Intro

Need to send or receive cash securely? Learn how to get a money order near you with our expert guide. Discover nearby locations, fees, and requirements for purchasing money orders at popular retailers like Walmart, CVS, and USPS. Find out how to use money orders for online purchases, rent, and more.

Are you in need of a money order, but don't know where to get one? You're not alone. Many people rely on money orders as a secure and reliable way to send funds to others, but finding a place to purchase one can be a challenge. In this article, we'll show you how to get a money order near you, so you can send funds quickly and easily.

What is a Money Order?

Before we dive into where to get a money order, let's quickly review what a money order is. A money order is a prepaid payment instrument that allows you to send funds to someone without using a personal check or cash. Money orders are typically available for purchase at post offices, grocery stores, and other retailers, and can be used to send funds within the United States or internationally.

Benefits of Using a Money Order

There are several benefits to using a money order, including:

- Security: Money orders are prepaid, so you can't spend more than you intend to.

- Convenience: Money orders can be purchased at a variety of locations, making it easy to get one when you need it.

- No Need for a Bank Account: You don't need a bank account to purchase a money order.

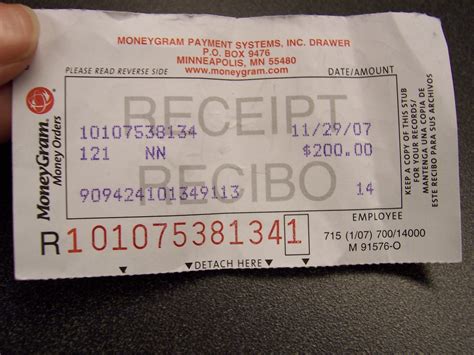

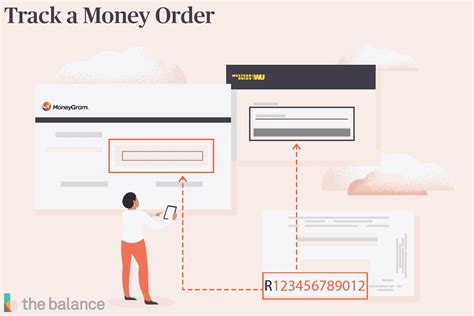

- Easy to Track: Money orders can be tracked, so you can see when the recipient receives the funds.

Where to Get a Money Order

Now that we've covered the benefits of using a money order, let's talk about where to get one. Here are some common places to purchase a money order:

- Post Office: The United States Postal Service (USPS) offers money orders at all post office locations.

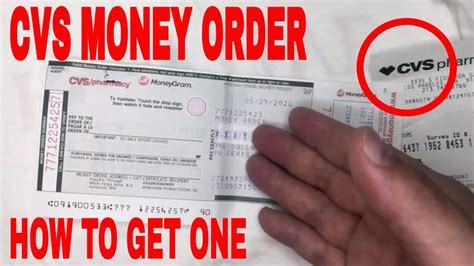

- Grocery Stores: Many grocery stores, such as Walmart and Kroger, offer money orders at their customer service desks.

- Convenience Stores: Some convenience stores, such as 7-Eleven, offer money orders.

- Banks: Some banks offer money orders, but this may not be a common practice.

- Credit Unions: Some credit unions may offer money orders to their members.

How to Get a Money Order

Getting a money order is a relatively straightforward process. Here are the steps:

- Find a Location: Find a location that offers money orders, such as a post office or grocery store.

- Provide Identification: You'll need to provide identification, such as a driver's license or passport.

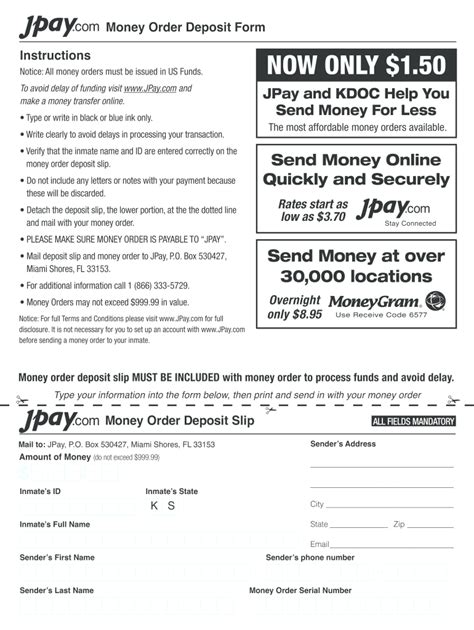

- Pay for the Money Order: Pay for the money order using cash or a debit card. The cost of a money order varies by location, but is typically around $1-$5.

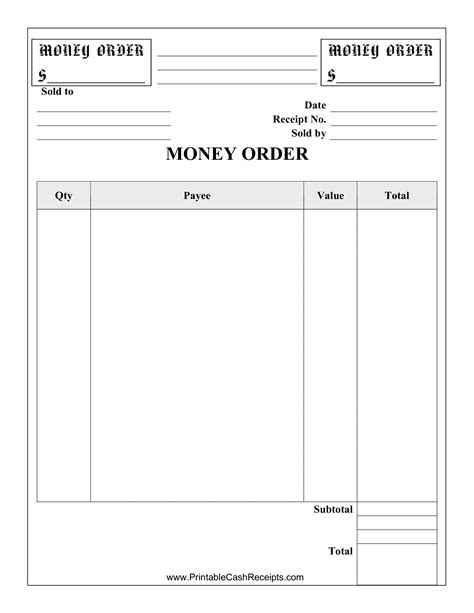

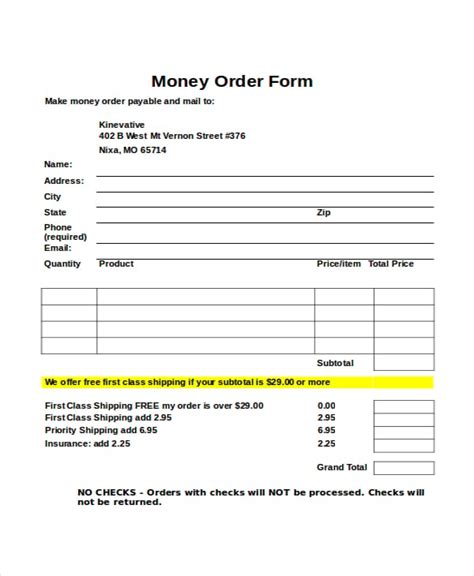

- Fill Out the Money Order: Fill out the money order with the recipient's name and address.

- Keep Your Receipt: Keep your receipt, as this will serve as proof of purchase.

Frequently Asked Questions

Here are some frequently asked questions about money orders:

- Can I Use a Credit Card to Purchase a Money Order?: No, you cannot use a credit card to purchase a money order.

- Can I Use a Check to Purchase a Money Order?: No, you cannot use a check to purchase a money order.

- How Long Does it Take to Process a Money Order?: The processing time for a money order varies by location, but is typically around 1-3 business days.

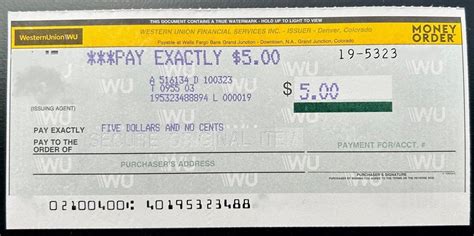

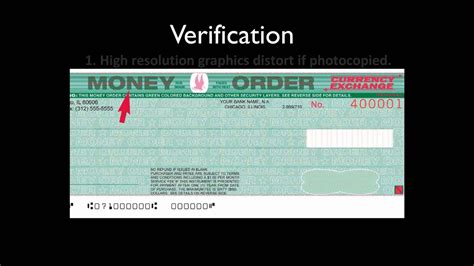

Money Order Image Gallery

Can I purchase a money order online?

+No, you cannot purchase a money order online. Money orders must be purchased in person at a participating location.

Can I use a money order to pay bills?

+Yes, you can use a money order to pay bills. Money orders are accepted by many businesses, including utility companies and landlords.

Can I purchase a money order with a credit card?

+No, you cannot purchase a money order with a credit card. Money orders must be purchased with cash or a debit card.

Now that you know where to get a money order, you can send funds quickly and easily. Whether you're paying bills, sending funds to a friend or family member, or paying for a purchase, a money order is a secure and reliable way to send funds.