Intro

Discover how to maximize your military retirement life insurance benefits. Learn 5 expert strategies to optimize your coverage, ensuring financial security for you and your loved ones. From leveraging Survivor Benefit Plans to navigating VGLI, explore essential tips to get the most out of your military retirement life insurance policy.

Maximizing military retirement life insurance is a crucial aspect of planning for a secure and comfortable post-service life. For military personnel, understanding the intricacies of life insurance options available during and after service can significantly impact their financial stability and peace of mind. In this article, we will delve into the five most effective ways to maximize military retirement life insurance, ensuring that veterans and their families are adequately protected.

Understanding Military Retirement Life Insurance Options

Before diving into the strategies for maximizing military retirement life insurance, it's essential to grasp the available options. The Department of Veterans Affairs (VA) and the military offer several life insurance programs designed specifically for service members and veterans. These include:

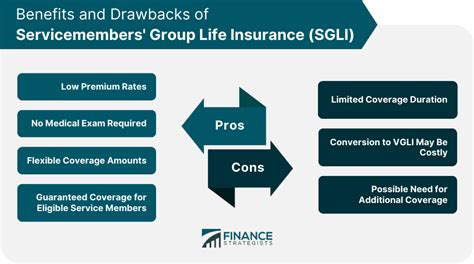

- Servicemembers' Group Life Insurance (SGLI): Provides low-cost term life insurance coverage to eligible service members.

- Veterans' Group Life Insurance (VGLI): Allows service members to convert their SGLI coverage to a civilian life insurance program after separation from service.

- Family Servicemembers' Group Life Insurance (FSGLI): Offers coverage for the spouses and dependent children of service members insured under SGLI.

- Servicemembers' Life Insurance Traumatic Injury Protection (TSGLI): Provides automatic traumatic injury coverage to all service members insured under SGLI.

1. Convert SGLI to VGLI

One of the most straightforward ways to maximize military retirement life insurance is by converting SGLI coverage to VGLI upon separation from service. VGLI allows veterans to maintain life insurance coverage without having to provide evidence of good health, making it an attractive option, especially for those who may have developed health issues during service. It's advisable to convert SGLI to VGLI within the first year after separation to ensure the best rates.

Maximizing Coverage Through Private Insurance

In addition to VA and military-offered life insurance programs, veterans can also explore private insurance options to maximize their coverage.

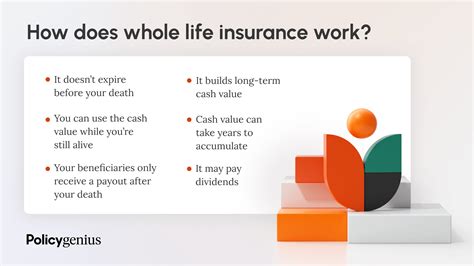

2. Consider Whole Life Insurance

Whole life insurance, also known as permanent life insurance, provides a guaranteed death benefit, a cash value component that grows over time, and fixed premiums. For veterans seeking lifelong coverage and a savings component, whole life insurance can be a viable option. However, it's crucial to weigh the higher premiums against the benefits, especially considering the budget constraints many veterans face.

3. Utilize Riders and Add-ons

Both military and private life insurance policies often offer riders or add-ons that can significantly enhance the coverage. For example, a waiver of premium rider can continue coverage without requiring premium payments if the policyholder becomes disabled. Understanding and strategically selecting these riders can maximize the value of a life insurance policy for veterans.

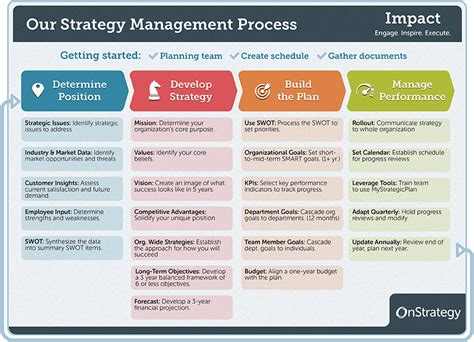

Strategic Planning and Management

Effective management and planning are key to maximizing military retirement life insurance.

4. Coordinate with Other Benefits

Veterans often qualify for a range of benefits, including pensions, disability compensation, and education assistance. Coordinating life insurance coverage with these benefits can ensure a comprehensive financial plan. For example, life insurance proceeds can be used to pay off debts or cover funeral expenses, ensuring that other benefits remain intact for living expenses.

5. Regular Review and Adjustment

Financial circumstances and insurance needs change over time. Regularly reviewing and adjusting life insurance coverage can ensure it remains aligned with current needs. Veterans should consider factors such as changes in family size, income, and health when deciding whether to increase, decrease, or change their life insurance coverage.

Gallery of Military Retirement Life Insurance Options

Military Retirement Life Insurance Options

What is the difference between SGLI and VGLI?

+SGLI (Servicemembers' Group Life Insurance) is a low-cost term life insurance coverage for eligible service members, while VGLI (Veterans' Group Life Insurance) allows service members to convert their SGLI coverage to a civilian life insurance program after separation from service.

How do I maximize my military retirement life insurance?

+To maximize your military retirement life insurance, consider converting SGLI to VGLI, exploring private insurance options, utilizing riders and add-ons, coordinating with other benefits, and regularly reviewing and adjusting your coverage.

Can I have both military and private life insurance?

+Yes, you can have both military and private life insurance. It's common for veterans to supplement their military-offered life insurance with private policies to ensure adequate coverage that meets their needs.

If you're a veteran looking to secure your financial future through military retirement life insurance, remember that planning and maximizing your coverage requires a comprehensive approach. By understanding your options, leveraging both military and private insurance, and strategically managing your benefits, you can achieve peace of mind knowing that you and your loved ones are protected. Share your experiences or ask questions in the comments section below!