Intro

Explore Navy Federal home equity loan options, including HELOCs and fixed-rate loans, with competitive rates and flexible terms, ideal for home improvements, debt consolidation, and refinancing, offering members borrowing power and financial flexibility.

Home equity loans have become a popular way for homeowners to tap into the value of their property to finance various expenses, such as home renovations, debt consolidation, or large purchases. Among the numerous financial institutions offering home equity loans, Navy Federal Credit Union stands out for its member-focused approach and competitive rates. For those considering Navy Federal home equity loan options, it's essential to understand the benefits, requirements, and processes involved.

The importance of choosing the right lender cannot be overstated, as it directly impacts the borrower's financial well-being. Navy Federal, with its long history of serving military personnel, veterans, and their families, has built a reputation for reliability and customer satisfaction. Its home equity loan products are designed to meet the diverse needs of its members, providing them with the financial flexibility they need.

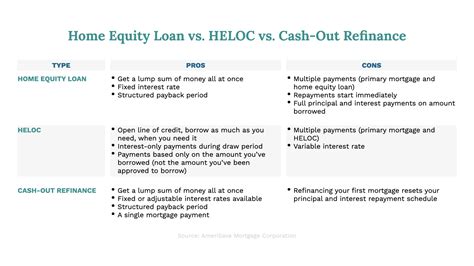

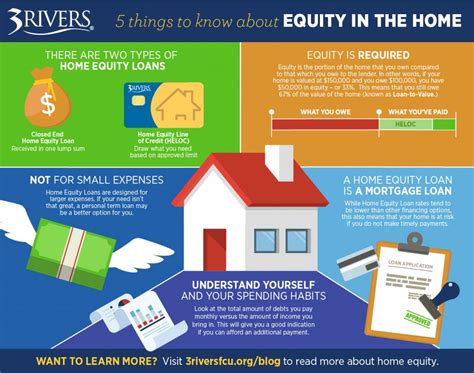

Home equity loans and lines of credit (HELOCs) are two primary options offered by Navy Federal. A home equity loan provides a lump sum of money upfront, which is then repaid over a set period, usually with fixed monthly payments. On the other hand, a HELOC allows borrowers to draw funds as needed during a specified draw period, often with variable interest rates and payments that can change based on the outstanding balance. Understanding the differences between these options is crucial for making an informed decision that aligns with one's financial situation and goals.

Overview of Navy Federal Home Equity Loans

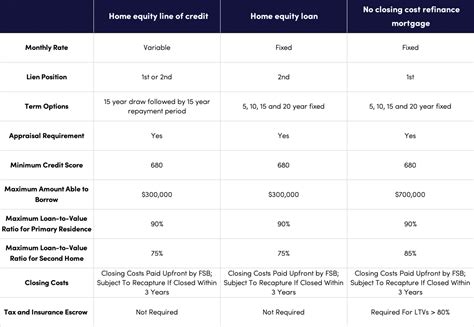

Navy Federal home equity loans are known for their competitive interest rates and flexible terms. Borrowers can choose from fixed-rate loans with repayment terms ranging from 5 to 20 years, allowing them to budget their payments accurately. The fixed-rate option provides stability and predictability, which can be particularly appealing in times of economic uncertainty. Additionally, Navy Federal offers a home equity line of credit with a variable rate, which can be beneficial for those who need ongoing access to funds over a longer period.

Benefits of Navy Federal Home Equity Loans

The benefits of choosing Navy Federal for home equity loans are multifaceted. Firstly, the credit union's membership model ensures that profits are reinvested to benefit members, often resulting in more favorable loan terms compared to traditional banks. Secondly, Navy Federal's extensive experience in serving the financial needs of military families means they understand the unique challenges and opportunities faced by this demographic. This expertise can lead to more personalized and relevant financial solutions.Requirements and Application Process

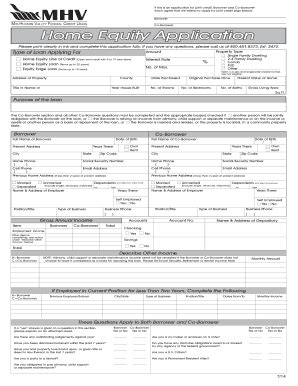

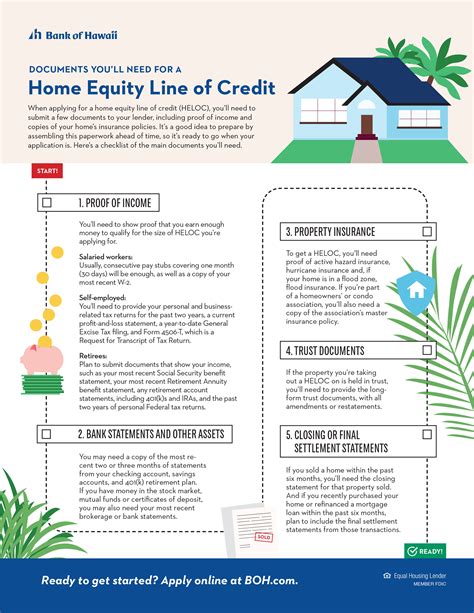

To apply for a Navy Federal home equity loan, potential borrowers must first ensure they meet the eligibility criteria. This includes being a member of Navy Federal Credit Union, which requires a connection to the military, Department of Defense, or National Guard. Once membership is established, applicants can proceed with the loan application, which typically involves providing financial information, such as income verification, credit history, and details about the property being used as collateral.

The application process for Navy Federal home equity loans can be initiated online, by phone, or in person at a local branch. Applicants are required to submit various documents, including but not limited to, identification, proof of income, and property deeds. Navy Federal's website and mobile app also offer tools and resources to help members navigate the application process and track the status of their loan.

Understanding Loan-to-Value (LTV) Ratio

A critical factor in determining eligibility for a home equity loan is the loan-to-value (LTV) ratio. The LTV ratio is calculated by dividing the amount borrowed by the appraised value of the property. For example, if a home is valued at $200,000 and the borrower wants to take out a $120,000 loan, the LTV ratio would be 60%. Navy Federal, like most lenders, has specific LTV ratio limits, typically up to 80% for home equity loans, though this can vary based on the loan product and the borrower's creditworthiness.Fixed-Rate Home Equity Loans

Fixed-rate home equity loans from Navy Federal offer predictability and stability, with interest rates that remain constant over the life of the loan. This feature can be particularly attractive to borrowers who prefer to know exactly how much they will pay each month. The fixed rates can also provide a hedge against rising interest rates, ensuring that the borrower's monthly payments do not increase over time.

Advantages of Fixed-Rate Loans

The advantages of fixed-rate home equity loans include: - Predictable monthly payments - Protection against rising interest rates - Potential for lower monthly payments compared to other types of loans - Flexibility in loan terms to accommodate different financial situationsHowever, fixed-rate loans may have higher interest rates compared to variable-rate loans, especially for shorter loan terms. It's essential for borrowers to weigh these factors and consider their financial goals and risk tolerance when deciding between fixed and variable-rate options.

Home Equity Line of Credit (HELOC)

A HELOC from Navy Federal provides borrowers with a line of credit that can be drawn upon as needed during the draw period, which is typically 10 years. This flexibility can be beneficial for expenses that are spread out over time, such as home renovations or educational costs. The interest rate on a HELOC is usually variable, which means it can fluctuate based on market conditions, affecting the monthly payments.

Using a HELOC Responsibly

While a HELOC offers flexibility, it's crucial to use it responsibly. Borrowers should only draw funds as needed and make timely payments to avoid accumulating too much debt. It's also important to understand the terms of the HELOC, including any fees associated with the account, such as annual fees or transaction fees.Comparison of Home Equity Loans and HELOCs

When deciding between a home equity loan and a HELOC, borrowers should consider their specific financial needs and situation. Key factors to consider include:

- The purpose of the loan: If the funds are needed for a one-time expense, a home equity loan might be more suitable. For ongoing expenses or projects with variable costs, a HELOC could be more appropriate.

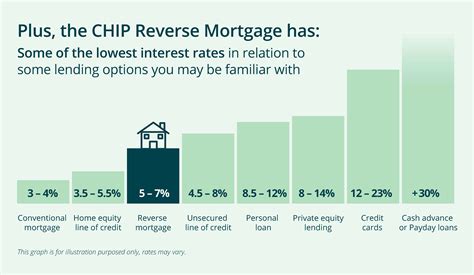

- Interest rates: Fixed-rate loans provide predictability, while variable-rate HELOCs may offer lower initial rates but with the risk of rate increases.

- Repayment terms: Home equity loans have fixed monthly payments, whereas HELOC payments can vary based on the outstanding balance and interest rate.

Making an Informed Decision

Making an informed decision requires careful consideration of these factors, as well as a thorough review of the loan terms and conditions. Borrowers should also consider seeking advice from a financial advisor to ensure that the chosen loan product aligns with their overall financial strategy.Gallery of Home Equity Loan Options

Home Equity Loan Image Gallery

Frequently Asked Questions

What are the benefits of choosing Navy Federal for home equity loans?

+The benefits include competitive interest rates, flexible terms, and a membership model that reinvests profits to benefit members.

How do I apply for a Navy Federal home equity loan?

+Applications can be initiated online, by phone, or in person at a local branch. Members must provide financial information and meet the eligibility criteria.

What is the difference between a home equity loan and a HELOC?

+A home equity loan provides a lump sum with fixed monthly payments, while a HELOC offers a line of credit with variable payments based on the outstanding balance and interest rate.

How do I decide between a fixed-rate home equity loan and a variable-rate HELOC?

+Consider your financial needs, risk tolerance, and the purpose of the loan. Fixed-rate loans offer predictability, while HELOCs provide flexibility for ongoing expenses.

What are the requirements for a Navy Federal home equity loan?

+Requirements include being a Navy Federal member, meeting the loan-to-value ratio, and providing necessary financial documents.

In conclusion, Navy Federal home equity loan options offer a range of benefits and flexibility for members looking to tap into their home's equity. Whether considering a fixed-rate home equity loan or a HELOC, understanding the terms, benefits, and requirements is essential for making an informed decision. By weighing the pros and cons and aligning the loan product with their financial goals, borrowers can leverage their home's value to achieve their objectives while managing their debt responsibly. We invite readers to share their experiences with home equity loans, ask questions, and explore how Navy Federal can support their financial journey.