Intro

Learn how to send and receive funds with Navy Federal wire transfer services, including transfer fees, routing numbers, and international transfer options, making online banking and money transfers convenient and secure.

The world of banking and financial transactions has become increasingly complex, with numerous options available for moving money from one account to another. One of the most popular and efficient methods is wire transfer, which allows individuals and businesses to send and receive funds quickly and securely. For members of Navy Federal Credit Union, understanding how to navigate the wire transfer process is essential for managing their finances effectively. In this article, we will delve into the details of Navy Federal wire transfers, exploring the benefits, steps involved, and key considerations to keep in mind.

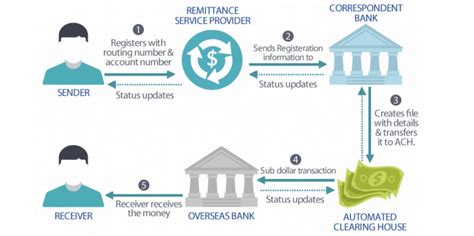

Wire transfers are a fundamental service offered by financial institutions, enabling the electronic transfer of funds between accounts. This method is particularly useful for large transactions, international payments, or situations where speed and security are paramount. Navy Federal Credit Union, as one of the largest and most reputable credit unions in the world, provides its members with a reliable and efficient wire transfer service. By leveraging the latest technology and maintaining stringent security protocols, Navy Federal ensures that wire transfers are not only fast but also protected against potential fraud and errors.

The importance of understanding the wire transfer process cannot be overstated, especially for Navy Federal members who may need to send or receive funds frequently. Whether it's for personal or business purposes, being familiar with the requirements, timelines, and potential fees associated with wire transfers can help individuals make informed decisions about their financial transactions. Moreover, in today's digital age, where online banking and mobile apps have become the norm, knowing how to initiate and manage wire transfers through these platforms can significantly enhance one's banking experience.

Navy Federal Wire Transfer Basics

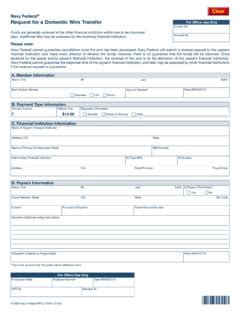

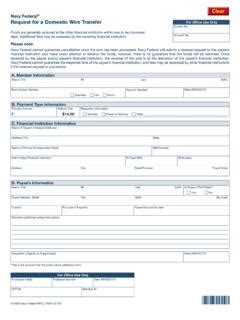

To initiate a wire transfer through Navy Federal, members need to understand the basic requirements and steps involved. First, it's essential to gather all the necessary information, including the recipient's name, address, and bank account details. For international transfers, additional information such as the recipient's bank's SWIFT code may be required. Navy Federal members can choose to initiate wire transfers online through the credit union's website or mobile app, over the phone, or by visiting a branch in person. Each method has its own set of instructions and potential fees, which will be discussed in more detail later.

Benefits of Using Navy Federal Wire Transfers

There are several benefits to using Navy Federal wire transfers for moving funds. One of the primary advantages is speed; wire transfers are typically processed on the same business day if initiated before the cut-off time, ensuring that recipients receive their funds quickly. Security is another significant benefit, as wire transfers are heavily regulated and monitored to prevent fraudulent activities. Additionally, Navy Federal's wire transfer service is designed to be convenient, allowing members to initiate transfers from the comfort of their own homes or on the go through their mobile devices.

Convenience and Accessibility

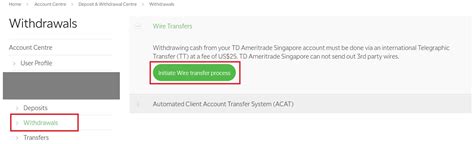

The convenience and accessibility of Navy Federal's wire transfer service are notable advantages. With online banking and mobile apps, members can initiate transfers at any time, provided they have access to the internet. This flexibility is particularly beneficial for individuals with busy schedules or those who need to send funds outside of regular banking hours. Moreover, the ability to track the status of wire transfers online or through the app adds an extra layer of convenience, allowing members to stay updated on the progress of their transactions.Steps to Initiate a Wire Transfer

Initiating a wire transfer through Navy Federal involves several steps. For online transfers, members start by logging into their account through the credit union's website or mobile app. They then navigate to the wire transfer section, where they will be prompted to enter the recipient's information and the amount to be transferred. It's crucial to ensure that all details are accurate to avoid delays or errors in processing. Once the transfer is initiated, members will receive a confirmation, and the funds will be processed according to Navy Federal's wire transfer schedule.

Required Information for Wire Transfers

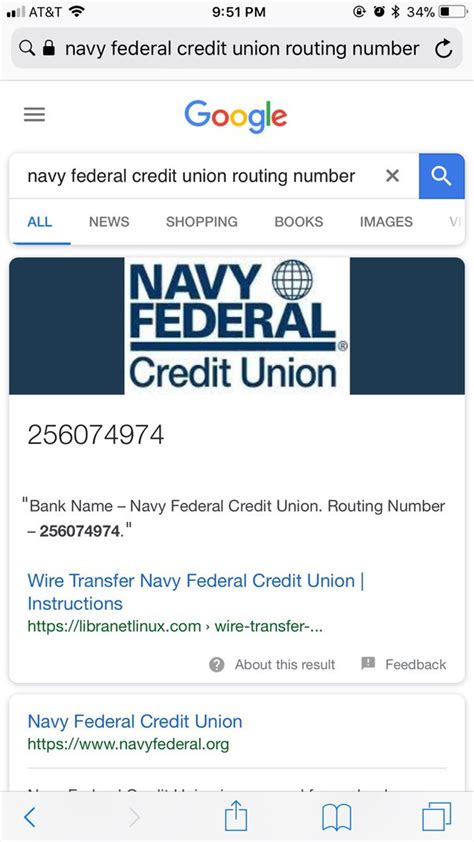

To complete a wire transfer, certain information is required. For domestic transfers, this typically includes the recipient's name, address, bank name, bank address, and account number, as well as the ABA routing number of the recipient's bank. For international transfers, additional details such as the recipient's bank's SWIFT code and the recipient's address may be necessary. It's essential to have all this information readily available when initiating the transfer to expedite the process.Fees and Limits Associated with Navy Federal Wire Transfers

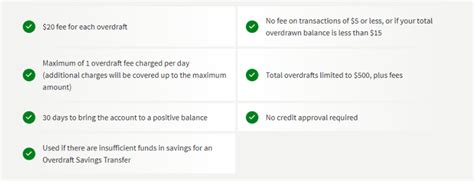

Like many financial services, Navy Federal wire transfers come with associated fees and limits. The fees for wire transfers can vary depending on the type of transfer (domestic or international), the method of initiation (online, phone, or in-person), and the member's account type. It's also important to note that there may be limits on the amount that can be transferred in a single transaction or over a certain period. Understanding these fees and limits is crucial for planning and budgeting, ensuring that members are not caught off guard by unexpected charges or restrictions.

Domestic vs. International Wire Transfers

Domestic and international wire transfers have different requirements and implications. Domestic transfers are generally faster and less expensive, as they are processed within the same country and do not require conversion between currencies. International transfers, on the other hand, involve more complexity, including the need for SWIFT codes and potential currency exchange, which can increase both the cost and the time it takes for the funds to reach the recipient. Navy Federal members should be aware of these differences when planning their wire transfers.Security Measures for Wire Transfers

The security of wire transfers is a top priority for Navy Federal. To protect members' accounts and transactions, the credit union employs advanced security measures, including encryption, secure login processes, and monitoring for suspicious activity. Members also play a critical role in maintaining security by keeping their account information confidential, using strong passwords, and being cautious of phishing attempts or other scams that could compromise their account security.

Best Practices for Secure Wire Transfers

To ensure the security of wire transfers, members should follow best practices. This includes verifying the recipient's information carefully before initiating the transfer, keeping track of transaction confirmations, and being aware of any changes in the credit union's security protocols. Additionally, staying informed about potential scams and frauds related to wire transfers can help members avoid falling victim to these crimes.Tracking and Managing Wire Transfers

Once a wire transfer is initiated, members can track its status through Navy Federal's online banking or mobile app. This feature provides real-time updates, allowing members to stay informed about the progress of their transactions. Managing wire transfers also involves keeping records of past transactions, which can be useful for accounting and budgeting purposes. Navy Federal's online platform makes it easy for members to access their transaction history and manage their accounts efficiently.

Common Issues with Wire Transfers

Despite the efficiency and security of wire transfers, issues can arise. These may include delays in processing, incorrect recipient information, or technical glitches. In such cases, Navy Federal's customer service is available to assist members in resolving the issues promptly. Members should not hesitate to reach out if they encounter any problems with their wire transfers, as timely intervention can help minimize delays and additional costs.Navy Federal Wire Transfer Image Gallery

What is the cut-off time for wire transfers at Navy Federal?

+The cut-off time for wire transfers at Navy Federal can vary depending on the type of transfer and the method of initiation. Generally, for domestic wire transfers initiated online or through the mobile app, the cut-off time is earlier in the day to ensure same-day processing. It's best to check with Navy Federal directly for the most current information on cut-off times.

How do I track the status of my wire transfer?

+You can track the status of your wire transfer through Navy Federal's online banking platform or mobile app. Simply log in to your account, navigate to the transaction history or wire transfer section, and look for the transfer in question. The status should be updated in real-time, showing whether the transfer is pending, in process, or complete.

What are the fees for international wire transfers at Navy Federal?

+The fees for international wire transfers at Navy Federal can vary based on several factors, including the destination country, the amount being transferred, and the method of initiation. Generally, international wire transfers incur higher fees than domestic transfers due to the additional processing and exchange rate considerations. For the most accurate and up-to-date fee information, it's recommended to consult Navy Federal's official website or contact their customer service directly.

In conclusion, Navy Federal wire transfers offer a convenient, secure, and efficient way for members to move funds domestically or internationally. By understanding the process, benefits, and considerations involved in wire transfers, members can better manage their financial transactions and make the most of the services provided by Navy Federal. Whether for personal or business purposes, the ability to initiate and track wire transfers with ease is a valuable tool in today's fast-paced financial landscape. As technology and banking services continue to evolve, staying informed about the latest developments in wire transfer services will be essential for navigating the complex world of financial transactions with confidence. We invite you to share your experiences or ask questions about Navy Federal wire transfers in the comments below, and don't forget to share this article with anyone who might benefit from this comprehensive guide.