Intro

Discover Navy Federal Certificate Of Deposit Rates, including high-yield CD options, term deposits, and savings certificates with competitive APYs and low minimums.

The world of savings and investments can be overwhelming, especially with the numerous options available in the market. However, for those looking for a low-risk investment with a fixed return, certificates of deposit (CDs) are an attractive option. Navy Federal Credit Union, one of the largest and most reputable credit unions in the United States, offers competitive CD rates that can help individuals grow their savings over time. In this article, we will delve into the world of Navy Federal Certificate of Deposit rates, exploring the benefits, types of CDs available, and how to make the most of these investment opportunities.

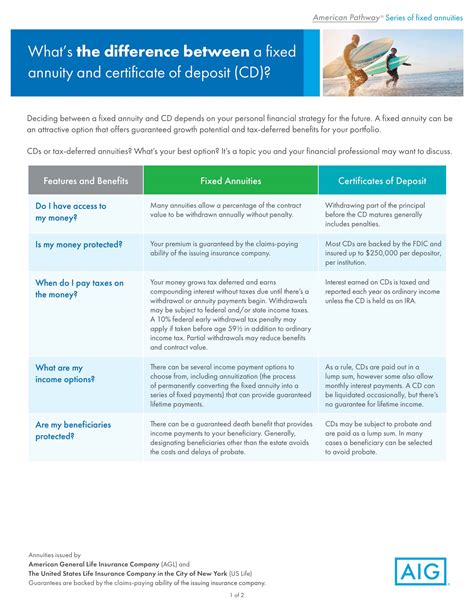

For many, the primary concern when it comes to investments is the safety of their money. CDs are insured by the National Credit Union Administration (NCUA), which means deposits are insured up to $250,000. This insurance provides peace of mind, knowing that your investment is secure. Moreover, CDs offer a fixed interest rate for a specified period, allowing individuals to plan their finances with certainty. Whether you're saving for a short-term goal, such as a down payment on a house, or a long-term objective, like retirement, CDs can be a valuable addition to your investment portfolio.

The flexibility of CDs is another significant advantage. They come in various terms, ranging from a few months to several years. This variety allows investors to choose a term that aligns with their financial goals and risk tolerance. For instance, those who need access to their money sooner may opt for a shorter-term CD, while individuals with a long-term perspective can benefit from higher interest rates offered by longer-term CDs. Navy Federal Credit Union understands the importance of flexibility and offers a range of CD terms to cater to different needs.

Navy Federal Certificate Of Deposit Rates Overview

Navy Federal Credit Union's CD rates are competitive and designed to help members achieve their savings goals. The rates vary based on the term of the CD and the amount deposited. Generally, longer-term CDs and larger deposits qualify for higher interest rates. This structure incentivizes members to save more and plan for the long term. By offering attractive rates, Navy Federal encourages a culture of savings and investment among its members.

One of the key benefits of Navy Federal's CDs is their simplicity. Opening a CD account is a straightforward process that can be completed online, over the phone, or in-person at a branch. Members can easily manage their CDs through Navy Federal's online banking platform or mobile app, making it convenient to monitor their investments and plan for the future. This accessibility is particularly beneficial for those who are new to investing or prefer a hands-off approach to managing their finances.

Types Of Navy Federal CDs

Navy Federal Credit Union offers several types of CDs to cater to the diverse needs of its members. The most common type is the standard CD, which requires a minimum deposit and offers a fixed interest rate for a specified term. For those looking for more flexibility, Navy Federal's jumbo CDs require a higher minimum deposit but offer higher interest rates in return. There are also special CDs, like the EasyStart CD, which has a lower minimum deposit requirement, making it more accessible to new savers.

Another option is the Add-On CD, which allows members to deposit additional funds into their CD during the term, providing an opportunity to increase their savings over time. This feature is particularly useful for individuals who receive irregular income or want to take advantage of excess funds to boost their savings. Navy Federal's variety of CD products ensures that members can find an option that aligns with their financial situation and goals.

Benefits Of Navy Federal CDs

The benefits of Navy Federal CDs are numerous. Firstly, they offer a safe and secure way to save, with deposits insured by the NCUA. This insurance protects members' investments, giving them peace of mind. Secondly, CDs provide a fixed return, which can be higher than traditional savings accounts, especially for longer terms. This predictability is invaluable for financial planning, allowing members to anticipate their returns and make informed decisions about their money.

Additionally, Navy Federal CDs promote a savings discipline. By locking funds into a CD for a specified term, members are less likely to spend impulsively, which can help them build their savings over time. This disciplined approach to savings can have a significant impact on long-term financial health, enabling individuals to achieve their goals, whether it's buying a car, funding education, or retiring comfortably.

How To Open A Navy Federal CD

Opening a Navy Federal CD is a straightforward process. Members can start by visiting the Navy Federal Credit Union website, where they can browse the available CD options and rates. Once they've selected the CD that best suits their needs, they can apply online, providing the necessary personal and financial information. Alternatively, members can visit a branch or call the credit union's customer service number to open a CD over the phone.

Before opening a CD, it's essential to review the terms and conditions, including the interest rate, term length, and any penalties for early withdrawal. Understanding these details will help members make an informed decision and ensure they're choosing the right CD for their financial goals. Navy Federal's customer service team is available to answer any questions and provide guidance throughout the process.

Navy Federal CD Rates And Terms

Navy Federal CD rates and terms are designed to offer flexibility and competitive returns. The credit union regularly updates its rates to ensure they remain attractive to members. By visiting the Navy Federal website or contacting customer service, members can get the most current information on CD rates and terms. This transparency allows members to make informed decisions about their investments and plan their finances effectively.

When considering a Navy Federal CD, it's crucial to weigh the benefits against the potential drawbacks. One of the main considerations is the penalty for early withdrawal, which can apply if members need to access their funds before the CD matures. Understanding these penalties and planning accordingly can help members avoid unnecessary fees and make the most of their CD investment.

Conclusion And Next Steps

In conclusion, Navy Federal Certificate of Deposit rates offer a compelling opportunity for individuals to grow their savings in a safe and secure environment. With competitive rates, flexible terms, and a range of CD options, Navy Federal Credit Union caters to the diverse needs of its members. Whether you're a seasoned investor or just starting to build your savings, Navy Federal's CDs can play a significant role in your financial strategy.

As you consider your investment options, remember to evaluate your financial goals, risk tolerance, and time horizon. Navy Federal's CDs can be a valuable component of a diversified investment portfolio, providing a predictable return and promoting a disciplined approach to savings. By taking advantage of Navy Federal's competitive CD rates and terms, you can take a significant step towards securing your financial future.

Gallery of Navy Federal Certificate Of Deposit Rates

Navy Federal Certificate Of Deposit Rates Image Gallery

What are the benefits of opening a Navy Federal CD?

+The benefits include a safe and secure way to save, competitive interest rates, and a fixed return for a specified period, which can help with financial planning.

How do I open a Navy Federal CD?

+You can open a Navy Federal CD by visiting the credit union's website, calling the customer service number, or visiting a branch in person.

What types of CDs does Navy Federal offer?

+Navy Federal offers standard CDs, jumbo CDs, and special CDs like the EasyStart CD and the Add-On CD, catering to different savings needs and goals.

As you navigate the world of investments and savings, remember that knowledge is power. By understanding your options and making informed decisions, you can secure your financial future and achieve your goals. Navy Federal Certificate of Deposit rates offer a compelling opportunity for growth and savings. Consider your financial objectives, explore the options available, and take the first step towards a more secure financial tomorrow. Share your thoughts on Navy Federal CDs and how they can fit into your investment strategy. Whether you're a current member or considering joining, the insights and experiences of others can provide valuable guidance.