Intro

Discover Navy Federal ATM limits, including daily withdrawal and deposit limits, to manage your accounts efficiently, avoiding overdrafts and fees, with insights on ATM networks and transaction limits.

The importance of understanding ATM limits cannot be overstated, especially for individuals who rely heavily on cash transactions. For members of Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, knowing the ATM limits is crucial for managing daily finances effectively. Navy Federal, with its wide range of financial services and products, caters to the financial needs of its members, including providing access to a vast network of ATMs. However, like all financial institutions, Navy Federal has established certain limits on ATM transactions to protect its members and prevent potential fraud.

These limits are designed to balance convenience with security, ensuring that members have access to the cash they need while minimizing the risk of significant losses in case of card theft or unauthorized transactions. Understanding these limits is essential for planning financial transactions, especially for those who frequently use ATMs for withdrawals or deposits. Moreover, being aware of these limits can help members avoid potential issues, such as declined transactions or additional fees associated with exceeding these limits.

Navy Federal's ATM limits are part of its broader strategy to provide secure, convenient, and member-friendly banking services. By setting these limits, the credit union aims to protect its members' accounts and maintain the trust that is fundamental to the financial relationship between the institution and its members. For individuals who are considering joining Navy Federal or are already members looking to understand their account better, knowing the specifics of these limits is a key aspect of managing their finances effectively.

Overview of Navy Federal ATM Limits

Navy Federal Credit Union offers its members a range of services, including access to thousands of ATMs nationwide. The ATM limits at Navy Federal are designed to be flexible and accommodate the varying needs of its members. These limits can vary based on the type of account, the member's relationship with the credit union, and other factors. Generally, Navy Federal sets daily limits for ATM withdrawals and deposits to protect its members from significant financial losses in the event of fraud or theft.

Types of Navy Federal ATM Limits

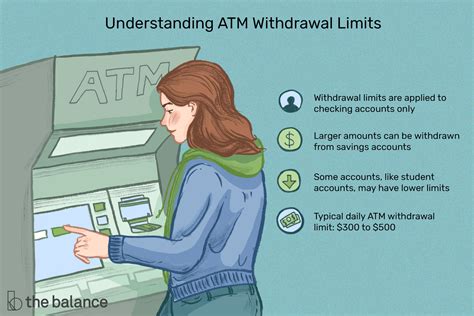

There are primarily two types of limits associated with Navy Federal ATMs: withdrawal limits and deposit limits. Withdrawal limits dictate how much cash a member can withdraw from an ATM within a 24-hour period. These limits are in place to prevent large-scale theft and to ensure that members have access to their funds without risking significant exposure to fraud. Deposit limits, on the other hand, apply to the amount of cash that can be deposited into an account via an ATM. Understanding both types of limits is essential for effectively managing one's accounts and avoiding any potential issues with transactions.

Withdrawal Limits

Withdrawal limits at Navy Federal can vary depending on the account type and the individual member's banking history. For most members, the daily ATM withdrawal limit is set at a specific amount, which can be found by logging into their online banking account or by contacting Navy Federal directly. It's also worth noting that these limits can be adjusted by the member upon request, subject to approval by Navy Federal. Adjusting these limits can provide members with greater flexibility in their financial transactions, especially for those who require larger amounts of cash for business or personal reasons.

Deposit Limits

Deposit limits are also an essential aspect of Navy Federal's ATM services. These limits are designed to prevent fraudulent activities and ensure the security of members' accounts. Like withdrawal limits, deposit limits can vary and are typically outlined in the account agreement or can be found through Navy Federal's online banking platform. Members who regularly deposit large amounts of cash may need to make arrangements with Navy Federal to increase their deposit limits or use alternative deposit methods.

Managing Navy Federal ATM Limits

Managing ATM limits effectively is crucial for avoiding transaction issues and ensuring that financial needs are met. Navy Federal provides its members with several tools and resources to manage their ATM limits. For instance, members can log into their online banking accounts to view their current limits, transaction history, and to request limit adjustments. Additionally, Navy Federal's mobile banking app allows members to manage their accounts on the go, providing real-time access to account information and the ability to transfer funds or check balances.

Requesting Limit Adjustments

Members who find that their current ATM limits are insufficient for their needs can request adjustments. This can typically be done through Navy Federal's customer service channels, including phone, email, or by visiting a branch in person. When requesting a limit adjustment, members may be required to provide additional information or documentation to verify their identity and account status. Navy Federal reviews these requests on a case-by-case basis, considering factors such as the member's account history, creditworthiness, and the purpose of the limit increase.

Monitoring Account Activity

Regularly monitoring account activity is another key aspect of managing Navy Federal ATM limits. Members should keep a close eye on their transaction history to detect any suspicious activity early. Navy Federal also offers alert services that can notify members of large or unusual transactions, providing an additional layer of security. By staying informed about account activity, members can quickly identify and report any potential fraud, thereby protecting their accounts and minimizing potential losses.

Benefits of Navy Federal ATM Limits

The ATM limits set by Navy Federal offer several benefits to its members. Firstly, these limits provide a significant layer of protection against fraud and theft. By limiting the amount of cash that can be withdrawn or deposited, Navy Federal reduces the potential financial loss in case of unauthorized transactions. Additionally, these limits encourage members to practice good financial habits, such as regularly monitoring account activity and maintaining a balanced financial portfolio.

Security

Security is a primary concern for any financial institution, and Navy Federal's ATM limits are a crucial component of its security measures. These limits help prevent large-scale fraud by capping the amount of money that can be accessed through an ATM. This not only protects the member's account but also contributes to the overall security of Navy Federal's financial systems.

Financial Discipline

ATM limits can also promote financial discipline among members. By setting daily limits on withdrawals and deposits, members are encouraged to plan their financial transactions more carefully. This can help in budgeting and avoiding impulse purchases, contributing to better financial health over time.Common Issues with Navy Federal ATM Limits

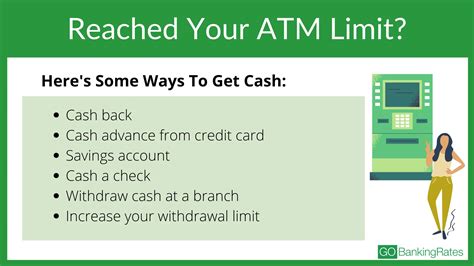

Despite the benefits, members may occasionally encounter issues with Navy Federal's ATM limits. One common issue is reaching the daily limit, which can result in declined transactions. Members who frequently travel or need access to large amounts of cash for business purposes may find the standard limits restrictive. Additionally, technical issues with ATMs or errors in account information can lead to incorrect limit enforcement, causing inconvenience to members.

Exceeding Limits

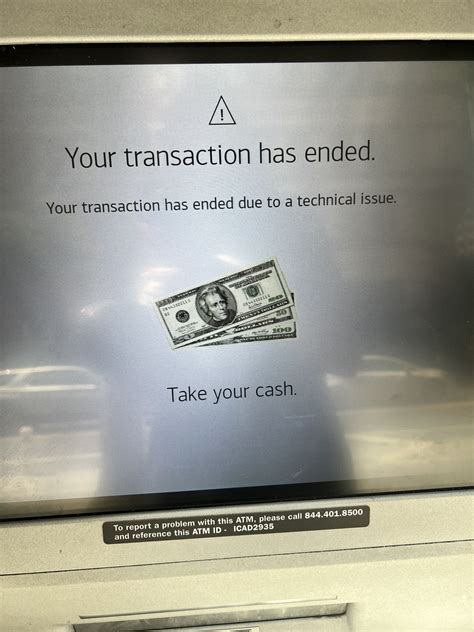

Exceeding the daily ATM limits can result in declined transactions, which can be inconvenient, especially in emergencies. Members who anticipate needing to exceed their limits should plan ahead by contacting Navy Federal to request a temporary or permanent limit increase. It's also essential to understand that exceeding limits can sometimes result in additional fees, which can add up quickly.Technical Issues

Technical issues with ATMs or Navy Federal's systems can occasionally cause problems with ATM transactions. Members may experience errors when trying to withdraw or deposit cash, which can be frustrating. In such cases, contacting Navy Federal's customer service is the best course of action. They can provide assistance, troubleshoot the issue, and offer alternative solutions to complete the transaction.Navy Federal ATM Limits Image Gallery

What are the daily ATM withdrawal limits for Navy Federal members?

+The daily ATM withdrawal limits for Navy Federal members can vary based on the account type and the member's relationship with the credit union. Generally, members can find their specific limits by logging into their online banking account or by contacting Navy Federal directly.

How can I increase my ATM withdrawal limit with Navy Federal?

+Members can request an increase in their ATM withdrawal limit by contacting Navy Federal's customer service. The request will be reviewed on a case-by-case basis, considering factors such as the member's account history and creditworthiness.

What should I do if I encounter technical issues with a Navy Federal ATM?

+In case of technical issues with a Navy Federal ATM, members should contact the credit union's customer service for assistance. They can help troubleshoot the issue, provide alternative solutions for completing the transaction, and offer support to resolve the problem.

Understanding and managing Navy Federal ATM limits is a critical aspect of effective financial management for its members. By being aware of these limits and how they can be adjusted, members can better plan their financial transactions, avoid potential issues, and enjoy the security and convenience that Navy Federal's ATM services provide. Whether you're a long-standing member or considering joining Navy Federal, taking the time to understand these limits and how they apply to your account can make a significant difference in your overall banking experience. We invite you to share your thoughts on how ATM limits impact your financial planning and to explore more about Navy Federal's services and how they can support your financial goals.