Intro

Discover 5 ways an amortization schedule helps with loan management, including mortgage planning, debt repayment, and interest savings, to achieve financial stability and optimize payments.

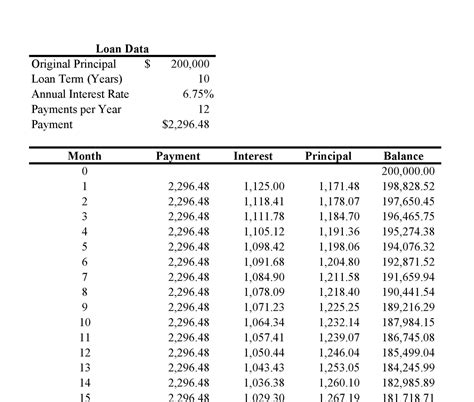

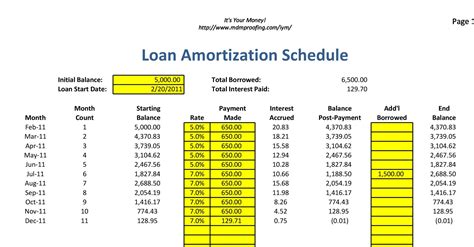

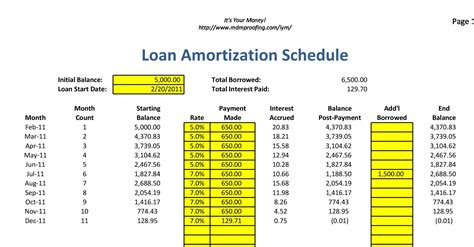

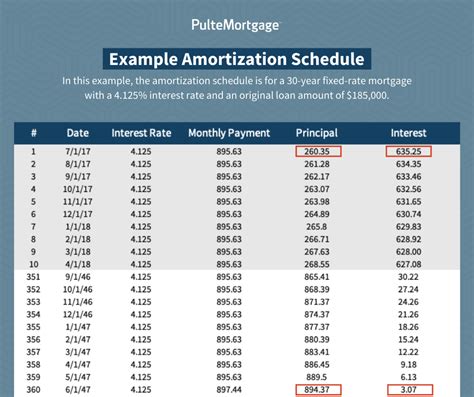

Amortization is a crucial concept in finance that refers to the process of gradually paying off a debt, such as a mortgage or a car loan, through regular payments. An amortization schedule is a table that outlines the amount of each payment that goes towards the principal balance and the amount that goes towards interest. In this article, we will explore 5 ways an amortization schedule can be beneficial for individuals and businesses.

An amortization schedule can be a powerful tool for managing debt and making informed financial decisions. By understanding how an amortization schedule works, individuals and businesses can better plan their finances and make the most of their money. Whether you're a homeowner, a business owner, or simply someone looking to pay off debt, an amortization schedule can be a valuable resource.

One of the key benefits of an amortization schedule is that it helps individuals and businesses understand the true cost of borrowing. By seeing exactly how much of each payment goes towards interest and how much goes towards the principal balance, borrowers can make more informed decisions about their debt. For example, if a borrower sees that a large portion of their monthly payment is going towards interest, they may decide to refinance their loan or make extra payments to pay off the principal balance more quickly.

Understanding Amortization Schedules

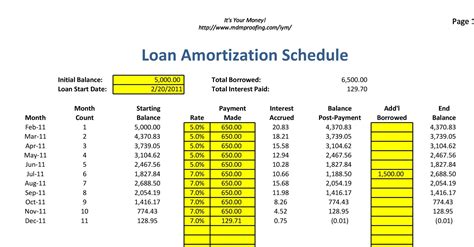

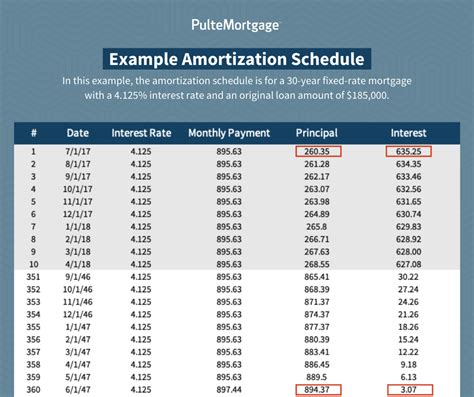

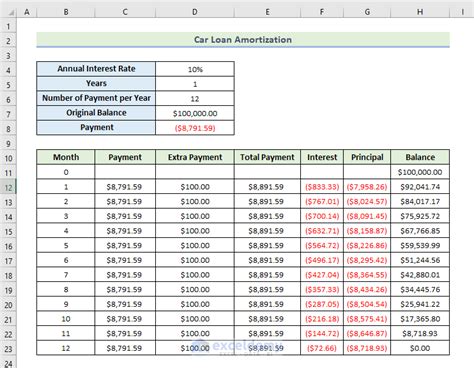

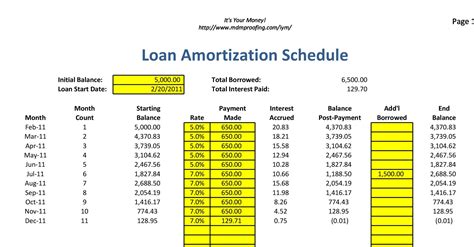

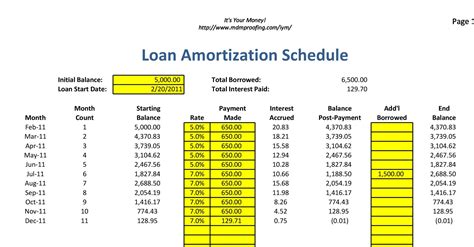

An amortization schedule typically includes several key pieces of information, including the loan amount, interest rate, loan term, and monthly payment amount. By using this information, borrowers can calculate exactly how much of each payment goes towards interest and how much goes towards the principal balance. This can be a powerful tool for managing debt and making informed financial decisions.

Key Components of an Amortization Schedule

Some of the key components of an amortization schedule include: * Loan amount: The total amount borrowed * Interest rate: The rate at which interest is charged on the loan * Loan term: The length of time over which the loan is repaid * Monthly payment amount: The amount paid each month towards the loan * Principal balance: The amount of the loan that has not yet been paid off * Interest paid: The amount of interest paid on the loan each monthBenefits of Using an Amortization Schedule

There are several benefits to using an amortization schedule, including:

- Helps borrowers understand the true cost of borrowing

- Allows borrowers to make informed decisions about their debt

- Helps borrowers plan their finances and make the most of their money

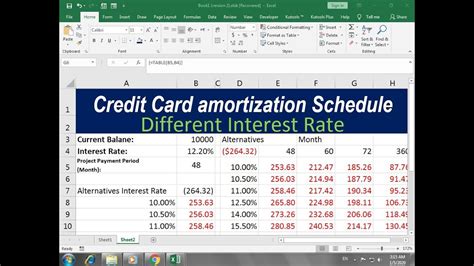

- Can be used to compare different loan options and choose the best one

- Can be used to make extra payments and pay off the loan more quickly

How to Create an Amortization Schedule

Creating an amortization schedule can be done using a spreadsheet or a financial calculator. The process typically involves entering the loan amount, interest rate, loan term, and monthly payment amount, and then calculating the principal balance and interest paid each month. There are also many online tools and resources available that can help borrowers create an amortization schedule.For more information on creating an amortization schedule, you can check out our article on creating a budget.

Using an Amortization Schedule to Make Informed Decisions

An amortization schedule can be a powerful tool for making informed decisions about debt. By understanding exactly how much of each payment goes towards interest and how much goes towards the principal balance, borrowers can make more informed decisions about their debt. For example, if a borrower sees that a large portion of their monthly payment is going towards interest, they may decide to refinance their loan or make extra payments to pay off the principal balance more quickly.

Common Mistakes to Avoid When Using an Amortization Schedule

Some common mistakes to avoid when using an amortization schedule include: * Not understanding the true cost of borrowing * Not making extra payments to pay off the loan more quickly * Not refinancing the loan when interest rates drop * Not considering all the costs associated with the loan, such as fees and chargesReal-World Examples of Amortization Schedules

An amortization schedule can be used in a variety of real-world situations, such as:

- Mortgages: An amortization schedule can be used to calculate the monthly payment amount and the total interest paid over the life of the loan.

- Car loans: An amortization schedule can be used to calculate the monthly payment amount and the total interest paid over the life of the loan.

- Student loans: An amortization schedule can be used to calculate the monthly payment amount and the total interest paid over the life of the loan.

- Business loans: An amortization schedule can be used to calculate the monthly payment amount and the total interest paid over the life of the loan.

How to Use an Amortization Schedule to Pay Off Debt More Quickly

There are several ways to use an amortization schedule to pay off debt more quickly, including: * Making extra payments: By making extra payments, borrowers can pay off the principal balance more quickly and reduce the amount of interest paid over the life of the loan. * Refinancing the loan: If interest rates have dropped since the loan was originated, borrowers may be able to refinance the loan and reduce the monthly payment amount. * Increasing the monthly payment amount: By increasing the monthly payment amount, borrowers can pay off the principal balance more quickly and reduce the amount of interest paid over the life of the loan.Amortization Schedule Image Gallery

What is an amortization schedule?

+An amortization schedule is a table that outlines the amount of each payment that goes towards the principal balance and the amount that goes towards interest.

How do I create an amortization schedule?

+You can create an amortization schedule using a spreadsheet or a financial calculator. There are also many online tools and resources available that can help you create an amortization schedule.

What are the benefits of using an amortization schedule?

+The benefits of using an amortization schedule include understanding the true cost of borrowing, making informed decisions about debt, and planning finances and making the most of your money.

Can I use an amortization schedule to pay off debt more quickly?

+Yes, you can use an amortization schedule to pay off debt more quickly by making extra payments, refinancing the loan, or increasing the monthly payment amount.

Are there any common mistakes to avoid when using an amortization schedule?

+Yes, some common mistakes to avoid when using an amortization schedule include not understanding the true cost of borrowing, not making extra payments, and not considering all the costs associated with the loan.

In conclusion, an amortization schedule is a powerful tool for managing debt and making informed financial decisions. By understanding how an amortization schedule works and using it to make informed decisions, individuals and businesses can make the most of their money and achieve their financial goals. We invite you to share your thoughts and experiences with amortization schedules in the comments below. If you found this article helpful, please share it with others who may benefit from it.