Intro

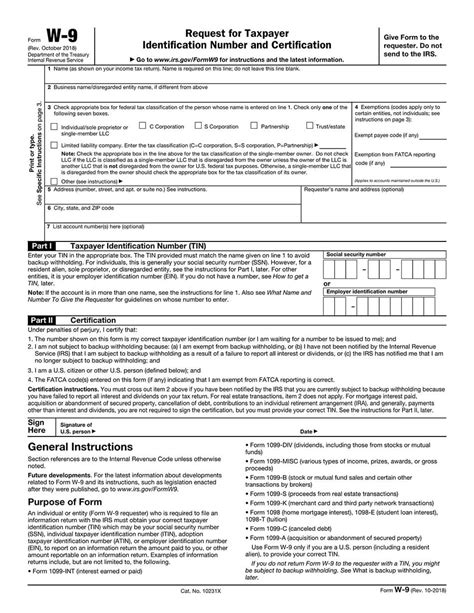

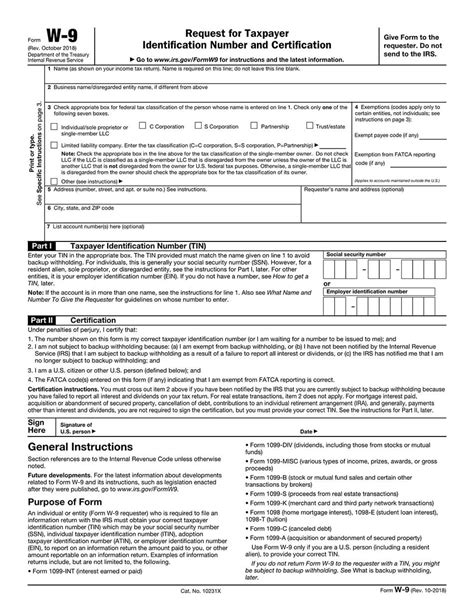

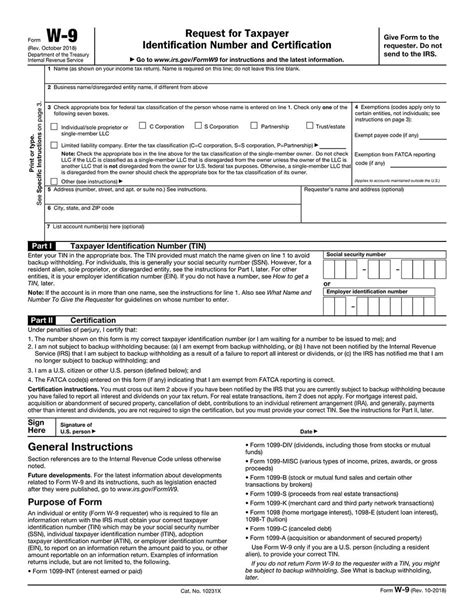

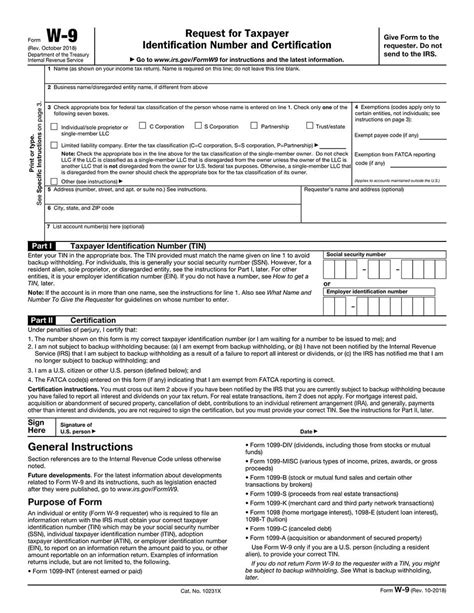

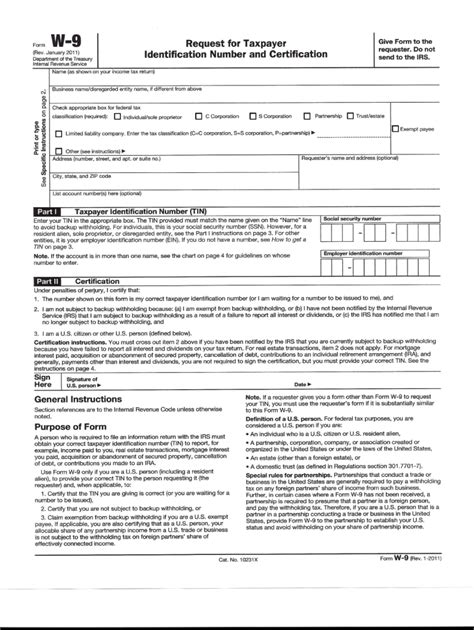

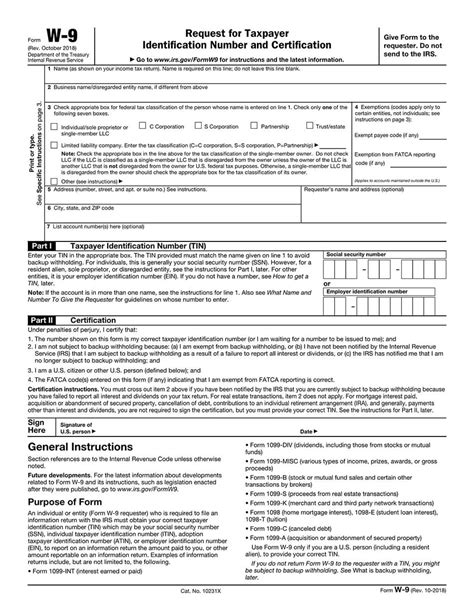

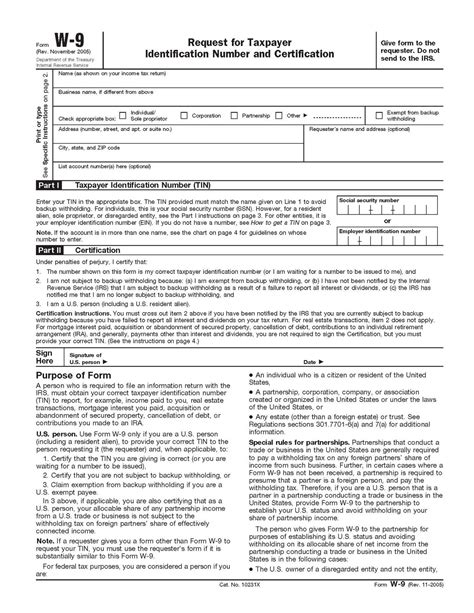

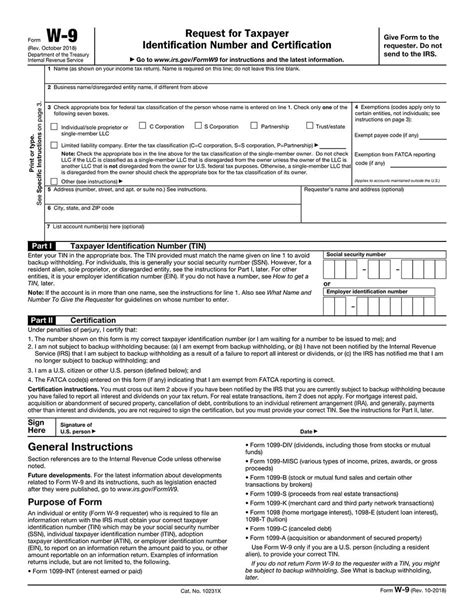

Download 5 free W9 printable forms, including IRS templates and sample W9 forms, to streamline 1099 tax filing and independent contractor management with accurate W9 information and compliance.

The 5 W9 printable forms are essential documents for businesses and individuals to report income and taxes to the Internal Revenue Service (IRS). Understanding the importance of these forms and how to fill them out correctly is crucial for compliance with tax laws and regulations. In this article, we will delve into the world of W9 forms, exploring their purpose, benefits, and steps to complete them accurately.

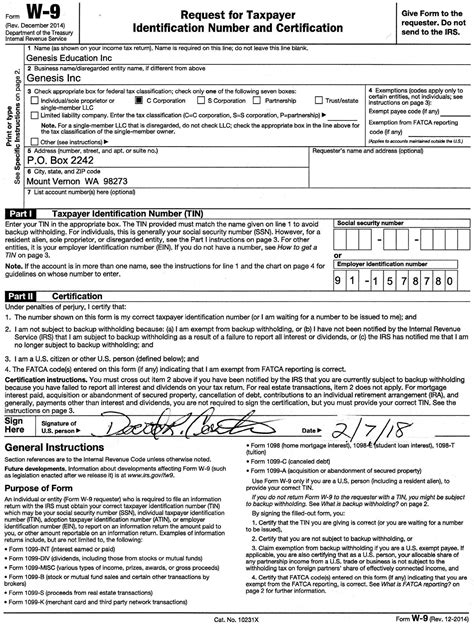

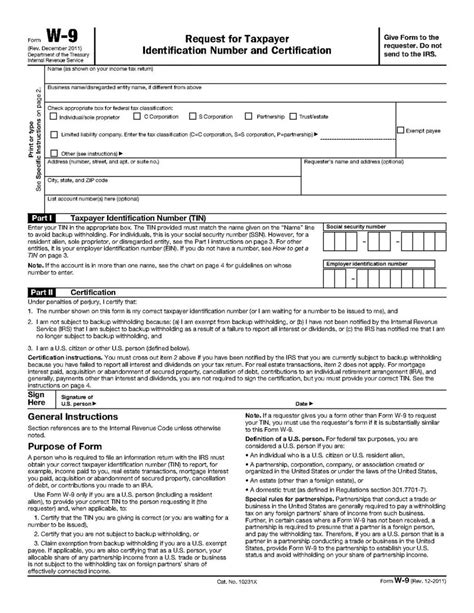

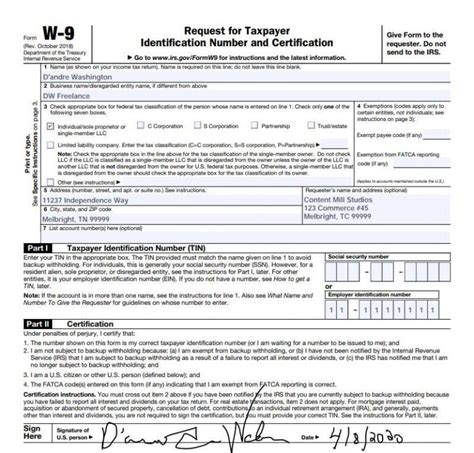

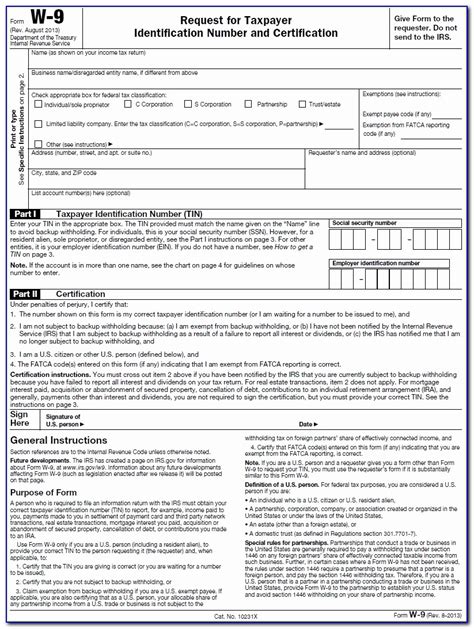

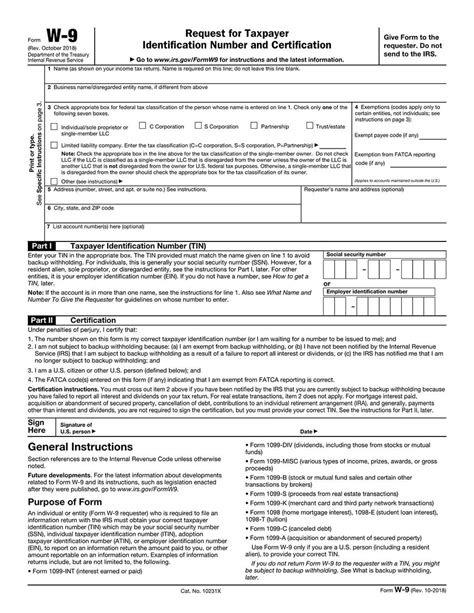

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a critical document used by businesses to gather necessary information from vendors, freelancers, and independent contractors. This information includes the taxpayer identification number, business name, and address, which are required for tax reporting purposes. The 5 W9 printable forms refer to the different types of W9 forms that cater to various business needs and industries.

Filling out W9 forms correctly is vital to avoid delays in payment and potential penalties from the IRS. Businesses must ensure that they have the most up-to-date and accurate information from their vendors and contractors to report income and taxes accurately. The 5 W9 printable forms provide a convenient and efficient way to collect and manage this information.

Introduction to W9 Forms

W9 forms are used to certify the taxpayer identification number (TIN) of a business or individual, which can be either a Social Security number (SSN) or an Employer Identification Number (EIN). The form also requires the business name, address, and type of business entity, such as a sole proprietorship, partnership, or corporation. The information collected on the W9 form is used to generate a 1099-MISC form, which reports income paid to vendors and contractors.

Benefits of Using W9 Forms

The benefits of using W9 forms are numerous. They provide a standardized way to collect and verify taxpayer identification numbers, reducing errors and potential penalties. W9 forms also help businesses to maintain accurate records and comply with tax laws and regulations. Additionally, the forms enable businesses to report income and taxes accurately, ensuring that they meet their tax obligations.

Types of W9 Forms

There are several types of W9 forms, each catering to specific business needs and industries. The most common types of W9 forms include:

- W9: Request for Taxpayer Identification Number and Certification

- W8: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding

- W7: Application for IRS Individual Taxpayer Identification Number

- 1099-MISC: Miscellaneous Income

Steps to Complete W9 Forms

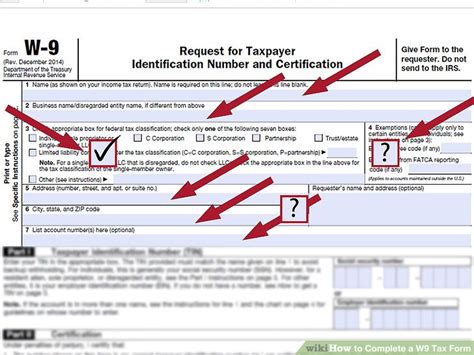

Completing W9 forms requires careful attention to detail to ensure accuracy and compliance with tax laws. The steps to complete W9 forms include:

- Download and print the W9 form from the IRS website or use a printable template.

- Fill out the form accurately, providing the required information, including the taxpayer identification number, business name, and address.

- Certify the information provided by signing and dating the form.

- Return the completed form to the requester, usually the business or individual requesting the information.

Best Practices for Managing W9 Forms

Managing W9 forms effectively is crucial to maintaining accurate records and complying with tax laws. Best practices for managing W9 forms include:

- Using a secure and centralized system to store and manage W9 forms

- Implementing a process to verify and update W9 forms regularly

- Providing training to employees on the importance of W9 forms and how to complete them accurately

- Using technology, such as electronic signatures and digital storage, to streamline the W9 form process

Common Mistakes to Avoid When Completing W9 Forms

Common mistakes to avoid when completing W9 forms include:

- Inaccurate or missing information

- Failure to certify the form

- Using an outdated or incorrect form

- Not keeping a copy of the completed form for records

Importance of W9 Forms in Tax Compliance

W9 forms play a critical role in tax compliance, enabling businesses to report income and taxes accurately. The importance of W9 forms in tax compliance includes:

- Accurate reporting of income and taxes

- Compliance with tax laws and regulations

- Reduction of errors and potential penalties

- Maintenance of accurate records

W9 Forms and IRS Audits

W9 forms can be an essential component of an IRS audit, providing evidence of tax compliance and accurate reporting of income and taxes. During an IRS audit, the examiner may request W9 forms to verify the taxpayer identification number and business information.

For more information on IRS audits and tax compliance, you can visit our IRS Audits page.

W9 Forms Image Gallery

What is the purpose of a W9 form?

+The purpose of a W9 form is to certify the taxpayer identification number and business information for tax reporting purposes.

Who needs to complete a W9 form?

+Vendors, freelancers, and independent contractors need to complete a W9 form to provide their taxpayer identification number and business information to businesses.

What are the consequences of not completing a W9 form accurately?

+The consequences of not completing a W9 form accurately include delays in payment, potential penalties from the IRS, and errors in tax reporting.

How often do I need to update my W9 form?

+You should update your W9 form whenever your business information changes, such as a change in address or taxpayer identification number.

Can I use an electronic signature on a W9 form?

+Yes, you can use an electronic signature on a W9 form, but it must meet the IRS requirements for electronic signatures.

In conclusion, the 5 W9 printable forms are essential documents for businesses and individuals to report income and taxes to the IRS. Understanding the importance of these forms and how to fill them out correctly is crucial for compliance with tax laws and regulations. By following the steps outlined in this article and using the best practices for managing W9 forms, businesses can ensure accurate reporting of income and taxes, reduce errors, and maintain compliance with tax laws. We invite you to share your thoughts and experiences with W9 forms in the comments below and to explore our other articles on tax compliance and IRS audits.