Intro

Take control of your financial future with Vanguards expert guidance. Discover 5 actionable strategies to secure your wealth, from low-cost investing to tax-efficient planning. Unlock the power of index funds, ETFs, and retirement accounts to achieve long-term financial freedom. Start building a brighter future today with Vanguards trusted investment solutions.

Investing in your future can be a daunting task, especially with the numerous options available in the market. However, with the right guidance and tools, you can take control of your financial future and secure a brighter tomorrow. Vanguard, a renowned investment management company, offers a range of solutions to help you own your future. In this article, we will explore five ways to own your future with Vanguard.

1. Start Early and Be Consistent

The power of compounding is a powerful force in investing. By starting early and being consistent, you can harness this power to grow your wealth over time. Vanguard's range of index funds and ETFs provide a low-cost and efficient way to invest in the market, making it easier to get started and stay on track.

Benefits of Starting Early

- Time is on your side: The earlier you start, the more time your money has to grow.

- Reduced financial stress: By investing regularly, you can reduce financial stress and feel more secure about your future.

- Increased wealth: Consistent investing can lead to significant wealth creation over the long-term.

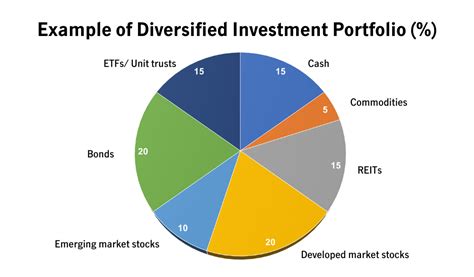

2. Diversify Your Portfolio

Diversification is key to managing risk and increasing potential returns. Vanguard's range of index funds and ETFs provides access to various asset classes, sectors, and geographic regions, making it easier to create a diversified portfolio.

Benefits of Diversification

- Reduced risk: By spreading your investments across different asset classes and sectors, you can reduce your exposure to market volatility.

- Increased potential returns: Diversification can lead to higher potential returns over the long-term.

- Improved resilience: A diversified portfolio is better equipped to withstand market downturns.

3. Keep Costs Low

High fees can erode your investment returns over time. Vanguard is known for its low-cost investment products, which can help you keep more of your hard-earned money.

Benefits of Low-Cost Investing

- Increased returns: By keeping costs low, you can retain more of your investment returns.

- Improved net wealth: Lower fees can lead to higher net wealth over the long-term.

- Better value: Vanguard's low-cost products provide better value for money.

4. Stay Informed and Educated

Investing in your future requires ongoing education and awareness. Vanguard provides a range of resources and tools to help you stay informed and make informed investment decisions.

Benefits of Investor Education

- Better decision-making: By staying informed, you can make more informed investment decisions.

- Improved financial literacy: Ongoing education can lead to improved financial literacy and confidence.

- Increased returns: Better decision-making can lead to higher potential returns.

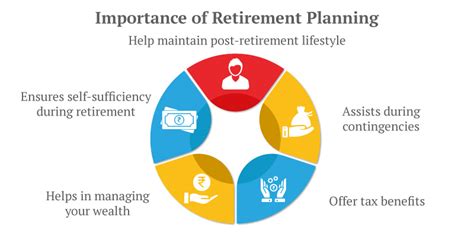

5. Seek Professional Advice

While investing in your future can be a DIY endeavor, seeking professional advice can provide valuable guidance and support. Vanguard offers a range of advisory services to help you create a personalized investment plan.

Benefits of Professional Advice

- Customized solutions: A financial advisor can create a tailored investment plan to meet your unique needs and goals.

- Ongoing support: Professional advice can provide ongoing support and guidance to help you stay on track.

- Improved outcomes: A financial advisor can help you make more informed investment decisions, leading to improved outcomes.

Vanguard Investing Image Gallery

What is the best way to invest in my future?

+The best way to invest in your future is to start early, be consistent, and diversify your portfolio. It's also essential to keep costs low and seek professional advice when needed.

How do I create a diversified investment portfolio?

+To create a diversified investment portfolio, you can invest in a range of asset classes, sectors, and geographic regions. Vanguard's index funds and ETFs provide a low-cost and efficient way to diversify your portfolio.

What is the importance of keeping costs low in investing?

+Keeping costs low is essential in investing as high fees can erode your investment returns over time. Vanguard's low-cost products provide better value for money and can lead to higher net wealth.

In conclusion, owning your future with Vanguard requires a combination of starting early, diversifying your portfolio, keeping costs low, staying informed and educated, and seeking professional advice when needed. By following these principles, you can take control of your financial future and secure a brighter tomorrow.