Intro

Discover 5 ways to refinance your mortgage, including rate and term refinancing, cash-out refinancing, and debt consolidation, to lower payments, reduce debt, and improve financial stability with refinancing options and strategies.

The concept of refinancing has been a game-changer for many individuals and businesses alike, offering a way to restructure debt, reduce costs, and improve financial stability. With the ever-changing economic landscape, it's essential to stay informed about the various refinancing options available. In this article, we'll delve into the world of refinancing, exploring its importance, benefits, and the different ways to refinance.

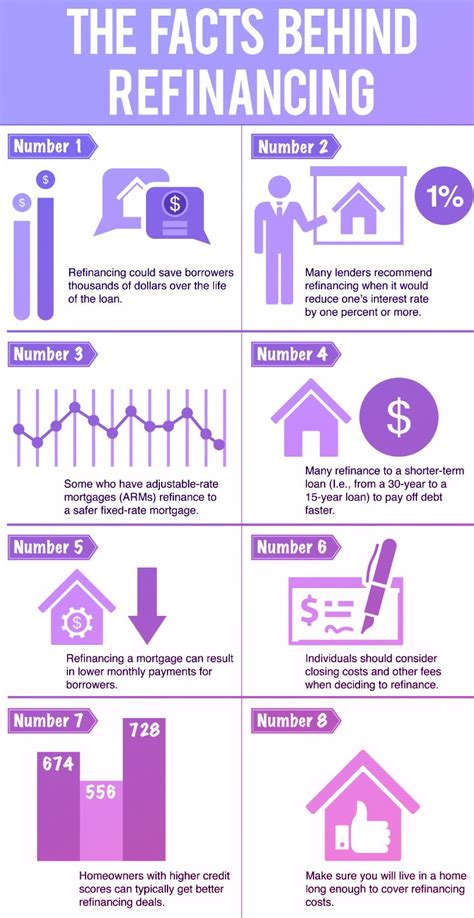

Refinancing can be a powerful tool for managing debt, whether it's a mortgage, car loan, or student loan. By refinancing, individuals can take advantage of lower interest rates, reduce their monthly payments, and free up more money in their budget for other expenses. Moreover, refinancing can also provide an opportunity to switch from a variable-rate loan to a fixed-rate loan, offering more stability and predictability in the long run.

The importance of refinancing cannot be overstated, especially in today's economy. With interest rates fluctuating constantly, it's crucial to stay on top of the latest trends and developments. By doing so, individuals can make informed decisions about their finances, avoiding costly mistakes and ensuring a more secure financial future. Whether you're a homeowner, student, or business owner, refinancing can be a valuable strategy for achieving your financial goals.

Understanding Refinancing Options

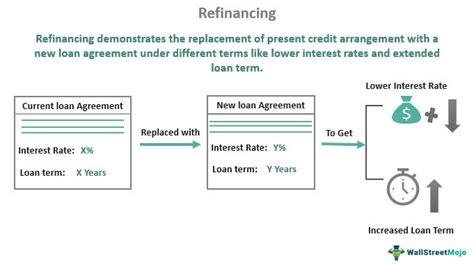

Before we dive into the different ways to refinance, it's essential to understand the concept of refinancing itself. Refinancing involves replacing an existing loan with a new one, often with more favorable terms, such as a lower interest rate or longer repayment period. This can be done for various types of loans, including mortgages, car loans, student loans, and personal loans. By refinancing, individuals can save money on interest, reduce their monthly payments, and improve their overall financial situation.

5 Ways to Refinance

Now that we've covered the basics of refinancing, let's explore the different ways to refinance. Here are five common methods:

- Mortgage Refinancing: This involves replacing an existing mortgage with a new one, often with a lower interest rate or longer repayment period. Mortgage refinancing can help homeowners save money on interest, reduce their monthly payments, and tap into their home's equity.

- Car Loan Refinancing: This involves refinancing an existing car loan with a new one, often with a lower interest rate or longer repayment period. Car loan refinancing can help individuals save money on interest, reduce their monthly payments, and avoid defaulting on their loan.

- Student Loan Refinancing: This involves refinancing an existing student loan with a new one, often with a lower interest rate or longer repayment period. Student loan refinancing can help individuals save money on interest, reduce their monthly payments, and simplify their loan repayment process.

- Personal Loan Refinancing: This involves refinancing an existing personal loan with a new one, often with a lower interest rate or longer repayment period. Personal loan refinancing can help individuals save money on interest, reduce their monthly payments, and improve their credit score.

- Debt Consolidation Refinancing: This involves refinancing multiple debts, such as credit cards, loans, and other debts, into a single loan with a lower interest rate or longer repayment period. Debt consolidation refinancing can help individuals simplify their debt repayment process, reduce their monthly payments, and save money on interest.

Benefits of Refinancing

Refinancing can offer numerous benefits, including:

- Lower interest rates: Refinancing can help individuals take advantage of lower interest rates, reducing their monthly payments and saving money on interest.

- Longer repayment periods: Refinancing can provide individuals with longer repayment periods, reducing their monthly payments and making it easier to manage their debt.

- Simplified loan repayment: Refinancing can simplify the loan repayment process, especially for individuals with multiple debts.

- Improved credit score: Refinancing can help individuals improve their credit score by reducing their debt-to-income ratio and making timely payments.

- Increased cash flow: Refinancing can provide individuals with more money in their budget for other expenses, such as saving, investing, or paying off other debts.

Working Mechanisms of Refinancing

The working mechanisms of refinancing involve several steps, including:

- Application: Individuals apply for refinancing by submitting their financial information, such as income, credit score, and debt obligations.

- Approval: Lenders review the application and approve or deny the refinancing request based on the individual's creditworthiness and financial situation.

- Loan disbursement: If approved, the lender disburses the new loan amount, which is used to pay off the existing loan.

- Repayment: Individuals repay the new loan according to the agreed-upon terms, including interest rate, repayment period, and monthly payments.

Steps to Refinance

To refinance, individuals can follow these steps:

- Check their credit score: Individuals should check their credit score to determine their creditworthiness and potential interest rate.

- Gather financial documents: Individuals should gather their financial documents, such as income statements, bank statements, and debt obligations.

- Research lenders: Individuals should research lenders and compare their interest rates, repayment terms, and fees.

- Apply for refinancing: Individuals should apply for refinancing by submitting their financial information and waiting for approval.

- Review and sign the loan agreement: If approved, individuals should review and sign the loan agreement, which outlines the terms and conditions of the new loan.

Practical Examples of Refinancing

Here are some practical examples of refinancing:

- Mortgage refinancing: A homeowner with a $200,000 mortgage at 6% interest rate can refinance to a 4% interest rate, saving $200 per month on interest.

- Car loan refinancing: An individual with a $20,000 car loan at 10% interest rate can refinance to a 6% interest rate, saving $100 per month on interest.

- Student loan refinancing: A student with a $50,000 student loan at 8% interest rate can refinance to a 4% interest rate, saving $150 per month on interest.

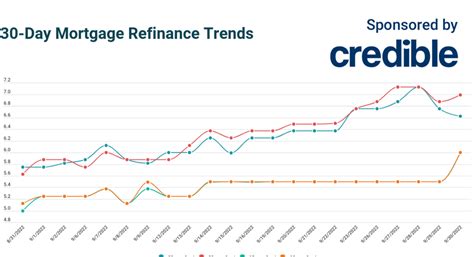

Statistical Data on Refinancing

According to recent statistics, refinancing has become increasingly popular, with:

- 70% of homeowners refinancing their mortgages to take advantage of lower interest rates.

- 40% of car owners refinancing their car loans to reduce their monthly payments.

- 30% of students refinancing their student loans to simplify their loan repayment process.

Refinancing Image Gallery

What is refinancing?

+Refinancing involves replacing an existing loan with a new one, often with more favorable terms, such as a lower interest rate or longer repayment period.

What are the benefits of refinancing?

+The benefits of refinancing include lower interest rates, longer repayment periods, simplified loan repayment, improved credit score, and increased cash flow.

How do I refinance my loan?

+To refinance your loan, you should check your credit score, gather your financial documents, research lenders, apply for refinancing, and review and sign the loan agreement.

What are the different types of refinancing?

+The different types of refinancing include mortgage refinancing, car loan refinancing, student loan refinancing, personal loan refinancing, and debt consolidation refinancing.

Is refinancing right for me?

+Refinancing may be right for you if you want to take advantage of lower interest rates, reduce your monthly payments, or simplify your loan repayment process. However, it's essential to weigh the pros and cons and consider your individual financial situation before making a decision.

In conclusion, refinancing can be a powerful tool for managing debt and improving financial stability. By understanding the different types of refinancing, their benefits, and the steps involved, individuals can make informed decisions about their finances. Whether you're a homeowner, student, or business owner, refinancing can help you achieve your financial goals and secure a more stable financial future. We encourage you to share your thoughts and experiences with refinancing in the comments below and to explore our other articles for more information on personal finance and debt management.