Intro

Resolve Navy Federal errors with 5 oops fixes, addressing common issues, troubleshooting tips, and account solutions to minimize financial disruptions and optimize banking experiences.

The importance of financial management cannot be overstated, especially when it comes to banking and credit unions. One of the most reputable and popular credit unions in the United States is Navy Federal Credit Union, which serves members of the military, veterans, and their families. Despite its excellent reputation, like any financial institution, Navy Federal is not immune to errors or issues that may arise from time to time. In this article, we will explore five common "oops" moments that Navy Federal members might experience and provide fixes for these issues.

Managing finances effectively is crucial for achieving financial stability and security. This includes understanding how to navigate the services provided by your credit union, such as Navy Federal, to avoid common pitfalls. Whether it's dealing with overdrafts, navigating the online banking system, or managing credit card limits, being informed is key. By understanding the potential issues that might arise and knowing how to address them, members can better utilize the services offered by Navy Federal and maintain a healthy financial profile.

Financial literacy is also an important aspect of managing one's finances. This includes understanding banking terms, being aware of fees associated with certain transactions, and knowing how to protect one's account from fraud. Navy Federal, like many financial institutions, offers a variety of resources to help its members improve their financial literacy and avoid common mistakes. From workshops and webinars to online tools and mobile apps, there are numerous ways for members to educate themselves and make informed financial decisions.

Understanding Navy Federal's Services

To fully benefit from Navy Federal's services, it's essential to have a comprehensive understanding of what they offer. This includes their checking and savings accounts, loans, credit cards, and investment services. Each of these products comes with its own set of features, benefits, and potential pitfalls. For instance, understanding the interest rates associated with loans and credit cards can help members make informed decisions about borrowing. Similarly, knowing the fees associated with certain accounts or transactions can help members avoid unnecessary expenses.

Common Issues and Fixes

Several common issues might arise during one's interaction with Navy Federal. These could range from technical difficulties with the online banking platform to disputes over transactions. Here are five potential "oops" moments and their fixes:

-

Overdrafts: One of the most common issues members might face is overdrafting their account. This occurs when the account balance goes below zero, often resulting in fees. To fix this, members can set up overdraft protection, which transfers funds from a linked account or credit card to cover the overdraft, thereby avoiding fees.

-

Credit Card Limit Issues: Sometimes, members might find their credit card limits too low for their needs or might accidentally exceed their limit. To address this, members can request a credit limit increase through Navy Federal's website or by contacting their customer service. It's essential to have a good credit score and a history of timely payments to increase the chances of approval.

-

Online Banking Errors: Technical issues with online banking can be frustrating, especially when trying to manage finances remotely. If a member encounters an error, they should first try clearing their browser's cache and cookies or switching to a different browser. If the issue persists, contacting Navy Federal's technical support can provide a solution.

-

Transaction Disputes: In cases where a member notices an unauthorized transaction, it's crucial to act quickly. The first step is to contact Navy Federal's customer service to report the issue. They will guide the member through the process of disputing the transaction and may temporarily credit the account while the dispute is being resolved.

-

Loan Application Mistakes: Applying for a loan can be a complex process, and mistakes in the application can lead to delays or even rejection. To avoid this, members should carefully review their application for any errors or omissions before submission. It's also beneficial to check credit scores beforehand, as a good credit score can significantly improve the chances of a successful loan application.

Prevention is the Best Fix

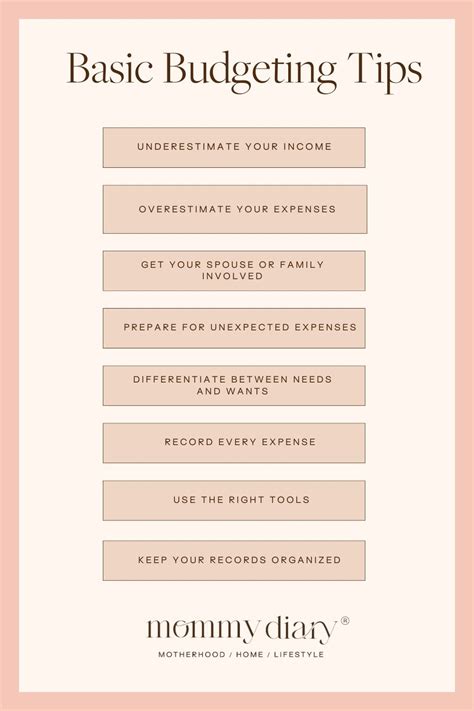

While knowing how to fix common issues is important, preventing them from occurring in the first place is even better. This can be achieved through regular monitoring of accounts, keeping track of expenses, and maintaining a good credit score. Navy Federal offers various tools and resources to help members in these efforts, including budgeting apps, credit score monitoring, and financial counseling services.

Benefits of Proactive Management

Proactive management of finances not only helps in avoiding common pitfalls but also leads to long-term financial health. By being aware of their financial situation at all times, members can make informed decisions about savings, investments, and borrowings. This proactive approach also helps in building a strong credit profile, which is essential for securing loans at favorable interest rates in the future.Utilizing Navy Federal's Resources

Navy Federal provides its members with a plethora of resources designed to enhance their financial literacy and management skills. These resources include workshops, webinars, online tutorials, and mobile apps. Members can leverage these resources to learn more about personal finance, understand how to use Navy Federal's services effectively, and stay updated on the latest financial trends and products.

Empowering Financial Decisions

By utilizing the resources provided by Navy Federal, members can empower themselves to make better financial decisions. This includes understanding the implications of different financial products, knowing how to manage debt effectively, and being aware of the importance of saving and investing for the future. Empowered with this knowledge, members can navigate the complex world of personal finance with confidence.Conclusion and Next Steps

In conclusion, while issues may arise during one's interaction with Navy Federal, being informed and proactive can significantly mitigate these problems. By understanding the common "oops" moments and their fixes, members can better manage their finances and make the most out of the services offered by Navy Federal. It's also crucial to utilize the resources provided by the credit union to enhance financial literacy and make informed decisions.

For those looking to delve deeper into the world of personal finance and learn more about managing their finances effectively with Navy Federal, there are numerous resources available. From the credit union's official website to financial advisory services, the path to financial stability and security is well-supported.

Navy Federal Financial Management Image Gallery

What is the best way to manage my finances with Navy Federal?

+The best way to manage your finances with Navy Federal is to utilize their online banking services, keep track of your expenses, and regularly monitor your accounts.

How can I avoid overdraft fees with Navy Federal?

+You can avoid overdraft fees by setting up overdraft protection, which transfers funds from a linked account or credit card to cover the overdraft.

What resources does Navy Federal offer for improving financial literacy?

+Navy Federal offers various resources including workshops, webinars, online tutorials, and mobile apps to help improve financial literacy and management skills.

We invite you to share your thoughts and experiences with managing finances through Navy Federal in the comments below. Your insights can be invaluable to others navigating similar financial journeys. Additionally, consider sharing this article with friends and family who might benefit from learning more about effectively managing their finances with Navy Federal. Together, we can empower each other to make informed financial decisions and achieve long-term financial stability.