Intro

Recover from financial setbacks with expert tips on getting back to black. Learn how to reassess your budget, prioritize needs over wants, and create a debt repayment plan. Discover strategies for building an emergency fund, improving credit scores, and achieving long-term financial stability, all in our comprehensive guide to financial recovery.

Getting back to black, or achieving financial stability, can be a daunting task, especially after a period of economic turmoil or personal financial struggles. However, with the right mindset, strategies, and techniques, it is possible to recover and regain control over your finances.

Assessing Your Financial Situation

Before you can start working towards financial recovery, it's essential to understand where you stand currently. Take some time to assess your financial situation, including your income, expenses, debts, and savings. This will help you identify areas where you need to make adjustments and create a plan for moving forward.

To assess your financial situation, consider the following steps:

- Gather all your financial documents, including bank statements, credit card statements, loan documents, and investment accounts.

- Calculate your net worth by subtracting your total liabilities from your total assets.

- Create a budget that outlines your income and expenses.

- Identify areas where you can cut back on unnecessary expenses and allocate that money towards debt repayment or savings.

Understanding the Importance of Budgeting

Budgeting is a crucial step in financial recovery. By creating a realistic budget, you can prioritize your spending, manage your debt, and make progress towards your financial goals. When creating a budget, consider the 50/30/20 rule:

- 50% of your income should go towards necessary expenses, such as rent, utilities, and groceries.

- 30% should go towards discretionary spending, such as entertainment and hobbies.

- 20% should go towards saving and debt repayment.

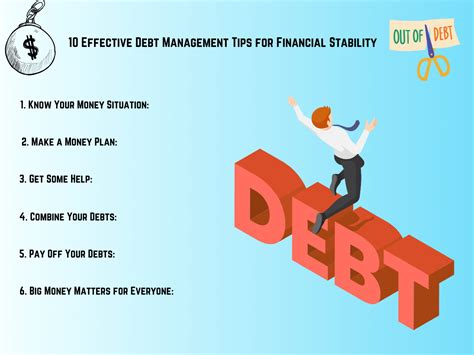

Managing Debt and Credit

Debt can be a significant obstacle to financial recovery. To manage debt effectively, consider the following strategies:

- Prioritize your debts: Focus on paying off high-interest debts first, while making minimum payments on other debts.

- Consolidate debt: If you have multiple debts with high interest rates, consider consolidating them into a single loan with a lower interest rate.

- Negotiate with creditors: Reach out to your creditors to see if they can offer any assistance, such as a temporary reduction in payments or interest rates.

Building Credit

In addition to managing debt, building credit is essential for long-term financial stability. To build credit, consider the following tips:

- Make on-time payments: Payment history accounts for 35% of your credit score, so making on-time payments is crucial.

- Keep credit utilization low: Keep your credit utilization ratio below 30% to show lenders you can manage credit responsibly.

- Monitor your credit report: Check your credit report regularly to ensure it's accurate and up-to-date.

Investing and Saving

Investing and saving are critical components of financial recovery. To get started, consider the following tips:

- Start small: Begin with small, achievable savings goals, such as setting aside $10 a week.

- Automate your savings: Set up automatic transfers from your checking account to your savings or investment accounts.

- Diversify your investments: Spread your investments across different asset classes, such as stocks, bonds, and real estate.

Long-Term Financial Planning

Financial recovery is not just about getting back on track; it's also about planning for the future. To create a long-term financial plan, consider the following steps:

- Identify your financial goals: Determine what you want to achieve, whether it's saving for retirement, paying off a mortgage, or funding a down payment on a new home.

- Create a timeline: Develop a timeline for achieving your financial goals, including milestones and deadlines.

- Prioritize your goals: Focus on the most important goals first, and allocate your resources accordingly.

Avoiding Financial Pitfalls

Financial recovery requires discipline and caution. To avoid common financial pitfalls, consider the following tips:

- Avoid lifestyle inflation: As your income increases, avoid the temptation to inflate your lifestyle by spending more on luxuries.

- Steer clear of get-rich-quick schemes: Be wary of investments or opportunities that promise unusually high returns with little risk.

- Don't neglect insurance: Make sure you have adequate insurance coverage, including health, disability, and life insurance.

Maintaining Financial Discipline

Maintaining financial discipline is essential for long-term financial stability. To stay on track, consider the following tips:

- Track your spending: Monitor your spending regularly to ensure you're staying within your budget.

- Avoid impulse purchases: Think twice before making impulse purchases, and ask yourself if they align with your financial goals.

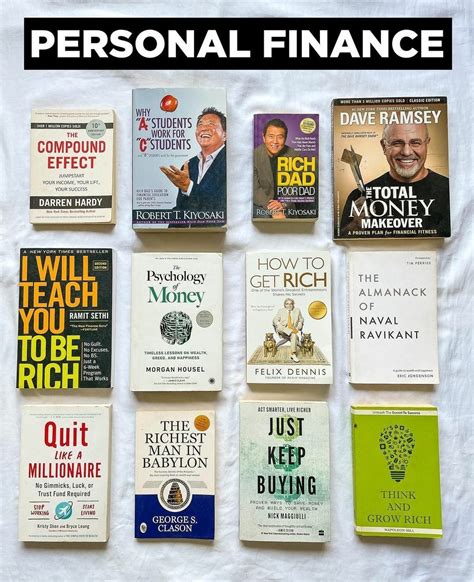

- Stay informed: Continuously educate yourself on personal finance and investing to make informed decisions.

Financial Recovery Image Gallery

What is the best way to create a budget?

+The best way to create a budget is to start by tracking your income and expenses. Use a budgeting app or spreadsheet to categorize your spending and identify areas where you can cut back. From there, you can create a budget that allocates your money towards your financial goals.

How can I improve my credit score?

+To improve your credit score, focus on making on-time payments, keeping credit utilization low, and monitoring your credit report for errors. You can also consider opening a secured credit card or becoming an authorized user on someone else's credit account to start building credit.

What is the best way to invest my money?

+The best way to invest your money depends on your financial goals and risk tolerance. Consider consulting with a financial advisor or using a robo-advisor to create a diversified investment portfolio. You can also start by investing in a tax-advantaged retirement account, such as a 401(k) or IRA.

We hope this article has provided you with valuable insights and practical tips for achieving financial recovery. Remember, getting back to black requires discipline, patience, and persistence, but with the right strategies and mindset, you can overcome financial challenges and achieve long-term financial stability.