Intro

Boost your finances with 5 expert Navy Federal Credit Union tips, including credit score management, loan options, and banking services, to enhance your financial stability and security.

Being a member of Navy Federal Credit Union can be highly beneficial, offering a wide range of financial services and benefits tailored to the needs of military personnel, veterans, and their families. With its origins dating back to 1933, Navy Federal has grown to become one of the largest credit unions in the world, serving over 10 million members globally. The credit union's mission is to provide its members with exceptional financial services, education, and guidance, helping them achieve their financial goals and secure their financial futures. In this article, we will delve into the importance of utilizing Navy Federal Credit Union's services effectively and explore five valuable tips to make the most out of your membership.

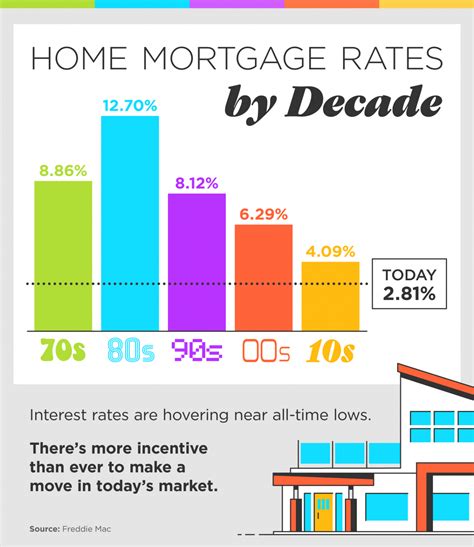

Navy Federal Credit Union stands out for its commitment to serving the military community, understanding the unique financial challenges that come with military life. From competitive loan rates to comprehensive insurance options, the credit union offers a broad spectrum of products and services designed to meet the diverse needs of its members. Whether you're looking to purchase a home, finance a vehicle, save for retirement, or simply manage your everyday expenses, Navy Federal has the tools and expertise to support you. By leveraging these resources and following a few key strategies, members can significantly enhance their financial well-being and navigate the complexities of personal finance with confidence.

The financial landscape is constantly evolving, with new challenges and opportunities emerging all the time. For members of Navy Federal Credit Union, staying informed and proactive is crucial. This involves not only keeping up with the latest financial trends and regulatory changes but also being aware of the full range of services and benefits available through the credit union. From financial counseling and planning tools to exclusive discounts and rewards programs, there are numerous ways to maximize the value of your membership. By doing so, you can better position yourself to achieve long-term financial stability and success, whether your goals involve building wealth, securing your family's future, or simply enjoying a more secure and prosperous life.

Understanding Navy Federal Credit Union Benefits

Key Financial Products and Services

Navy Federal offers a diverse array of financial products and services, each tailored to meet the unique needs of its members. This includes: - High-yield savings accounts for maximizing your savings potential - Low-interest loans for financing major purchases or consolidating debt - Investment products to help you grow your wealth over time - Insurance options to protect your assets and ensure your family's financial security - Financial planning resources and tools to guide your decision-making and help you stay on track with your financial goalsTip 1: Leverage Competitive Loan Rates

Strategies for Using Loans Effectively

Using loans effectively is about more than just securing a low interest rate; it's also about understanding how to structure your debt in a way that works for you, rather than against you. Consider the following strategies: - Consolidate high-interest debt into a single, lower-interest loan to simplify your payments and reduce your overall interest burden. - Use loans as part of a broader financial strategy, such as financing a home improvement project that will increase the value of your property. - Always review the terms and conditions of any loan carefully, ensuring you understand all the costs and obligations involved.Tip 2: Maximize Your Savings

Strategies for Growing Your Savings

Growing your savings over time requires discipline, patience, and the right strategy. Consider the following approaches: - Set clear savings goals, whether short-term (e.g., building an emergency fund) or long-term (e.g., saving for retirement). - Automate your savings by setting up regular transfers from your checking account to your savings or investment accounts. - Take advantage of Navy Federal's financial tools and resources to track your progress, identify areas for improvement, and make informed decisions about your savings strategy.Tip 3: Utilize Financial Planning Resources

Benefits of Financial Planning

Financial planning offers numerous benefits, including: - Clarity and direction: A clear understanding of your financial situation and goals. - Reduced stress: Knowing you have a plan in place to manage your finances effectively. - Improved outcomes: Making informed decisions that align with your financial objectives. - Enhanced financial security: Protecting your assets and ensuring your long-term financial well-being.Tip 4: Explore Investment Opportunities

Investment Strategies for Success

Successful investing requires a well-thought-out strategy, patience, and a commitment to long-term goals. Consider the following: - Diversification: Spread your investments across different asset classes to manage risk. - Dollar-cost averaging: Invest a fixed amount of money at regular intervals, regardless of the market's performance. - Long-term focus: Resist the temptation to make emotional decisions based on short-term market fluctuations.Tip 5: Protect Your Assets with Insurance

Importance of Insurance

Insurance plays a vital role in managing risk and protecting your financial future. Consider the following benefits: - Financial protection: Insurance can provide a financial safety net in the event of unexpected events such as illness, injury, or death. - Peace of mind: Knowing you have insurance coverage can reduce financial stress and anxiety. - Compliance: Certain types of insurance, such as auto insurance, may be required by law.Navy Federal Credit Union Image Gallery

What are the benefits of joining Navy Federal Credit Union?

+Joining Navy Federal Credit Union provides access to a wide range of financial services and benefits, including competitive loan rates, high-yield savings accounts, investment opportunities, and insurance products, all designed to support the unique financial needs of military personnel, veterans, and their families.

How can I maximize my savings with Navy Federal Credit Union?

+To maximize your savings, consider utilizing Navy Federal's high-yield savings accounts, setting up automatic transfers, and taking advantage of financial planning resources to develop a personalized savings strategy that aligns with your financial goals and risk tolerance.

What investment options are available through Navy Federal Credit Union?

+Navy Federal Credit Union offers a variety of investment products and services, including stocks, bonds, mutual funds, and retirement accounts, designed to help members grow their wealth over time and achieve their long-term financial goals.

In conclusion, being a member of Navy Federal Credit Union offers a multitude of benefits and opportunities for managing your finances effectively, achieving financial stability, and securing your long-term financial well-being. By understanding the full range of services and benefits available, leveraging competitive loan rates, maximizing your savings, utilizing financial planning resources, exploring investment opportunities, and protecting your assets with insurance, you can make the most out of your membership and set yourself up for financial success. We invite you to share your experiences, ask questions, and explore how Navy Federal Credit Union can help you achieve your financial goals. Whether you're just starting out or nearing retirement, the right financial strategy and support can make all the difference. Take the first step today towards a more secure and prosperous financial future.