Intro

Discover expert Ed Kornhauser tips for enhanced learning, featuring strategic instruction, adaptive assessment, and personalized feedback, boosting student engagement and academic success.

The world of financial planning and wealth management is complex and ever-changing. With so many options and strategies available, it can be difficult to know where to start or how to make the most of your investments. This is where Ed Kornhauser's tips come in, offering valuable insights and guidance for individuals looking to secure their financial futures. In this article, we will delve into the importance of Ed Kornhauser's advice and explore how his tips can help you achieve your financial goals.

Ed Kornhauser is a renowned expert in the field of financial planning, with years of experience helping individuals and families manage their wealth and achieve financial security. His tips are based on a deep understanding of the financial markets and a commitment to helping people make informed decisions about their money. Whether you are just starting out or are well-established in your financial journey, Ed Kornhauser's advice is essential reading.

The importance of Ed Kornhauser's tips cannot be overstated. In today's fast-paced and often unpredictable financial landscape, it is more important than ever to have a solid understanding of how to manage your money and make smart investment decisions. With the rise of new technologies and investment opportunities, there are more options available than ever before, but this also means that there are more potential pitfalls to avoid. By following Ed Kornhauser's advice, you can navigate the complexities of the financial world with confidence and achieve your long-term goals.

Introduction to Ed Kornhauser's Tips

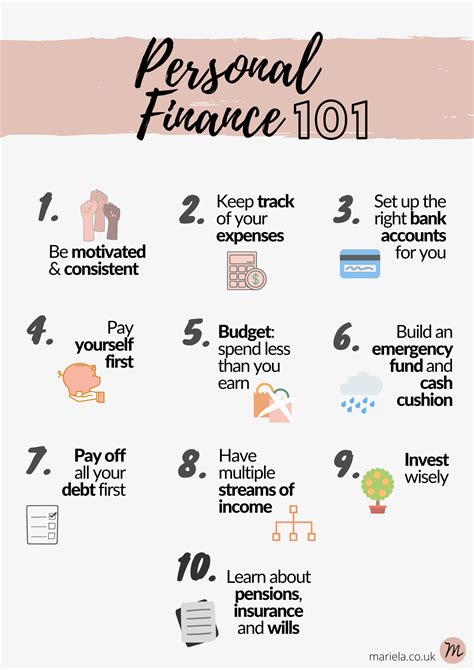

Tip 1: Start Early and Be Consistent

Benefits of Starting Early

Some of the benefits of starting early and being consistent in your financial planning include: * More time for your investments to grow * Reduced risk through diversification and long-term averaging * Increased financial security and peace of mind * Greater flexibility and freedom to pursue your goals and dreamsTip 2: Diversify Your Portfolio

Benefits of Diversification

Some of the benefits of diversifying your portfolio include: * Reduced risk through spreading your investments across different asset classes and sectors * Increased potential returns through exposure to a range of growth opportunities * Improved liquidity and flexibility through a diversified portfolio * Greater peace of mind and financial security through reduced risk and increased stabilityTip 3: Minimize Debt and Maximize Savings

Benefits of Minimizing Debt and Maximizing Savings

Some of the benefits of minimizing debt and maximizing savings include: * Reduced financial stress and increased peace of mind * Increased flexibility and freedom to pursue your goals and dreams * Improved credit score and reduced interest payments * Greater financial security and stability through a cash reserve and reduced debtTip 4: Invest for the Long Term

Benefits of Long-Term Investing

Some of the benefits of long-term investing include: * Reduced risk through diversification and long-term averaging * Increased potential returns through exposure to growth opportunities over the long term * Improved financial security and stability through a long-term approach * Greater peace of mind and reduced stress through a disciplined and patient approach to investingTip 5: Seek Professional Advice

Benefits of Seeking Professional Advice

Some of the benefits of seeking professional advice include: * Expert guidance and support to help you make informed decisions about your money * Personalized planning and advice tailored to your unique needs and circumstances * Increased financial security and stability through a comprehensive and long-term approach * Greater peace of mind and reduced stress through professional guidance and supportEd Kornhauser Tips Image Gallery

What is the importance of starting early in financial planning?

+Starting early in financial planning allows you to take advantage of the power of compound interest, reduce risk, and increase potential returns. It also gives you more time to achieve your long-term goals and enjoy financial security and stability.

How can I minimize debt and maximize savings?

+To minimize debt and maximize savings, focus on avoiding high-interest debt, creating a budget, and building a cash reserve. You can also consider consolidating debt, negotiating with creditors, and taking advantage of tax-advantaged savings vehicles.

What are the benefits of seeking professional advice in financial planning?

+Seeking professional advice in financial planning can provide expert guidance and support, help you make informed decisions about your money, and increase financial security and stability. A financial advisor can also help you develop a personalized plan tailored to your unique needs and circumstances.

In conclusion, Ed Kornhauser's tips offer valuable insights and practical guidance for individuals looking to secure their financial futures. By starting early, diversifying your portfolio, minimizing debt, investing for the long term, and seeking professional advice, you can make the most of your investments and achieve your financial goals. Remember to stay informed, stay disciplined, and always keep your long-term objectives in mind. With the right approach and a commitment to financial planning, you can enjoy financial freedom and security, and live the life you deserve. We invite you to share your thoughts and experiences with financial planning, and to take the first step towards securing your financial future today.