Intro

Master budgeting with 5 essential spreadsheet tips, including expense tracking, financial planning, and cost management to optimize your personal finance and money management skills.

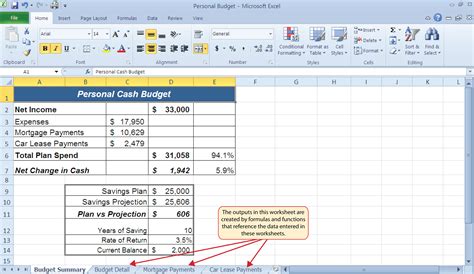

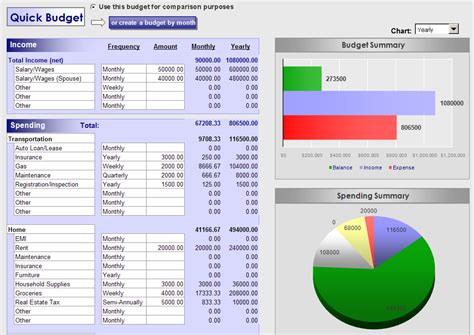

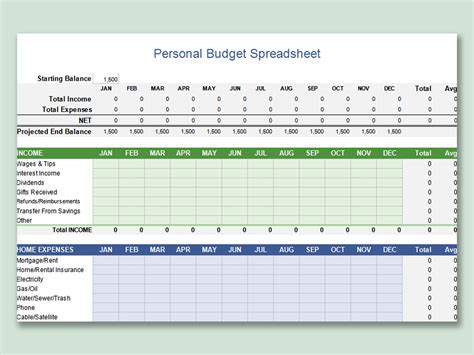

Creating and managing a budget is an essential part of personal finance and can help individuals achieve their financial goals. One of the most effective tools for managing a budget is a budget spreadsheet. A budget spreadsheet is a table or worksheet that outlines projected income and expenses, allowing users to track their spending and stay on top of their finances. In this article, we will explore five budget spreadsheet tips that can help individuals create and manage an effective budget.

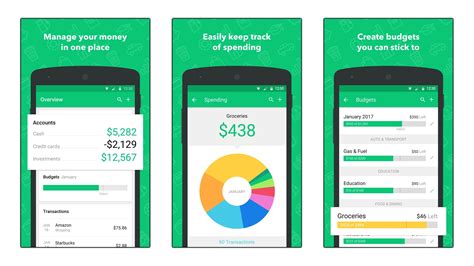

Budgeting is a crucial aspect of personal finance, and it can be challenging to manage expenses without a clear plan. A budget spreadsheet can help individuals prioritize their spending, identify areas where they can cut back, and make informed financial decisions. With a budget spreadsheet, users can track their income and expenses, set financial goals, and make adjustments as needed. Whether you're a student, a working professional, or a retiree, a budget spreadsheet can be a valuable tool for managing your finances.

Effective budgeting requires discipline, patience, and the right tools. A budget spreadsheet can help individuals stay organized and focused on their financial goals. By tracking income and expenses, users can identify trends and patterns in their spending, make adjustments as needed, and avoid financial pitfalls. A budget spreadsheet can also help individuals prioritize their spending, allocate funds for savings and investments, and make progress towards their long-term financial goals. With the right budget spreadsheet tips and strategies, individuals can take control of their finances and achieve financial stability.

Understanding Budget Spreadsheets

Benefits of Budget Spreadsheets

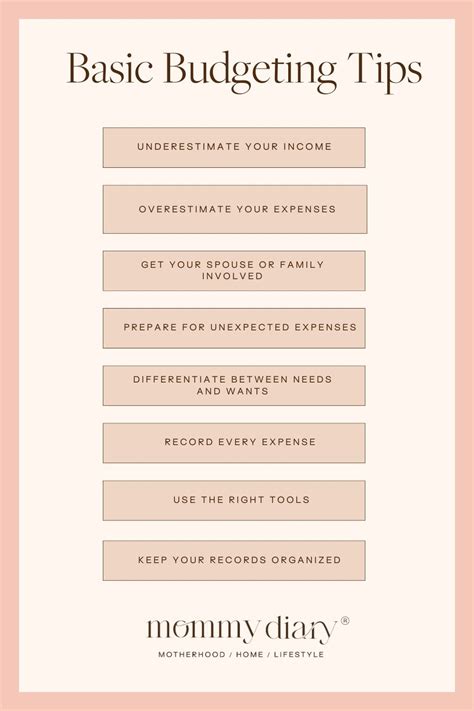

The benefits of using a budget spreadsheet are numerous. Some of the most significant advantages include: * Improved financial organization and tracking * Enhanced budgeting and forecasting capabilities * Increased transparency and accountability * Simplified financial planning and decision-making * Reduced stress and anxiety related to financial management By using a budget spreadsheet, individuals can gain a clearer understanding of their financial situation, make more informed decisions, and achieve their long-term financial goals.Setting Up a Budget Spreadsheet

Customizing the Budget Spreadsheet

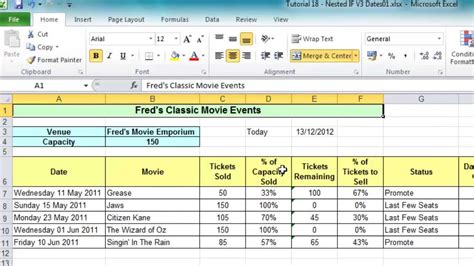

Once the budget spreadsheet is set up, users can customize it to suit their needs. This may involve adding or removing columns and rows, creating formulas and calculations, and formatting the spreadsheet to make it easier to read and understand. Users can also add charts and graphs to visualize their financial data and track their progress over time. By customizing the budget spreadsheet, individuals can create a tailored tool that meets their unique financial needs and goals.Using Budget Spreadsheet Formulas

Common Budget Spreadsheet Mistakes

Despite the benefits of using a budget spreadsheet, there are common mistakes that individuals can make. Some of the most significant errors include: * Failing to regularly update the spreadsheet * Not accounting for irregular expenses * Overlooking tax deductions and credits * Not prioritizing needs over wants * Failing to review and adjust the budget regularly By avoiding these common mistakes, individuals can create an effective budget spreadsheet that helps them achieve their financial goals.Advanced Budget Spreadsheet Tips

Budget Spreadsheet Security

Budget spreadsheet security is an essential consideration for individuals who store sensitive financial information in their spreadsheets. Some tips for securing the budget spreadsheet include: * Using strong passwords and encryption * Limiting access to authorized users * Regularly backing up the spreadsheet * Using two-factor authentication * Keeping the spreadsheet software up to date By following these security tips, individuals can protect their financial information and prevent unauthorized access to their budget spreadsheet.Conclusion and Next Steps

Final Thoughts

Creating and managing a budget spreadsheet requires discipline, patience, and the right tools. By using a budget spreadsheet, individuals can gain a clearer understanding of their financial situation, make more informed decisions, and achieve their long-term financial goals. Whether you're a student, a working professional, or a retiree, a budget spreadsheet can be a valuable tool for managing your finances.Budget Spreadsheet Image Gallery

What is a budget spreadsheet?

+A budget spreadsheet is a table or worksheet that outlines projected income and expenses, allowing users to track their spending and stay on top of their finances.

How do I set up a budget spreadsheet?

+To set up a budget spreadsheet, choose a spreadsheet software, create a new spreadsheet, and set up the columns and rows to represent different categories of income and expense.

What are some common budget spreadsheet mistakes?

+Common budget spreadsheet mistakes include failing to regularly update the spreadsheet, not accounting for irregular expenses, overlooking tax deductions and credits, and not prioritizing needs over wants.

We hope this article has provided you with valuable insights and tips for creating and managing an effective budget spreadsheet. If you have any questions or comments, please don't hesitate to reach out. Share this article with your friends and family to help them achieve their financial goals. Take the first step towards financial stability and security by creating your own budget spreadsheet today!