Intro

Discover the 7 key responsibilities of a financial manager, including financial planning, budgeting, forecasting, risk management, and more. Learn how a financial managers strategic role drives business growth, improves financial health, and informs investment decisions. Unlock the skills and expertise required to excel in this critical position.

A financial manager plays a crucial role in any organization, overseeing financial planning, decision-making, and risk management. Their primary goal is to maximize profits and minimize financial risks, ensuring the organization's financial health and stability. In this article, we will explore the 7 key responsibilities of a financial manager and how they contribute to an organization's success.

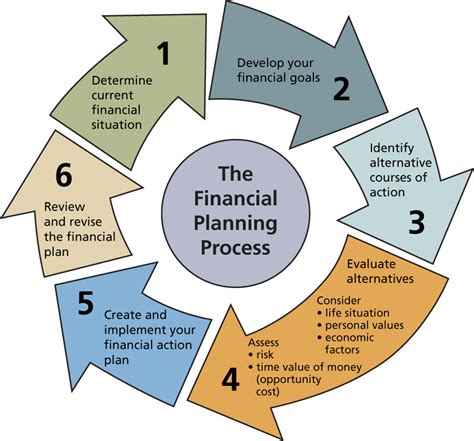

Financial Planning and Budgeting

Financial planning and budgeting are critical responsibilities of a financial manager. They must analyze the organization's financial data, identify trends, and develop forecasts to create comprehensive financial plans. This involves setting financial goals, allocating resources, and establishing budgets to achieve these objectives. Effective financial planning enables organizations to make informed decisions, prioritize investments, and optimize resource allocation.

Key Activities:

- Analyze financial data and market trends to develop forecasts and budgets

- Develop and implement financial plans to achieve organizational objectives

- Allocate resources and prioritize investments to optimize returns

Financial Reporting and Analysis

Financial managers are responsible for preparing and presenting financial reports to stakeholders, including investors, management, and regulatory bodies. These reports provide insights into an organization's financial performance, highlighting areas of strength and weakness. Financial managers must analyze financial data, identify trends, and provide recommendations to improve financial performance.

Key Activities:

- Prepare and present financial reports to stakeholders

- Analyze financial data to identify trends and areas for improvement

- Provide recommendations to management to enhance financial performance

Cash and Liquidity Management

Financial managers must ensure that an organization has sufficient cash and liquidity to meet its financial obligations. This involves managing cash flows, maintaining liquidity, and investing excess funds to optimize returns. Effective cash and liquidity management enables organizations to respond to changing market conditions and capitalize on new opportunities.

Key Activities:

- Manage cash flows to ensure sufficient liquidity

- Maintain optimal cash and liquidity levels

- Invest excess funds to optimize returns

Investment and Funding

Financial managers are responsible for identifying investment opportunities and securing funding to support organizational growth. This involves evaluating investment options, assessing risk, and developing funding strategies to optimize returns. Effective investment and funding management enables organizations to achieve their strategic objectives and maximize shareholder value.

Key Activities:

- Identify investment opportunities and assess risk

- Develop funding strategies to optimize returns

- Secure funding to support organizational growth

Risk Management

Financial managers must identify, assess, and mitigate financial risks to ensure an organization's financial stability. This involves developing risk management strategies, implementing controls, and monitoring risk exposure. Effective risk management enables organizations to minimize financial losses and capitalize on new opportunities.

Key Activities:

- Identify and assess financial risks

- Develop risk management strategies to mitigate risk

- Implement controls and monitor risk exposure

Tax Planning and Compliance

Financial managers are responsible for ensuring that an organization complies with tax laws and regulations. This involves developing tax planning strategies, preparing tax returns, and managing tax audits. Effective tax planning and compliance enable organizations to minimize tax liabilities and maintain a positive reputation.

Key Activities:

- Develop tax planning strategies to minimize tax liabilities

- Prepare tax returns and manage tax audits

- Ensure compliance with tax laws and regulations

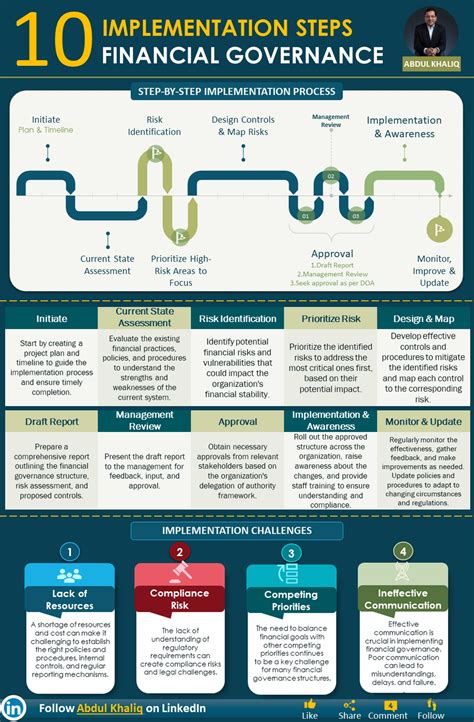

Financial Governance and Compliance

Financial managers must ensure that an organization's financial activities are governed by a robust framework of policies, procedures, and controls. This involves developing financial governance frameworks, implementing compliance programs, and monitoring financial performance. Effective financial governance and compliance enable organizations to maintain a positive reputation and minimize financial risks.

Key Activities:

- Develop financial governance frameworks to ensure transparency and accountability

- Implement compliance programs to prevent financial misconduct

- Monitor financial performance to ensure compliance with policies and procedures

Financial Management Image Gallery

What is the role of a financial manager?

+A financial manager is responsible for overseeing financial planning, decision-making, and risk management to ensure an organization's financial health and stability.

What are the key responsibilities of a financial manager?

+The key responsibilities of a financial manager include financial planning and budgeting, financial reporting and analysis, cash and liquidity management, investment and funding, risk management, tax planning and compliance, and financial governance and compliance.

Why is financial management important?

+Financial management is important because it enables organizations to achieve their strategic objectives, maximize shareholder value, and maintain a positive reputation.

In conclusion, the role of a financial manager is critical to an organization's success. By understanding the 7 key responsibilities of a financial manager, organizations can ensure that their financial activities are governed by a robust framework of policies, procedures, and controls. This enables organizations to maintain a positive reputation, minimize financial risks, and achieve their strategic objectives.