Intro

Simplify home buying with Navy Federal pre approval, streamlining mortgage applications with pre qualification and credit checks, making homeownership easier.

The process of purchasing a home can be a daunting and complex task, especially for first-time buyers. One of the most crucial steps in this journey is obtaining pre-approval for a mortgage. Navy Federal, a well-established and reputable financial institution, offers a streamlined pre-approval process that can help make the experience less overwhelming. In this article, we will delve into the world of Navy Federal pre-approval, exploring its benefits, requirements, and the steps involved in securing a pre-approval letter.

Navy Federal Credit Union has been serving its members for over 80 years, providing a wide range of financial products and services tailored to their needs. With a strong commitment to excellence and customer satisfaction, Navy Federal has become a trusted partner for many individuals and families seeking to achieve their financial goals. One of the key advantages of working with Navy Federal is its user-friendly pre-approval process, which can be completed online, over the phone, or in-person at a local branch.

Navy Federal Pre Approval Benefits

The benefits of obtaining pre-approval through Navy Federal are numerous. For starters, a pre-approval letter provides buyers with a clear understanding of their budget, allowing them to focus on finding a home that meets their needs and financial capabilities. This, in turn, can give them a competitive edge in the market, as sellers often view pre-approved buyers as more attractive and serious candidates. Additionally, Navy Federal's pre-approval process can help identify potential issues with a buyer's credit report or financial history, providing an opportunity to address these concerns before submitting an offer on a property.

How to Get Pre Approved with Navy Federal

To get pre-approved with Navy Federal, buyers will need to provide certain documentation and information. This typically includes:

- Identification (driver's license, passport, etc.)

- Social Security number

- Proof of income (pay stubs, W-2 forms, etc.)

- Proof of employment (letter from employer, etc.)

- Bank statements and asset information

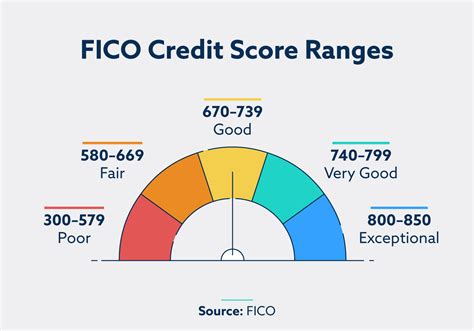

- Credit report and score

Once the necessary documentation has been gathered, buyers can submit their pre-approval application online, over the phone, or in-person at a Navy Federal branch. The application will be reviewed, and a pre-approval letter will be issued if the buyer meets the credit union's lending criteria.

Navy Federal Pre Approval Requirements

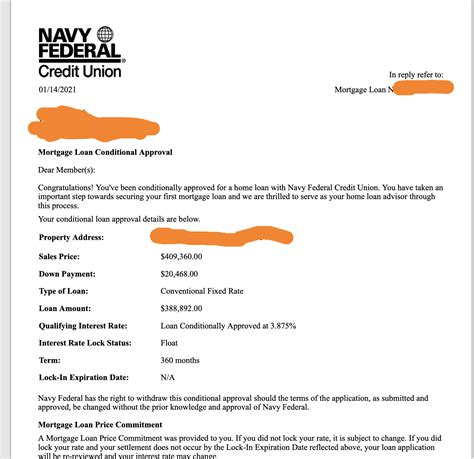

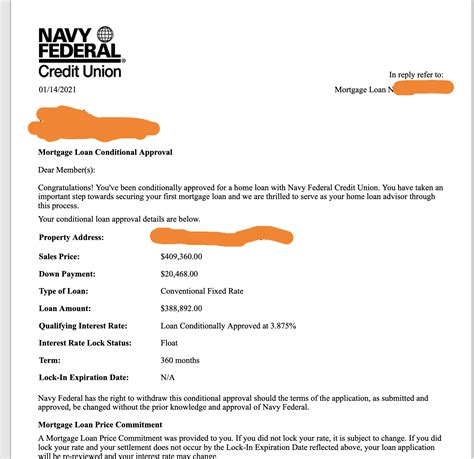

The requirements for Navy Federal pre-approval are similar to those of other lenders. Buyers will need to have a stable income, a decent credit score, and a manageable debt-to-income ratio. The specific requirements may vary depending on the type of loan and the buyer's individual circumstances. For example, buyers who are eligible for VA loans may have more lenient credit score requirements than those applying for conventional loans.

Navy Federal Pre Approval Process

The Navy Federal pre-approval process typically involves the following steps:

- Application: Buyers submit their pre-approval application, either online, over the phone, or in-person at a Navy Federal branch.

- Review: The application is reviewed, and the necessary documentation is verified.

- Credit Check: A credit report is pulled, and the buyer's credit score is evaluated.

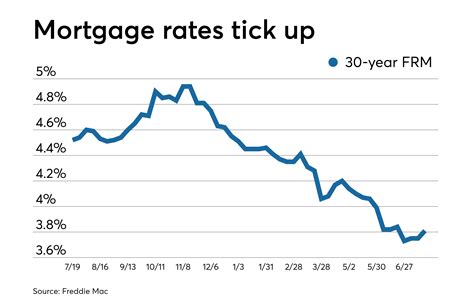

- Pre-Approval Letter: If the buyer meets the lending criteria, a pre-approval letter is issued, outlining the terms of the loan, including the amount, interest rate, and repayment terms.

- Home Search: With pre-approval in hand, buyers can begin their home search, focusing on properties that meet their budget and needs.

Navy Federal Pre Approval Calculator

To help buyers estimate their mortgage payments and determine how much home they can afford, Navy Federal offers a pre-approval calculator on its website. This tool takes into account factors such as income, credit score, debt, and loan terms to provide a personalized estimate of the buyer's mortgage payments.

Navy Federal Pre Approval FAQs

Some frequently asked questions about Navy Federal pre-approval include:

- What is the difference between pre-approval and pre-qualification?

- How long does the pre-approval process take?

- What documents do I need to provide for pre-approval?

- Can I get pre-approved for a mortgage with bad credit?

Navy Federal Pre Approval Reviews

Navy Federal has received positive reviews from its members, who appreciate the credit union's streamlined pre-approval process and competitive loan terms. Many buyers have reported a smooth and efficient experience, with some even noting that the pre-approval process was completed in as little as 24 hours.

Navy Federal Pre Approval Image Gallery

What is the difference between pre-approval and pre-qualification?

+Pre-approval and pre-qualification are both steps in the mortgage application process, but they have distinct differences. Pre-qualification is an initial assessment of a buyer's creditworthiness, while pre-approval is a more thorough evaluation that results in a written commitment from the lender.

How long does the pre-approval process take?

+The pre-approval process can take anywhere from a few minutes to several days, depending on the complexity of the application and the speed of the lender.

What documents do I need to provide for pre-approval?

+Typically, buyers will need to provide identification, proof of income, proof of employment, bank statements, and credit reports to complete the pre-approval process.

In conclusion, Navy Federal pre-approval is a valuable tool for buyers looking to navigate the complex world of mortgage financing. By understanding the benefits, requirements, and process involved in securing a pre-approval letter, buyers can position themselves for success in the competitive housing market. Whether you're a first-time buyer or an experienced homeowner, Navy Federal's streamlined pre-approval process and competitive loan terms make it an excellent choice for anyone seeking to achieve their dream of homeownership. We invite you to share your thoughts and experiences with Navy Federal pre-approval in the comments below, and don't forget to share this article with anyone who may be embarking on their own home-buying journey.