Intro

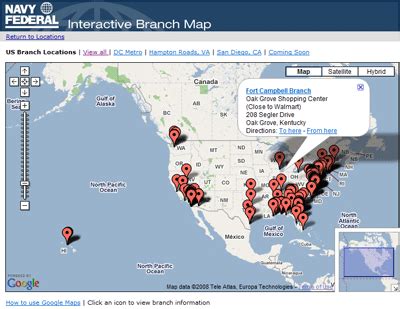

Find Navy Federal Credit Union locations near you. Get branch addresses, hours, and services for NFCU banking, loans, and credit cards with convenient ATM access and member support.

The Navy Federal Credit Union is one of the largest and most reputable credit unions in the world, serving over 10 million members globally. As a not-for-profit financial cooperative, it offers a wide range of financial products and services to its members, including checking and savings accounts, loans, credit cards, and investment services. With a history dating back to 1933, the Navy Federal Credit Union has grown to become a trusted financial institution, known for its excellent customer service, competitive rates, and convenient locations. In this article, we will explore the various Navy Federal Credit Union locations, their services, and benefits, as well as provide an overview of the credit union's history, mission, and values.

The Navy Federal Credit Union has a long and storied history, dating back to the Great Depression. Founded in 1933 by a group of seven Navy Department employees, the credit union was initially called the Navy Department Employees' Credit Union of the District of Columbia. Over the years, the credit union has undergone several name changes, eventually becoming the Navy Federal Credit Union in 1954. Today, the credit union is headquartered in Vienna, Virginia, and has grown to become one of the largest credit unions in the world, with over $150 billion in assets.

The Navy Federal Credit Union is committed to serving its members and providing them with the best possible financial products and services. The credit union's mission is to provide its members with exceptional financial services, education, and guidance, while also promoting financial wellness and stability. The credit union's values include a commitment to excellence, integrity, and member satisfaction, as well as a focus on community involvement and social responsibility. With a strong foundation and a clear vision for the future, the Navy Federal Credit Union is well-positioned to continue serving its members and providing them with the financial products and services they need to achieve their goals.

Navy Federal Credit Union Locations

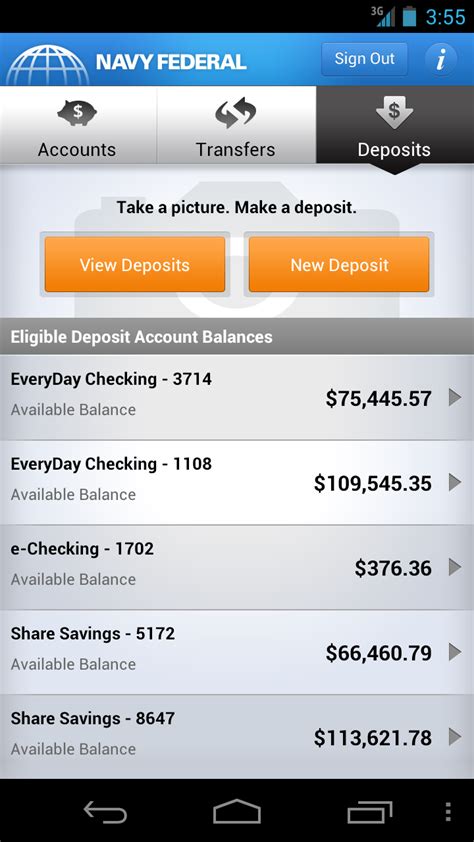

In addition to its physical locations, the Navy Federal Credit Union also offers a range of online and mobile banking services, allowing members to access their accounts, pay bills, and transfer funds from the comfort of their own homes. The credit union's online banking platform is secure, easy to use, and provides members with real-time access to their account information. The Navy Federal Credit Union also offers a mobile banking app, which allows members to access their accounts, deposit checks, and transfer funds using their smartphones.

Services Offered by Navy Federal Credit Union

In addition to its deposit and loan products, the Navy Federal Credit Union also offers a range of investment services, including brokerage accounts, retirement accounts, and insurance products. The credit union's investment services are designed to help members achieve their long-term financial goals, whether it's saving for retirement, a down payment on a home, or a child's education. The Navy Federal Credit Union also offers a range of insurance products, including life insurance, disability insurance, and long-term care insurance, to help members protect their assets and income.

Benefits of Joining Navy Federal Credit Union

In addition to its financial benefits, the Navy Federal Credit Union also offers a range of educational resources and tools to help members manage their finances and achieve their financial goals. The credit union's website features a range of articles, videos, and webinars on topics such as budgeting, saving, and investing, as well as a range of calculators and tools to help members plan for their financial future. The Navy Federal Credit Union also offers a range of financial counseling services, including one-on-one counseling sessions and group workshops, to help members get back on track with their finances.

Eligibility to Join Navy Federal Credit Union

The process of joining the Navy Federal Credit Union is straightforward and can be completed online or in person at a branch. To join, you will need to provide proof of eligibility, such as a military ID or a letter from your commanding officer, as well as identification and proof of address. Once you have joined, you will have access to all of the credit union's products and services, including checking and savings accounts, loans, credit cards, and investment services.

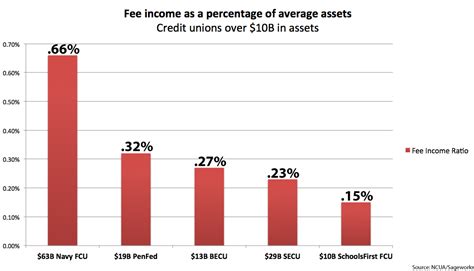

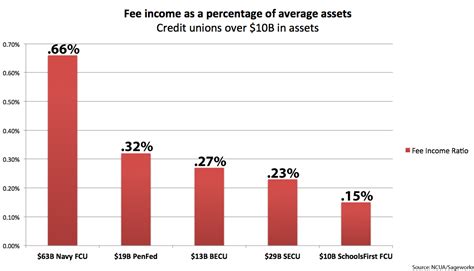

Navy Federal Credit Union Fees and Rates

In addition to its competitive rates and low fees, the Navy Federal Credit Union also offers a range of discounts and promotions to its members. The credit union's members, for example, can receive discounts on loans and credit cards, as well as free financial counseling and investment advice. The Navy Federal Credit Union also offers a range of rewards programs, including cash back and travel rewards, to help members earn rewards and save money.

Navy Federal Credit Union Customer Service

In addition to its customer service channels, the Navy Federal Credit Union also offers a range of educational resources and tools to help members manage their finances and achieve their financial goals. The credit union's website features a range of articles, videos, and webinars on topics such as budgeting, saving, and investing, as well as a range of calculators and tools to help members plan for their financial future. The Navy Federal Credit Union also offers a range of financial counseling services, including one-on-one counseling sessions and group workshops, to help members get back on track with their finances.

Gallery of Navy Federal Credit Union Locations

Navy Federal Credit Union Image Gallery

Frequently Asked Questions

What are the benefits of joining the Navy Federal Credit Union?

+The benefits of joining the Navy Federal Credit Union include competitive rates, low fees, and excellent customer service, as well as access to a range of exclusive benefits, including discounts on loans and credit cards, free financial counseling, and investment advice.

How do I join the Navy Federal Credit Union?

+To join the Navy Federal Credit Union, you must be a member of the military, a veteran, or a family member of a military personnel. You can join online or in person at a branch, and will need to provide proof of eligibility, such as a military ID or a letter from your commanding officer.

What services does the Navy Federal Credit Union offer?

+The Navy Federal Credit Union offers a wide range of financial products and services, including checking and savings accounts, loans, credit cards, and investment services. The credit union also offers online and mobile banking, as well as a range of educational resources and tools to help members manage their finances and achieve their financial goals.

How do I contact the Navy Federal Credit Union customer service?

+The Navy Federal Credit Union customer service can be contacted by phone, email, or online chat. The credit union's customer service representatives are available 24/7 to answer questions and provide assistance with accounts and services.

What are the fees and rates associated with Navy Federal Credit Union products and services?

+The Navy Federal Credit Union offers competitive rates and low fees on its products and services. The credit union's checking accounts, for example, offer competitive rates and low fees, with no monthly maintenance fees and no minimum balance requirements. The credit union's loan products, including personal loans, auto loans, and mortgages, offer competitive rates and flexible repayment terms, with no origination fees and no prepayment penalties.

In conclusion, the Navy Federal Credit Union is a reputable and trustworthy financial institution that offers a wide range of financial products and services to its members. With its extensive branch and ATM network, competitive rates, and low fees, the credit union provides its members with the convenience and flexibility they need to manage their finances on the go. Whether you're looking for a checking or savings account, a loan or credit card, or investment services, the Navy Federal Credit Union has something to offer. We invite you to share your experiences with the Navy Federal Credit Union, ask questions, or provide feedback on our article. Your input is valuable to us, and we look forward to hearing from you.