Intro

Unlock smart borrowing with 5 Navy Federal Loan Tips, including loan options, interest rates, and repayment terms, to make informed decisions on personal loans, credit cards, and mortgage loans.

The world of personal finance can be overwhelming, especially when it comes to borrowing money. With so many options available, it's essential to make informed decisions that suit your financial situation. For members of the military, veterans, and their families, Navy Federal Credit Union is a popular choice for loans. In this article, we'll delve into the world of Navy Federal loans, exploring five valuable tips to help you navigate the process and make the most of their offerings.

Navy Federal Credit Union is one of the largest credit unions in the world, serving over 10 million members. Their loan products are designed to meet the unique needs of military personnel, veterans, and their families. From personal loans to mortgages, Navy Federal offers a range of options with competitive rates and flexible terms. However, with so many choices available, it's crucial to approach borrowing with caution and careful consideration.

Borrowing money can be a significant decision, and it's essential to understand the terms and conditions of any loan before signing on the dotted line. Navy Federal loans are no exception. With their competitive rates and flexible repayment terms, it's easy to get caught up in the excitement of borrowing. However, it's crucial to take a step back and assess your financial situation before applying for a loan. Consider your income, expenses, and credit score to determine how much you can afford to borrow and repay.

Understanding Navy Federal Loan Options

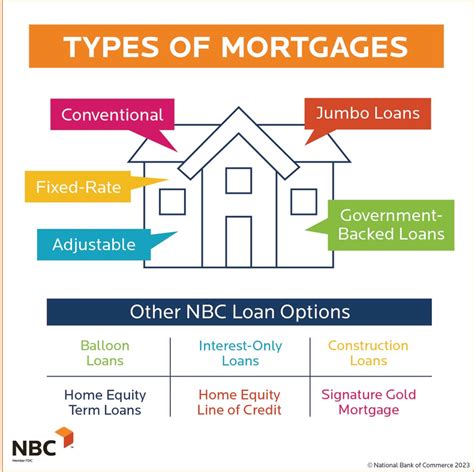

Navy Federal offers a range of loan products, including personal loans, mortgages, home equity loans, and auto loans. Each type of loan has its unique features, benefits, and requirements. Personal loans, for example, can be used for anything from consolidating debt to financing a wedding. Mortgages, on the other hand, are designed for purchasing or refinancing a home. Understanding the different types of loans available and their purposes is essential to making an informed decision.

Personal Loans

Personal loans are a popular choice for Navy Federal members, offering flexible repayment terms and competitive rates. These loans can be used for a variety of purposes, from consolidating debt to financing a major purchase. With personal loans, you can borrow up to $50,000, depending on your creditworthiness and financial situation.Mortgages

Mortgages are a significant investment, and Navy Federal offers a range of options to suit different needs and budgets. From conventional loans to VA loans, Navy Federal's mortgage products are designed to help you achieve your dream of homeownership. With competitive rates and flexible repayment terms, you can find a mortgage that fits your financial situation.Tip 1: Check Your Credit Score

Before applying for a Navy Federal loan, it's essential to check your credit score. Your credit score plays a significant role in determining the interest rate you'll qualify for and whether you'll be approved for a loan. A good credit score can help you qualify for better rates and terms, while a poor credit score may limit your options. You can check your credit score for free on the Navy Federal website or through other credit reporting agencies.

Why Credit Scores Matter

Credit scores are a three-digit number that represents your creditworthiness. They're calculated based on your payment history, credit utilization, and other factors. A good credit score can help you qualify for better loan rates and terms, while a poor credit score may result in higher interest rates or loan denials. By checking your credit score before applying for a loan, you can identify areas for improvement and work on building a stronger credit profile.Tip 2: Choose the Right Loan Type

With so many loan options available, it's essential to choose the right type of loan for your needs. Consider your financial situation, income, and expenses to determine which loan product is best for you. If you're looking to consolidate debt, a personal loan may be a good option. If you're purchasing a home, a mortgage is the way to go. By choosing the right loan type, you can ensure that you're getting the best rates and terms for your situation.

Loan Types and Their Purposes

Different loan types serve different purposes. Personal loans, for example, are designed for short-term borrowing, while mortgages are designed for long-term financing. Auto loans, on the other hand, are specifically designed for purchasing vehicles. By understanding the different loan types and their purposes, you can make an informed decision and choose the right loan for your needs.Tip 3: Consider the Interest Rate

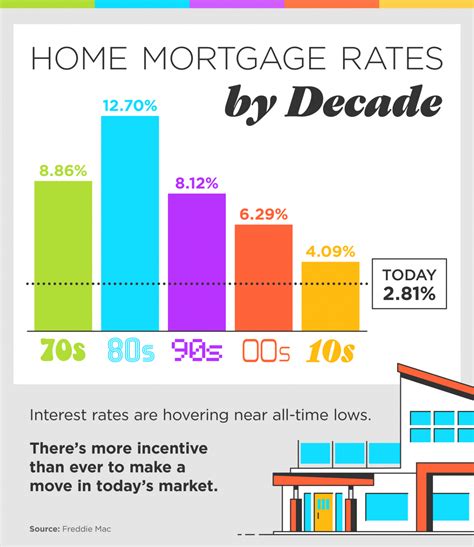

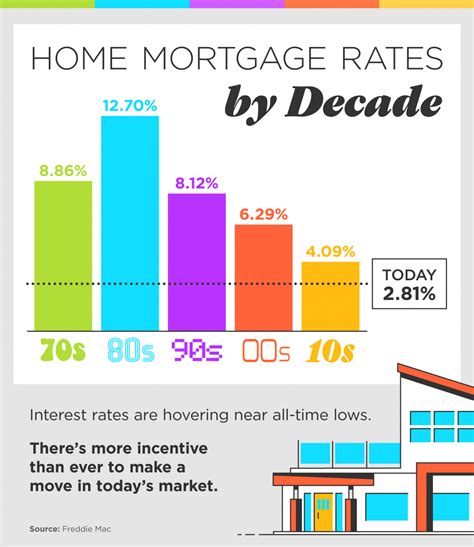

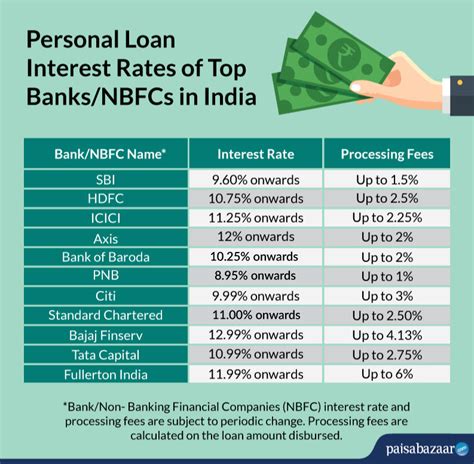

The interest rate on your loan can significantly impact your monthly payments and the overall cost of borrowing. Navy Federal offers competitive rates on their loan products, but it's essential to consider the interest rate before applying. A lower interest rate can save you money in the long run, while a higher interest rate can increase your monthly payments. By considering the interest rate, you can make an informed decision and choose a loan that fits your budget.

How Interest Rates Work

Interest rates are a percentage of the loan amount that you'll pay over the life of the loan. They're calculated based on your creditworthiness, loan type, and other factors. A lower interest rate can result in lower monthly payments and less interest paid over the life of the loan. By understanding how interest rates work, you can make an informed decision and choose a loan with a competitive rate.Tip 4: Review the Repayment Terms

The repayment terms on your loan can significantly impact your monthly payments and the overall cost of borrowing. Navy Federal offers flexible repayment terms on their loan products, but it's essential to review the terms before applying. Consider the loan term, monthly payment amount, and any fees associated with the loan. By reviewing the repayment terms, you can ensure that you're getting a loan that fits your budget and financial situation.

Understanding Repayment Terms

Repayment terms refer to the conditions under which you'll repay your loan. They include the loan term, monthly payment amount, and any fees associated with the loan. By understanding the repayment terms, you can make an informed decision and choose a loan that fits your financial situation. Consider your income, expenses, and credit score to determine which repayment terms are best for you.Tip 5: Take Advantage of Navy Federal Benefits

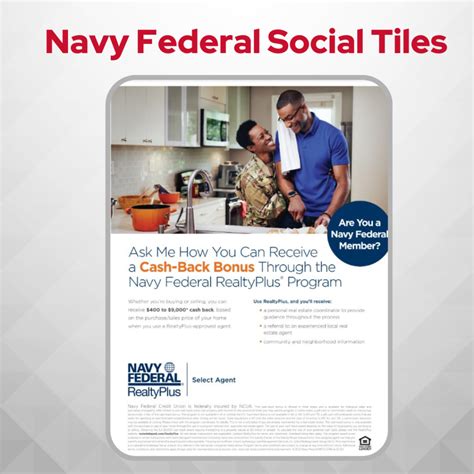

As a Navy Federal member, you're eligible for a range of benefits that can help you save money and achieve your financial goals. From competitive rates to flexible repayment terms, Navy Federal offers a range of perks that can make borrowing easier and more affordable. By taking advantage of these benefits, you can get the most out of your loan and achieve your financial objectives.

Navy Federal Benefits and Perks

Navy Federal offers a range of benefits and perks that can help you save money and achieve your financial goals. From competitive rates to flexible repayment terms, these benefits can make borrowing easier and more affordable. Consider your financial situation and goals to determine which benefits are best for you. By taking advantage of these perks, you can get the most out of your loan and achieve financial success.Navy Federal Loan Image Gallery

What are the benefits of using Navy Federal for loans?

+Navy Federal offers competitive rates, flexible repayment terms, and a range of benefits that can help you save money and achieve your financial goals.

How do I check my credit score with Navy Federal?

+You can check your credit score for free on the Navy Federal website or through other credit reporting agencies.

What types of loans does Navy Federal offer?

+Navy Federal offers a range of loan products, including personal loans, mortgages, home equity loans, and auto loans.

How do I apply for a loan with Navy Federal?

+You can apply for a loan with Navy Federal online, by phone, or in person at a branch location.

What are the repayment terms for Navy Federal loans?

+The repayment terms for Navy Federal loans vary depending on the type of loan and your individual circumstances. You can review the repayment terms before applying for a loan.

In conclusion, Navy Federal loans offer a range of benefits and options for members. By following these five tips, you can make an informed decision and choose a loan that fits your financial situation and goals. Remember to check your credit score, choose the right loan type, consider the interest rate, review the repayment terms, and take advantage of Navy Federal benefits. With these tips and a little planning, you can achieve your financial objectives and enjoy the benefits of borrowing with Navy Federal. We invite you to share your thoughts and experiences with Navy Federal loans in the comments below. If you found this article helpful, please share it with others who may benefit from this information.