Intro

Discover 7 financial survival tips for E-5 military personnel with a family of six. Learn how to manage your military pay, prioritize expenses, and build wealth despite the challenges of raising a large family on a modest income. Get expert advice on budgeting, saving, and investing for a secure financial future.

Raising a family of six on an E-5 military salary can be a daunting task. With the constant pressure to make ends meet, it's easy to feel overwhelmed and stressed about finances. However, with the right strategies and mindset, it is possible to thrive and achieve financial stability, even on a modest income.

As an E-5 with four kids, it's essential to prioritize your spending, make the most of your benefits, and cultivate healthy financial habits. Here are seven financial survival tips to help you navigate the challenges of raising a large family on a military salary.

1. Create a Realistic Budget

The first step to achieving financial stability is to create a realistic budget that accounts for your income, expenses, and savings goals. Start by tracking your spending to identify areas where you can cut back on unnecessary expenses. Make a list of your essential expenses, such as rent/mortgage, utilities, groceries, and transportation costs.

As an E-5 with four kids, you may need to adjust your budget to accommodate your large family's needs. Consider ways to reduce your expenses, such as:

- Cooking meals in bulk and using coupons to save on groceries

- Canceling subscription services like streaming platforms and gym memberships

- Finding free or low-cost entertainment options, such as hiking or game nights

- Shopping for second-hand clothing and household items

Use the 50/30/20 Rule

Allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment. This will help you strike a balance between enjoying your life and securing your financial future.

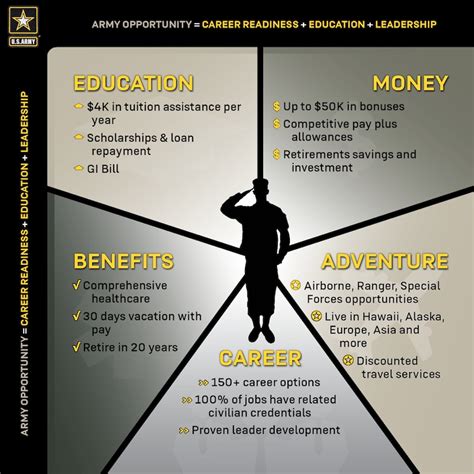

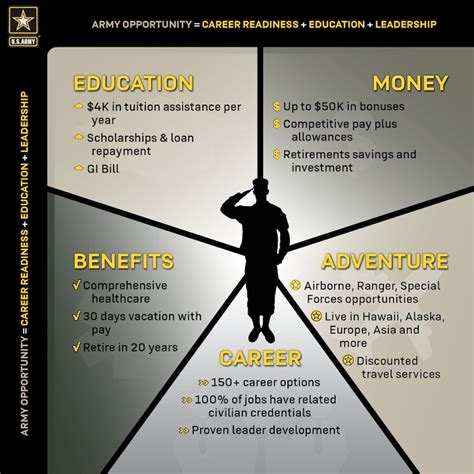

2. Maximize Your Military Benefits

As a military family, you have access to a range of benefits that can help you save money and achieve financial stability. Some of the most valuable benefits for large families include:

- Base Allowance for Housing (BAH): This tax-free allowance can help you cover the cost of rent or mortgage payments.

- Basic Allowance for Subsistence (BAS): This allowance can help you cover the cost of groceries and other food expenses.

- Military healthcare: Tricare and other military healthcare plans can provide affordable medical, dental, and vision coverage for your family.

- Education benefits: The GI Bill and other education benefits can help you pursue higher education or vocational training.

Make sure to take advantage of these benefits and explore other resources, such as the Military Assistance Program (MAP) and the National Military Family Association (NMFA), which offer financial assistance and support for military families.

3. Use Cashback and Rewards Programs

Cashback and rewards programs can help you earn money back or accumulate points on your everyday purchases. Some popular programs for military families include:

- Military cashback apps, such as Rakuten (formerly known as Ebates) and TopCashback

- Rewards credit cards, such as the American Express Blue Cash Preferred card

- Store loyalty programs, such as the Target RedCard and the Walgreens Balance Rewards program

Make sure to use these programs strategically and avoid overspending to maximize your rewards.

4. Build an Emergency Fund

Having an emergency fund in place can help you weather financial storms and avoid going into debt when unexpected expenses arise. Aim to save three to six months' worth of living expenses in a easily accessible savings account.

Consider setting up automatic transfers from your checking account to your savings account to make saving easier and less prone to being neglected.

5. Pay Off High-Interest Debt

High-interest debt, such as credit card balances, can quickly add up and become overwhelming. Consider using the debt avalanche method, where you prioritize paying off debts with the highest interest rates first.

You can also explore debt consolidation options, such as balance transfer credit cards or personal loans, to simplify your payments and save on interest.

6. Invest in Your Future

As an E-5 with four kids, it's essential to think about your long-term financial goals, such as retirement and your children's education. Consider contributing to a Thrift Savings Plan (TSP) or other retirement accounts, and explore education savings options, such as 529 plans.

Remember, investing in your future is crucial to achieving financial stability and securing your family's well-being.

7. Seek Support and Resources

Finally, don't be afraid to seek support and resources when you need them. Military families face unique challenges, and there are many organizations and resources available to help.

Consider reaching out to:

- Military OneSource: A 24/7 hotline and online resource center that provides financial counseling, education, and support.

- The Military Assistance Program (MAP): A program that offers financial assistance and support for military families.

- The National Military Family Association (NMFA): A non-profit organization that provides education, advocacy, and support for military families.

By following these seven financial survival tips, you can achieve financial stability and thrive as an E-5 with four kids. Remember to prioritize your spending, maximize your military benefits, and seek support when you need it.

Gallery of Financial Survival Tips for Military Families

What is the best way to budget for a large military family?

+The best way to budget for a large military family is to create a realistic budget that accounts for your income, expenses, and savings goals. Consider using the 50/30/20 rule, where you allocate 50% of your income towards essential expenses, 30% towards discretionary spending, and 20% towards savings and debt repayment.

What are some ways to save money on groceries for a large military family?

+Some ways to save money on groceries for a large military family include cooking meals in bulk, using coupons, and shopping for second-hand clothing and household items. You can also consider shopping at discount stores or using cashback apps like Rakuten (formerly known as Ebates) and TopCashback.

What are some resources available to help military families with financial planning?

+Some resources available to help military families with financial planning include Military OneSource, the Military Assistance Program (MAP), and the National Military Family Association (NMFA). These organizations offer financial counseling, education, and support to help military families achieve financial stability.