Intro

Discover the potential impact of 5 Ways Rich Face Tax Hikes on high-net-worth individuals. Learn how proposed tax reforms may affect affluent families, including increased income tax rates, wealth transfer taxes, and changes to deductions and exemptions. Understand the implications for wealth management and estate planning.

As governments around the world continue to grapple with the challenges of increasing public spending and reducing debt, the wealthy are likely to face a barrage of tax hikes in the coming years. The rich, who have long been accused of not paying their fair share of taxes, will be expected to contribute more to the public purse. In this article, we will explore five ways in which the rich face tax hikes.

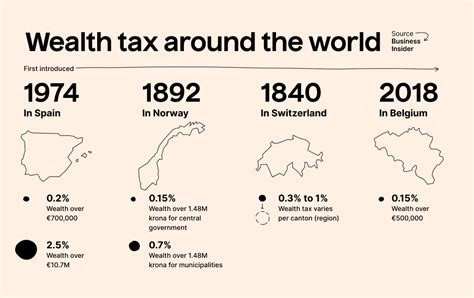

The Increasing Trend of Wealth Taxes

Wealth taxes are becoming increasingly popular among governments looking to raise revenue from the rich. These taxes are levied on an individual's net wealth, rather than their income, and are often used to fund social programs and reduce inequality. Several countries, including France, Spain, and Norway, have already implemented wealth taxes, and others are likely to follow suit.

How Wealth Taxes Work

Wealth taxes typically work by requiring individuals to declare their net wealth, which includes assets such as property, stocks, and bonds. The tax is then levied on the total value of these assets, often at a rate of around 1-2% per annum. The tax is usually paid annually, and the revenue generated is used to fund public services and reduce debt.

The Rise of Inheritance Taxes

Inheritance taxes, also known as estate taxes, are another way in which the rich are likely to face tax hikes. These taxes are levied on the transfer of wealth from one generation to the next, and are often used to reduce inequality and raise revenue. Several countries, including the UK and the US, have already implemented inheritance taxes, and others are likely to follow suit.

How Inheritance Taxes Work

Inheritance taxes typically work by requiring the estate of a deceased individual to pay a tax on the transfer of wealth to their heirs. The tax is usually levied at a rate of around 40-50% of the total value of the estate, although this can vary depending on the country and the size of the estate.

The Increasing Use of Capital Gains Taxes

Capital gains taxes are another way in which the rich are likely to face tax hikes. These taxes are levied on the profits made from the sale of assets, such as stocks, bonds, and property. Several countries, including the US and the UK, have already implemented capital gains taxes, and others are likely to follow suit.

How Capital Gains Taxes Work

Capital gains taxes typically work by requiring individuals to pay a tax on the profits made from the sale of assets. The tax is usually levied at a rate of around 20-30% of the total profit, although this can vary depending on the country and the type of asset.

The Rise of Income Taxes on the Rich

Income taxes on the rich are another way in which the wealthy are likely to face tax hikes. These taxes are levied on the income earned by individuals, and are often used to fund public services and reduce debt. Several countries, including the US and the UK, have already implemented income taxes on the rich, and others are likely to follow suit.

How Income Taxes on the Rich Work

Income taxes on the rich typically work by requiring individuals to pay a tax on their income above a certain threshold. The tax is usually levied at a rate of around 40-50% of the total income, although this can vary depending on the country and the level of income.

The Increasing Use of Tax Havens to Avoid Taxes

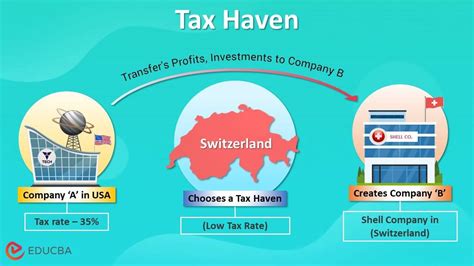

Tax havens are another way in which the rich are likely to face tax hikes. These are countries or territories that offer low or zero tax rates to attract foreign investment. However, several countries, including the US and the UK, have implemented measures to crack down on the use of tax havens to avoid taxes.

How Tax Havens Work

Tax havens typically work by offering low or zero tax rates to attract foreign investment. However, several countries have implemented measures to crack down on the use of tax havens to avoid taxes. These measures include requiring individuals to disclose their use of tax havens, and imposing penalties on those who fail to comply.

Gallery of Rich Face Tax Hikes

What are wealth taxes?

+Wealth taxes are taxes levied on an individual's net wealth, rather than their income.

How do inheritance taxes work?

+Inheritance taxes are levied on the transfer of wealth from one generation to the next.

What are capital gains taxes?

+Capital gains taxes are taxes levied on the profits made from the sale of assets.

As the rich face tax hikes, it's essential to understand the various ways in which they will be affected. From wealth taxes to inheritance taxes, capital gains taxes, and income taxes on the rich, the wealthy will be expected to contribute more to the public purse. Whether you're a billionaire or a millionaire, it's crucial to stay informed about the changing tax landscape and plan accordingly.