Intro

Discover the truth about military officers compensation. Learn if military officers receive Basic Allowance for Subsistence (BAS) and how it impacts their overall pay. Explore the differences between BAS and other allowances, such as Basic Allowance for Housing (BAH) and Cost of Living Allowance (COLA). Get the facts on military officer pay and benefits.

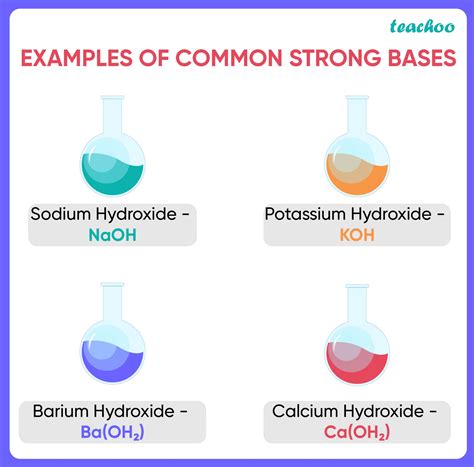

Military officers, like all other members of the United States Armed Forces, are entitled to receive a Basic Allowance for Subsistence (BAS) as part of their compensation package. The BAS is a monthly stipend provided to military personnel to help offset the cost of food and other subsistence expenses.

The BAS is a non-taxable allowance, which means that it is not subject to federal income tax. The amount of the BAS varies based on the individual's pay grade and the number of dependents they have. For example, as of 2022, the monthly BAS rate for officers in the Army, Navy, Air Force, and Marine Corps is $369.39 for officers with no dependents and $415.46 for officers with dependents.

The BAS is intended to cover the cost of food and other subsistence expenses, but it is not meant to cover all of the individual's expenses. Military personnel are expected to use their BAS to purchase food and other essential items, but they may also use it to cover other expenses such as dining out or purchasing take-out meals.

One of the benefits of the BAS is that it is not subject to the same fluctuations as the cost of living in different areas. Unlike the Basic Allowance for Housing (BAH), which varies based on the cost of living in the area where the individual is stationed, the BAS is a fixed amount that is the same regardless of where the individual is stationed.

Another benefit of the BAS is that it is not affected by the individual's marital status or the number of dependents they have. Unlike the BAH, which takes into account the individual's family size and composition, the BAS is the same for all individuals in the same pay grade, regardless of their family status.

It's worth noting that military officers who are eligible to receive BAS may also be eligible to receive other forms of compensation, such as the Basic Allowance for Housing (BAH) and the Cost of Living Allowance (COLA). These allowances are intended to help offset the cost of housing and living expenses in areas with a high cost of living.

How Does BAS Work for Military Officers?

The BAS is a monthly stipend provided to military officers to help offset the cost of food and other subsistence expenses. The amount of the BAS varies based on the individual's pay grade and the number of dependents they have.

Here's an example of how the BAS works for military officers:

- Let's say an officer in the Army is a captain with no dependents. As of 2022, their monthly BAS rate would be $369.39.

- If the officer is married with two children, their monthly BAS rate would be $415.46.

- The officer would receive this amount every month, in addition to their basic pay and any other allowances they may be eligible to receive.

BAS vs. BAH: What's the Difference?

The BAS and the Basic Allowance for Housing (BAH) are two separate allowances provided to military personnel to help offset the cost of living expenses. The main difference between the two allowances is that the BAS is intended to cover the cost of food and other subsistence expenses, while the BAH is intended to cover the cost of housing expenses.

Here's an example of how the two allowances work together:

- Let's say an officer in the Navy is a lieutenant with no dependents, stationed in San Diego, California. As of 2022, their monthly BAS rate would be $369.39.

- Their monthly BAH rate would be $2,343.90, based on the cost of living in the San Diego area.

- The officer would receive both allowances every month, in addition to their basic pay.

What Are the Benefits of BAS for Military Officers?

The BAS provides several benefits to military officers, including:

- A non-taxable stipend to help offset the cost of food and other subsistence expenses

- A fixed amount that is the same regardless of where the individual is stationed

- A benefit that is not affected by the individual's marital status or the number of dependents they have

- A benefit that can be used in conjunction with other allowances, such as the BAH and the Cost of Living Allowance (COLA)

Overall, the BAS is an important part of the military's compensation package, providing military officers with a monthly stipend to help offset the cost of living expenses.

Eligibility for BAS

To be eligible to receive BAS, military officers must meet certain requirements, including:

- Being an active-duty member of the United States Armed Forces

- Being a member of the Army, Navy, Air Force, or Marine Corps

- Having a pay grade of O-1 or higher

- Not being eligible to receive a meal allowance or other subsistence benefits

Military officers who meet these requirements are eligible to receive BAS, regardless of their marital status or the number of dependents they have.

How to Calculate BAS

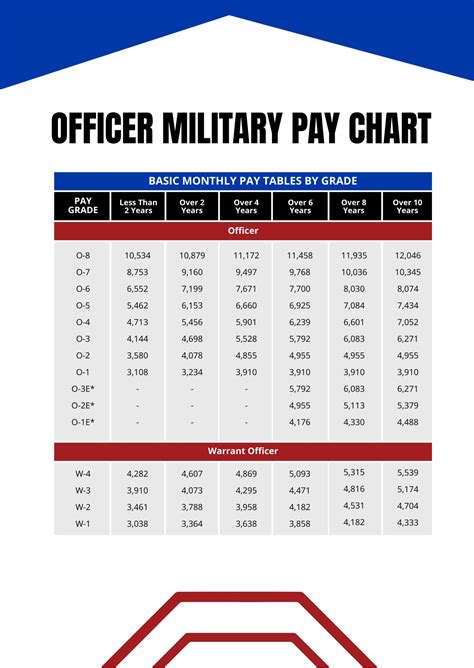

The BAS is calculated based on the individual's pay grade and the number of dependents they have. The monthly BAS rate for officers in the Army, Navy, Air Force, and Marine Corps is as follows:

- Officers with no dependents: $369.39 per month

- Officers with dependents: $415.46 per month

To calculate the BAS, military officers can use the following formula:

BAS = (pay grade x number of dependents) x monthly BAS rate

For example, let's say an officer in the Air Force is a major with two dependents. Their monthly BAS rate would be:

BAS = (O-4 x 2) x $415.46 = $830.92 per month

BAS and Taxes

The BAS is a non-taxable stipend, which means that it is not subject to federal income tax. Military officers who receive BAS do not have to pay taxes on this benefit, which can help reduce their taxable income.

However, military officers who receive BAS may still have to pay taxes on their basic pay and other allowances, such as the BAH and the COLA. It's always a good idea to consult with a tax professional to determine the tax implications of receiving BAS and other military allowances.

BAS and Other Allowances

The BAS is just one of several allowances provided to military personnel to help offset the cost of living expenses. Other allowances include:

- Basic Allowance for Housing (BAH)

- Cost of Living Allowance (COLA)

- Basic Allowance for Subsistence (BAS)

- Overseas Housing Allowance (OHA)

Military personnel who receive BAS may also be eligible to receive these other allowances, depending on their individual circumstances.

Gallery of BAS Images

BAS Image Gallery

FAQs

What is the Basic Allowance for Subsistence (BAS)?

+The Basic Allowance for Subsistence (BAS) is a monthly stipend provided to military personnel to help offset the cost of food and other subsistence expenses.

How much is the BAS for military officers?

+The monthly BAS rate for officers in the Army, Navy, Air Force, and Marine Corps is $369.39 for officers with no dependents and $415.46 for officers with dependents.

Is the BAS taxable?

+No, the BAS is a non-taxable stipend, which means that it is not subject to federal income tax.

We hope this article has provided you with a comprehensive understanding of the Basic Allowance for Subsistence (BAS) and how it works for military officers. If you have any further questions or concerns, please don't hesitate to reach out to us.