Intro

Master budgeting with 5 essential budget worksheets, featuring expense trackers, income calculators, and financial planners to optimize savings, manage debt, and boost financial stability.

Creating a budget is an essential step in managing your finances effectively. It helps you understand where your money is going, identify areas for savings, and make informed decisions about your financial resources. One of the most effective tools for creating and managing a budget is a budget worksheet. In this article, we will explore the importance of budgeting, discuss the benefits of using budget worksheets, and provide guidance on how to create and use them effectively.

Budgeting is not just about tracking your expenses; it's about planning for your financial future. By allocating your income into different categories, you can ensure that you have enough money for necessities like rent, utilities, and food, while also saving for long-term goals such as buying a house, retirement, or your children's education. Budget worksheets are designed to simplify this process by providing a structured format for recording your income and expenses.

Using budget worksheets can have several benefits. They help you stay organized, ensuring that you don't overlook any essential expenses. They also provide a clear picture of your spending habits, which can help you identify areas where you can cut back and save more. Additionally, budget worksheets can help you set and achieve financial goals, whether it's paying off debt, building an emergency fund, or saving for a big purchase.

Understanding Budget Worksheets

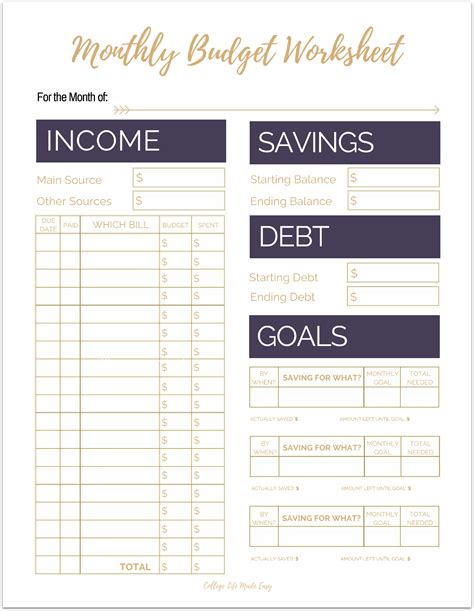

Budget worksheets typically consist of columns for listing income sources and categories of expenses, along with rows for each month of the year. They may also include sections for tracking savings, debt repayment, and financial goals. The key to using a budget worksheet effectively is to be thorough and accurate in recording all your financial transactions.

Types of Budget Worksheets

There are various types of budget worksheets available, catering to different needs and preferences. Some worksheets are designed for specific financial situations, such as budgeting for a wedding or planning for retirement. Others may focus on particular expenses, like housing costs or transportation expenses. You can choose a worksheet that best fits your financial situation and goals.Creating Your Own Budget Worksheet

If you prefer a more personalized approach, you can create your own budget worksheet. Start by identifying all your income sources and listing them at the top of the worksheet. Next, categorize your expenses into groups such as housing, food, transportation, entertainment, and savings. Be sure to include a category for unexpected expenses to cover any emergencies that may arise.

When filling out your budget worksheet, begin by recording your income for each month. Then, allocate funds to each expense category based on your financial goals and priorities. It's essential to be realistic and flexible; your budget should be a guide, not a rigid plan that you can't adjust as needed.

Steps to Fill Out a Budget Worksheet

Here are the steps to follow when filling out a budget worksheet: - Identify all sources of income. - List all fixed expenses, such as rent and utilities. - Estimate variable expenses, like food and entertainment. - Allocate funds for savings and debt repayment. - Review and adjust your budget regularly.Benefits of Using Budget Worksheets

Using budget worksheets can have numerous benefits for your financial health. They help you manage your money more effectively, ensure that you're saving enough, and reduce financial stress. By tracking your expenses and income, you can identify patterns and trends in your spending, which can help you make smarter financial decisions.

Budget worksheets are also useful for achieving long-term financial goals. By setting aside a portion of your income each month, you can build savings over time, whether it's for a down payment on a house, a car, or retirement. Additionally, budgeting can help you avoid debt by ensuring that you're living within your means and not overspending.

Common Budgeting Mistakes

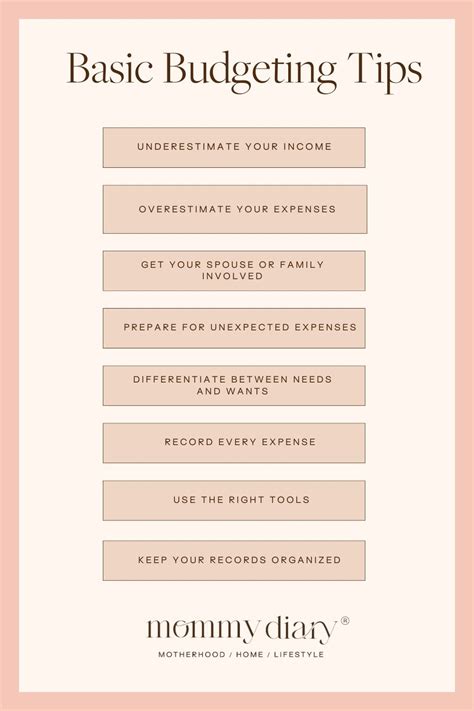

Despite the benefits of budgeting, many people make mistakes that can undermine their financial plans. Common errors include failing to account for all expenses, not prioritizing needs over wants, and neglecting to review and adjust the budget regularly. By being aware of these potential pitfalls, you can create a more effective budget that helps you achieve your financial goals.Using Technology for Budgeting

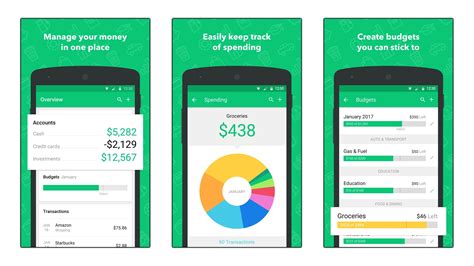

In addition to traditional paper worksheets, there are many digital tools and apps available for budgeting. These platforms can provide more convenience and flexibility, allowing you to track your finances on the go and receive alerts and reminders to help you stay on track. Some popular budgeting apps also offer features like automated savings, investment tracking, and bill payment reminders.

Choosing the Right Budgeting App

With so many budgeting apps on the market, choosing the right one can be overwhelming. Consider your specific financial needs and goals, as well as the app's features, user interface, and cost. Some apps are free, while others charge a subscription fee. Reading reviews and trying out a few different options can help you find the app that works best for you.Sticking to Your Budget

Creating a budget is just the first step; the real challenge is sticking to it over time. This requires discipline, patience, and a willingness to make adjustments as needed. Regularly reviewing your budget and tracking your progress can help you stay motivated and on track.

For more information on personal finance and budgeting, you can check out our article on personal finance tips.

Tips for Long-Term Success

Here are some tips for achieving long-term success with your budget: - Set realistic goals and priorities. - Automate your savings and bill payments. - Avoid impulse purchases and stay disciplined. - Review and adjust your budget regularly.Budgeting Image Gallery

What is the purpose of a budget worksheet?

+A budget worksheet is a tool used to track income and expenses, helping individuals manage their finances effectively and achieve their financial goals.

How do I create a budget worksheet?

+To create a budget worksheet, start by identifying all sources of income and categorizing expenses. Then, allocate funds to each category based on financial priorities and goals.

What are the benefits of using budget worksheets?

+Using budget worksheets can help individuals manage their money more effectively, reduce financial stress, and achieve long-term financial goals.

In conclusion, budget worksheets are a powerful tool for managing your finances and achieving your financial goals. By understanding how to create and use these worksheets effectively, you can take control of your money and build a more secure financial future. Whether you prefer traditional paper worksheets or digital budgeting apps, the key is to find a method that works for you and to stick with it over time. With discipline, patience, and the right tools, you can overcome financial challenges and achieve financial freedom. We invite you to share your experiences with budgeting and provide tips that have worked for you in the comments below.