Intro

Discover how Earned Pay Reserve can transform employee finances with our expert guide. Learn five innovative ways to unlock financial stability, reduce debt, and increase savings. Explore the benefits of on-demand pay, wage management, and employee financial wellness. Boost employee satisfaction and productivity with Earned Pay Reserve solutions.

In today's fast-paced and often unpredictable work environment, financial stress is a common concern for many employees. The struggle to make ends meet, combined with the burden of living paycheck to paycheck, can have a significant impact on an individual's overall well-being and productivity. This is where Earned Pay Reserve comes into play – a game-changing solution designed to empower employees to take control of their finances and improve their financial stability.

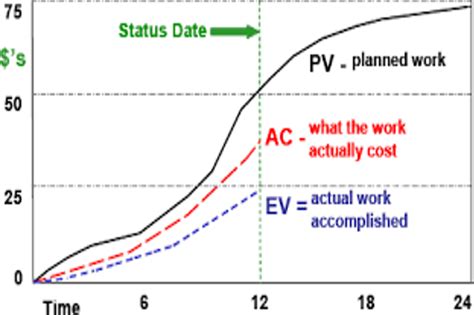

Earned Pay Reserve is a financial wellness tool that allows employees to access a portion of their earned but unpaid wages ahead of their scheduled payday. By providing employees with early access to their hard-earned money, Earned Pay Reserve can help alleviate financial stress, promote better budgeting, and foster a healthier relationship with money.

Let's dive deeper into the world of Earned Pay Reserve and explore five ways this innovative solution can boost employee finances.

Reducing Financial Stress and Anxiety

Financial stress can be overwhelming, especially when unexpected expenses arise. Earned Pay Reserve helps mitigate this stress by providing employees with a financial safety net. By offering access to earned wages ahead of schedule, employees can address urgent financial needs without resorting to predatory lenders or accumulating high-interest debt.

A study by the American Psychological Association found that financial stress affects 64% of adults, with many reporting feelings of anxiety, worry, and fear. By providing a solution to financial uncertainty, Earned Pay Reserve can help reduce stress levels, promoting a better work-life balance and improved overall well-being.

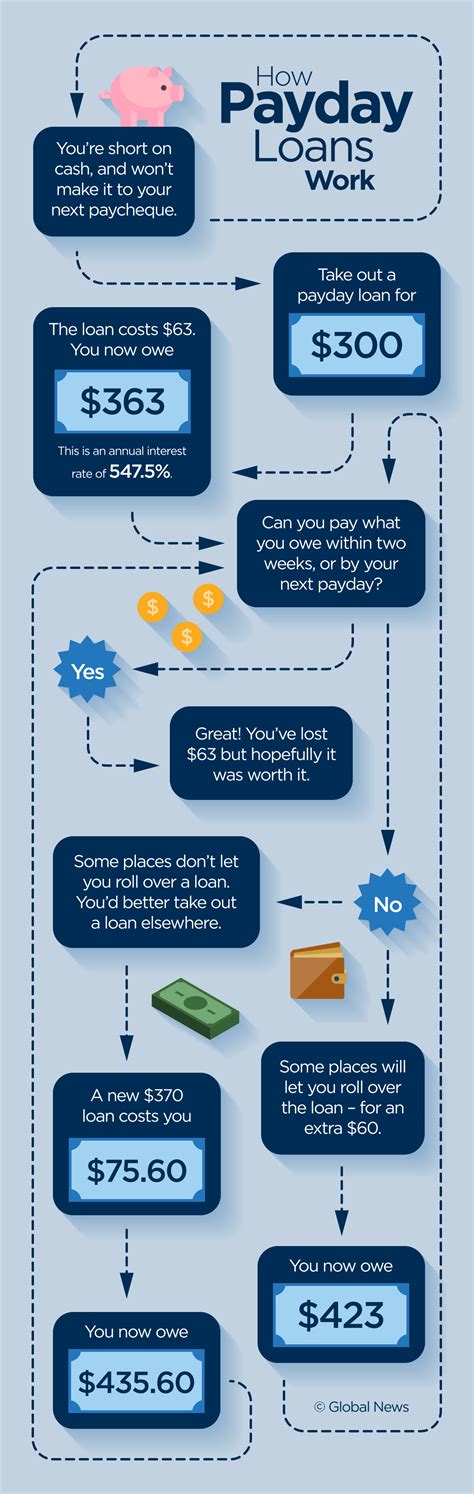

Breaking the Payday Loan Cycle

Payday loans often come with exorbitant interest rates, hidden fees, and unrealistic repayment terms, leading to a cycle of debt that's difficult to escape. Earned Pay Reserve offers a debt-free alternative, allowing employees to access their own money without accumulating interest or fees.

By avoiding payday loans, employees can save money on interest payments and fees, allocating those funds towards essential expenses, savings, or debt repayment. This can lead to a significant reduction in financial stress and a more stable financial foundation.

Improving Budgeting and Financial Planning

Earned Pay Reserve can help employees develop healthier financial habits by providing a more predictable and flexible income stream. With access to earned wages ahead of schedule, employees can better manage their finances, prioritize expenses, and make informed decisions about their money.

By having a clearer picture of their financial situation, employees can:

- Create a budget that accurately reflects their income and expenses

- Prioritize needs over wants

- Allocate funds towards savings, emergency funds, or debt repayment

- Avoid overspending and make more informed financial decisions

Enhancing Employee Financial Literacy

Financial literacy is a crucial aspect of financial wellness, and Earned Pay Reserve can play a significant role in promoting employee financial education. By providing access to earned wages, employees can develop a deeper understanding of their financial situation and make more informed decisions about their money.

Employers can also use Earned Pay Reserve as a teaching tool, offering financial literacy resources, workshops, or webinars to help employees develop essential financial skills. This can lead to a more financially savvy workforce, better equipped to manage their finances and achieve long-term financial goals.

Boosting Employee Productivity and Engagement

Financial stress can significantly impact employee productivity and engagement, with many employees reporting difficulty focusing on work due to financial concerns. Earned Pay Reserve can help alleviate this stress, allowing employees to focus on their work and perform at their best.

By providing a financial safety net, Earned Pay Reserve can lead to:

- Increased employee satisfaction and engagement

- Improved productivity and focus

- Reduced absenteeism and turnover

- Enhanced overall well-being and job satisfaction

Creating a Competitive Advantage

In today's competitive job market, employers need to offer attractive benefits and perks to attract and retain top talent. Earned Pay Reserve can be a valuable addition to an employer's benefits package, providing a unique and innovative solution to employee financial wellness.

By offering Earned Pay Reserve, employers can:

- Differentiate themselves from competitors

- Attract and retain top talent

- Enhance their reputation as a caring and supportive employer

- Improve employee satisfaction and engagement

Conclusion

Earned Pay Reserve is a powerful tool that can have a significant impact on employee finances. By providing access to earned wages ahead of schedule, employees can reduce financial stress, avoid payday loans, improve budgeting and financial planning, enhance financial literacy, and boost productivity and engagement.

Employers can also benefit from offering Earned Pay Reserve, creating a competitive advantage, differentiating themselves from competitors, and enhancing their reputation as a caring and supportive employer.

Earned Pay Reserve Image Gallery

What is Earned Pay Reserve?

+Earned Pay Reserve is a financial wellness tool that allows employees to access a portion of their earned but unpaid wages ahead of their scheduled payday.

How does Earned Pay Reserve work?

+Earned Pay Reserve allows employees to access a portion of their earned wages ahead of schedule, providing a financial safety net and helping to alleviate financial stress.

What are the benefits of Earned Pay Reserve?

+The benefits of Earned Pay Reserve include reduced financial stress, improved budgeting and financial planning, enhanced financial literacy, and increased employee productivity and engagement.