Intro

Stay ahead with the Weekly Earnings Calendar Whisper Update, featuring stock market insights, earnings reports, and financial analysis, including quarterly forecasts and investor updates.

The weekly earnings calendar is a crucial tool for investors, analysts, and financial professionals to stay informed about the upcoming earnings reports of publicly traded companies. Earnings season can be a volatile time for the stock market, as companies' quarterly reports can significantly impact their stock prices and the overall market sentiment. In this article, we will delve into the importance of the weekly earnings calendar, its components, and how investors can use it to make informed decisions.

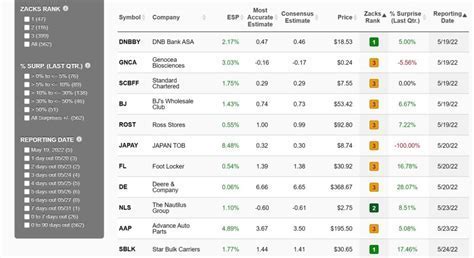

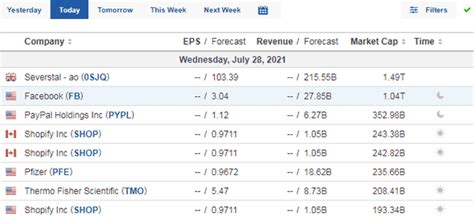

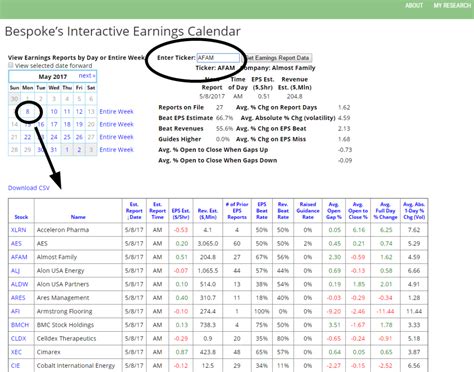

The weekly earnings calendar is a schedule of upcoming earnings reports, typically released by companies on a quarterly basis. The calendar provides essential information, such as the date and time of the earnings report, the company's name, and the expected earnings per share (EPS). This information is vital for investors, as it allows them to prepare for potential market movements and make informed decisions about their investment portfolios. The earnings calendar is usually released by financial news outlets, such as Bloomberg, CNBC, or Yahoo Finance, and is available online for investors to access.

The weekly earnings calendar is an essential tool for investors, as it provides a snapshot of the upcoming earnings reports and allows them to plan their investment strategies accordingly. By monitoring the earnings calendar, investors can identify potential opportunities and risks, and make informed decisions about buying or selling stocks. Additionally, the earnings calendar can help investors to diversify their portfolios, as they can invest in companies that are expected to report strong earnings, while avoiding those that are expected to report weak earnings.

Understanding the Earnings Calendar

The earnings calendar is typically divided into four sections: the company name, the earnings date, the expected EPS, and the actual EPS. The company name section lists the name of the company that is scheduled to report its earnings. The earnings date section lists the date and time of the earnings report, which is usually after the market closes. The expected EPS section lists the expected earnings per share, which is the average estimate of the company's EPS by analysts. The actual EPS section lists the company's actual EPS, which is released during the earnings report.

Benefits of the Earnings Calendar

The earnings calendar provides several benefits to investors, including: * Identifying potential opportunities: The earnings calendar allows investors to identify companies that are expected to report strong earnings, which can be a potential buying opportunity. * Managing risk: The earnings calendar helps investors to manage risk by identifying companies that are expected to report weak earnings, which can be a potential selling opportunity. * Diversifying portfolios: The earnings calendar allows investors to diversify their portfolios by investing in companies that are expected to report strong earnings, while avoiding those that are expected to report weak earnings. * Staying informed: The earnings calendar provides investors with essential information about upcoming earnings reports, which helps them to stay informed and make informed decisions.How to Use the Earnings Calendar

To use the earnings calendar effectively, investors should follow these steps:

- Identify the companies that are scheduled to report their earnings: Investors should identify the companies that are listed on the earnings calendar and review their financial performance.

- Review the expected EPS: Investors should review the expected EPS for each company and compare it to the actual EPS from previous quarters.

- Analyze the company's financial performance: Investors should analyze the company's financial performance, including its revenue, net income, and cash flow.

- Make informed decisions: Based on the analysis, investors should make informed decisions about buying or selling stocks.

Common Mistakes to Avoid

When using the earnings calendar, investors should avoid the following common mistakes: * Overreacting to earnings reports: Investors should avoid overreacting to earnings reports, as the market can be volatile during earnings season. * Not considering other factors: Investors should consider other factors, such as the company's financial performance, industry trends, and economic conditions, when making investment decisions. * Not diversifying portfolios: Investors should diversify their portfolios by investing in companies that are expected to report strong earnings, while avoiding those that are expected to report weak earnings.Earnings Season Strategies

During earnings season, investors can employ several strategies to maximize their returns and minimize their losses. Some of these strategies include:

- Buying stocks before earnings reports: Investors can buy stocks before earnings reports if they expect the company to report strong earnings.

- Selling stocks before earnings reports: Investors can sell stocks before earnings reports if they expect the company to report weak earnings.

- Hedging positions: Investors can hedge their positions by buying or selling options contracts, which can help to reduce potential losses.

Conclusion and Next Steps

In conclusion, the weekly earnings calendar is a crucial tool for investors, analysts, and financial professionals to stay informed about upcoming earnings reports. By understanding the components of the earnings calendar and using it effectively, investors can make informed decisions about their investment portfolios and maximize their returns. To stay up-to-date with the latest earnings reports and market trends, investors should regularly review the earnings calendar and adjust their investment strategies accordingly.Earnings Calendar Image Gallery

What is the earnings calendar?

+The earnings calendar is a schedule of upcoming earnings reports, typically released by companies on a quarterly basis.

How can I use the earnings calendar to make informed investment decisions?

+By monitoring the earnings calendar, investors can identify potential opportunities and risks, and make informed decisions about buying or selling stocks.

What are some common mistakes to avoid when using the earnings calendar?

+Common mistakes to avoid include overreacting to earnings reports, not considering other factors, and not diversifying portfolios.

How can I stay up-to-date with the latest earnings reports and market trends?

+Investors can stay up-to-date with the latest earnings reports and market trends by regularly reviewing the earnings calendar and adjusting their investment strategies accordingly.

What are some earnings season strategies that investors can employ?

+Some earnings season strategies that investors can employ include buying stocks before earnings reports, selling stocks before earnings reports, and hedging positions.

We hope this article has provided you with a comprehensive understanding of the weekly earnings calendar and its importance in making informed investment decisions. If you have any further questions or would like to share your experiences with using the earnings calendar, please do not hesitate to comment below. Additionally, if you found this article informative, please share it with your friends and family who may benefit from this knowledge.