Intro

Download a free W4 Form Printable Template to simplify employee tax withholding, including dependent claims, multiple jobs, and tax credits, with easy-to-use IRS forms and instructions.

The W-4 form is a crucial document for employees in the United States, as it determines the amount of federal income tax withheld from their wages. The form is typically completed by new employees when they start a job, but it can also be updated at any time if an employee's tax situation changes. In this article, we will delve into the world of W-4 forms, exploring their importance, benefits, and how to complete them accurately.

Completing a W-4 form can seem daunting, especially for those who are new to the workforce or have never had to deal with tax withholding before. However, it is essential to get it right to avoid any potential issues with the IRS. The form is used to determine the amount of federal income tax that should be withheld from an employee's wages, and it takes into account factors such as marital status, number of dependents, and other sources of income.

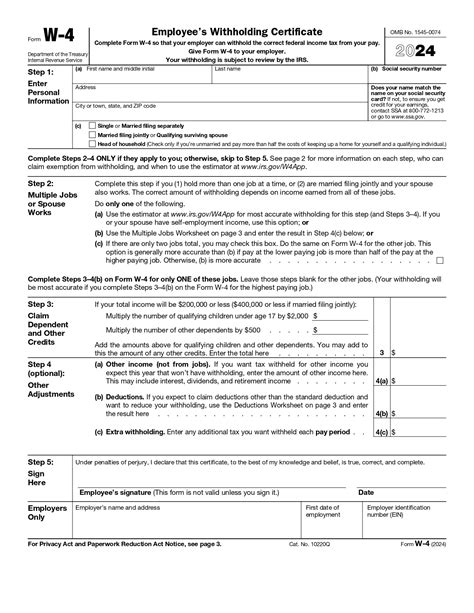

The W-4 form is typically provided by an employer, but it can also be downloaded from the IRS website or obtained from a local IRS office. The form is usually updated annually to reflect any changes in tax laws or regulations, so it is essential to use the most recent version. Employees can complete the form manually or use tax software to help guide them through the process.

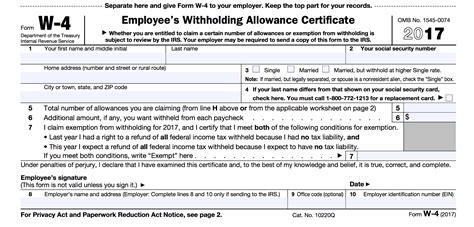

Understanding the W-4 Form

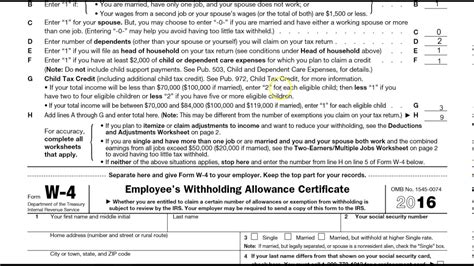

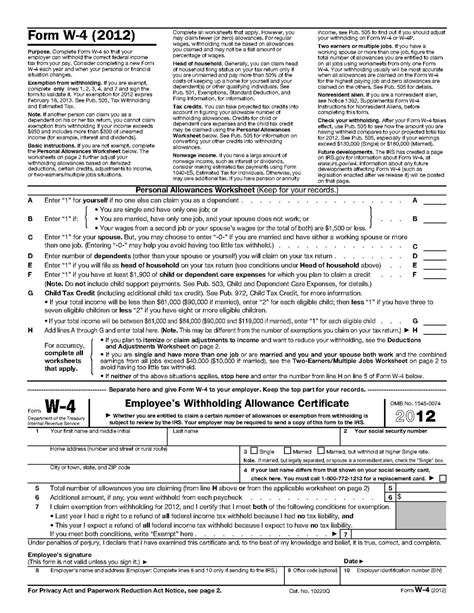

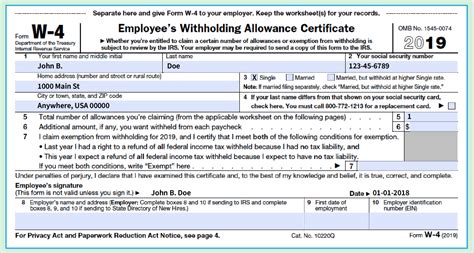

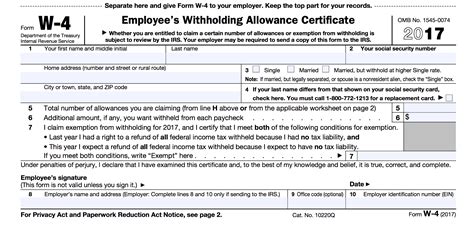

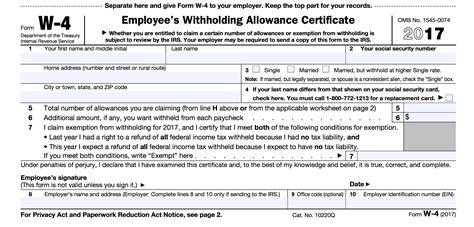

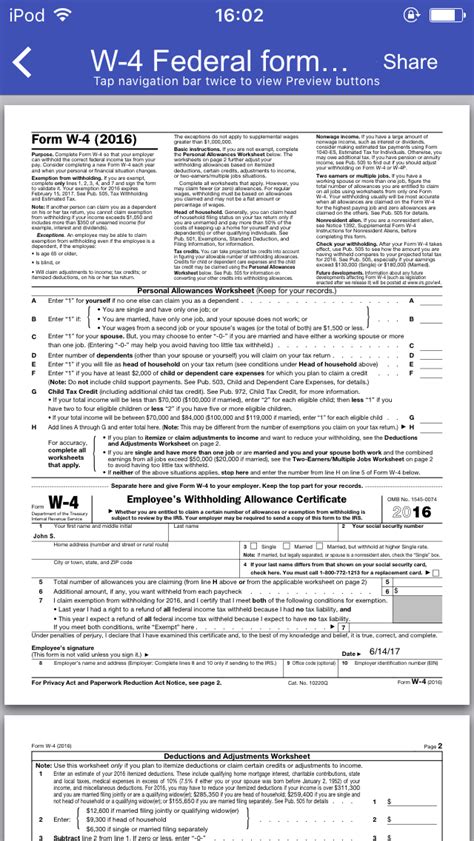

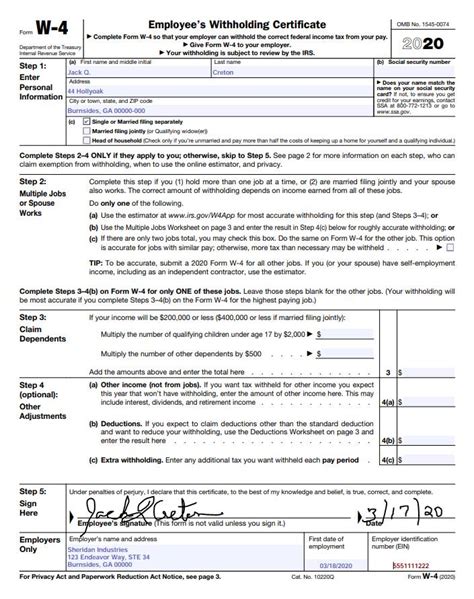

The W-4 form is divided into several sections, each of which requires specific information. The first section asks for personal details, such as name, address, and Social Security number. The second section is where employees claim their withholding allowances, which determine how much tax is withheld from their wages. The more allowances an employee claims, the less tax will be withheld.

The third section is for reporting other income, such as interest, dividends, or capital gains. This section is important, as it helps to ensure that the correct amount of tax is withheld from an employee's wages. The fourth section is for claiming exemptions, such as the standard deduction or itemized deductions. Employees can also use this section to claim any additional tax credits they may be eligible for.

Benefits of Using a W-4 Form Printable Template

Using a W-4 form printable template can be beneficial for several reasons. Firstly, it ensures that employees complete the form accurately and thoroughly, reducing the risk of errors or omissions. Secondly, it saves time and effort, as employees can simply print out the form and fill it in, rather than having to create their own version from scratch.

Thirdly, using a printable template can help to reduce stress and anxiety, as employees can be confident that they are completing the form correctly. Finally, it can help to improve communication between employees and employers, as the form provides a clear and concise way of reporting tax withholding information.

How to Complete a W-4 Form

Completing a W-4 form requires careful attention to detail and an understanding of the various sections and schedules. Here are some steps to follow:

- Start by filling in the personal details section, including name, address, and Social Security number.

- Claim withholding allowances in the second section, taking into account factors such as marital status, number of dependents, and other sources of income.

- Report other income, such as interest, dividends, or capital gains, in the third section.

- Claim exemptions, such as the standard deduction or itemized deductions, in the fourth section.

- Review the form carefully to ensure that all information is accurate and complete.

W-4 Form Printable Template Steps

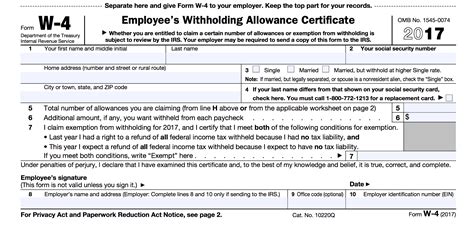

To use a W-4 form printable template, follow these steps:

- Download the template from a reputable source, such as the IRS website or a tax software provider.

- Print out the template and fill it in carefully, using a pen or pencil.

- Review the form to ensure that all information is accurate and complete.

- Sign and date the form, and return it to your employer.

- Keep a copy of the form for your records, in case you need to refer to it later.

Common Mistakes to Avoid

When completing a W-4 form, there are several common mistakes to avoid. These include:

- Failing to claim withholding allowances, which can result in too much tax being withheld from wages.

- Claiming too many allowances, which can result in too little tax being withheld.

- Failing to report other income, such as interest or dividends.

- Claiming exemptions that are not eligible, such as the standard deduction or itemized deductions.

Internal Link to Another Post

For more information on tax withholding and the W-4 form, check out our [post on understanding tax brackets](https://example.com/understanding-tax-brackets).W-4 Form Example

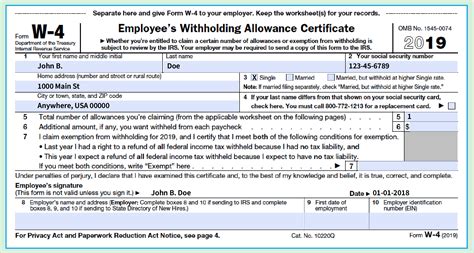

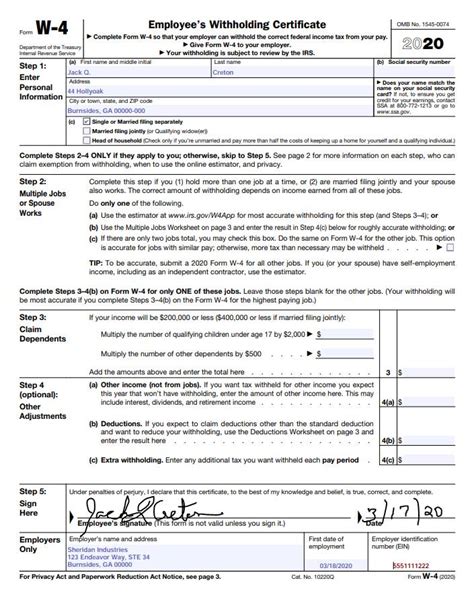

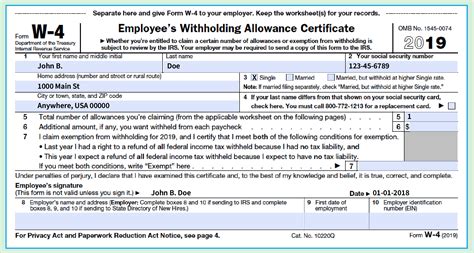

Here is an example of a completed W-4 form:

- Personal details: John Doe, 123 Main Street, Anytown, USA 12345

- Withholding allowances: 2

- Other income: $10,000 in interest and dividends

- Exemptions: standard deduction

W-4 Form Printable Template Download

To download a W-4 form printable template, visit the IRS website or a tax software provider. Simply click on the link, download the template, and print it out.

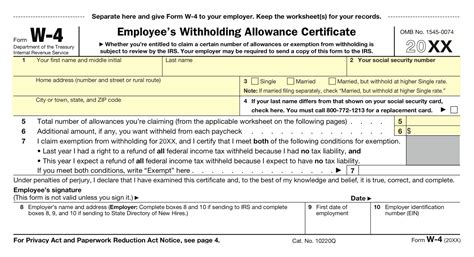

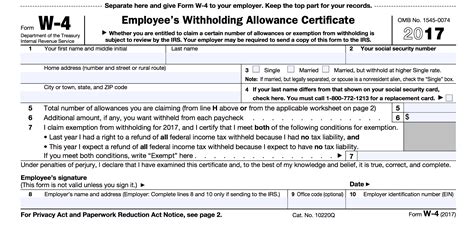

Gallery of W4 Form Printable Templates

W4 Form Printable Templates Image Gallery

What is a W-4 form?

+A W-4 form is a document used to determine the amount of federal income tax withheld from an employee's wages.

How do I complete a W-4 form?

+To complete a W-4 form, start by filling in the personal details section, then claim withholding allowances, report other income, and claim exemptions.

What are the benefits of using a W-4 form printable template?

+Using a W-4 form printable template can help ensure accuracy, save time, and reduce stress when completing the form.

In conclusion, the W-4 form is an essential document for employees in the United States, and completing it accurately is crucial to avoid any potential issues with the IRS. By understanding the importance of the form, using a printable template, and following the steps outlined in this article, employees can ensure that their tax withholding is correct and avoid any unnecessary stress or penalties. We invite you to share your thoughts and experiences with W-4 forms in the comments section below, and don't forget to share this article with anyone who may find it helpful.