Intro

Unlock the secrets of Selective Reserve: a little-known banking concept. Discover how it impacts your financial stability, interest rates, and the economy. Learn what Selective Reserve is, how it differs from fractional reserve, and its implications on monetary policy, lending, and borrowing. Get expert insights and stay ahead.

The concept of selective reserve has been widely discussed in various fields, including finance, economics, and politics. It's essential to understand the intricacies of selective reserve, as it can have a significant impact on the economy, financial markets, and individual investors. In this article, we will delve into the world of selective reserve, exploring its definition, benefits, working mechanisms, and potential drawbacks.

What is Selective Reserve?

Selective reserve refers to a monetary policy tool used by central banks to manage the money supply and regulate the banking system. It involves setting aside a portion of a bank's deposits in a reserve account, rather than lending them out. This reserve requirement is typically applied to specific types of deposits, such as commercial bank deposits or thrift institution deposits.

Types of Selective Reserve

There are two primary types of selective reserve:

- Required reserve: This is the minimum amount of reserves that a bank must hold against its deposits. The required reserve ratio is set by the central bank and can vary depending on the type of deposit and the bank's size.

- Excess reserve: This is the amount of reserves that a bank holds above the required reserve ratio. Excess reserves can be used to make loans, invest in securities, or meet unexpected demands for cash.

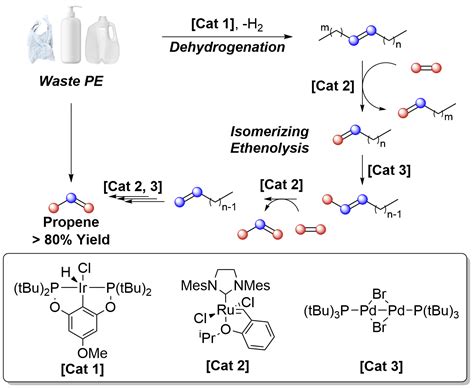

How Selective Reserve Works

The selective reserve system works as follows:

- Deposit creation: When a customer deposits money into a bank, the bank credits the customer's account and creates a new deposit.

- Reserve requirement: The bank must set aside a portion of the deposit in a reserve account, based on the required reserve ratio set by the central bank.

- Lending and investing: The bank can use the remaining funds to make loans, invest in securities, or engage in other activities.

- Reserve management: The central bank monitors the bank's reserve account and ensures that the bank meets the required reserve ratio.

Benefits of Selective Reserve

The selective reserve system offers several benefits, including:

- Reduced inflation risk: By requiring banks to hold a portion of their deposits in reserve, the central bank can reduce the risk of inflation.

- Improved financial stability: Selective reserve helps to ensure that banks have sufficient liquidity to meet unexpected demands for cash.

- Increased lending: By allowing banks to lend out excess reserves, selective reserve can stimulate economic growth.

Drawbacks of Selective Reserve

While selective reserve can be an effective monetary policy tool, it also has some drawbacks:

- Reduced bank profitability: By requiring banks to hold a portion of their deposits in reserve, selective reserve can reduce bank profitability.

- Inflexibility: Selective reserve can limit a bank's ability to respond to changing market conditions.

- Complexity: The selective reserve system can be complex and difficult to manage.

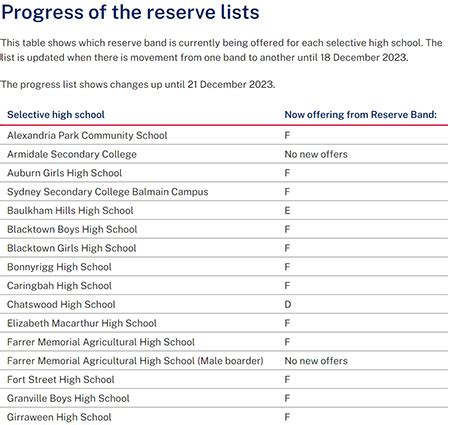

Real-World Examples of Selective Reserve

Selective reserve has been used by central banks around the world to manage the money supply and regulate the banking system. For example:

- Federal Reserve: The Federal Reserve, the central bank of the United States, uses selective reserve to regulate the banking system and manage the money supply.

- European Central Bank: The European Central Bank uses selective reserve to regulate the banking system and manage the money supply in the eurozone.

Conclusion

In conclusion, selective reserve is a monetary policy tool that can be used to manage the money supply and regulate the banking system. While it has several benefits, including reduced inflation risk and improved financial stability, it also has some drawbacks, including reduced bank profitability and inflexibility. By understanding the intricacies of selective reserve, investors and policymakers can make informed decisions about monetary policy and financial regulation.

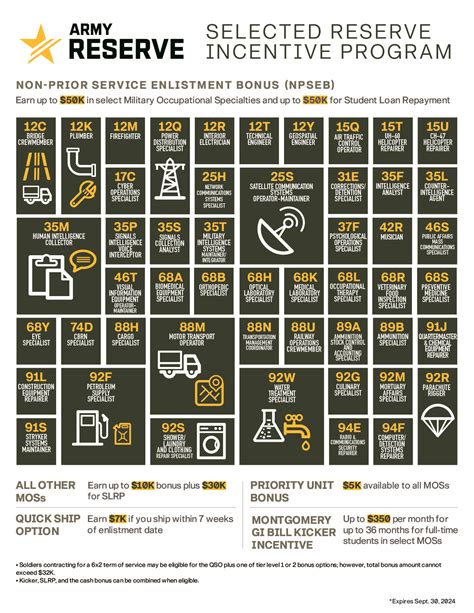

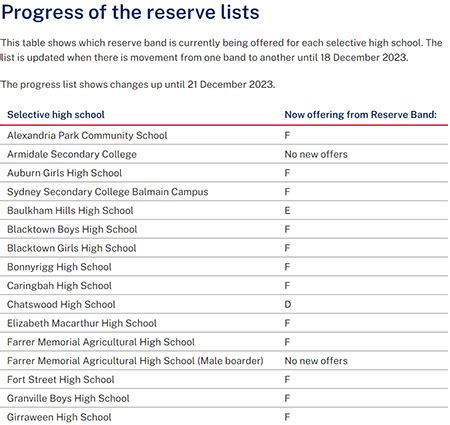

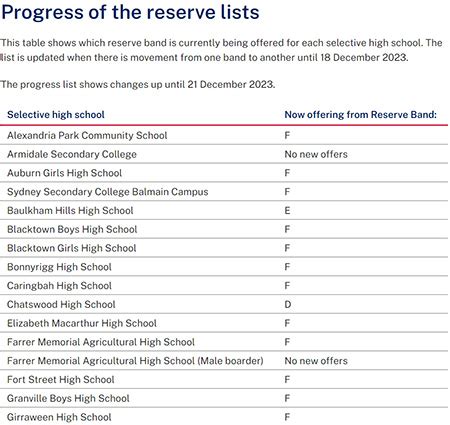

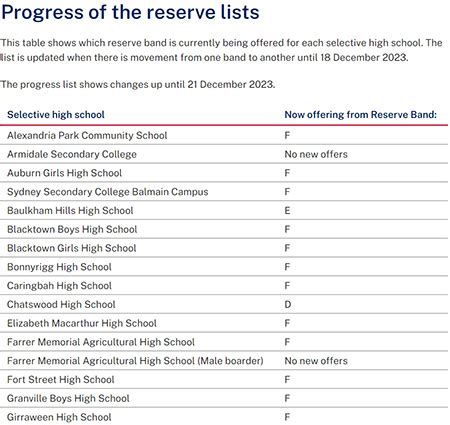

Selective Reserve Image Gallery

What is the purpose of selective reserve?

+The purpose of selective reserve is to manage the money supply and regulate the banking system.

How does selective reserve work?

+Selective reserve works by requiring banks to set aside a portion of their deposits in a reserve account, based on the required reserve ratio set by the central bank.

What are the benefits of selective reserve?

+The benefits of selective reserve include reduced inflation risk, improved financial stability, and increased lending.

I hope you found this article informative and helpful. If you have any questions or comments, please feel free to share them below.