Intro

Discover 5 ways Navy Federal wire transfer simplifies online banking, including domestic and international money transfers, online wire transfer services, and mobile banking solutions, for secure and convenient fund transfers.

The world of banking has evolved significantly over the years, and one of the most convenient ways to transfer money is through wire transfers. Navy Federal Credit Union, one of the largest and most reputable credit unions in the world, offers its members a secure and efficient way to send and receive money through wire transfers. In this article, we will explore the 5 ways Navy Federal wire transfer can benefit its members.

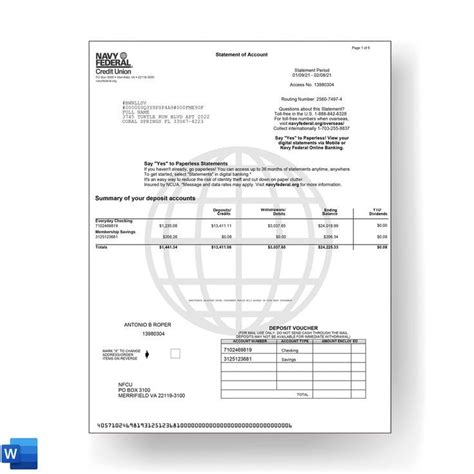

Navy Federal Credit Union has been serving its members for over 80 years, providing them with a wide range of financial services and products. With over 8 million members, Navy Federal has become one of the largest credit unions in the world. One of the key services offered by Navy Federal is wire transfers, which allow members to send and receive money quickly and securely. Whether you need to send money to a family member, pay a bill, or transfer funds to another bank account, Navy Federal wire transfer is a convenient and reliable option.

The importance of wire transfers cannot be overstated. In today's fast-paced world, people need to be able to transfer money quickly and securely. Wire transfers offer a convenient way to do just that, and Navy Federal Credit Union has made it easy for its members to take advantage of this service. With Navy Federal wire transfer, members can send and receive money from anywhere in the world, at any time. This service is particularly useful for members who have family or friends living abroad, or for those who need to conduct international business.

Introduction to Navy Federal Wire Transfer

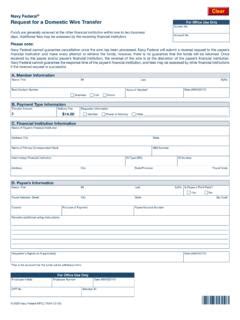

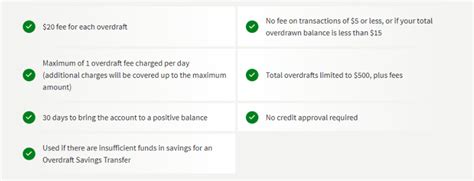

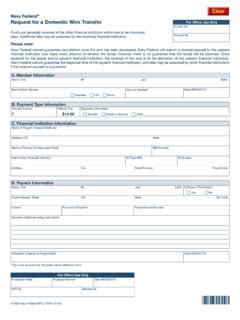

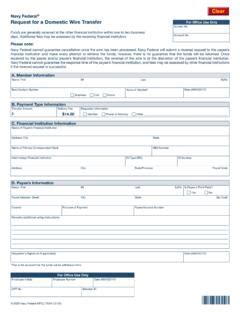

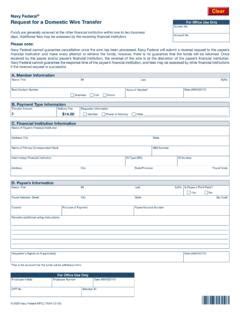

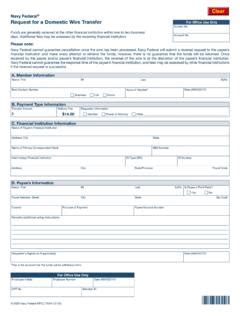

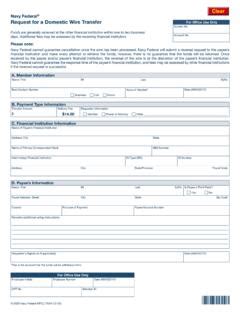

To send a wire transfer, members will need to provide some basic information, including the recipient's name, address, and bank account information. They will also need to specify the amount of money they want to transfer and the currency they want to use. Once the transfer is initiated, the funds will be deducted from the member's account, and they will be sent to the recipient's account.

Benefits of Using Navy Federal Wire Transfer

The benefits of using Navy Federal wire transfer are numerous. Some of the most significant advantages include: * Convenience: Wire transfers can be sent and received from anywhere in the world, at any time. * Security: Wire transfers are a secure way to transfer money, as they are protected by robust security measures. * Speed: Wire transfers are typically processed quickly, with most transfers being completed within a few hours. * Reliability: Navy Federal wire transfer is a reliable service, with a high success rate for transfers.How to Send a Wire Transfer with Navy Federal

Types of Wire Transfers Available

Navy Federal offers several types of wire transfers, including: * Domestic wire transfers: These transfers are used to send money within the United States. * International wire transfers: These transfers are used to send money to other countries. * Inbound wire transfers: These transfers are used to receive money from other bank accounts. * Outbound wire transfers: These transfers are used to send money to other bank accounts.Wire Transfer Fees and Limits

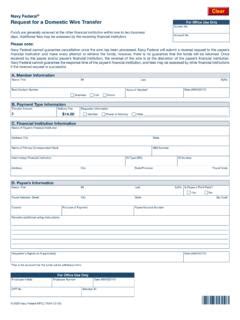

The limits for wire transfers also vary depending on the type of transfer and the member's account status. Here are some of the limits associated with Navy Federal wire transfers:

- Domestic wire transfers: $10,000-$50,000

- International wire transfers: $5,000-$20,000

- Inbound wire transfers: $10,000-$50,000

- Outbound wire transfers: $10,000-$50,000

Security Measures

Navy Federal takes the security of its members' accounts very seriously. To protect against fraud and unauthorized transactions, Navy Federal has implemented several security measures, including: * Encryption: Navy Federal uses robust encryption to protect member data and transactions. * Two-factor authentication: Members are required to use two-factor authentication to access their accounts and initiate transfers. * Monitoring: Navy Federal monitors all transactions for suspicious activity and alerts members to potential security threats.Common Uses for Navy Federal Wire Transfer

Advantages Over Other Transfer Methods

Navy Federal wire transfer has several advantages over other transfer methods, including: * Speed: Wire transfers are typically faster than other transfer methods, such as checks or money orders. * Security: Wire transfers are more secure than other transfer methods, as they are protected by robust security measures. * Convenience: Wire transfers can be sent and received from anywhere in the world, at any time.Alternatives to Navy Federal Wire Transfer

Comparison to Other Financial Institutions

Navy Federal wire transfer is comparable to other financial institutions in terms of fees and limits. However, Navy Federal offers several advantages, including: * Lower fees: Navy Federal fees are generally lower than those of other financial institutions. * Higher limits: Navy Federal limits are generally higher than those of other financial institutions. * Better security: Navy Federal has a strong reputation for security and uses robust measures to protect member data and transactions.Navy Federal Wire Transfer Image Gallery

What is the fee for a domestic wire transfer with Navy Federal?

+The fee for a domestic wire transfer with Navy Federal is $15-$30.

How long does it take to process a wire transfer with Navy Federal?

+Wire transfers with Navy Federal are typically processed within a few hours.

Can I use Navy Federal wire transfer to send money internationally?

+Yes, Navy Federal wire transfer can be used to send money internationally.

What is the limit for a domestic wire transfer with Navy Federal?

+The limit for a domestic wire transfer with Navy Federal is $10,000-$50,000.

Is Navy Federal wire transfer secure?

+Yes, Navy Federal wire transfer is a secure way to send and receive money, as it is protected by robust security measures.

In conclusion, Navy Federal wire transfer is a convenient and secure way to send and receive money. With its low fees, high limits, and robust security measures, Navy Federal wire transfer is an excellent option for members who need to transfer funds quickly and securely. Whether you need to send money to a family member, pay a bill, or conduct international business, Navy Federal wire transfer is a reliable and efficient way to do so. We invite you to share your experiences with Navy Federal wire transfer in the comments below and to explore the other services and products offered by Navy Federal Credit Union.