Intro

Discover how Navy Federal consolidation loans simplify debt repayment, offering lower interest rates, flexible terms, and financial freedom through debt consolidation, credit union benefits, and loan refinancing options.

The concept of debt consolidation has become increasingly popular among individuals looking to simplify their financial lives. One institution that offers such services is Navy Federal Credit Union, with its Navy Federal Consolidation Loan. This loan is designed to help members manage their debt more efficiently by combining multiple debts into a single, more manageable loan. Understanding how this loan works is crucial for anyone considering consolidating their debt.

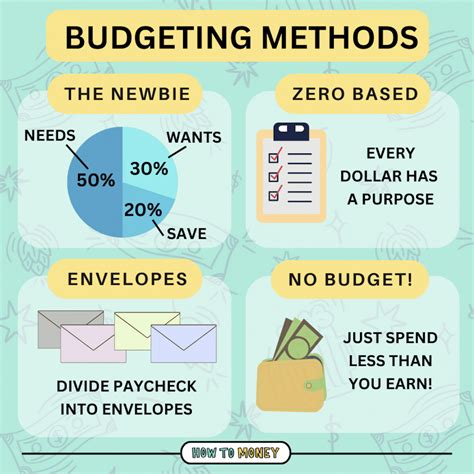

Debt consolidation can be a powerful tool for regaining control over one's finances. It involves taking out a new loan to pay off multiple debts, ideally with a lower interest rate and a single monthly payment. This approach can simplify budgeting, reduce stress, and potentially save money on interest over time. Navy Federal Credit Union, known for its member-centric approach and competitive financial products, offers a consolidation loan that aligns with these goals.

The Navy Federal Consolidation Loan is particularly appealing to members of the military, veterans, and their families, as it is tailored to meet their unique financial challenges. With its competitive rates, flexible terms, and the convenience of consolidating debts into one loan, this option can provide significant relief to those overwhelmed by multiple payments and high-interest rates. However, like any financial product, it's essential to understand the specifics of how it works and whether it's the right solution for an individual's financial situation.

Introduction to Navy Federal Consolidation Loan

The Navy Federal Consolidation Loan is designed to assist members in consolidating their debts into one manageable loan. It offers a straightforward way to combine debts such as credit cards, personal loans, and other financial obligations into a single loan with a fixed interest rate and payment term. This consolidation can help in reducing the complexity of managing multiple debts and can potentially lower the total interest paid over time.

Benefits of Navy Federal Consolidation Loan

There are several benefits associated with the Navy Federal Consolidation Loan. Firstly, it simplifies finances by consolidating multiple debts into one loan, making it easier to keep track of payments. Secondly, it offers the potential for a lower interest rate, especially for those consolidating high-interest debts like credit card balances. This can lead to significant savings over the life of the loan. Additionally, the loan provides flexible repayment terms, allowing borrowers to choose a term that fits their budget and financial goals.

How to Apply for Navy Federal Consolidation Loan

Applying for a Navy Federal Consolidation Loan involves several steps. Members start by checking their eligibility and the rates they qualify for. This can often be done through Navy Federal's online platform or by visiting a branch. Once eligibility is confirmed, members can proceed to apply for the loan, providing necessary documentation such as proof of income, identification, and details of the debts to be consolidated. The application process is designed to be straightforward, with the option for online application making it even more convenient.

Eligibility Criteria for Navy Federal Consolidation Loan

To be eligible for a Navy Federal Consolidation Loan, applicants must meet certain criteria. These include being a member of Navy Federal Credit Union, having a good credit history, and sufficient income to repay the loan. The credit union may also consider the applicant's debt-to-income ratio and other financial obligations when determining eligibility and the loan amount. Membership in Navy Federal is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel, as well as their families.

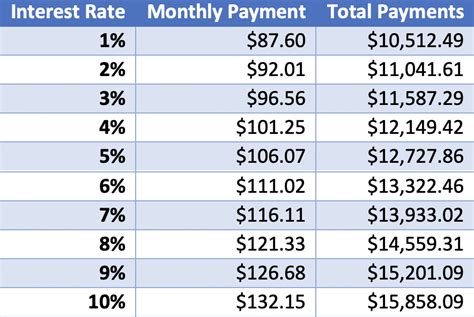

Repayment Terms and Interest Rates

The repayment terms and interest rates for the Navy Federal Consolidation Loan are designed to be competitive and flexible. Borrowers can choose from various repayment terms, allowing them to select the one that best fits their financial situation and goals. The interest rates offered are also competitive, potentially lower than those of the debts being consolidated, especially for credit cards. This can result in lower monthly payments and less interest paid over the life of the loan.

Factors Affecting Interest Rates

Several factors can affect the interest rate offered on a Navy Federal Consolidation Loan. These include the borrower's credit score, the loan amount, the repayment term chosen, and the borrower's relationship with Navy Federal. Generally, borrowers with higher credit scores and those who opt for shorter repayment terms may qualify for lower interest rates.

Managing Repayments

Managing repayments on a Navy Federal Consolidation Loan is straightforward. Borrowers can set up automatic payments from their checking account, ensuring timely payments and avoiding late fees. Navy Federal also offers online tools and mobile banking apps to help borrowers keep track of their loan balance, payment due dates, and interest paid.

Navy Federal Consolidation Loan Image Gallery

What is the purpose of a Navy Federal Consolidation Loan?

+The purpose of a Navy Federal Consolidation Loan is to help members consolidate their debts into one manageable loan, potentially reducing the total interest paid and simplifying their finances.

Who is eligible for a Navy Federal Consolidation Loan?

+Eligibility for a Navy Federal Consolidation Loan includes being a member of Navy Federal Credit Union, having a good credit history, and sufficient income to repay the loan. Membership is open to all Department of Defense and Coast Guard Active Duty, civilian, and contractor personnel, as well as their families.

How do I apply for a Navy Federal Consolidation Loan?

+To apply for a Navy Federal Consolidation Loan, members can check their eligibility and rates online, then proceed to apply through Navy Federal's online platform or by visiting a branch, providing necessary documentation such as proof of income and identification.

In conclusion, the Navy Federal Consolidation Loan offers a valuable solution for individuals looking to simplify their debt and potentially save on interest. By understanding the benefits, eligibility criteria, and application process, members can make informed decisions about their financial health. Whether you're a military service member, veteran, or part of their family, taking control of your debt can be a significant step towards achieving financial stability and peace of mind. We invite you to share your thoughts on debt consolidation and how it has impacted your financial journey. Your experiences and insights can be invaluable to others considering this path.