Intro

Discover the 5 key roles of financial managers in driving business success. From financial planning and analysis to risk management, investing, and funding, learn how financial managers navigate financial markets, manage cash flow, and make strategic decisions to optimize profitability, growth, and shareholder value.

In today's fast-paced business world, companies are constantly seeking ways to optimize their financial performance and stay ahead of the competition. At the forefront of this endeavor are financial managers, who play a crucial role in shaping the financial strategy and direction of an organization. Their expertise and guidance enable companies to make informed decisions, mitigate risks, and drive growth.

The role of financial managers has evolved significantly over the years, and their responsibilities now encompass a wide range of tasks that go beyond traditional accounting and bookkeeping. In this article, we will delve into the five key roles of financial managers and explore how they contribute to the success of an organization.

The Strategic Advisor

As a strategic advisor, a financial manager provides critical insights and guidance to the company's leadership team. They analyze market trends, assess financial risks, and identify opportunities for growth, helping to inform key business decisions. By developing and implementing financial strategies, financial managers enable companies to achieve their objectives and stay competitive in the market.

Financial managers use various tools and techniques, such as financial modeling, forecasting, and scenario planning, to help organizations anticipate and respond to changes in the market. They also work closely with other departments, such as sales and marketing, to ensure that financial goals are aligned with overall business objectives.

Key Responsibilities:

- Develop and implement financial strategies to drive business growth

- Analyze market trends and financial risks to inform business decisions

- Collaborate with other departments to ensure alignment with financial goals

- Provide financial guidance and support to the leadership team

The Risk Manager

Financial managers are also responsible for identifying and mitigating financial risks that could impact the organization. This includes assessing potential risks, such as market volatility, credit risk, and operational risk, and developing strategies to minimize their impact.

Financial managers use various risk management tools, such as hedging, diversification, and insurance, to mitigate potential risks. They also work closely with other departments, such as compliance and audit, to ensure that financial risks are properly identified and managed.

Key Responsibilities:

- Identify and assess potential financial risks

- Develop and implement risk management strategies

- Collaborate with other departments to ensure risk management is integrated into overall business strategy

- Monitor and report on financial risks to the leadership team

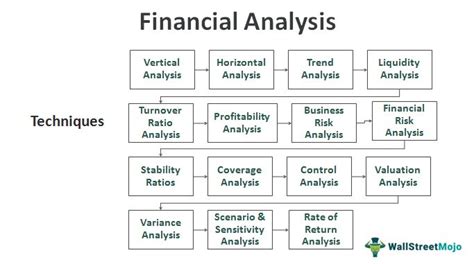

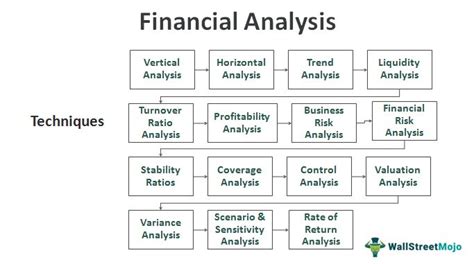

The Financial Analyst

Financial managers are responsible for analyzing financial data to provide insights and recommendations to the leadership team. This includes analyzing financial statements, such as income statements and balance sheets, as well as other financial metrics, such as cash flow and return on investment (ROI).

Financial managers use various analytical tools, such as financial modeling and forecasting, to help organizations make informed decisions. They also work closely with other departments, such as operations and sales, to ensure that financial data is properly integrated into overall business strategy.

Key Responsibilities:

- Analyze financial data to provide insights and recommendations

- Develop financial models and forecasts to inform business decisions

- Collaborate with other departments to ensure financial data is integrated into overall business strategy

- Present financial findings and recommendations to the leadership team

The Capital Raiser

Financial managers are responsible for raising capital to fund business operations and growth initiatives. This includes identifying potential sources of capital, such as debt and equity financing, and developing strategies to secure funding.

Financial managers use various tools and techniques, such as financial modeling and forecasting, to help organizations raise capital. They also work closely with other departments, such as marketing and sales, to ensure that capital raising efforts are properly integrated into overall business strategy.

Key Responsibilities:

- Identify potential sources of capital to fund business operations and growth initiatives

- Develop strategies to secure funding, including debt and equity financing

- Collaborate with other departments to ensure capital raising efforts are integrated into overall business strategy

- Present capital raising strategies and recommendations to the leadership team

The Compliance Officer

Financial managers are responsible for ensuring that the organization complies with relevant financial regulations and laws. This includes ensuring that financial reporting is accurate and transparent, and that financial transactions are properly recorded and disclosed.

Financial managers use various tools and techniques, such as financial modeling and forecasting, to help organizations comply with financial regulations. They also work closely with other departments, such as compliance and audit, to ensure that financial compliance is properly integrated into overall business strategy.

Key Responsibilities:

- Ensure that financial reporting is accurate and transparent

- Ensure that financial transactions are properly recorded and disclosed

- Collaborate with other departments to ensure financial compliance is integrated into overall business strategy

- Present financial compliance findings and recommendations to the leadership team

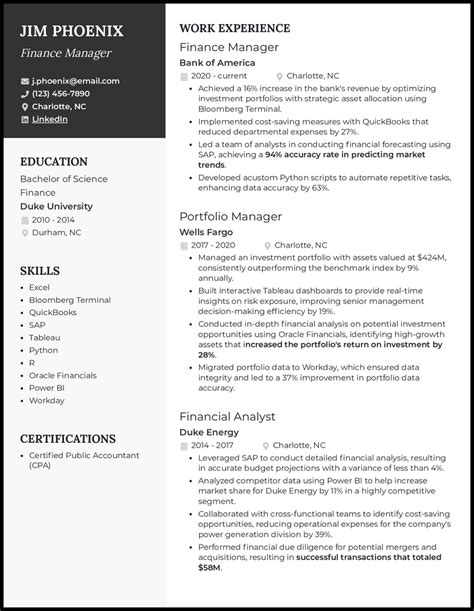

Financial Manager Image Gallery

What are the key responsibilities of a financial manager?

+The key responsibilities of a financial manager include developing and implementing financial strategies, identifying and mitigating financial risks, analyzing financial data, raising capital, and ensuring compliance with financial regulations.

What skills do financial managers need to be successful?

+Financial managers need to have strong analytical and problem-solving skills, excellent communication and leadership skills, and the ability to think strategically and make informed decisions.

What is the role of a financial manager in a company?

+The role of a financial manager is to provide financial guidance and support to the leadership team, ensure that the company is financially stable and profitable, and make strategic decisions to drive business growth.

In conclusion, the role of financial managers is critical to the success of any organization. By developing and implementing financial strategies, identifying and mitigating financial risks, analyzing financial data, raising capital, and ensuring compliance with financial regulations, financial managers enable companies to achieve their objectives and stay competitive in the market. As the business world continues to evolve, the role of financial managers will only become more important, and their expertise and guidance will be essential to driving business growth and success.