Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

Navy Federal Credit Union is one of the largest and most reputable financial institutions in the world, offering a wide range of financial products and services to its members. One of the most popular services offered by Navy Federal is its loan program, which provides members with access to affordable and flexible financing options. If you're considering taking out a loan from Navy Federal, here are five tips to help you make the most of your experience.

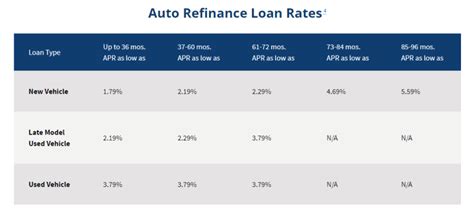

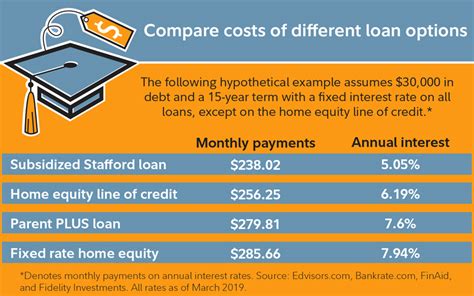

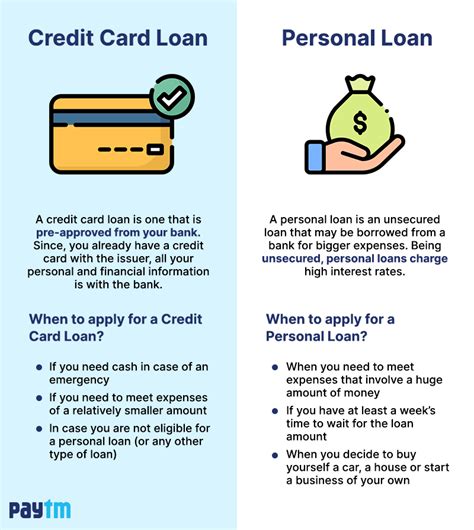

Firstly, it's essential to understand the different types of loans offered by Navy Federal. The credit union provides a variety of loan options, including personal loans, auto loans, mortgages, and student loans. Each type of loan has its own unique features, benefits, and requirements, so it's crucial to choose the one that best suits your needs. For example, if you're looking to purchase a new car, a Navy Federal auto loan may be an excellent option, with competitive interest rates and flexible repayment terms.

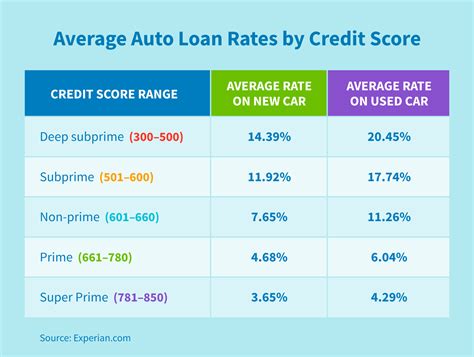

Secondly, it's vital to check your credit score before applying for a Navy Federal loan. Your credit score plays a significant role in determining the interest rate you'll qualify for and whether your loan application will be approved. Navy Federal offers free credit score checks to its members, so be sure to take advantage of this service to get an idea of your creditworthiness. A good credit score can help you qualify for lower interest rates and better loan terms, so it's worth working on improving your credit score before applying for a loan.

Thirdly, consider the benefits of becoming a Navy Federal member. As a member, you'll have access to a range of exclusive benefits, including lower interest rates, reduced fees, and more flexible repayment terms. Additionally, Navy Federal members can take advantage of free financial counseling, investment services, and other resources to help them manage their finances effectively. If you're not already a member, it's worth considering joining Navy Federal to take advantage of these benefits and more.

Fourthly, be sure to carefully review the terms and conditions of your loan before signing on the dotted line. Navy Federal loans come with a range of features, including fixed or variable interest rates, flexible repayment terms, and optional insurance products. It's essential to understand the terms of your loan, including the interest rate, repayment period, and any fees or charges that may apply. Don't be afraid to ask questions or seek clarification if you're unsure about any aspect of your loan.

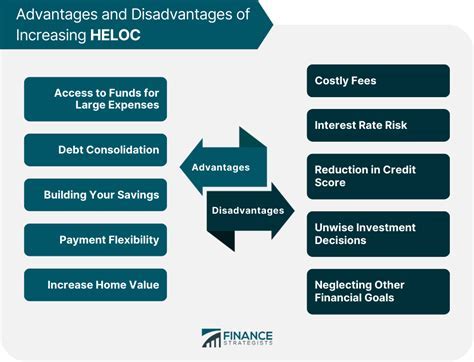

Lastly, consider the potential risks and consequences of taking out a loan. While borrowing money can be a helpful way to achieve your financial goals, it's essential to remember that loans must be repaid, and failure to do so can have serious consequences for your credit score and financial stability. Be sure to carefully consider your budget and financial situation before taking out a loan, and make sure you have a plan in place to repay the loan on time.

Understanding Navy Federal Loan Options

Types of Navy Federal Loans

Some of the most popular types of loans offered by Navy Federal include: * Personal loans: for debt consolidation, home improvements, or unexpected expenses * Auto loans: for purchasing new or used vehicles * Mortgages: for purchasing or refinancing a home * Student loans: for financing education expenses * Home equity loans: for borrowing against the value of your home * Credit card loans: for consolidating credit card debt or financing large purchasesApplying for a Navy Federal Loan

Navy Federal Loan Application Requirements

Some of the key requirements for applying for a Navy Federal loan include: * Membership: you must be a member of Navy Federal to apply for a loan * Credit score: a good credit score can help you qualify for lower interest rates and better loan terms * Income: you'll need to provide proof of income to support your loan application * Employment history: a stable employment history can help you qualify for a loan * Documentation: you may need to provide documentation, such as pay stubs or tax returns, to support your applicationNavy Federal Loan Rates and Terms

Navy Federal Loan Interest Rates

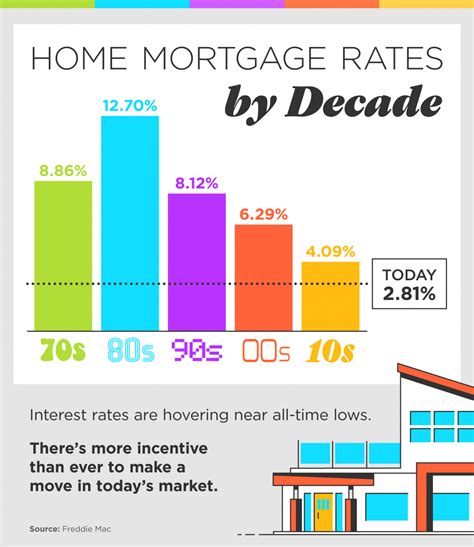

Some of the key factors that can affect Navy Federal loan interest rates include: * Credit score: a good credit score can help you qualify for lower interest rates * Loan type: different types of loans may have different interest rates and terms * Loan amount: the amount you borrow can affect the interest rate you're offered * Repayment term: the length of your repayment term can affect the interest rate you're offered * Market conditions: interest rates may be affected by market conditions, such as inflation or economic downturnsNavy Federal Loan Benefits

Navy Federal Loan Discounts

Some of the key discounts and benefits available to Navy Federal members include: * Competitive interest rates: Navy Federal offers competitive interest rates on its loans * Flexible repayment terms: members can choose from a range of repayment terms to suit their needs * Exclusive discounts: members may be eligible for exclusive discounts on certain loan products * Free financial counseling: members can access free financial counseling and advice * Investment services: members can take advantage of investment services and resources to help them manage their financesNavy Federal Loan Repayment

Navy Federal Loan Repayment Options

Some of the key repayment options available to Navy Federal members include: * Automatic payments: members can set up automatic payments to be deducted from their account * Online payments: members can make payments online through the Navy Federal website * Mail-in payments: members can mail in payments to the address listed on their loan statement * Phone payments: members can make payments over the phone by calling the Navy Federal customer service number * In-person payments: members can make payments in person at a local Navy Federal branchNavy Federal Loan Image Gallery

What are the benefits of becoming a Navy Federal member?

+As a Navy Federal member, you'll have access to a range of exclusive benefits, including lower interest rates, reduced fees, and more flexible repayment terms. You'll also be able to take advantage of free financial counseling, investment services, and other resources to help you manage your finances effectively.

How do I apply for a Navy Federal loan?

+To apply for a Navy Federal loan, you can visit the Navy Federal website, call the customer service number, or visit a local branch in person. You'll need to provide some basic personal and financial information, including your income, employment history, and credit score. You may also need to provide documentation, such as pay stubs or tax returns, to support your application.

What are the repayment options for Navy Federal loans?

+Navy Federal offers a range of repayment options, including automatic payments, online payments, mail-in payments, phone payments, and in-person payments. You can choose the repayment option that best suits your needs and budget.

How do I check my credit score with Navy Federal?

+Navy Federal offers free credit score checks to its members. You can check your credit score by logging into your online account, visiting a local branch, or calling the customer service number.

What are the interest rates for Navy Federal loans?

+Navy Federal loan interest rates vary depending on the type of loan and your individual circumstances. You can check the current interest rates on the Navy Federal website or by contacting the customer service number.

We hope this article has provided you with a comprehensive overview of Navy Federal loans and the benefits they offer. Whether you're looking to purchase a new car, finance a home, or consolidate debt, Navy Federal has a range of loan options to suit your needs. By following the tips and guidelines outlined in this article, you can make the most of your Navy Federal loan experience and achieve your financial goals. If you have any further questions or would like to share your experiences with Navy Federal loans, please don't hesitate to comment below.