Intro

Get pre-approved for a Navy Federal auto loan and secure competitive rates, flexible terms, and exclusive member benefits, streamlining your car buying experience with pre-qualification and financing options.

Purchasing a vehicle can be a daunting task, especially when it comes to financing. With so many options available, it's essential to find a lender that offers competitive rates, flexible terms, and a hassle-free process. Navy Federal Credit Union is a popular choice among car buyers, and their auto loan pre-approval process is a great way to get started. In this article, we'll delve into the world of Navy Federal auto loan pre-approval, exploring its benefits, requirements, and steps to get pre-approved.

For those who are unfamiliar with Navy Federal Credit Union, it's a not-for-profit financial cooperative that serves members of the military, veterans, and their families. With over 10 million members, Navy Federal is one of the largest credit unions in the world, offering a wide range of financial products and services, including auto loans. Their auto loan pre-approval process is designed to simplify the car-buying experience, providing members with a clear understanding of their financing options before visiting a dealership.

Navy Federal Auto Loan Pre Approval Benefits

The benefits of Navy Federal auto loan pre-approval are numerous. For starters, it allows members to know exactly how much they can afford to spend on a vehicle, eliminating the guesswork and uncertainty that often comes with car shopping. With pre-approval, members can also negotiate a better price at the dealership, as they'll have a clear understanding of their financing terms. Additionally, Navy Federal auto loan pre-approval can help members avoid high-pressure sales tactics, as they'll have a solid understanding of their financing options before visiting the dealership.

How to Get Pre Approved for a Navy Federal Auto Loan

To get pre-approved for a Navy Federal auto loan, members can follow a simple, step-by-step process. First, they'll need to check their credit score, as this will play a significant role in determining their interest rate and loan terms. Next, they'll need to gather some basic information, including their income, employment history, and debt-to-income ratio. With this information in hand, members can apply for pre-approval online, by phone, or in person at a Navy Federal branch.

The pre-approval process typically takes just a few minutes, and members can expect to receive a decision immediately. If approved, they'll receive a pre-approval letter or certificate, which they can use to negotiate a better price at the dealership. It's essential to note that pre-approval is not a guarantee of financing, as the final loan terms will depend on the specific vehicle being purchased and other factors.

Navy Federal Auto Loan Rates and Terms

Navy Federal auto loan rates and terms are highly competitive, with rates starting as low as 2.99% APR for new vehicles. Loan terms range from 36 to 96 months, allowing members to choose a repayment schedule that fits their budget and financial goals. Additionally, Navy Federal offers a range of loan options, including fixed-rate loans, variable-rate loans, and loans with no down payment required.

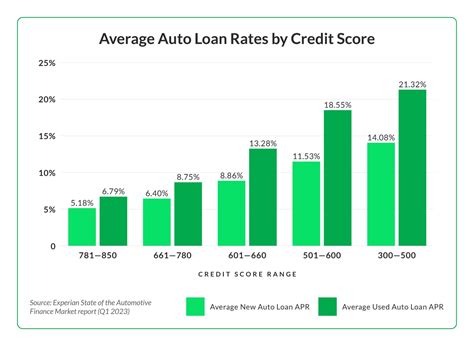

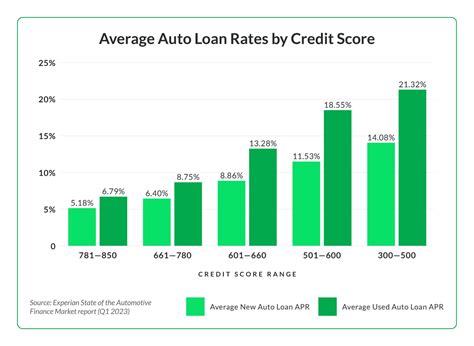

It's worth noting that Navy Federal auto loan rates and terms may vary depending on the member's credit score, income, and other factors. Members with excellent credit can expect to qualify for the best rates and terms, while those with lower credit scores may need to pay a higher interest rate or make a larger down payment.

Navy Federal Auto Loan Requirements

To qualify for a Navy Federal auto loan, members will need to meet certain requirements. These include:

- Being a member of Navy Federal Credit Union

- Having a valid government-issued ID

- Providing proof of income and employment

- Having a minimum credit score of 620 (although higher scores may qualify for better rates and terms)

- Meeting Navy Federal's debt-to-income ratio requirements

Members can check their eligibility and apply for pre-approval online, by phone, or in person at a Navy Federal branch. It's essential to note that Navy Federal auto loan requirements may vary depending on the specific loan program and other factors, so it's always best to check with a representative for the most up-to-date information.

Navy Federal Auto Loan Calculator

Navy Federal offers a range of tools and resources to help members manage their finances and make informed decisions about their auto loan. One of these tools is the Navy Federal auto loan calculator, which allows members to estimate their monthly payment, total interest paid, and other loan details. The calculator is easy to use and can be accessed online or through the Navy Federal mobile app.

To use the calculator, members will need to enter some basic information, including the loan amount, interest rate, and loan term. They can then adjust the variables to see how different scenarios would affect their loan payments and overall cost. This can be a powerful tool for members who want to compare different loan options and make the best decision for their financial situation.

Navy Federal Auto Loan Reviews

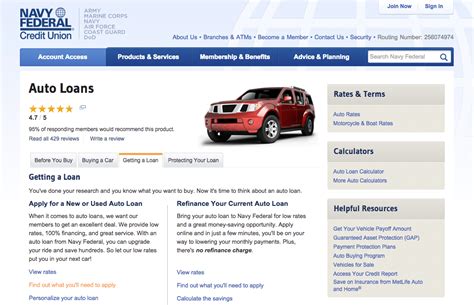

Navy Federal auto loan reviews are overwhelmingly positive, with members praising the credit union's competitive rates, flexible terms, and exceptional customer service. Many members have reported saving thousands of dollars by refinancing their existing auto loan with Navy Federal, while others have appreciated the convenience and simplicity of the pre-approval process.

Of course, as with any lender, there may be some negative reviews and complaints. However, Navy Federal has a strong reputation for responding to member concerns and resolving issues promptly. Members can read reviews and ratings from other members to get a sense of the overall experience and make a more informed decision about their auto loan.

Gallery of Navy Federal Auto Loan Images

Navy Federal Auto Loan Image Gallery

What is the minimum credit score required for a Navy Federal auto loan?

+The minimum credit score required for a Navy Federal auto loan is 620, although higher scores may qualify for better rates and terms.

How long does the Navy Federal auto loan pre-approval process take?

+The Navy Federal auto loan pre-approval process typically takes just a few minutes, and members can expect to receive a decision immediately.

Can I apply for a Navy Federal auto loan online?

+Yes, members can apply for a Navy Federal auto loan online, by phone, or in person at a Navy Federal branch.

What are the benefits of Navy Federal auto loan pre-approval?

+The benefits of Navy Federal auto loan pre-approval include knowing exactly how much you can afford to spend on a vehicle, negotiating a better price at the dealership, and avoiding high-pressure sales tactics.

Can I refinance my existing auto loan with Navy Federal?

+Yes, Navy Federal offers auto loan refinancing options, which can help members save thousands of dollars in interest over the life of the loan.

In conclusion, Navy Federal auto loan pre-approval is a great way to simplify the car-buying experience and get the best possible financing terms. With competitive rates, flexible terms, and exceptional customer service, Navy Federal is a popular choice among car buyers. By understanding the benefits, requirements, and steps involved in the pre-approval process, members can make a more informed decision about their auto loan and drive away in their dream vehicle with confidence. We invite you to share your thoughts and experiences with Navy Federal auto loan pre-approval in the comments below, and don't forget to share this article with friends and family who may be in the market for a new vehicle.