Intro

Get W9 forms easily with our guide, covering IRS requirements, independent contractor tax, and 1099 filing, to simplify your tax season and compliance needs.

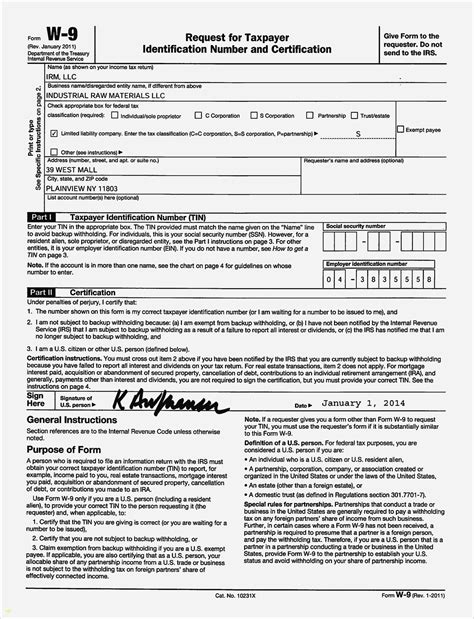

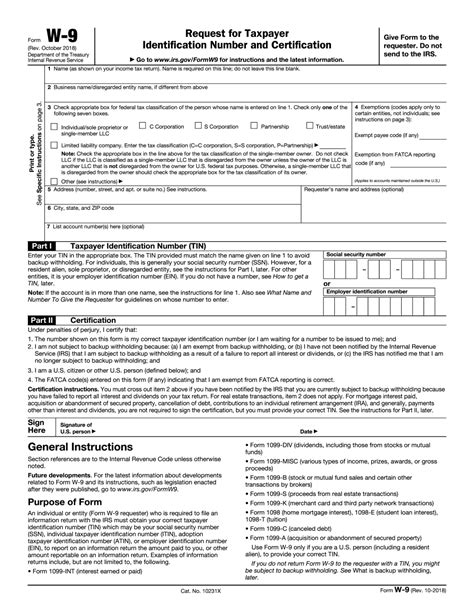

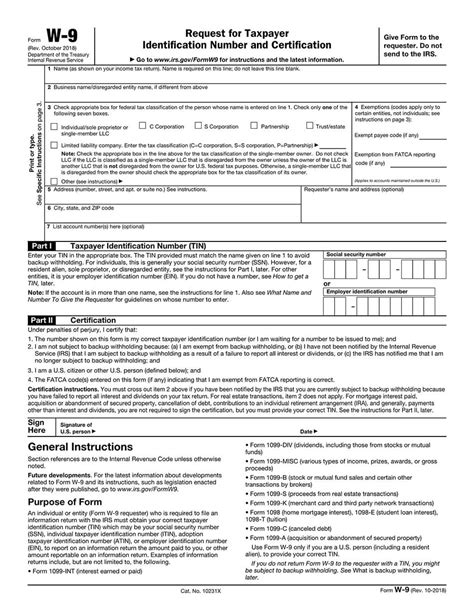

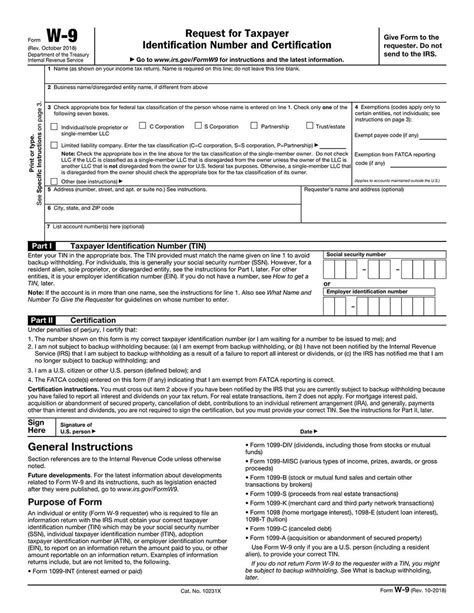

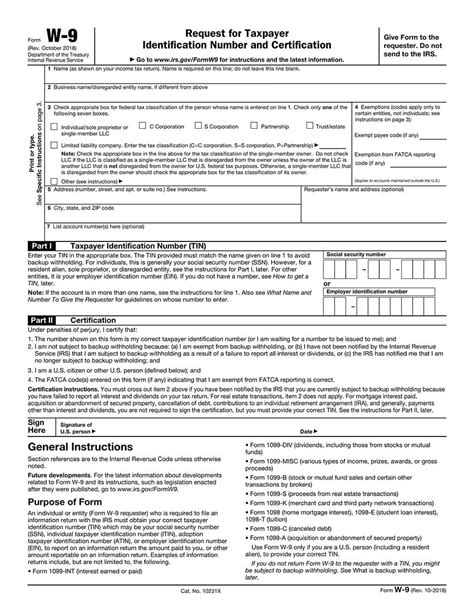

The W9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document for freelancers, independent contractors, and businesses. It provides the necessary information for the Internal Revenue Service (IRS) to process tax payments and ensure compliance with tax laws. Obtaining a W9 form is relatively straightforward, and there are several ways to get one. In this article, we will explore the different methods of obtaining a W9 form and provide guidance on how to complete it accurately.

The importance of having a W9 form cannot be overstated. It is a requirement for many businesses and organizations, and failure to provide one can result in delayed payments or even penalties. Moreover, the W9 form helps to establish a paper trail, which is essential for auditing purposes and ensuring that all parties are in compliance with tax regulations. With the rise of the gig economy and remote work, the need for W9 forms has become more pronounced, making it essential to understand the process of obtaining and completing one.

For individuals and businesses looking to obtain a W9 form, there are several options available. The most common method is to download the form from the IRS website, which provides the most up-to-date version of the document. Alternatively, you can contact the IRS directly and request a copy of the form, or visit a local IRS office to pick one up in person. Additionally, many accounting software programs and online platforms offer W9 forms as part of their services, making it easy to access and complete the form digitally.

Obtaining a W9 Form Online

Benefits of Downloading the W9 Form Online

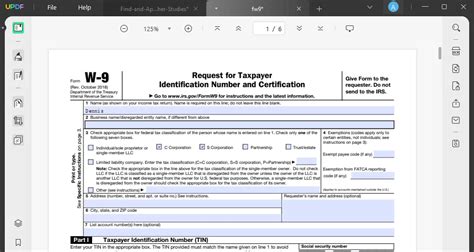

The benefits of downloading the W9 form online are numerous. For one, it is a quick and convenient way to obtain the form, eliminating the need to visit an IRS office or wait for a copy to be mailed. Additionally, downloading the form online ensures that you have the most up-to-date version, which is essential for ensuring compliance with tax regulations. Furthermore, completing the form digitally can help reduce errors and make it easier to store and manage the document.Requesting a W9 Form from the IRS

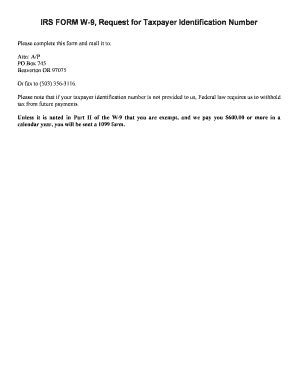

Steps to Request a W9 Form from the IRS

To request a W9 form from the IRS, follow these steps: * Call the IRS toll-free number and ask to have a copy of the form mailed to you. * Provide your name and address to the IRS representative. * Wait for the form to arrive in the mail, which may take several days or weeks. * Once you receive the form, complete it accurately and return it to the requester.Obtaining a W9 Form through Accounting Software

Benefits of Using Accounting Software to Obtain a W9 Form

The benefits of using accounting software to obtain a W9 form are numerous. For one, it is a quick and convenient way to access the form, eliminating the need to visit the IRS website or request a copy by mail. Additionally, accounting software often provides tools and guidance to help complete the form accurately, reducing the risk of errors. Furthermore, digital W9 forms can be easily stored and managed, making it easier to keep track of documents and ensure compliance with tax regulations.Completing a W9 Form Accurately

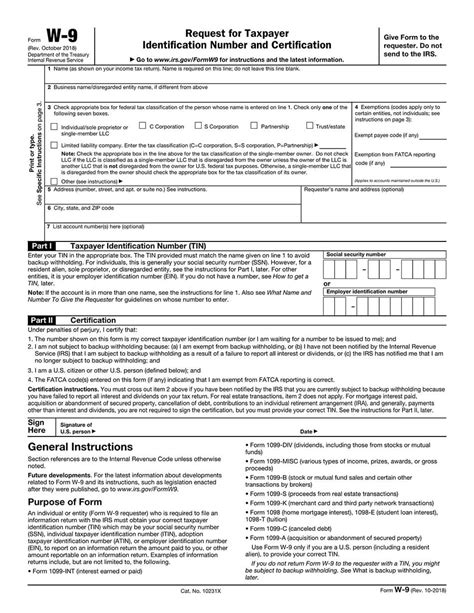

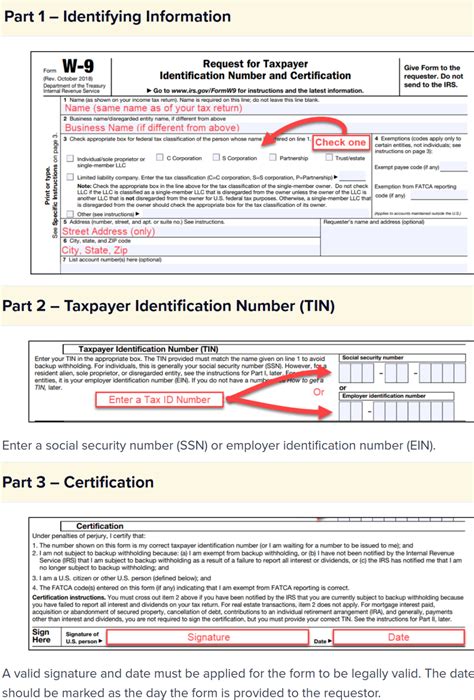

Steps to Complete a W9 Form Accurately

To complete a W9 form accurately, follow these steps: * Read the instructions carefully and understand what information is required. * Provide your name and address accurately, ensuring that it matches the information on file with the IRS. * Enter your taxpayer identification number, which can be either a Social Security number or an Employer Identification Number. * Sign and date the form, ensuring that you have completed it accurately and truthfully.Internal Link to Another Post

For more information on tax compliance and regulations, check out our article on tax compliance. This article provides guidance on the importance of tax compliance, as well as tips and strategies for ensuring that your business or organization is in compliance with tax regulations.W9 Form Image Gallery

What is a W9 form?

+A W9 form is a document used to provide taxpayer identification information to the IRS.

How do I obtain a W9 form?

+You can obtain a W9 form by downloading it from the IRS website, requesting a copy from the IRS, or using accounting software.

How do I complete a W9 form accurately?

+To complete a W9 form accurately, read the instructions carefully, provide accurate and complete information, and sign and date the form.

In conclusion, obtaining a W9 form is a relatively straightforward process that can be completed in several ways. Whether you download the form online, request a copy from the IRS, or use accounting software, it is essential to complete the form accurately and provide the necessary information to ensure compliance with tax regulations. By following the steps outlined in this article, you can ensure that you have the necessary documentation to meet your tax obligations and avoid any potential penalties or delays. If you have any further questions or concerns, please do not hesitate to comment below or share this article with others who may find it useful.