Intro

Maximize rewards with Navy Federal Cash Rewards Credit Card, offering cashback, low rates, and no fees, ideal for everyday purchases, balance transfers, and credit building with exclusive member benefits.

The world of credit cards can be overwhelming, with numerous options available in the market. However, for those who are affiliated with the Navy Federal Credit Union, the Navy Federal Cash Rewards Credit Card is an attractive option. This card offers a range of benefits, including cashback rewards, low interest rates, and exclusive discounts. In this article, we will delve into the details of the Navy Federal Cash Rewards Credit Card, exploring its features, benefits, and drawbacks.

As a credit union-based credit card, the Navy Federal Cash Rewards Credit Card is designed to cater to the financial needs of its members. With a strong reputation for providing excellent customer service and competitive rates, Navy Federal Credit Union has established itself as a trusted institution. The cash rewards credit card is just one of the many products offered by the credit union, and it has gained popularity among members due to its simplicity and rewards structure.

The Navy Federal Cash Rewards Credit Card is ideal for individuals who want to earn cashback on their daily purchases. With no rotating categories or spending limits, cardholders can earn unlimited 1.5% cashback on all purchases. This means that whether you're buying groceries, filling up your gas tank, or dining out, you'll earn a consistent reward rate. Additionally, the card has no foreign transaction fees, making it a great option for those who travel abroad frequently.

Key Features and Benefits

Some of the key features and benefits of the Navy Federal Cash Rewards Credit Card include:

- Unlimited 1.5% cashback on all purchases

- No rotating categories or spending limits

- No foreign transaction fees

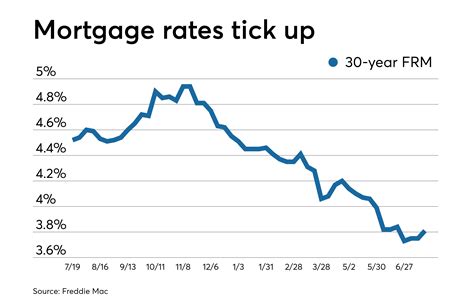

- Low interest rates, with a variable APR ranging from 12.99% to 18.00%

- Exclusive discounts and promotions for Navy Federal Credit Union members

- Travel and purchase protection, including trip cancellation insurance and extended warranty coverage

- 24/7 customer service and online account management

How to Earn Cashback Rewards

Earning cashback rewards with the Navy Federal Cash Rewards Credit Card is straightforward. Cardholders earn 1.5% cashback on all purchases, with no limits or restrictions. The rewards are earned in the form of cash credits, which can be redeemed at any time. There are no minimum redemption requirements, and the rewards do not expire.Using the Navy Federal Cash Rewards Credit Card for Everyday Purchases

The Navy Federal Cash Rewards Credit Card is designed to be used for everyday purchases, from groceries and gas to dining and entertainment. With its unlimited 1.5% cashback reward rate, cardholders can earn rewards on all their purchases, without having to worry about rotating categories or spending limits.

Some examples of everyday purchases that can be made with the Navy Federal Cash Rewards Credit Card include:

- Groceries and household essentials

- Gas and fuel

- Dining out and takeout

- Entertainment, such as movies and concerts

- Travel and accommodations

- Online purchases and subscriptions

Managing Your Account and Making Payments

Managing your Navy Federal Cash Rewards Credit Card account is easy, with 24/7 online access and mobile banking. Cardholders can view their account balances, transaction history, and rewards balances, as well as make payments and transfer funds.Making payments is also straightforward, with options to pay online, by phone, or by mail. The credit union offers a range of payment due dates, allowing cardholders to choose a date that works best for them.

Pros and Cons of the Navy Federal Cash Rewards Credit Card

Like any credit card, the Navy Federal Cash Rewards Credit Card has its pros and cons. Some of the advantages include:

- Unlimited 1.5% cashback on all purchases

- No foreign transaction fees

- Low interest rates

- Exclusive discounts and promotions for Navy Federal Credit Union members

- Travel and purchase protection

However, there are also some potential drawbacks to consider:

- The card has a variable APR, which can range from 12.99% to 18.00%

- There is a late payment fee of up to $25

- The card has a foreign transaction fee of 0%, but there may be other fees associated with international transactions

Who is Eligible for the Navy Federal Cash Rewards Credit Card?

The Navy Federal Cash Rewards Credit Card is available to members of the Navy Federal Credit Union. To be eligible for membership, individuals must meet certain criteria, such as: * Being an active or retired member of the military * Being a family member of a military personnel * Being a Department of Defense civilian employee * Being a contractor or consultant for the militaryComparison to Other Cashback Credit Cards

The Navy Federal Cash Rewards Credit Card is just one of many cashback credit cards available in the market. Some other popular options include:

- Citi Double Cash Card

- Chase Freedom Unlimited

- Discover it Cash Back

- Capital One Quicksilver Cash Rewards Credit Card

When comparing these cards, it's essential to consider factors such as:

- Reward rates and structures

- Interest rates and fees

- Introductory offers and promotions

- Travel and purchase protection

- Customer service and online account management

Conclusion and Final Thoughts

In conclusion, the Navy Federal Cash Rewards Credit Card is a solid option for individuals who want to earn cashback on their daily purchases. With its unlimited 1.5% cashback reward rate, low interest rates, and exclusive discounts, this card is an attractive choice for Navy Federal Credit Union members.However, as with any credit card, it's essential to carefully consider the terms and conditions, including the APR, fees, and rewards structure. By doing so, cardholders can make informed decisions and get the most out of their credit card.

Navy Federal Cash Rewards Credit Card Image Gallery

What is the reward rate for the Navy Federal Cash Rewards Credit Card?

+The Navy Federal Cash Rewards Credit Card offers an unlimited 1.5% cashback reward rate on all purchases.

Are there any foreign transaction fees associated with the Navy Federal Cash Rewards Credit Card?

+No, the Navy Federal Cash Rewards Credit Card has no foreign transaction fees.

How do I redeem my cashback rewards?

+Cashback rewards can be redeemed at any time, with no minimum redemption requirements. Rewards can be redeemed as a statement credit or deposited into a Navy Federal Credit Union account.

Is the Navy Federal Cash Rewards Credit Card available to non-military personnel?

+No, the Navy Federal Cash Rewards Credit Card is only available to members of the Navy Federal Credit Union, which includes active and retired military personnel, their families, and certain Department of Defense civilians.

What is the APR for the Navy Federal Cash Rewards Credit Card?

+The APR for the Navy Federal Cash Rewards Credit Card is variable, ranging from 12.99% to 18.00%.

We hope this article has provided you with a comprehensive overview of the Navy Federal Cash Rewards Credit Card. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them make informed decisions about their credit card options.