Intro

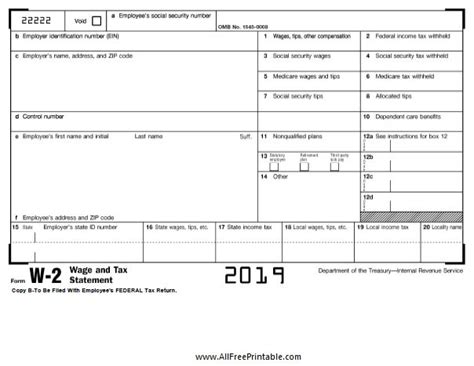

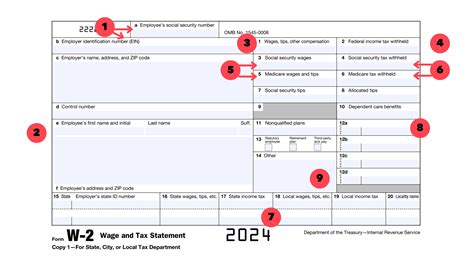

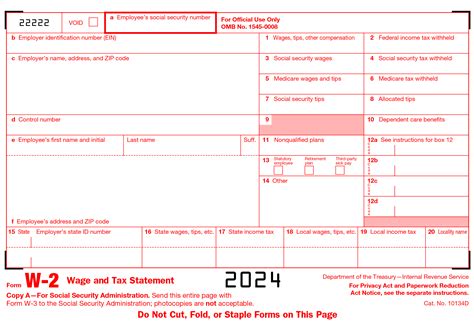

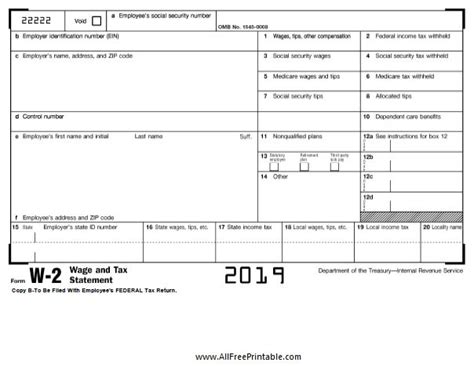

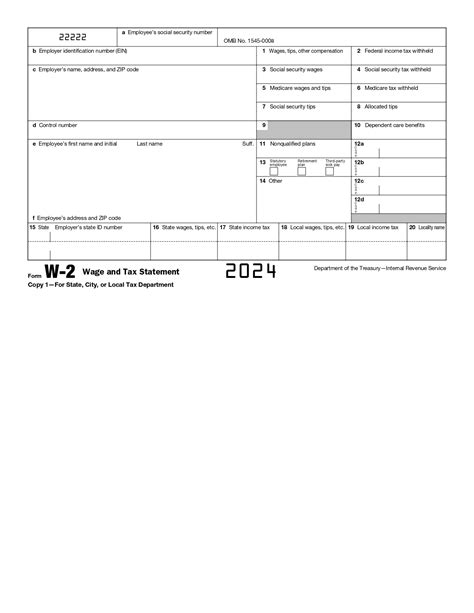

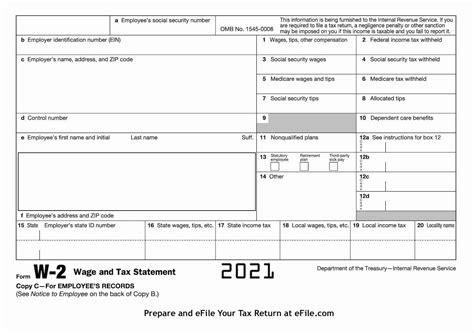

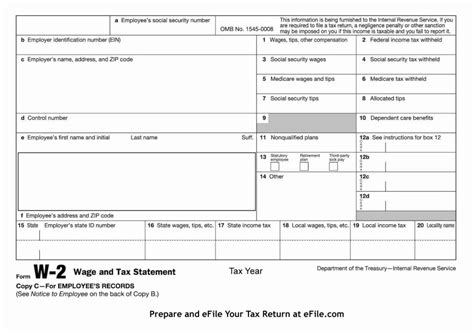

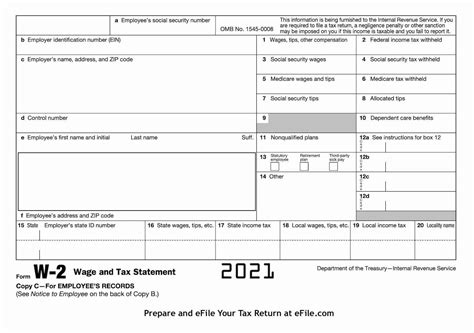

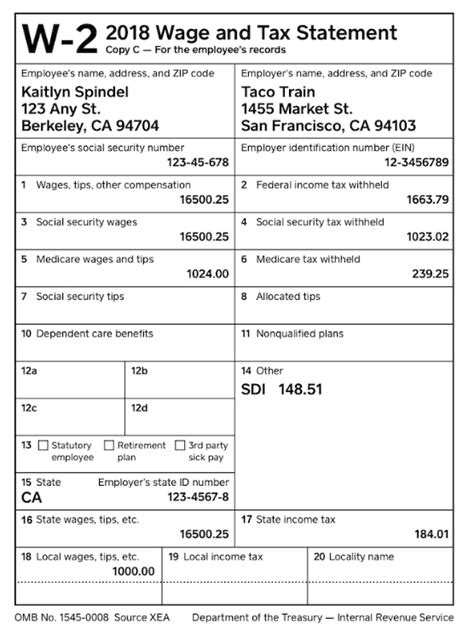

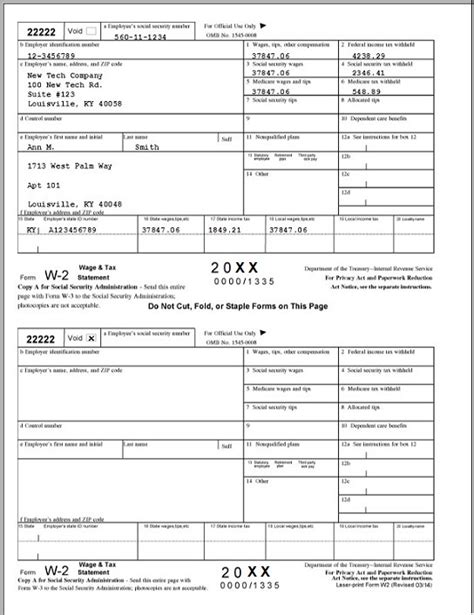

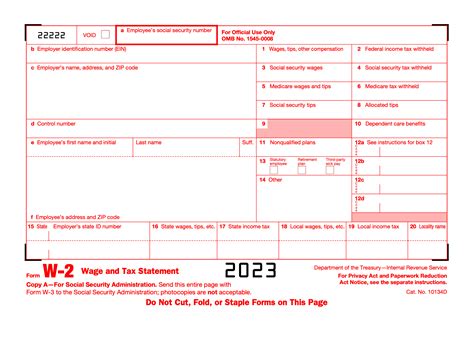

Get instant access to a free W2 Form Printable Template, featuring employer and employee information, income details, and tax withholding data, making tax season easier with accurate wage reporting and compliance.

The W2 form is a crucial document for both employers and employees in the United States. It serves as a record of the wages earned and taxes withheld from an employee's income during a given tax year. The form is typically provided by employers to their employees by January 31st of each year, and it plays a vital role in the tax filing process. In this article, we will delve into the world of W2 forms, exploring their importance, the information they contain, and how to obtain a W2 form printable template.

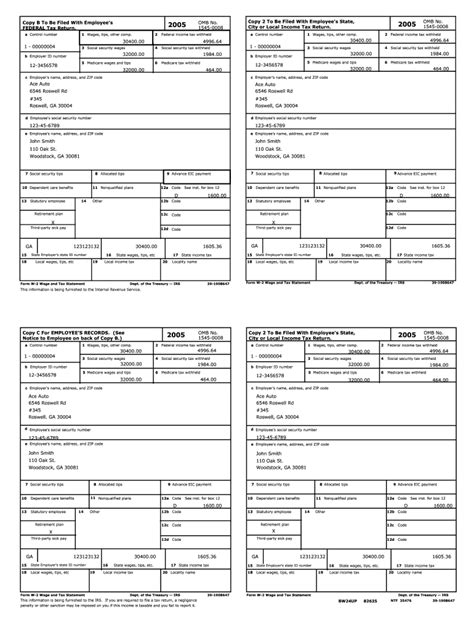

The W2 form is essential for employees as it provides them with the necessary information to file their tax returns accurately. The form includes details such as the employee's name, address, Social Security number, and the amount of wages earned during the tax year. It also reports the amount of federal, state, and local taxes withheld from the employee's income. Employers, on the other hand, use the W2 form to report the wages paid to their employees and the taxes withheld to the Social Security Administration (SSA) and the Internal Revenue Service (IRS).

For employees who have lost their W2 form or have not received it from their employer, obtaining a W2 form printable template can be a convenient solution. A W2 form printable template can be downloaded from various online sources, including the IRS website. The template can be filled out manually or using a software program, and it must be signed by the employer to be considered valid. However, it is essential to note that a W2 form printable template should only be used as a last resort, and employees should always try to obtain the original form from their employer.

Understanding the W2 Form

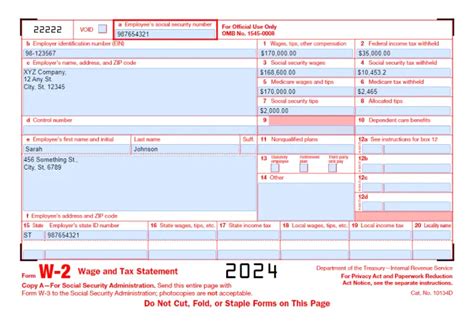

The W2 form is a multi-part form that contains several boxes and sections. Each box and section reports specific information related to the employee's income and taxes withheld. The form is typically divided into several sections, including:

- Employee information: This section includes the employee's name, address, and Social Security number.

- Employer information: This section includes the employer's name, address, and Employer Identification Number (EIN).

- Wages and taxes: This section reports the employee's wages earned during the tax year, as well as the federal, state, and local taxes withheld.

- Other income: This section reports any other income earned by the employee, such as tips or commissions.

Importance of the W2 Form

The W2 form plays a crucial role in the tax filing process. It provides employees with the necessary information to file their tax returns accurately, and it helps employers report the wages paid to their employees and the taxes withheld to the SSA and IRS. The form is also used to determine an employee's eligibility for certain tax credits and deductions.

Some of the key importance of the W2 form includes:

- Accurate tax filing: The W2 form provides employees with the necessary information to file their tax returns accurately.

- Tax credits and deductions: The form is used to determine an employee's eligibility for certain tax credits and deductions.

- Social Security benefits: The W2 form is used to report an employee's earnings to the SSA, which helps determine their Social Security benefits.

- Compliance with tax laws: The form helps employers comply with tax laws and regulations, including reporting wages paid to employees and taxes withheld.

How to Obtain a W2 Form Printable Template

Obtaining a W2 form printable template can be a convenient solution for employees who have lost their W2 form or have not received it from their employer. There are several ways to obtain a W2 form printable template, including:

- Downloading from the IRS website: The IRS website provides a W2 form printable template that can be downloaded and filled out manually or using a software program.

- Using a tax software program: Many tax software programs, such as TurboTax or H&R Block, offer a W2 form printable template that can be filled out and printed.

- Contacting the employer: Employees can contact their employer to request a replacement W2 form or a W2 form printable template.

Filling Out a W2 Form Printable Template

Filling out a W2 form printable template requires careful attention to detail. The template must be filled out accurately and completely, and it must be signed by the employer to be considered valid. Some of the key information that must be included on the template includes:

- Employee information: The employee's name, address, and Social Security number must be included on the template.

- Employer information: The employer's name, address, and EIN must be included on the template.

- Wages and taxes: The employee's wages earned during the tax year, as well as the federal, state, and local taxes withheld, must be reported on the template.

W2 Form Printable Template for Employers

Employers can also use a W2 form printable template to report the wages paid to their employees and the taxes withheld. The template can be downloaded from the IRS website or obtained from a tax software program. Employers must fill out the template accurately and completely, and they must provide a copy of the form to each employee by January 31st of each year.

Some of the key benefits of using a W2 form printable template for employers include:

- Convenience: The template can be filled out and printed quickly and easily.

- Accuracy: The template helps ensure that the information reported is accurate and complete.

- Compliance: The template helps employers comply with tax laws and regulations, including reporting wages paid to employees and taxes withheld.

Common Mistakes to Avoid When Using a W2 Form Printable Template

When using a W2 form printable template, there are several common mistakes to avoid. Some of the key mistakes include:

- Inaccurate information: The template must be filled out accurately and completely, and any mistakes can result in delays or penalties.

- Missing information: The template must include all required information, including employee and employer information, wages and taxes, and other income.

- Unsigned template: The template must be signed by the employer to be considered valid.

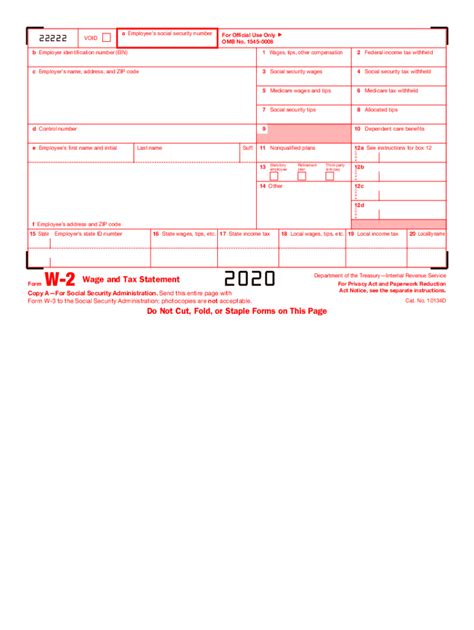

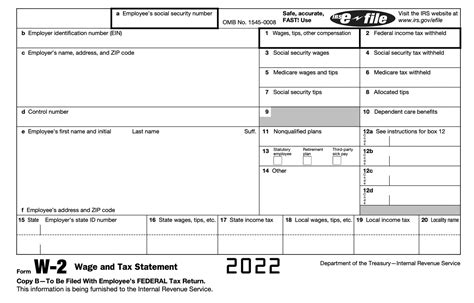

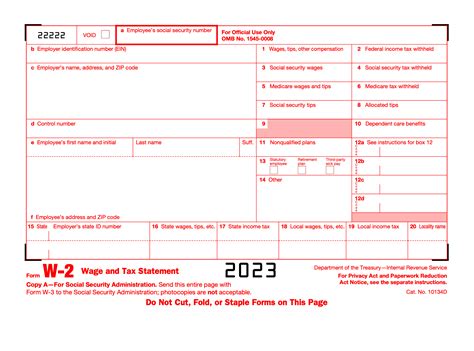

Gallery of W2 Form Printable Templates

W2 Form Printable Template Image Gallery

Frequently Asked Questions

What is a W2 form?

+A W2 form is a document that reports an employee's wages earned and taxes withheld during a given tax year.

How do I obtain a W2 form printable template?

+You can obtain a W2 form printable template by downloading it from the IRS website or using a tax software program.

What information is required on a W2 form printable template?

+The template must include employee and employer information, wages and taxes, and other income.

Can I use a W2 form printable template for multiple employees?

+Yes, you can use a W2 form printable template for multiple employees, but you must fill out a separate template for each employee.

What are the consequences of not providing a W2 form to an employee?

+The consequences of not providing a W2 form to an employee can include penalties and fines from the IRS.

In conclusion, a W2 form printable template is a convenient solution for employees and employers who need to report wages earned and taxes withheld. The template can be downloaded from the IRS website or obtained from a tax software program, and it must be filled out accurately and completely. By understanding the importance of the W2 form and how to obtain and fill out a W2 form printable template, employees and employers can ensure compliance with tax laws and regulations. For more information on tax-related topics, you can check out our article on tax returns. We hope this article has been informative and helpful. Please feel free to comment or share this article with others who may find it useful.