Intro

Learn about Navy Federal Zelle transfer limits, sending and receiving money, and daily transaction caps with this guide on peer-to-peer payments and online banking services.

The rise of digital payment systems has revolutionized the way we transfer money, making it faster, easier, and more convenient. One such popular service is Zelle, which allows users to send and receive money directly from their bank accounts. For members of Navy Federal Credit Union, using Zelle for transactions is a common practice. However, like all financial services, there are limits to how much you can transfer using Zelle through Navy Federal. Understanding these limits is essential for managing your finances effectively and avoiding any potential issues with your transactions.

Zelle's popularity stems from its simplicity and speed. It enables near-instant transfers, making it an ideal choice for splitting bills, paying back friends, or sending money to family members. Navy Federal, being one of the largest credit unions in the world, offers Zelle as part of its online banking and mobile banking app services. This integration allows Navy Federal members to access Zelle directly, making it a seamless part of their banking experience.

When considering the Navy Federal Zelle transfer limit, it's crucial to understand that these limits are in place for security and regulatory reasons. They help protect users from potential fraud and ensure compliance with financial laws. The limits can vary based on several factors, including the type of account you have with Navy Federal and your history of using Zelle. Generally, Zelle has a standard limit, but financial institutions like Navy Federal can impose their own limits, which might be lower.

Navy Federal Zelle Transfer Limits Explained

The specifics of Navy Federal's Zelle transfer limits can depend on the user's account status and the bank's current policies. For most users, there is a daily and monthly limit on how much can be sent through Zelle. These limits are designed to balance convenience with security, ensuring that members can use Zelle for everyday transactions while minimizing the risk of significant financial loss due to fraud.

Benefits of Using Zelle with Navy Federal

Using Zelle with Navy Federal comes with several benefits, including speed, convenience, and security. Transactions are processed quickly, often in minutes, which is much faster than traditional banking transfers. The service is also widely accepted, with millions of users across the U.S., making it easy to send money to friends, family, or businesses that use Zelle. Additionally, since Zelle is integrated into Navy Federal's banking app, users can manage their Zelle transactions alongside their other banking activities, providing a streamlined financial management experience.

How to Increase Your Zelle Transfer Limit with Navy Federal

For users who need to transfer larger amounts, there might be options to increase the Zelle transfer limit with Navy Federal. This could involve verifying your identity further, linking additional accounts, or speaking with a Navy Federal representative to discuss your specific needs. It's also important to note that while increasing your limit might provide more flexibility, it's essential to only transfer amounts that you can afford and to always use Zelle with trusted recipients to avoid potential scams.

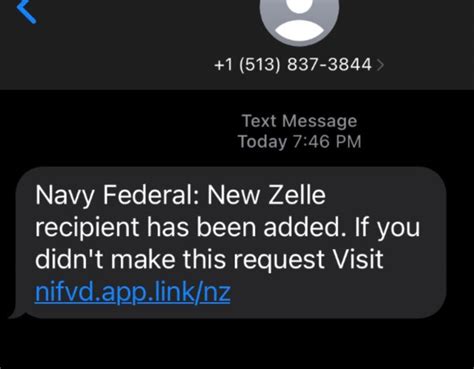

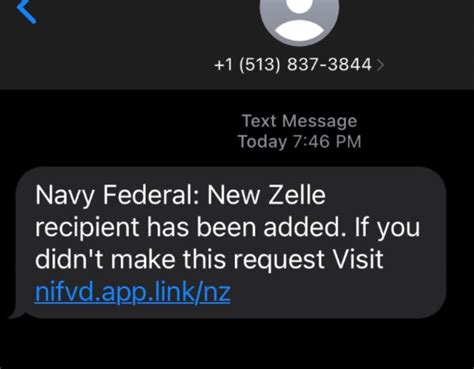

Security Measures for Zelle Transfers

Navy Federal and Zelle implement various security measures to protect users' transactions. These include encryption, two-factor authentication, and monitoring for suspicious activity. Users are also advised to keep their banking app and devices secure, use strong passwords, and be cautious of phishing scams. By combining these measures, the risk of fraud can be significantly reduced, making Zelle a safe option for transferring money.

Tips for Using Zelle with Navy Federal Effectively

To get the most out of using Zelle with Navy Federal, users should familiarize themselves with the service's features and limits. This includes understanding the transfer limits, knowing how to split bills or request money, and being aware of any fees associated with using Zelle. Additionally, users should regularly review their account activity and report any suspicious transactions to Navy Federal immediately.

Common Issues and Solutions

While Zelle is designed to be reliable, issues can sometimes arise, such as delayed transactions or errors during the transfer process. In such cases, users can contact Navy Federal's customer service for assistance. They can also check the Zelle website or Navy Federal's banking app for troubleshooting guides and FAQs. Keeping your banking app and information up to date can also help prevent issues with Zelle transfers.

Future of Digital Payments and Zelle

The future of digital payments, including services like Zelle, looks promising. With advancements in technology, we can expect even faster, more secure, and more convenient payment methods. Zelle, in particular, is likely to continue evolving, possibly incorporating new features such as international transfers or enhanced security protocols. As digital payments become the norm, financial institutions like Navy Federal will play a crucial role in adapting these technologies to meet their members' changing needs.

Gallery of Zelle Transfer Images

Zelle Transfer Image Gallery

What are the daily and monthly transfer limits for Zelle with Navy Federal?

+The daily and monthly limits can vary depending on your account type and history with Navy Federal. It's best to check your account details or contact Navy Federal directly for the most accurate information.

How do I increase my Zelle transfer limit with Navy Federal?

+To increase your limit, you may need to verify your identity further or link additional accounts. You can do this through Navy Federal's banking app or by contacting their customer service.

Are there any fees for using Zelle with Navy Federal?

+Generally, there are no fees for sending or receiving money with Zelle through Navy Federal. However, it's always a good idea to check with Navy Federal for the most current information on fees and charges.

How secure is using Zelle for transactions with Navy Federal?

+Zelle, in conjunction with Navy Federal, employs advanced security measures, including encryption and monitoring for suspicious activity, to protect your transactions. Additionally, always be cautious of phishing scams and keep your banking information secure.

Can I use Zelle internationally with Navy Federal?

+Currently, Zelle is designed for domestic transactions within the U.S. If you need to send money internationally, you may want to explore other services that Navy Federal offers for international transfers.

In wrapping up, understanding the Navy Federal Zelle transfer limit is crucial for anyone looking to use this convenient service for their financial transactions. By being aware of these limits and how to manage them, users can enjoy the benefits of fast, secure, and easy money transfers. Whether you're splitting a bill with friends, paying back a family member, or sending money to someone in need, Zelle with Navy Federal is a reliable option. Remember to always follow best practices for security and to reach out to Navy Federal if you have any questions or concerns about using Zelle. Share your experiences with Zelle and Navy Federal in the comments below, and don't forget to share this article with others who might find it helpful.