or a online form builder, to create a customizable W9 form template. These templates can be tailored to meet specific business needs and can include additional fields or information as required.Completing a W9 Form Printable Template

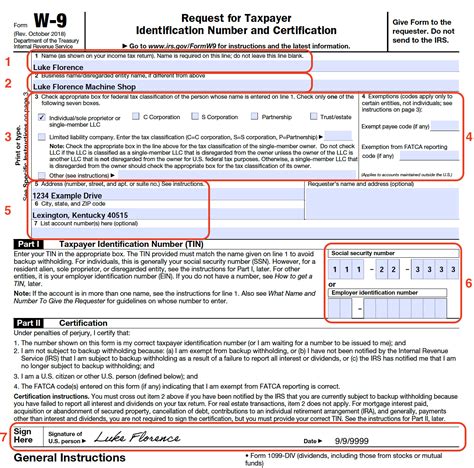

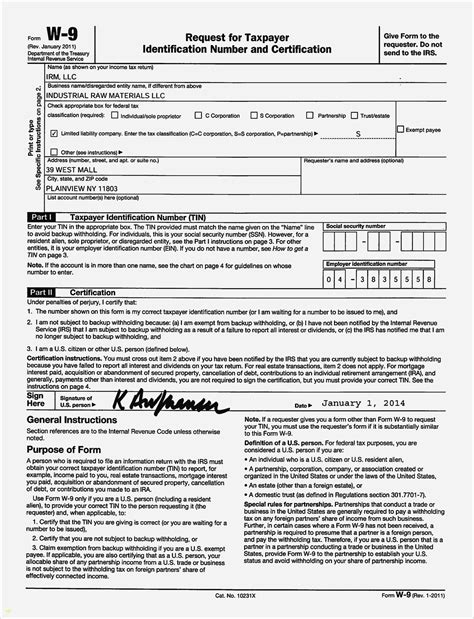

Completing a W9 form printable template is a straightforward process that requires individuals to provide their personal and tax information. The form typically includes the following fields:

- Name and address

- Taxpayer identification number (such as a Social Security number or Employer Identification Number)

- Certification that the individual is not subject to backup withholding

- Certification that the individual is a U.S. person (including a U.S. citizen, resident, or entity)

To complete the form, individuals should follow these steps:

- Download and print out a W9 form printable template

- Fill in the required information, including name, address, and taxpayer identification number

- Certify that the individual is not subject to backup withholding and is a U.S. person

- Sign and date the form

- Submit the completed form to the employer or payer

Common Mistakes to Avoid When Completing a W9 Form

When completing a W9 form printable template, there are several common mistakes to avoid, including: * Inaccurate or incomplete information * Failure to sign and date the form * Using an outdated or incorrect form * Not keeping a copy of the completed form for recordsTo avoid these mistakes, individuals should carefully review the form before submitting it and ensure that all information is accurate and complete. Additionally, it is essential to keep a copy of the completed form for records, as this can help to prevent issues or delays with tax returns.

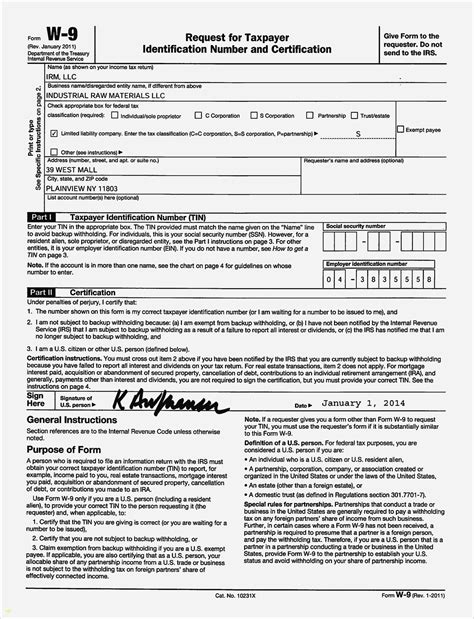

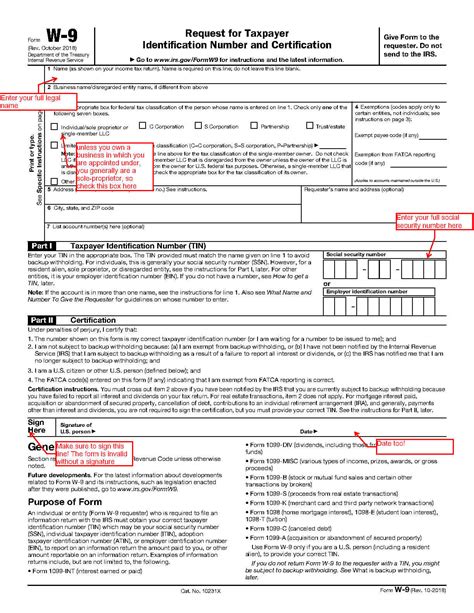

W9 Form Printable Template Example

A W9 form printable template example can be helpful for individuals who are unsure about how to complete the form. The example can provide a guide on how to fill in the required information and can help to reduce errors or omissions. Additionally, using an example can help to ensure that all necessary information is included, which can help to prevent delays or issues with tax returns.

For more information on tax forms and publications, you can visit our internal link to another post on tax forms.

Best Practices for Using a W9 Form Printable Template

When using a W9 form printable template, there are several best practices to follow, including: * Using a current and accurate form * Keeping a copy of the completed form for records * Ensuring that all information is accurate and complete * Reviewing the form carefully before submitting it * Using a secure and reliable method to submit the formBy following these best practices, individuals can help to ensure that their W9 form is completed accurately and efficiently, reducing the risk of errors or delays with tax returns.

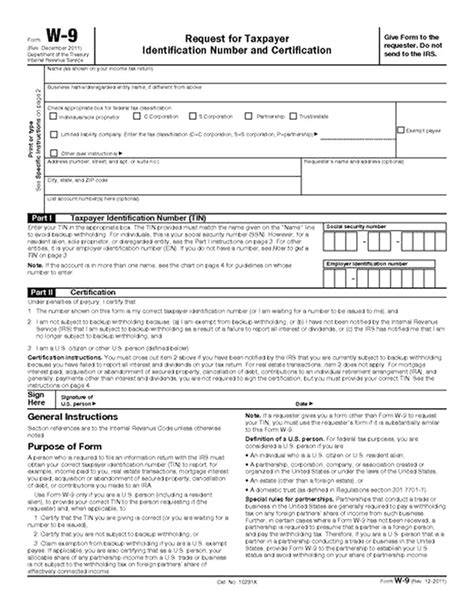

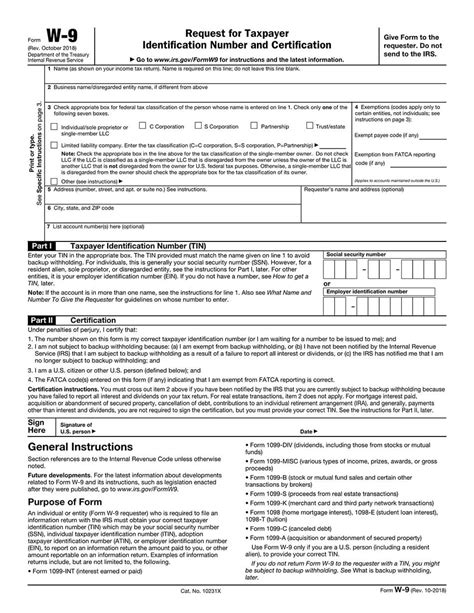

Gallery of W9 Forms

W9 Form Image Gallery

FAQs

What is a W9 form used for?

+A W9 form is used to confirm a person's identity and taxpayer identification number.

How do I obtain a W9 form printable template?

+You can obtain a W9 form printable template by downloading one from the IRS website or using a third-party provider.

What information do I need to provide on a W9 form?

+You will need to provide your name, address, taxpayer identification number, and certification that you are not subject to backup withholding.

In summary, a W9 form printable template is a useful tool for businesses and individuals, providing a convenient and efficient way to complete the form. By using a template, individuals can reduce errors and ensure that all necessary information is included, helping to prevent delays or issues with tax returns. Whether you are an employer, contractor, or vendor, having a completed W9 form on file is essential for compliance with tax laws and regulations. We invite you to share your thoughts and experiences with W9 forms in the comments below, and don't forget to share this article with others who may find it helpful.