Intro

Download a free W9 printable form, a crucial tax document for independent contractors, freelancers, and self-employed individuals, requiring accurate IRS information and employer identification numbers for tax compliance and reporting purposes.

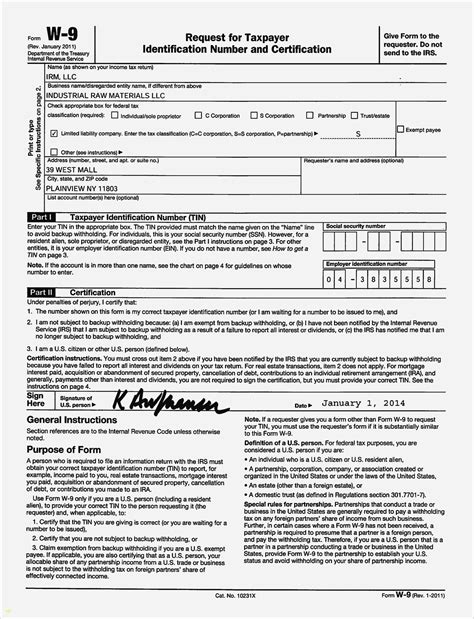

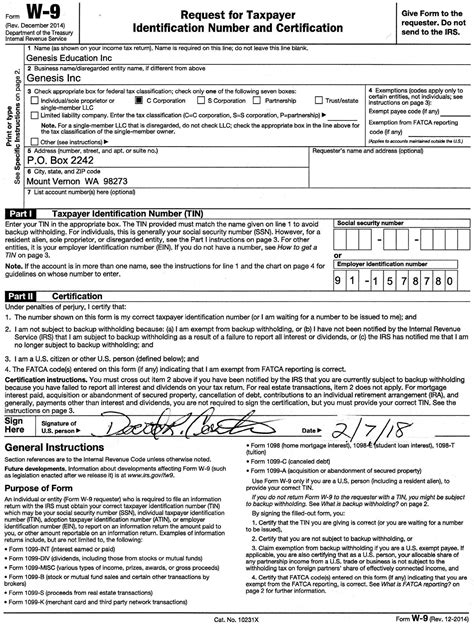

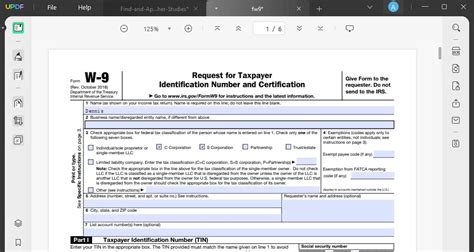

The W9 printable form is a crucial document for freelancers, independent contractors, and businesses in the United States. It serves as a request for taxpayer identification number and certification, which is essential for tax purposes. The form is used to provide accurate information to the Internal Revenue Service (IRS) and to avoid any potential penalties or fines. In this article, we will delve into the importance of the W9 form, its components, and the steps to fill it out accurately.

The W9 form is typically required by businesses that hire independent contractors or freelancers to provide services. The form is used to collect necessary information, such as the contractor's name, address, and taxpayer identification number. This information is used to generate a 1099-MISC form, which reports the income earned by the contractor to the IRS. The W9 form is usually provided to the contractor at the beginning of the working relationship, and it must be completed and returned to the business before any payments are made.

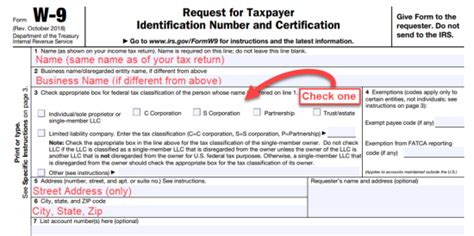

The W9 form is a simple and straightforward document that requires basic information from the contractor. The form includes fields for the contractor's name, business name, address, and taxpayer identification number. The taxpayer identification number can be either a Social Security number (SSN) or an Employer Identification Number (EIN). The form also includes a section for the contractor to certify their tax status and to claim any exemptions from backup withholding.

Understanding the W9 Form

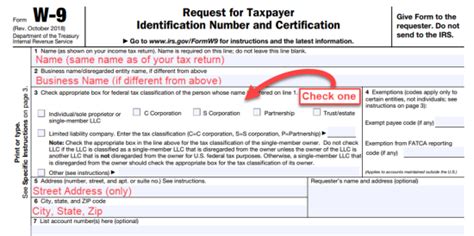

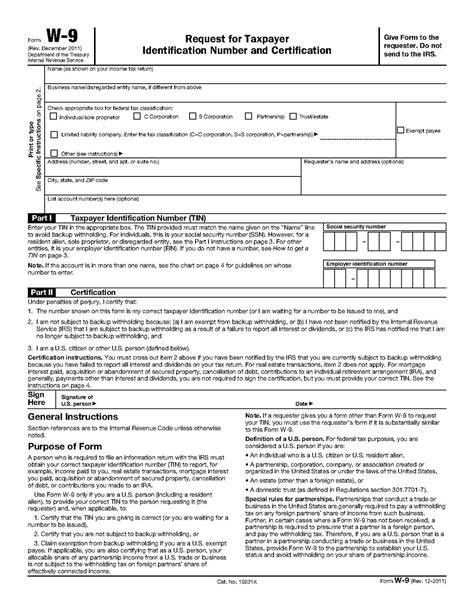

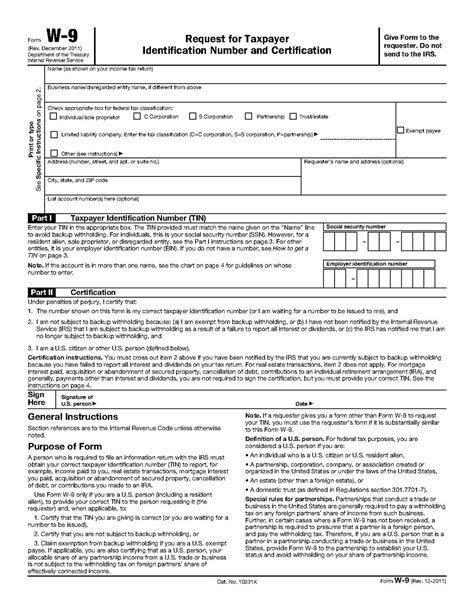

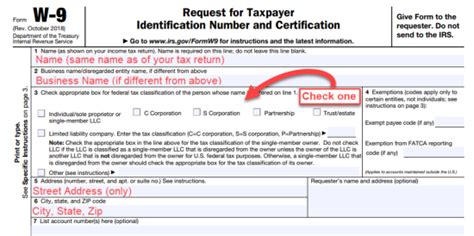

To understand the W9 form, it's essential to familiarize yourself with its components. The form is divided into several sections, each requiring specific information from the contractor. The first section requires the contractor's name, business name, and address. The second section requires the taxpayer identification number, which can be either an SSN or an EIN. The third section requires the contractor to certify their tax status and to claim any exemptions from backup withholding.

Components of the W9 Form

The W9 form includes the following components: * Name and business name * Address * Taxpayer identification number (SSN or EIN) * Certification of tax status * Exemptions from backup withholdingFilling Out the W9 Form

Filling out the W9 form is a straightforward process that requires accurate information from the contractor. The form can be downloaded from the IRS website or obtained from the business that requires it. The contractor must fill out the form legibly and accurately, using either a pen or a computer. The form must be signed and dated by the contractor, and it must be returned to the business before any payments are made.

Steps to Fill Out the W9 Form

The steps to fill out the W9 form are as follows: 1. Download the W9 form from the IRS website or obtain it from the business that requires it. 2. Fill out the form legibly and accurately, using either a pen or a computer. 3. Provide your name, business name, and address in the first section. 4. Provide your taxpayer identification number (SSN or EIN) in the second section. 5. Certify your tax status and claim any exemptions from backup withholding in the third section. 6. Sign and date the form. 7. Return the form to the business before any payments are made.Importance of the W9 Form

The W9 form is a crucial document that serves several purposes. It provides accurate information to the IRS, which is essential for tax purposes. It also helps businesses to avoid any potential penalties or fines related to tax withholding. The form is also used to generate a 1099-MISC form, which reports the income earned by the contractor to the IRS.

Benefits of the W9 Form

The benefits of the W9 form include: * Accurate information for tax purposes * Avoidance of potential penalties or fines * Generation of 1099-MISC form * Compliance with IRS regulationsFor more information on tax-related topics, you can visit our internal link to another post.

Common Mistakes to Avoid

When filling out the W9 form, it's essential to avoid common mistakes that can lead to delays or penalties. Some common mistakes include:

- Inaccurate or incomplete information

- Failure to sign and date the form

- Failure to return the form to the business

- Using an outdated version of the form

Tips to Avoid Mistakes

The tips to avoid mistakes include: * Using the most recent version of the form * Filling out the form legibly and accurately * Signing and dating the form * Returning the form to the business before any payments are madeGallery of W9 Form Examples

W9 Form Image Gallery

What is the purpose of the W9 form?

+The W9 form is used to provide accurate information to the IRS and to avoid any potential penalties or fines related to tax withholding.

Who needs to fill out the W9 form?

+Freelancers, independent contractors, and businesses that hire independent contractors or freelancers need to fill out the W9 form.

What information is required on the W9 form?

+The W9 form requires the contractor's name, business name, address, and taxpayer identification number, as well as certification of tax status and exemptions from backup withholding.

We hope this article has provided you with a comprehensive understanding of the W9 printable form and its importance. If you have any further questions or concerns, please don't hesitate to comment below. You can also share this article with others who may find it useful. Remember to always fill out the W9 form accurately and return it to the business before any payments are made. By doing so, you can avoid any potential penalties or fines and ensure compliance with IRS regulations.