Intro

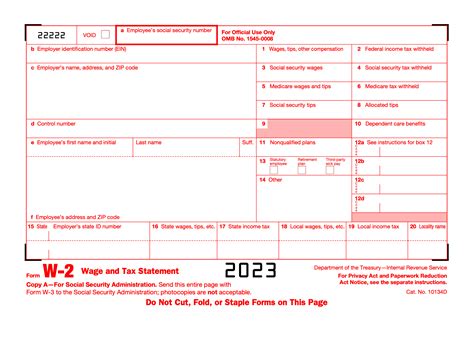

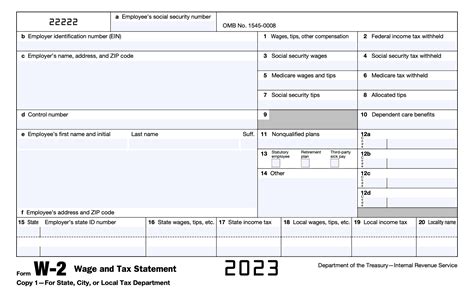

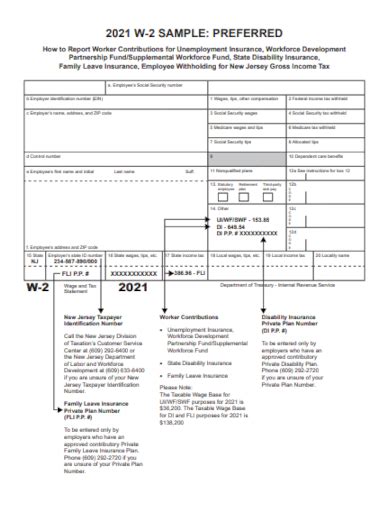

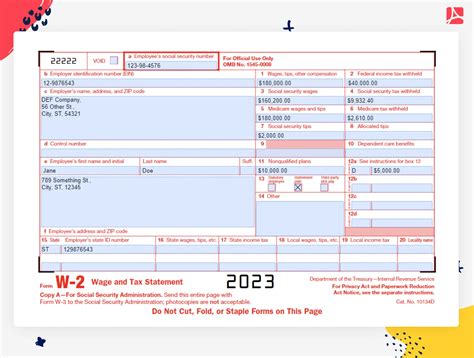

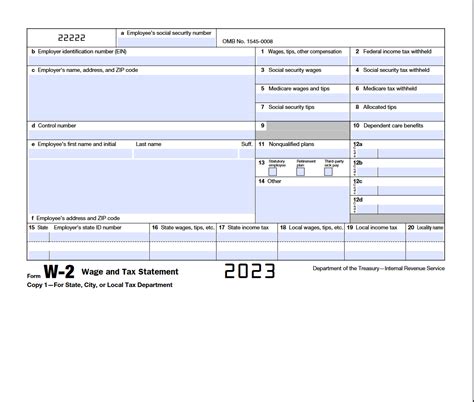

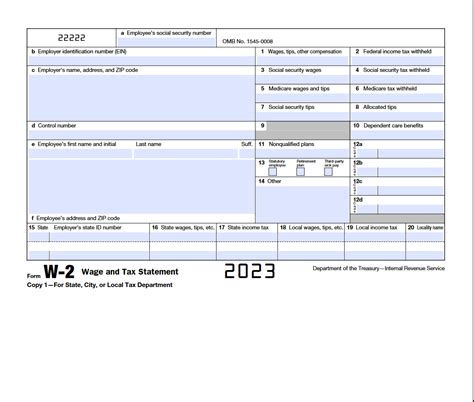

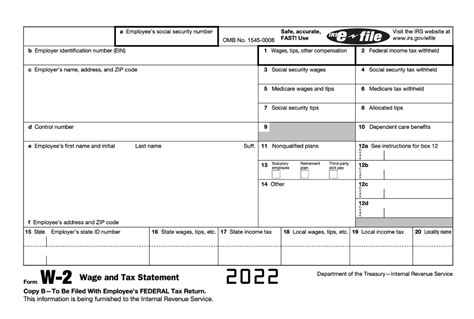

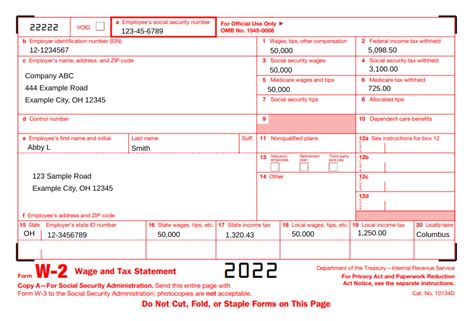

Get instant access to a free W2 Form Printable Template, featuring employer info, employee details, and tax withholding data, making tax season easier with editable and downloadable templates.

The W2 form is a crucial document for both employers and employees in the United States, as it serves as a record of an employee's income and taxes withheld. Employers are required to provide a W2 form to each of their employees by January 31st of each year, and the form must be filed with the Social Security Administration (SSA) by the same deadline. In this article, we will delve into the world of W2 forms, exploring their importance, the information they contain, and how to obtain a printable template.

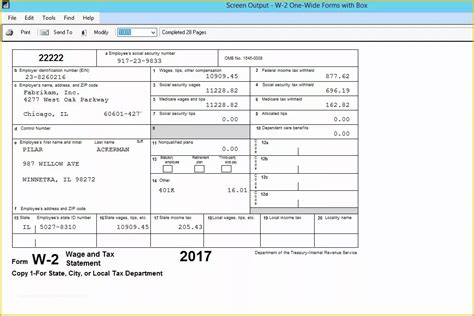

The W2 form is a vital component of the tax filing process, as it provides the necessary information for employees to complete their tax returns. The form includes details such as the employee's name, address, and Social Security number, as well as the employer's name, address, and Employer Identification Number (EIN). Additionally, the W2 form reports the employee's wages, tips, and other compensation, as well as the amount of federal, state, and local taxes withheld.

For employers, the W2 form is a critical document that must be accurately completed and filed on time. Failure to do so can result in penalties and fines, which can be costly and time-consuming to resolve. Furthermore, the W2 form is used by the SSA to track employees' earnings and determine their eligibility for Social Security benefits.

Understanding the W2 Form

The W2 form is typically divided into several sections, each containing specific information about the employee and their employment. The form includes the following boxes:

- Box 1: Wages, tips, other compensation

- Box 2: Federal income tax withheld

- Box 3: Social Security wages

- Box 4: Social Security tax withheld

- Box 5: Medicare wages and tips

- Box 6: Medicare tax withheld

- Box 7: Social Security tips

- Box 8: Allocated tips

- Box 9: Advance EIC payment

- Box 10: Dependent care benefits

- Box 11: Nonqualified plans

- Box 12: Codes

- Box 13: Retirement plan

- Box 14: Other

Benefits of Using a W2 Form Printable Template

Using a W2 form printable template can simplify the process of completing and filing W2 forms. A template can help employers ensure that they are including all the necessary information and that the form is accurately completed. Additionally, a template can save time and reduce the risk of errors, which can be costly and time-consuming to correct.Some of the benefits of using a W2 form printable template include:

- Accuracy: A template can help ensure that the W2 form is accurately completed, reducing the risk of errors and penalties.

- Efficiency: A template can save time and streamline the process of completing and filing W2 forms.

- Compliance: A template can help employers comply with tax laws and regulations, reducing the risk of penalties and fines.

- Cost savings: A template can reduce the cost of completing and filing W2 forms, as it eliminates the need for manual completion and reduces the risk of errors.

How to Obtain a W2 Form Printable Template

There are several ways to obtain a W2 form printable template, including:

- IRS website: The IRS website offers a range of tax forms and templates, including the W2 form.

- Tax software: Many tax software programs, such as TurboTax and H&R Block, offer W2 form templates and completion tools.

- Online template providers: There are several online template providers that offer W2 form templates, such as Microsoft Office and Adobe.

- Accounting software: Many accounting software programs, such as QuickBooks and Xero, offer W2 form templates and completion tools.

Steps to Complete a W2 Form Printable Template

Completing a W2 form printable template involves several steps, including: 1. Gathering necessary information: Employers must gather the necessary information, including the employee's name, address, and Social Security number, as well as the employer's name, address, and EIN. 2. Completing the form: Employers must complete the W2 form, including all the necessary boxes and information. 3. Reviewing and verifying: Employers must review and verify the information on the W2 form to ensure accuracy and completeness. 4. Signing and dating: Employers must sign and date the W2 form, indicating that the information is accurate and complete. 5. Filing with the SSA: Employers must file the W2 form with the SSA by the deadline, which is typically January 31st of each year.For more information on tax-related topics, you can visit our internal link to another post.

Common Mistakes to Avoid When Completing a W2 Form

When completing a W2 form, there are several common mistakes to avoid, including:

- Inaccurate or incomplete information

- Failure to include all necessary boxes and information

- Failure to sign and date the form

- Failure to file the form with the SSA by the deadline

- Using an incorrect or outdated form

Consequences of Failing to File a W2 Form

Failing to file a W2 form can result in serious consequences, including: * Penalties and fines: The IRS can impose penalties and fines on employers who fail to file W2 forms or who file them incorrectly. * Delayed tax refunds: Employees may experience delayed tax refunds if their employer fails to file a W2 form or files it incorrectly. * Inaccurate tax records: Failure to file a W2 form can result in inaccurate tax records, which can affect an employee's ability to claim tax credits and deductions.Best Practices for Managing W2 Forms

To manage W2 forms effectively, employers should follow best practices, including:

- Maintaining accurate and complete records

- Using a W2 form printable template to ensure accuracy and completeness

- Reviewing and verifying the information on the W2 form

- Filing the W2 form with the SSA by the deadline

- Providing employees with a copy of the W2 form by the deadline

Security and Confidentiality of W2 Forms

W2 forms contain sensitive and confidential information, including employees' Social Security numbers and financial data. Employers must take steps to ensure the security and confidentiality of W2 forms, including: * Storing W2 forms in a secure and locked location * Limiting access to W2 forms to authorized personnel * Using secure and encrypted methods to transmit W2 forms * Destroying W2 forms securely and confidentially when they are no longer neededW2 Form Image Gallery

What is a W2 form?

+A W2 form is a document that reports an employee's income and taxes withheld to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

Who is required to file a W2 form?

+Employers are required to file a W2 form for each of their employees by January 31st of each year.

What information is included on a W2 form?

+A W2 form includes information such as the employee's name, address, and Social Security number, as well as the employer's name, address, and EIN, and the employee's wages, tips, and other compensation.

How do I obtain a W2 form printable template?

+There are several ways to obtain a W2 form printable template, including the IRS website, tax software, online template providers, and accounting software.

What are the consequences of failing to file a W2 form?

+Failing to file a W2 form can result in penalties and fines, delayed tax refunds, and inaccurate tax records.

We hope this article has provided you with a comprehensive understanding of W2 forms and the importance of using a printable template. By following the steps outlined in this article and using a W2 form printable template, employers can ensure that they are accurately completing and filing W2 forms, reducing the risk of errors and penalties. If you have any further questions or comments, please don't hesitate to reach out. Share this article with your friends and colleagues to help them understand the importance of W2 forms and how to manage them effectively.