Intro

Unlock the full potential of your GI Bill benefits with these 5 expert strategies. Maximize your education assistance, vocational training, and career development opportunities. Discover how to navigate the GI Bill application process, choose the right program, and leverage additional benefits like housing allowances and tutoring assistance to achieve your post-military goals.

The GI Bill is one of the most valuable benefits available to veterans and their families, providing financial assistance for education and training. However, navigating the complexities of the GI Bill can be overwhelming, and many veterans may not be aware of the full range of benefits available to them. In this article, we will explore five ways to maximize your GI Bill benefits, ensuring that you get the most out of this valuable resource.

Understanding Your GI Bill Benefits

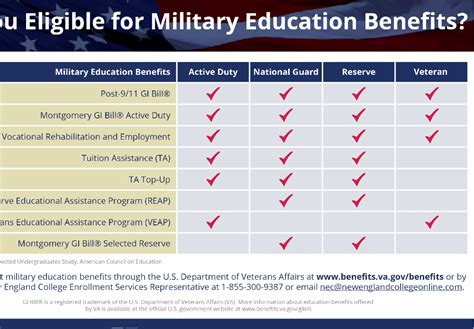

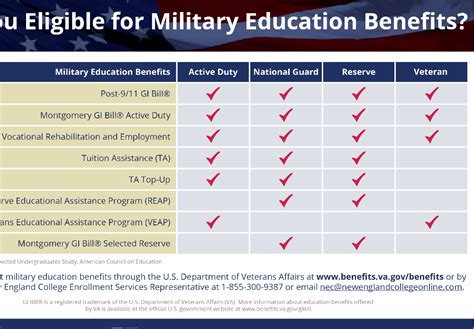

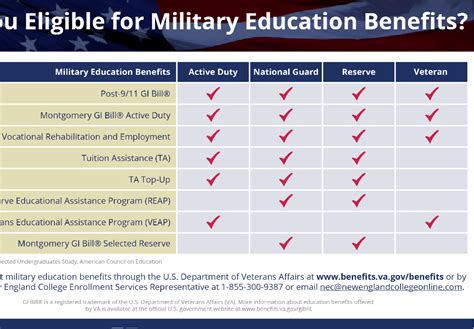

Before we dive into the five ways to maximize your GI Bill benefits, it's essential to understand what the GI Bill covers. The GI Bill provides financial assistance for education and training, including college degrees, vocational training, and apprenticeships. There are two main types of GI Bill benefits: the Post-9/11 GI Bill (Chapter 33) and the Montgomery GI Bill (Chapter 30).

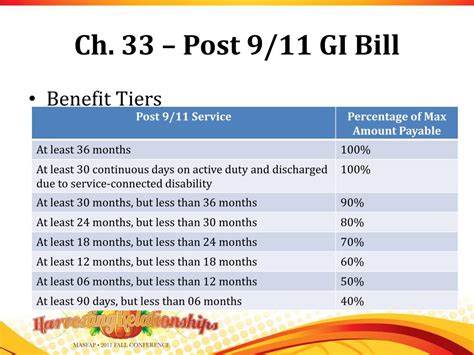

Post-9/11 GI Bill (Chapter 33)

The Post-9/11 GI Bill is available to veterans who have served at least 90 days of active duty since September 10, 2001. This benefit provides up to 36 months of education benefits, including tuition and fees, housing stipend, and book stipend.

Montgomery GI Bill (Chapter 30)

The Montgomery GI Bill is available to veterans who have served at least two years of active duty. This benefit provides up to 36 months of education benefits, including tuition and fees, but does not include a housing stipend.

1. Choose the Right GI Bill Benefit

One of the most critical decisions you'll make when it comes to maximizing your GI Bill benefits is choosing the right benefit for your needs. The Post-9/11 GI Bill and the Montgomery GI Bill have different eligibility requirements and benefits, so it's essential to understand the differences before making a decision.

Consider your education goals, financial situation, and personal circumstances when choosing a GI Bill benefit. If you're eligible for both benefits, you may want to consider the Post-9/11 GI Bill, which provides a more comprehensive benefit package, including a housing stipend.

2. Use Your GI Bill Benefits Strategically

To maximize your GI Bill benefits, it's essential to use them strategically. Consider the following tips:

- Use your GI Bill benefits for a degree that aligns with your career goals.

- Attend a public college or university to minimize out-of-pocket expenses.

- Consider using your GI Bill benefits for online or distance learning programs.

- Use your GI Bill benefits for vocational training or certification programs.

By using your GI Bill benefits strategically, you can ensure that you get the most out of this valuable resource.

3. Combine Your GI Bill Benefits with Other Education Benefits

One of the best ways to maximize your GI Bill benefits is to combine them with other education benefits. Consider the following options:

- Federal Pell Grant: The Federal Pell Grant is a need-based grant program that provides up to $6,195 per year for undergraduate students.

- Federal Supplemental Educational Opportunity Grant (FSEOG): The FSEOG is a need-based grant program that provides up to $4,000 per year for undergraduate students.

- Military Tuition Assistance (TA): Military TA is a benefit program that provides up to $4,500 per year for active-duty military personnel.

By combining your GI Bill benefits with other education benefits, you can reduce your out-of-pocket expenses and maximize your financial aid package.

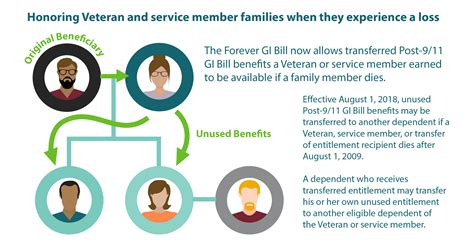

4. Transfer Your GI Bill Benefits to Family Members

If you're not planning to use your GI Bill benefits, you may be able to transfer them to family members. The Post-9/11 GI Bill allows eligible veterans to transfer up to 36 months of benefits to their spouse or dependent children.

To transfer your GI Bill benefits, you'll need to meet the following eligibility requirements:

- You must have served at least six years of active duty.

- You must agree to serve an additional four years of active duty.

- You must be a member of the Uniformed Services.

By transferring your GI Bill benefits to family members, you can help them achieve their education goals and maximize your benefits.

5. Use Your GI Bill Benefits for Entrepreneurship and Small Business Training

Finally, consider using your GI Bill benefits for entrepreneurship and small business training. The Post-9/11 GI Bill provides benefits for vocational training and certification programs, including entrepreneurship and small business training.

Consider the following programs:

- The Entrepreneurship Bootcamp for Veterans with Disabilities (EBV): The EBV is a free entrepreneurship program for veterans with disabilities.

- The Veterans Entrepreneurship Program (VEP): The VEP is a free entrepreneurship program for veterans.

- The Small Business Administration (SBA) Veterans Business Outreach Centers (VBOCs): The VBOCs provide free entrepreneurship training and counseling for veterans.

By using your GI Bill benefits for entrepreneurship and small business training, you can turn your passion into a successful business venture.

GI Bill Benefits Image Gallery

What is the GI Bill?

+The GI Bill is a federal education benefit program for veterans and their families.

What are the different types of GI Bill benefits?

+The two main types of GI Bill benefits are the Post-9/11 GI Bill (Chapter 33) and the Montgomery GI Bill (Chapter 30).

How do I apply for GI Bill benefits?

+You can apply for GI Bill benefits through the US Department of Veterans Affairs website or by contacting a VA representative.

Can I transfer my GI Bill benefits to family members?

+Yes, you can transfer your GI Bill benefits to family members, but you must meet certain eligibility requirements.

How do I maximize my GI Bill benefits?

+You can maximize your GI Bill benefits by choosing the right benefit for your needs, using your benefits strategically, combining your benefits with other education benefits, transferring your benefits to family members, and using your benefits for entrepreneurship and small business training.