Intro

Download W2 printable form for easy employee tax reporting, featuring fillable W2 templates and instant access to W2 forms, W2 instructions, and W2 filing requirements for seamless payroll processing and tax compliance.

The W2 printable form is a crucial document for both employers and employees in the United States. It serves as a record of the wages paid to employees and the taxes withheld from their paychecks. The form is typically provided by employers to their employees by January 31st of each year, and it plays a vital role in the tax filing process. In this article, we will delve into the importance of the W2 form, its components, and how to obtain a W2 printable form download.

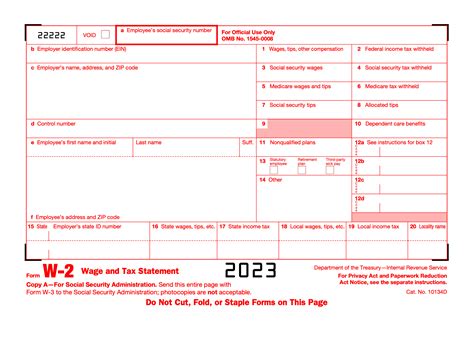

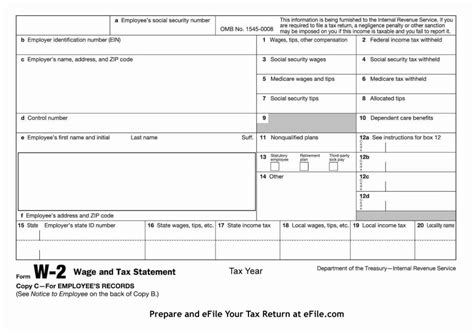

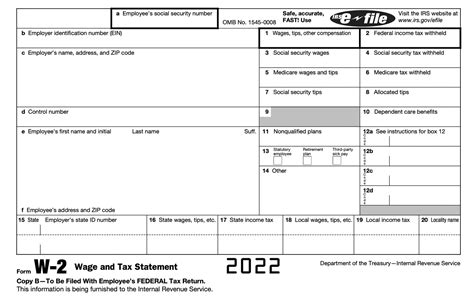

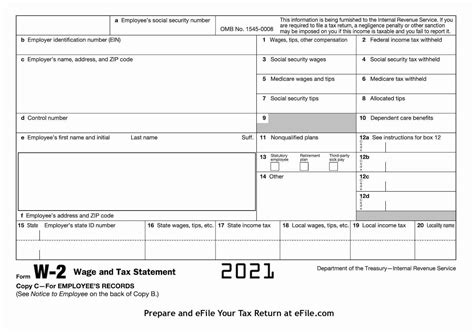

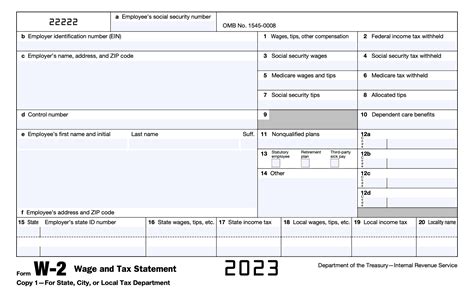

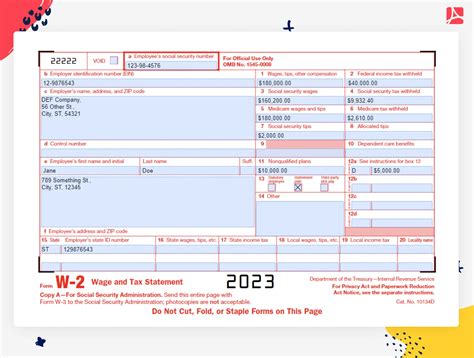

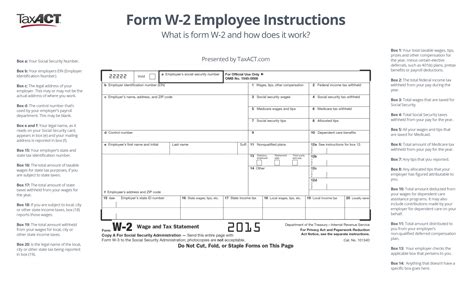

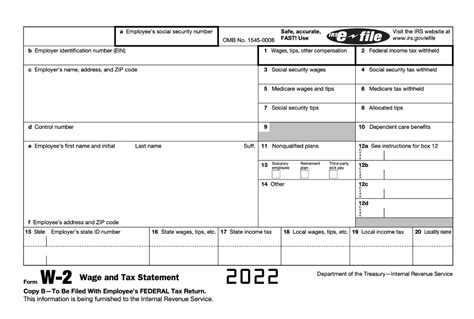

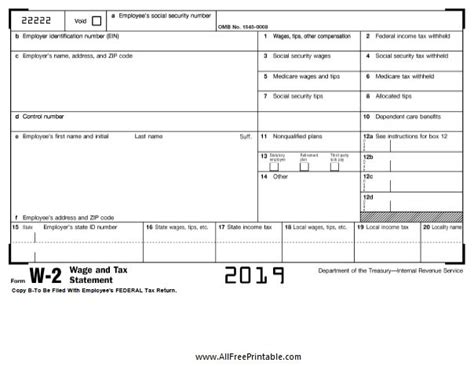

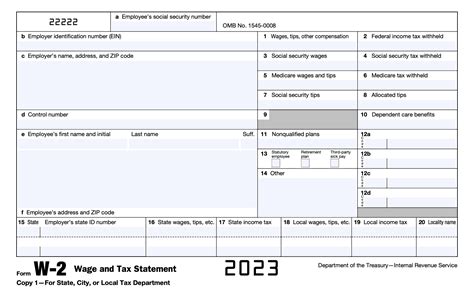

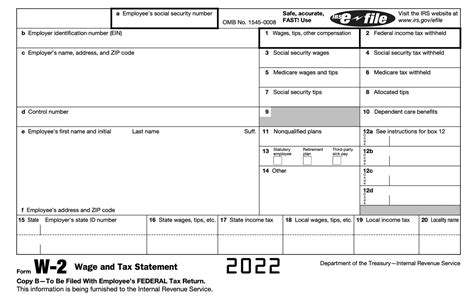

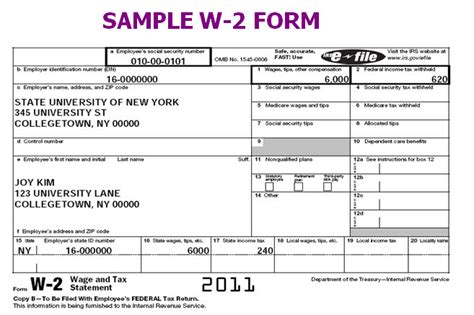

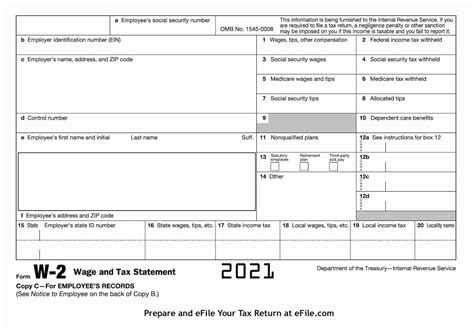

The W2 form is a standard document used by the Internal Revenue Service (IRS) to report wage and salary information for employees. It includes details such as the employee's name, address, and Social Security number, as well as the employer's name, address, and Employer Identification Number (EIN). The form also reports the total wages paid to the employee, the amount of federal income tax withheld, and the amount of Social Security and Medicare taxes withheld. This information is essential for employees to complete their tax returns accurately and for employers to comply with tax laws.

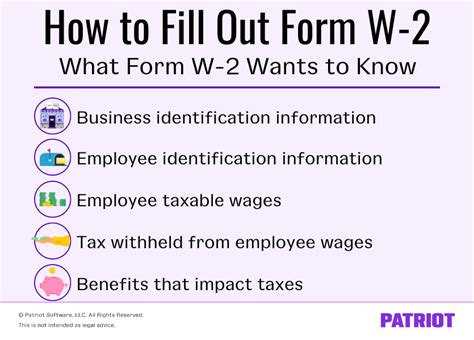

Understanding the W2 Form

The W2 form consists of several boxes that contain different types of information. Box 1 reports the total wages paid to the employee, while Box 2 reports the amount of federal income tax withheld. Box 3 reports the total wages subject to Social Security tax, and Box 4 reports the amount of Social Security tax withheld. Box 5 reports the total wages subject to Medicare tax, and Box 6 reports the amount of Medicare tax withheld. The form also includes other boxes that report additional information, such as tips, dependent care benefits, and retirement plan contributions.

Importance of the W2 Form

The W2 form is essential for both employees and employers. For employees, the form provides a record of their wages and taxes withheld, which they need to complete their tax returns. Without a W2 form, employees may face delays or difficulties in filing their taxes, which could result in penalties or fines. For employers, the W2 form is a critical document that helps them comply with tax laws and regulations. Employers must provide W2 forms to their employees by January 31st of each year, and they must also submit a copy of the form to the Social Security Administration (SSA) by February 28th.

Obtaining a W2 Printable Form Download

There are several ways to obtain a W2 printable form download. Employers can download the form from the IRS website or purchase it from an office supply store. Employees can also obtain a copy of their W2 form from their employer or by contacting the SSA. Additionally, many tax preparation software programs, such as TurboTax or H&R Block, offer W2 printable form downloads as part of their tax preparation services.

To obtain a W2 printable form download, follow these steps:

- Visit the IRS website at [internal link to IRS website]

- Click on the "Forms and Publications" tab

- Search for "W2 form"

- Select the correct tax year and download the form

- Print the form and complete it according to the instructions

Completing the W2 Form

Completing the W2 form requires careful attention to detail. Employers must ensure that all information is accurate and complete, including the employee's name, address, and Social Security number. The form must also be signed and dated by the employer. Employees should review their W2 form carefully to ensure that all information is correct and that they have received the correct amount of wages and taxes withheld.

Tips for Employers

Employers can take several steps to ensure that they comply with W2 form requirements:

- Verify employee information, including names, addresses, and Social Security numbers

- Use the correct tax year and form version

- Complete all required boxes and fields

- Sign and date the form

- Provide the form to employees by January 31st of each year

- Submit a copy of the form to the SSA by February 28th

Tips for Employees

Employees can take several steps to ensure that they receive an accurate W2 form:

- Verify their information, including name, address, and Social Security number

- Review the form carefully to ensure that all information is correct

- Contact their employer if they have not received their W2 form by January 31st

- Use the form to complete their tax return accurately

Common Mistakes to Avoid

Both employers and employees can avoid common mistakes by following these tips:

- Use the correct tax year and form version

- Complete all required boxes and fields

- Verify employee information, including names, addresses, and Social Security numbers

- Sign and date the form

- Provide the form to employees by January 31st of each year

- Submit a copy of the form to the SSA by February 28th

Gallery of W2 Forms

W2 Form Gallery

Frequently Asked Questions

What is the purpose of the W2 form?

+The W2 form is used to report wage and salary information for employees, including the amount of wages paid and taxes withheld.

Who is required to provide a W2 form?

+Employers are required to provide a W2 form to their employees by January 31st of each year.

What information is included on the W2 form?

+The W2 form includes information such as the employee's name, address, and Social Security number, as well as the employer's name, address, and EIN.

How can I obtain a W2 printable form download?

+Employers can download the W2 form from the IRS website or purchase it from an office supply store. Employees can also obtain a copy of their W2 form from their employer or by contacting the SSA.

What are the consequences of not providing a W2 form?

+Employers who fail to provide a W2 form to their employees may face penalties and fines. Employees who do not receive a W2 form may experience delays or difficulties in filing their taxes.

In summary, the W2 printable form is a critical document that plays a vital role in the tax filing process. Employers and employees must ensure that they comply with W2 form requirements to avoid penalties and fines. By understanding the importance of the W2 form, completing it accurately, and obtaining a W2 printable form download, individuals can ensure a smooth and successful tax filing experience. We invite you to share your thoughts and experiences with the W2 form in the comments section below.